Summary:

- Lithium Americas suffered a severe stock price decline after the company split. Lithium Americas Argentina stock declined far less, due to its already existing production.

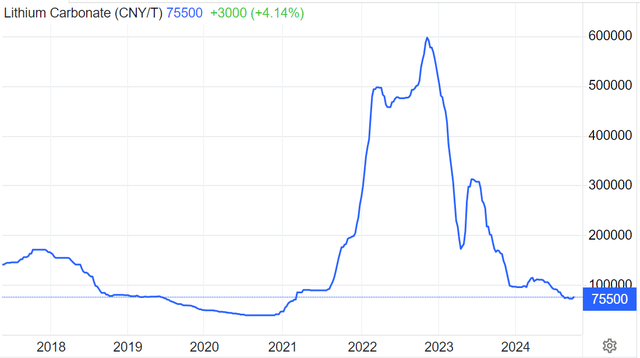

- The volatile lithium market may have reached the bottom or may be close to it, with a potentially equally dramatic price spike potentially on the way.

- A lithium market turnaround, coupled with geopolitical trends that put a premium on domestic self-sufficiency, may combine to coincide with Lithium Americas commencement of mined lithium production. Its stock could outperform peers.

Just_Super

Investment thesis: After the stock split event that partitioned the old Lithium Americas into the new US-based Lithium Americas (NYSE:LAC) and Lithium Americas Argentina (LAAC), both companies saw a dramatic decline in their share price, in part due to the broader lithium miner selloff. Lithium Americas however is the stock that suffered by far the largest decline. It is a pre-production company with the earliest revenue inflow set to happen in 2027. Before then, it has significant capital spending needs that must be covered. Having said all that, much of it is already priced into its current stock price. What is not priced in is the prospect of a lithium market rebound as well as the company’s unique position as a US-based miner, with no geopolitical risk exposure. I had a small position in the pre-split company, and now I have a small position in both companies post-split. Now that the post-split period is over, I expect Lithium Americas to be the stronger long-term performer, which is why I decided to add to my modest position.

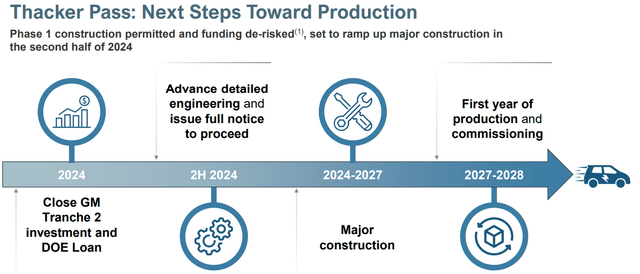

Lithium Americas preparing for the mine construction phase.

Given that Lithium Americas is a pre-production miner, there is very little that we can discuss regarding revenues, profitability prospects, and other usual metrics that tend to be of interest when kicking the tires on a potential investment opportunity. All we can do for now in terms of examining its financial results is to ascertain how prepared it is to undertake the task ahead of reaching the production phase.

Lithium Americas entered into an exclusive supply agreement with GM (GM) last year, which brings it a valuable infusion of $650 million. In addition, Lithium Americas reported several government support initiatives in its latest quarterly report. The Department of Energy is offering it a conditional commitment for a $2.26 billion loan in the first half of this year. The company also received an $11.8 million grant from the Department of Defense in August of this year. While the road toward the production phase is long, this company is seeing a lot of external support, which has the potential to spare investors from shouldering the burden of stock dilution events.

Once phase one of the Thacker Pass project reaches full production, it will yield 40 ktpa of lithium carbonate/year, which at current prices, will result in about $400 million/year in revenues at current spot price levels. It should be noted that the record-high spot price for lithium carbonate was about eight times higher. If we return to a similar lithium price level in the foreseeable future, revenues, and profits could potentially come in much higher. A lot is riding on the volatile lithium market.

The lithium market will continue to be volatile, with the current price downswing probably giving way to a price spike.

Aside from the pre-production status of Lithium Americas once it was split away from the Argentinian segment of the business, which does have ongoing production, the dramatic decline in lithium prices served as a double hit for the company.

I am not certain whether we will reach the old all-time high price for lithium carbonate again within a timeframe of years or even decades. One thing that I am certain of is that with both supply and demand growing at exponential rates, the inevitable outcome will be a great deal of price volatility, as the industry will be unable to maintain some sort of steady supply/demand balance.

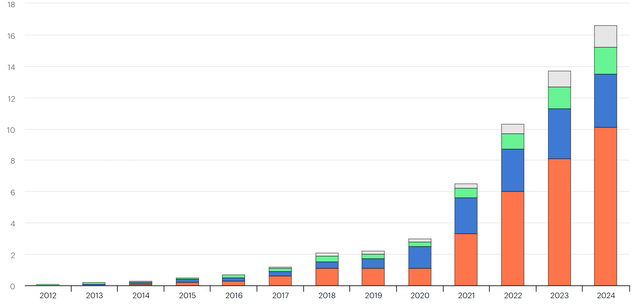

There has been a great deal of talk about a slowdown in EV sales, with signs of weakening demand. Sales growth is nevertheless continuing, with China leading the way.

Global EV sales. China (orange), Europe (blue), US (green) (IEA)

While it is true that two of the three major EV markets are stagnant, this is not the case with China. We should also pay attention to the rest of the world’s market shown in grey on the chart, where most of the world’s population lives. There has been a visible increase in EV demand from a low base so far this decade. I believe there are factors aside from climate change that are likely to drive EV sales higher throughout the world in the coming years. With EV sales likely to surprise to the upside, we will probably see a lithium price spike at some point in the second half of the decade, perhaps just in time for Lithium Americas to start production.

