Summary:

- A short report put some downward pressure on Lithium Americas.

- Lithium stocks are unloved and unwanted. It has been a rough few months with the stock price getting cut in half, but buying cheap and holding can work.

- We explore the math behind the project to show exactly how the project could be funded.

- While dark clouds loom over lithium in the short term, the long-term demand for lithium is rising. New projects are announced monthly that will require massive amounts of the white metal.

- While risky, we view Lithium Americas stock as a value play given future lithium demand.

Just_Super

A recent short report attempted to paint a very unfavorable picture of Lithium Americas (NYSE:LAC)(TSX:LAC:CA) and that has caused the stock to drop rather sharply over the last week or so. Let’s look a bit deeper into LAC to see if this has become a value play.

DOE Loans $2.26 Billion to Lithium Americas

Something to remember, the Department of Energy is not going to throw away $2.26 billion without doing a degree of due diligence. Nor is General Motors (GM) going to throw away its tranche #1 investment of $320 million in LAC. (Note: GM has a second tranche set to invest $330 million. If Tranche 2 funding is secured, the GM investment expands to a total of $650 million total).

| Tranche 1 for $320 million of the total GM Investment closed, and closing of Tranche 2 for the remaining $330 million is expected before or in connection with closing of the DOE Loan. – Source: Lithium Americas March 2024 PR |

The DOE and GM have both conducted due diligence for the project. Would both be so utterly foolish to loan or invest in something that makes no sense? I doubt it, but nevertheless, we need to see what current long-term prices of lithium are. (China spot prices, which are not the best measurement, should be avoided.)

Current Lithium Pricing

Pondering lithium pricing, one has to include three things. First, the China spot price is often quoted simply because we have visibility into China spot prices. Second, these China prices do not necessarily reflect the reality of long-term contract pricing (via large companies like Sociedad Química y Minera (SQM) or Albemarle)

Third, we are seeing some companies reporting average lithium contract prices over $20,000. Per Arcadium (ALTM):

|

“The Company achieved average realized pricing of over $20,000 per product metric ton for its combined hydroxide and carbonate volumes in the first quarter. Our multi-year customer relationships and wide range of high-quality lithium products allow us to reduce the overall volatility of our earnings while maximizing the value per unit of lithium sold. We see encouraging signs in the lithium market, and underlying demand fundamentals remain very strong. Prices have increased from the cycle bottom and appear to have stabilized at levels that are notably higher than what we saw in the last downturn.” – Source: Arcadium |

For long-term pricing, Albemarle is also starting to try to provide color to the market via open auctions. Prices are typically higher than China spot prices. More can be read about this effort here.

Lastly (and most important) is you have to realize that the $24,000 lithium price that LAC used is near contract prices currently available AND the $24,000 assumes this is the value you are going to get over the life of the mine. In this case, 25 years for Phase 1.

For comparison’s sake, Century Lithium used $24,000 and Standard Lithium (SLI) used $30,000 a tonne. In this rare instance, inflation is in our court and will help inflate lithium pricing over time well beyond current prices in our estimation.

The Break Even Point

Even with the DOE loan of $2.26 billion and a GM loan of hundreds of millions, there are still some analysts and investors that doubt whether Thacker Pass will work at China spot prices of $14,000 at tonne. Fair enough, any project has a point in which it does not make sense. However, since we are currently seeing long-term contracts at $20,000+ I do not think this concern carries much weight currently.

