Summary:

- Lithium Americas faces risks from volatile lithium prices and dilutive financing, but these risks are overblown by a recent short report.

- LAC’s Thacker Pass project has already produced lithium carbonate samples and utilizes proven technology and equipment.

- The U.S. government’s aggressive plan to support the domestic supply chain includes a focus on lithium production, which bodes well for Lithium Americas’ DoE loan.

- The stock is cheap based on even conservative feasibility studies for the Thacker Pass.

Just_Super

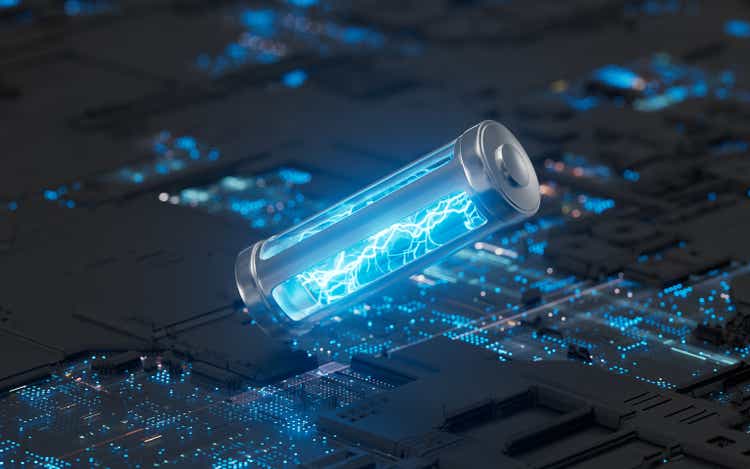

Lithium Americas Corp. (NYSE:LAC) slumped to a new low on a new short report. The lithium miner faces normal risks from volatile lithium prices and dilutive financing in the future, but the risks are overblown by the report. My investment thesis remains ultra-Bullish on the stock on expectations of higher lithium prices in the future, while the company doesn’t have any near-term supply impacted by the current low prices.

Source: Finviz

Biggest Short Hit

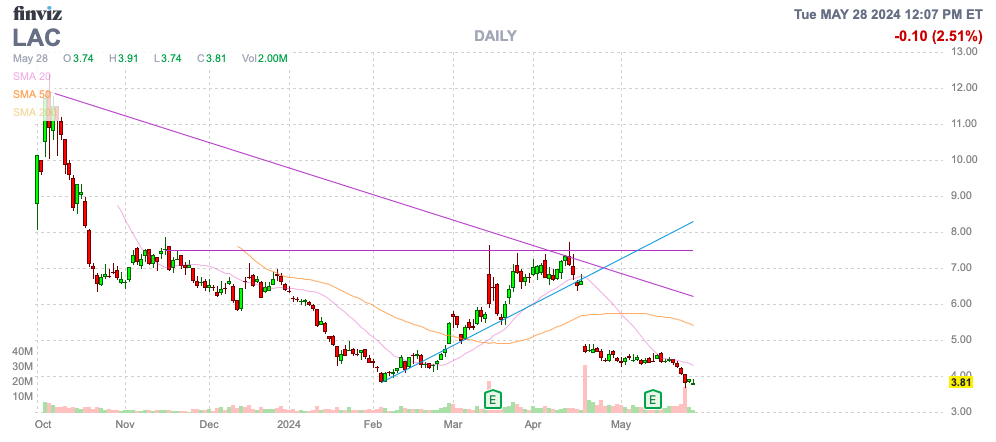

Bleecker Street Research hit the stock with a short report last week and is clear the firm is short Lithium Americas, but the company appears to go the extra effort to distort the truth about the lithium miner. In the opening summaries, the research firm calls the company both a “pre-revenue junior miner” and a “stock promotion”. While the first claim is technically true, both claims appear as an intentional attempt to distort the market.

Source: Bleeker Street Research

While Lithium Americas is technically a pre-revenue miner now, the company and management team recently completed the Caucharí-Olaroz lithium mine in Argentina and split off the business from Lithium Americans (Argentina) (LAAC). One of the major investment points is this very crucial distinction.

