Summary:

- Lithium Americas is a high-risk, high-reward investment, akin to a call option on lithium demand, especially with EV market growth projections.

- The company aims to finance Thacker Pass mine construction through a $2.26 billion DOE loan and $330 million investment from GM.

- Despite current lithium price weakness, Thacker Pass’s low production costs ensure profitability, with significant upside potential if lithium prices rebound.

- Rio Tinto’s aggressive move into lithium, valuing Arcadium Lithium at double its recent price, underscores the sector’s long-term bullish outlook.

Just_Super

The big merger in the lithium space points to the upside potential in Lithium Americas Corp. (NYSE:LAC). The junior lithium miner isn’t financially impacted by the current price weakness, other than with any financing needed to complete the big U.S. mine. My investment thesis remains ultra-Bullish on the stock, especially after a large diversified miner confirmed the value of lithium.

Call Option On Lithium

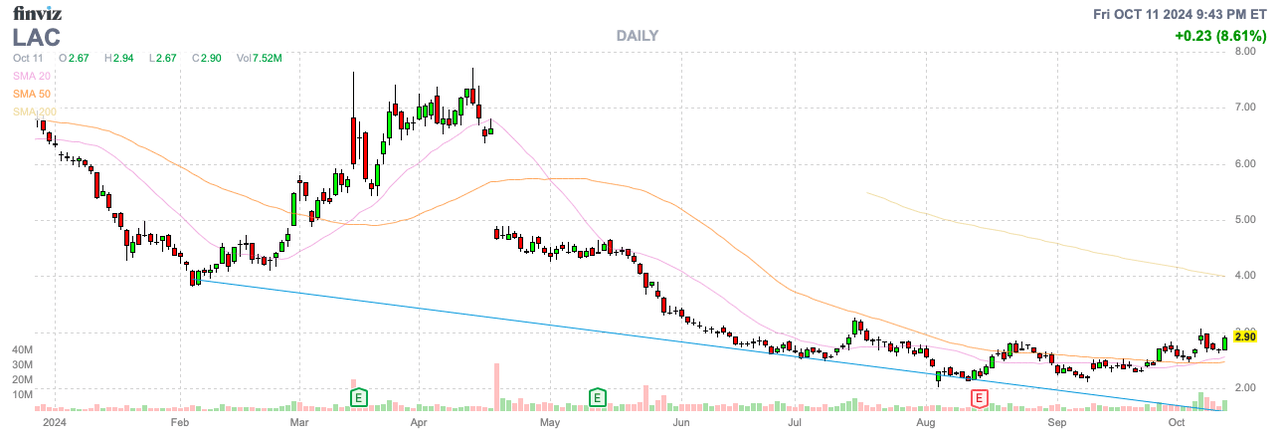

Lithium Americas slipped below $3 this year due to the weak lithium prices. The pre-revenue junior miner is still working towards financing the construction of the big Thacker Pass mine in Nevada, with plans for production of up to 80,000/t LCE per annum.

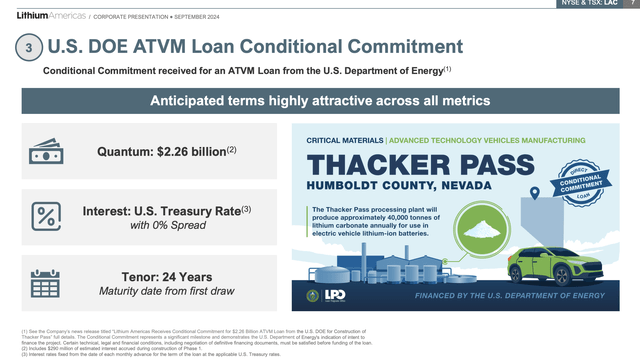

The company has a simple path to paying for the capex by finalizing the $2.26 billion loan from the U.S. Department of Energy under the Advanced Technology Vehicles Manufacturing Loan Program, for which the DOE provided a conditional commitment. After this is complete, Lithium Americas should finalize the second tranche of the General Motors (GM) agreement for $330 million.

Source: Lithium Americas Q2’24 presentation

The total funds would amount to nearly $2.6 billion to pay substantially all of the remaining Thacker Pass construction project, though these funds include ~$290 million in interest expenses during the construction phase. The miner already has a cash balance of $378 million to continue to the capex plans.

Lithium Americas offers a huge advantage to GM with the domestic lithium supply of 40,000 tpa from Phase 1 sufficient to supply 800K EVs. The IRA-compliant lithium will provide up to $7,500 in consumer tax credits for EVs. Of course, the rules and regulations by 2027/28 production could alter the attractiveness of a domestic supplier.

Either way, Lithium Americas still estimates a production cost of $7K/t helping ensure the lithium production is a low-cost source. Even after lithium prices have plunged to $11K/t, the Thacker Pass production would still be highly profitable.

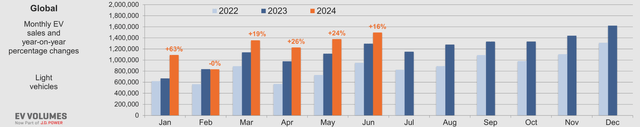

Global EV demand still remains strong, led by China with 31% growth in the 1H’24 to reach 4.4 million EVs sold. The latest data has global EV sales reaching 1.4 million vehicles per month, up 16% YoY in June.

Lithium Americas is primarily focused on U.S. EV sales, and the North American market has been weak. Total EV sales in this region were only up 12% YoY to 836K vehicles.

The key demand equation involves lithium supply failing to keep up with demand, with a goal for 60% of vehicles sales being EVs in 2030. Under this scenario, Lithium supply fails to keep up with demand by around 2027/28 depending on new mines coming online, just about when Lithium Americas expects to open Phase 1 of Thacker Pass mine.

Sub-$3, the stock quickly becomes like a call option on lithium demand. As with any junior miner, the stock is high risk due to the construction hiccups and uncertainty about the mineral demand. If lithium surges again, an investor will own a stock that trades at multiples of the current price, similar to a call option.

Big Arcadium Lithium Deal

While lithium prices were down in the dumps, Rio Tinto (RIO) showed up to Arcadium Lithium (ALTM) with a big offer. Rio offered a deal that valued the lithium miner at $5.85 per share, equivalent to double the initial October price.

Both Lithium Americas and Arcadium Lithium had stock prices trade towards the low $2s at the lows in early September. LAC has only rebounded to right below $3 versus Arcadium Lithium, rallying to $5.55 on the deal.

The Thacker Pass feasibility study came back to a $1.1 billion adjusted EBITDA estimate for the Phase 1 project based on $36,000/t price for LCE. Lithium America would have an after-tax NPV of $5.7 billion for a stock currently trading at a market cap of $580 million for 10x upside.

The investment story has a lot of unknowns with questionable long-term EV demand, especially in the U.S. Not to mention, Lithium Americas still has to secure all of the funding and finish constructing of the mine while a short report questioned the mining process, amongst other stuff.

Rio Tinto is a diversified miner with a market value topping $110 billion and experience in the sector, with struggles to build the largest European lithium mine in Serbia. The company aggressively bought into the lithium space in a bullish long-term sign and an investor can follow the mining giant into Lithium Americas at a still beaten down price, though with higher risk.

Takeaway

The key investor takeaway is that Lithium Americas is like a call option on the lithium demand story. For an investor that believes in the world moving to EVs, the stock is a near no-brainer bargain here. Ultimately, though, risk exists for the complete loss of capital due to questions on funding and future lithium demand.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q4, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.