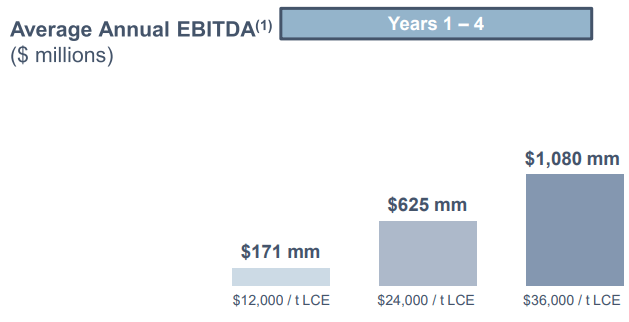

Let’s pull up the March 2023 update from LAC just to be sure. On page 47 we see EBITDA for Phase 1. EBITDA is not the optimal metric for use; however, right now, it might be the best I have to work with. I’ll have to ponder this more. We should note that EBITDA ignores a lot of things like taxes and interest. Interest on $2.26 billion could be quite a burden if we assumed lithium dropped from long-term prices of $20,000+ to $14,000. We can see below that at $12,000 LAC stands at an EBITDA of $171 million. Factor in taxes, interest, depreciation and it could get sticky.

LAC Phase 1 EBITDA (LAC) |

And Phase 2:

Phase 2 EBITDA (LAC ) |

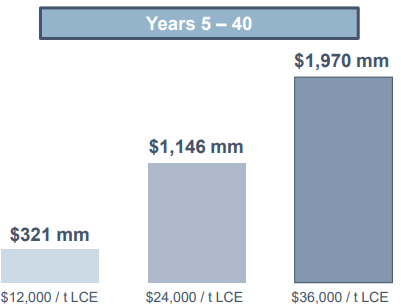

LAC After-Tax NPV (LAC DFS)

My initial thoughts are that, obviously, at $14,000 lithium LAC would be getting near the danger zone. The Table 22-12 from the DFS gives weight to this. Lucky for us, this is just theoretical, as lithium contract prices are over $20,000 and rising.

Albemarle Likes Clay Lithium

There aren’t any clay-based lithium projects that are currently operational at a broad commercial scale that I am aware of. But there is interest in the approach.

One promising project was the canceled Sonora Lithium clay project in old Mexico as an example of a failed clay project. From my research, the mine was never constructed because the Mexican government decided to commit seppuku by nationalizing its lithium mining industry. With that, lithium powerhouse Ganfeng (OTCPK:GNENF) pulled out of the project and Mexico passed on an opportunity.

However, we see some very promising clay projects moving forward in Nevada: Century Lithium (OTCQX:CYDVF), Surge Battery Metals (OTCQX:NILIF) and dare I say Albemarle (ALB) is even eying clay-based lithium per a 2021 PR:

Albemarle Eyes Clay (Albemarle)

Albemarle Eyes Clay Assets Next Door

One might even connect the dots and realize that ALB and Century lithium are neighbors. ALB has the valley and a brine evaporation operation, while Century (with its water rights) has the higher ground that is clay rich. Digressions aside, clay-based lithium is moving forward.

Concerns About Dilution

In the next section, we look at the capex concerns and address how the current financing works out when we include the DOE loan as well as the second tranche from GM.

Some investors have expressed concerns about the costs associated with bringing the projects to production, but the actual Capex is in the DFS. The DFS does not magically shift north based upon loan values.

Some speculation has cropped up that a Department of Energy (DOE) loan will result in dilution. DOE loans do not result in dilution, but rather they are a loan that bears interest (this interest is included in the DOE loan amount as $290 million). Hence, the DOE loan will not result in dilution.

The GM tranche 2 loan should result in dilution as it is a stock-based transaction vs a simple DOE interest bearing loan. Yet, LAC stands to gain $330 million from this potential diluting investment by GM.

The Real Math Behind Thacker Pass

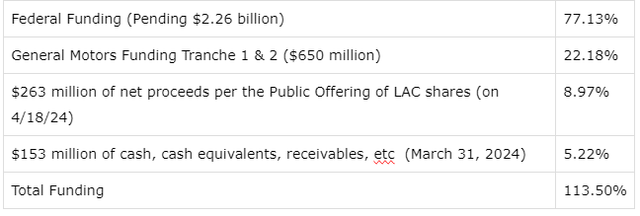

Trust but verify. First, we must factor in that Phase 1 for Lithium America is going to cost $2.93 billion per the DFS. You can pull this capex cost up if you read the LAC DFS, and you should. Here is the real math behind the project, which we will explain below. Assuming a capex of $2.93 billion and assuming GM tranche #2 closes, here are how the numbers break down for funding the project in relation to the capex:

Thacker Pass Math (Lithium Americas / General Motors)

Thacker Pass Math (Lithium Americas / General Motors)

Running simple math, we can take the potential DOE loan of $2.26 billion and divide it by the $2.93 billion capex, and we arrive at the DOE funding 77.13% of the project. If we assume GM fund tranche #2 closes, then LAC will have obtained $650 million total from GM or 22.18% of capex costs. The raise of $263 million provides 8.97%, while cash on hand of $153 million (as of March 31, 2024) brings in 5.22%. The grand total that you can verify is 113.50%. As you can clearly see, the project could be very well capitalized.

But Wait, There’s More Math!

To quote the late great Billy Mays, “But wait, there’s more!” LAC has already invested $194 million into Thacker Pass. We can see this via this statement from the 4/18/2024 PR.

| “Net proceeds of the Offering of approximately $263 million (before giving effect to any exercise of the Over-Allotment Option), along with and after accounting for the funding from the Loan and the GM Tranche 2 Investment, are expected to result in the estimated remaining capital expenditures of approximately $2.736 billion for construction of Phase 1 as well as the Company’s 2024 operating budget being substantially fully funded.” |

If you take Phase 1 capex of $2.93 billion and subtract the $2.736 billion above, you get $194 million invested so far in the project. If we were to run the UPDATED capex of $2.736 billion, obviously our numbers would improve to:

|

Thus, we can see the company has a nice secondary cushion for any cost overruns on top of the cushion built into the DFS.

Lithium Americas Risk Factors

Risk can be broken down into a few factors: Company specific risk such as the DOE loan and the GM tranche 2 loan not closing. We could also ponder macro risk factors, such as the general economy continuing to deteriorate under high inflation and high interest rates. This economic hardship and uncertainty must impact EV sales as consumers simply have less income. Another uncertainty hanging over the stock is how will the GM loan impact the stock? Dilution for a massive cash injection of $330 million could occur, but how will the stock react? That is an unknown, and the stock market does not like unknowns.

We also have election unknowns adding murk to the water. On one hand, President Trump did push the critical elements list and Thacker Pass during his tenure. On the other, he is a wild card if anything. I would venture his business leanings and anti-China stance would put him in a balanced camp of being pro oil while supporting independence from foreign countries dominating lithium production and refining. We will see how the elections play out. It should be interesting.

Right now, we are in the perfect storm that is rattling the lithium market, but these things also have a way of reversing much like the tides of the sea. If we eliminate election uncertainty and somehow manage to improve the macro picture, things might reverse quickly for lithium in general.

Mining Legal Updates

Let’s talk legal for a moment and why it matters. During the last few years, we have seen out-of-state actors conduct operations to disrupt and delay lithium projects. This should not be unexpected, though (and they have lost every single court case against LAC thus far).