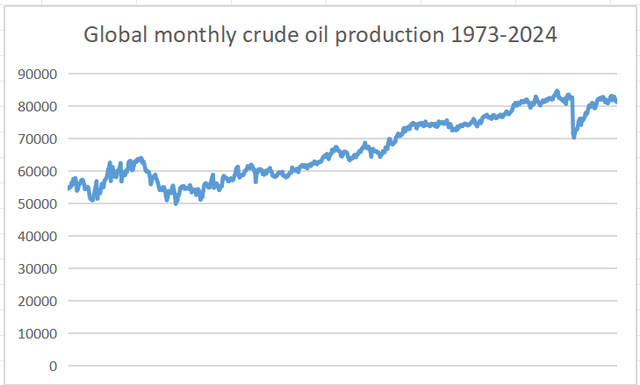

Signs of global crude oil supplies stagnating may lead to government measures as well as market forces that will favor EV sales growth.

There are some barriers to the mass-market adoption of EVs. As I have been writing for many years now, with some articles dedicated to the subject, the price/range relationship changes the very concept of what it means to have a regular versus a luxury vehicle. For instance, assuming respect for speed limits and with all else held equal, a person driving any moderately-priced sedan is likely to cover the same distance in a day of driving as someone driving a six-figure-priced luxury car. It is not the case with EVs, since cheaper EVs tend to have less driving range than EVs priced in the luxury vehicle price range.

While EVs are facing significant hurdles to penetrating the middle-class market, it may be the case nevertheless, that most consumers, including those who might not consider an EV currently will be forced to take it under consideration, whether it will be due to government restrictions on conventional cars, subsidies for EVs, or perhaps because the cost of gasoline will make EV more attractive.

The global monthly crude oil production record was set in November 2018 at 84.6 mb/d. It is currently down to 81.1 mb/d as of June of this year. It is important to understand that part of the reason why production is down so sharply from the monthly record set in the fall of 2018 is because of the OPEC + reductions in output. Having said that, even if OPEC + members were to redeploy their production capacity currently, I have some doubts whether we would see new record highs on a sustained basis. While on paper, these countries may have almost twice as much spare capacity on hand than the roughly 3.5 mb/d gap between current production and the 2018 monthly record, in reality, I don’t believe that they could come close to helping the world surpass the 2018 production record.

My view on the global oil supply situation is that in late 2018 we either reached a long-term plateau in production, or perhaps we may have even reached the point of permanent global production decline. Regardless, it provides an additional stimulus to global EV sales.

Investment implications:

As the lithium spot price decline started at the end of 2022, I started looking at lithium miners as a long-term bet, with the belief that the EV sales growth trend will continue, despite some temporary signs of stagnation in certain markets. Thus I built a sizable position in lithium miners, with Albemarle (ALB) and SQM (SQM) making up by far the largest portion of it. I built a small position in Lithium Americas before the split, and I did not move to increase my position in either of the two new companies, until recently.

Though Lithium Americas Argentina performed far better comparatively since the split, on the back of it being a producing miner, Lithium Americas now has a more positive profile in my view. Its pre-production status has been baked into its valuation, while its advantageous geopolitical situation, being located in the United States is arguably yet to be fully appreciated. Most lithium producers are currently undervalued in my view, given that we are still operating under the assumption that the crude oil market will be in a constant supply glut situation, based on what increasingly seems like flawed supply/demand projections.

- Risks to my thesis.

The main company-specific risk I see with Lithium Americas is what is typically to be expected with a pre-production mining company. It seems to have enough external support to reach the stage of production, which is one less thing to worry about. At the same time, the company may stumble in terms of project execution. Environmentally driven legal or political challenges to the project could always be an issue. Once production will commence, there is always the risk that it will simply be unprofitable. Higher wages in the US and arguably stricter environmental and other regulations can easily eat into profit margins and make mining operations unprofitable relative to similar projects in other parts of the world.

The main external risk is that I am wrong about the continued growth in global EV sales. There is a potential scenario, where oil prices stay low, governments give up on more assertive measures on transitioning to EVs, while EVs do not necessarily provide the same utility to middle-class consumers as an ICE vehicle due to the price/range relationship. There are already pressures in the EU to abandon the ICE ban set to enter into force in 2035. EV subsidies and other incentives may start to fade as well. The bullish case for EVs cannot be taken for granted. Lithium miners could potentially face years or even a permanent stagnation in demand, even as they are planning to aggressively increase production in coming years, under the assumption that demand will be there.

- Lithium Americas stock may be a bargain, despite risk factors.

There is no denying a high degree of uncertainty within the lithium mining space because supply and demand have both increased exponentially in the past decade. Any disruption in demand growth will likely hit miners very hard. We are going through such a phase right now, with EV demand growth struggling in the Western Markets, with only China continuing to show impressive growth. If one believes that the slowdown in demand growth in North America & Europe is only temporary and EV sales will also pick up in other markets around the world, then the current steep decline in lithium prices is the best time to invest in lithium miners, which I have done starting last year and this year as well.

The bulk of my position in the lithium mining industry will continue to be Albemarle and SQM, given that both are well-established miners, which arguably lessens the company-specific risks associated with investing in this sector. Lithium Americas does offer a compelling enough investment opportunity in my view, to be worth the risk of investing in a pre-production miner. A combination of mostly external factors, such as prospects for a lithium market rebound as well as the rising premium on domestic self-sufficiency can combine with a well-executed commencement of production within a few years to make this stock an outperformer in the sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ALB, SQM, LAC, LAAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.