Summary:

- Lithium Americas Corp. stock experienced a setback after a surge, but technical indicators suggest potential for improvement.

- Global lithium demand is projected to double in 2025–2030, indicating the potential for higher prices.

- Lithium Americas’ market cap is small, but its significant lithium mine could lead to substantial revenue and stock appreciation.

Olemedia

After a remarkable surge, Lithium Americas Corp. (NYSE:LAC) stock experienced a temporary setback. It’s important to note that LAC had made significant strides, bouncing back by over 100% from below $4 to nearly $8 in a short time frame, thanks to the positive developments surrounding the Thacker Pass project. However, the market sentiment quickly shifted as news of dilution emerged.

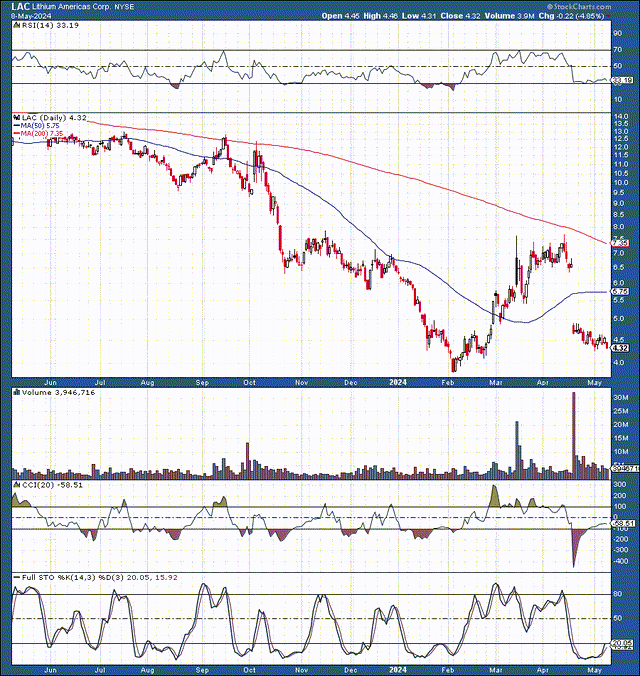

LAC: 1-Year Chart

LAC raised $275M through a 55M share offering at $5. This move effectively allows Goldman Sachs (GS), Evercore ISIS, BMO Capital, and others to purchase LAC stock at $5 or less, compared to the $7-8 price range it was trading at before the dilution. While this may be unfavorable for existing shareholders, it could prove beneficial eventually. The bright side regarding the raise is that LAC has more working capital and more interested parties invested in its stock.

Technically, LAC is showing signs of improvement. It has a significant gap to fill. Also, LAC has considerable potential to move to around the $6.50-7 resistance zone and then move higher afterward. The CCI, RSI, and other technical indicators are rebounding, suggesting a positive shift in technical conditions. Additionally, the full stochastic could soon move decisively above 20, indicating a potential upward movement in the stock.

LAC stock is significantly depressed and well below its 200-day MA, a level from which we often see long-term rebounds. Lithium has been in a downturn for a long time, and LAC’s stock could rebound considerably as lithium prices recover and move higher in future years.

Keeping Sight Of The Big Picture

The big picture is that lithium prices may have bottomed. Moreover, we may have seen a low point regarding global EV demand. Future demand waves should increase, leading to higher than anticipated lithium demand, likely enabling substantially higher prices to materialize in the coming years.

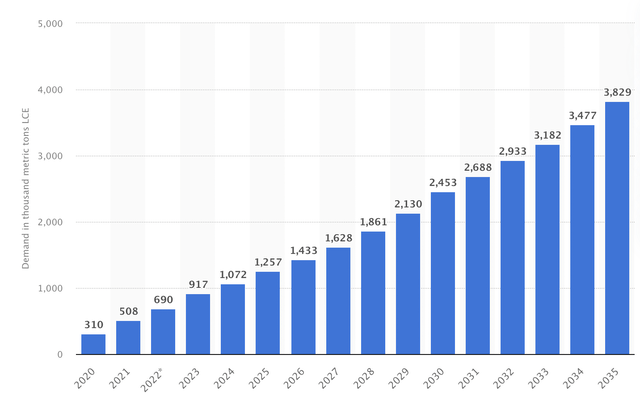

Global Demand Projections

Lithium demand projections (statista.com )

Global lithium demand could surpass 2.4 million metric tons of lithium carbonate by 2030, doubling the forecast for 2025. This dynamic illustrates the explosive demand potential in the lithium market. Moreover, the image suggests that the recent price declines due to overplay and soft EV demand are transitory, and lithium prices should balance out and increase in future years.

The Most Significant DOE Loan Ever

LAC has secured a $2.26B federal government loan (the most significant DOE loan to a mining company ever). This money, the funds from the offering, and future funds should primarily go toward making Thacker Pass work.

Thacker Pass is a massive lithium mine project with the richest known North American deposits, making it one of the most significant lithium mines globally. The mine’s phase 1 production could meet the battery demand for about 800,000 EVs annually. The massive lithium production facility represents the U.S.’s national interests and is strategically important for the U.S. and the Federal Government.

General Motors (GM) has secured exclusive rights to the lithium production from Phase 1 for up to 15 years and holds a right of first offer on the production from Phase 2. Thacker Pass is a long-term project, and LAC could experience considerable price appreciation as we advance and lithium production at Thacker Pass increases.

LAC Is Still Relatively Small

Lithium Americas Corp.’s market cap is less than $1B. Yet, operating one of the most significant lithium mines globally should enable substantial revenues and profitability to materialize. This dynamic implies that Lithium Americas Corp.’s market cap could expand substantially, leading to considerable stock appreciation as we move on.

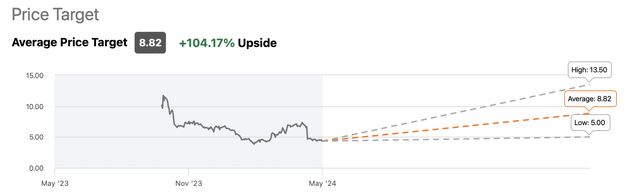

LAC price targets (seekingalpha.com )

The average price target for Lithium Americas Corp. on Wall Street is nearly $9, over 100% above its current price. Even the low-end estimate is $5, above where the stock is today. $5 is also around the recent offering, providing a logical low for the shares. On the upside, high-end targets exceed $13, implying the potential for a 100-200% gain in the next year.

Risks To LAC

LAC is an elevated risk/high reward potential investment. It’s riskier than others in its segment because LAC still needs to prove itself. The company has the project and the funding, and now it’s showtime. From here, it’s all about execution. Therefore, there are many unforeseen risks. For instance, LAC may run into funding issues in the future, leading to more dilution. Also, the Thacker Pass project could take longer than expected to be brought into the production phase. Other risks, such as persistently low lithium prices, exist. Investors should examine these and other risks before investing in LAC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!