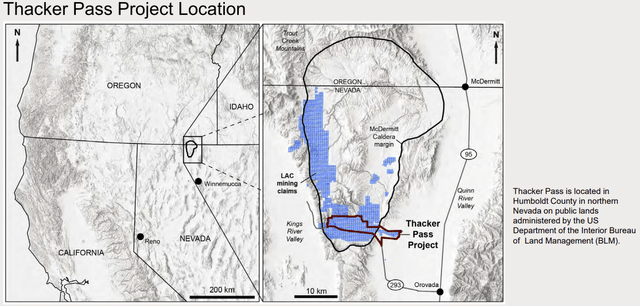

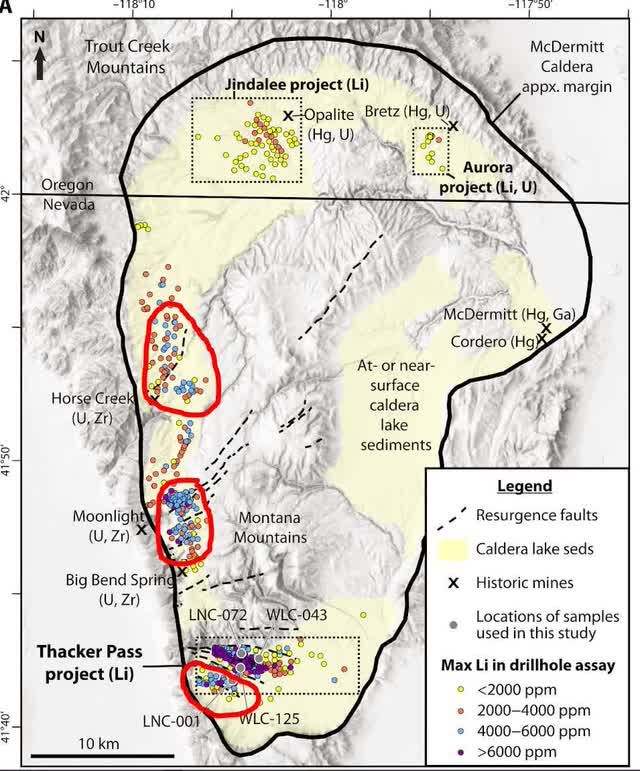

However, what was unexpected is that politicians passed a law that will clear up an issue wherein companies could only use valuable land in mining operations per a court ruling (as opposed to putting tailings on non-valuable land). This clears the path for Lithium Americas to expand into new areas long-term, be it on the south side of the highway or even some of the northern lands that we have talked about in the past (noted in blue below). Of course, this is several years down the road.

Future Lithium Expansions (LAC June 2023 PDF)

In red, we can see future potential lithium sites per LAC.

Expansion Potential ((Benson, Coble, & Dilles))

Follow The Lithium Demand

Ignore the politics. Ignore the propaganda. Just sit back and follow the money. Take note when the DOE loans out $2.93 billion. Your ears should perk up when you see car companies investing tens of billions into battery projects. When the Department of Defense joins the fray, realize this is just icing on the cake as it demonstrates the intent of the government. These are massive economic wheels that are turning and yes, it will take time to see the lithium demand from these projects, but it will come. Here are just a few notable examples of future lithium demand engines. Note the bulk of links below are from 2024 unless noted.

- $65 billion – The amount Honda plans to invest in EV over the next 10 years. Of which $11 billion is set for a Canada expansion this year.

- $1.6 billion – Asahi Kasei investment in a battery separation plant in Canada.

- $1.5 billion – Rivian to expand plant in Illinois.

- $1.3 billion – Toyota EV plant in Kentucky.

- $171 million – Korea building lithium reserves.

- $140 million – Green New Energy Materials in North Carolina.

- $90 million – Department of Defense & ALB (Sept 2023).

- Saudi Arabia – Seeks to invest in lithium mines.

- Volvo – Improves charging times by up to 30%.

Lastly, the United States has updated EV tax credit rules, enabling more electric cars to be eligible.

A Vetted Value Play

At $3 and some change, LAC represents a stock in a sector that the market just does not get. Traders do not like it, some longs are near despondency, and with the recent company raise, LAC is frankly a perfect target for a bearish attack. The GM potential dilution for funding weighs on the stock too. Even with project funding lined up, we still have closing risk. GM needs to close in order for the DOE funding to close. We even have political uncertainty impacting lithium. However, we also have two absolute power houses (Dept of Energy and General Motors) that have conducted due diligence on LAC and are betting on the company.

At some future point, if we are past the multitude of jitters listed above, we could watch the project build out to production and profits. At some point, lithium demand from future projects has to come into play. This could take several years, though. While the pain might continue, I view LAC as a value play. I will be buying some here and I will keep some powder dry in case it goes lower to buy more. The long-term lithium demand is just too much to ignore.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC, TSLA, NILIF, CYDVF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We also own SLI.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.