Since Lithium Americas has a recent history of opening a lithium mine, the whole stock promotion thesis should be thrown out the window. Not to mention, General Motors (GM) aggressively invested in the miner and the DoE has conditionally approved a large loan for the Thacker Pass mine, providing a long list of credibility to avoid the stock promotion label.

Once getting past some of the distortion attempts, the biggest negative from the Bleeker short report is that Lithium Americas somehow has technology unsupportable by the current market. The executives have already developed the Lithium Americans (Argentina) mine in Argentina and are highly experienced in the lithium mining sector, though it clearly doesn’t mean the management team is beyond approach.

One common thread of short reports is to question technological and product assumptions via deemed experts that most investors don’t have the knowledge and expertise to counter. Management would have no reason to overstate the Thacker Pass claims.

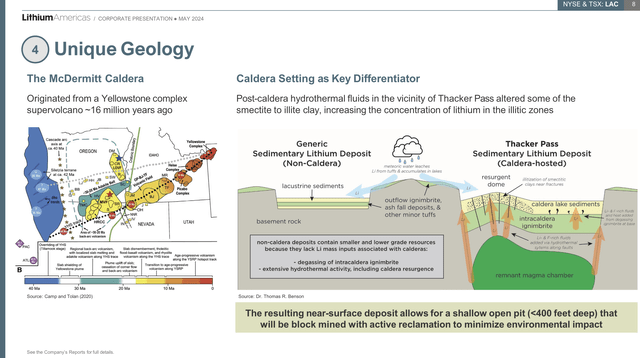

The McDermitt Caldera geology was recently estimated to have one of the largest lithium deposits in the world. If anything, Lithium Americas might have far more resources than forecasted.

Source: Lithium Americas Q1’24 presentation

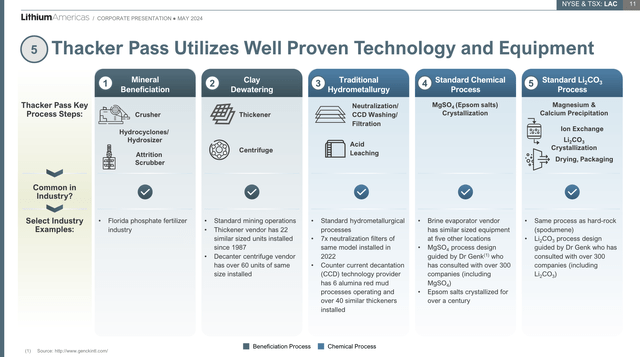

Lithium Americas went into great details in the Q1’24 presentation, highlighting how the Thacker Pass project utilizes well-proven technology and equipment. The lithium miner has already produced lithium carbonate samples from the Thacker Pass since July 2022 with proven production of battery-quality lithium via continuous-production process.

Source: Lithium Americas Q1’24 presentation

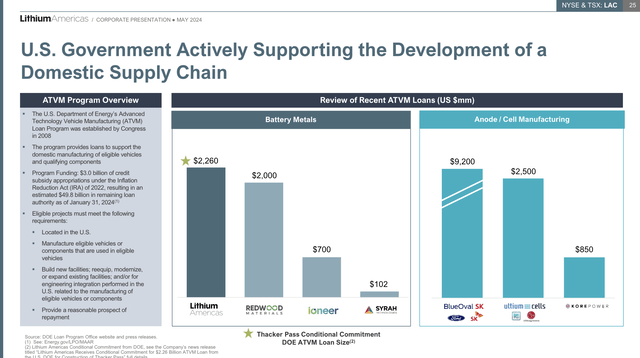

The short report appears to make a huge stretch on the past history of DoE loans. The U.S. government has a new aggressive plan to support the domestic supply chain, including a huge focus on lithium production for EVs.

Source: Lithium Americas Q1’24 presentation

The Redwood Materials $2 billion loan was only conditionally approved last year, and the Inflation Reduction Act was only passed in August 2022. Any prior loans were completely under a different era.

Again, the main negatives are really unproven points distorted by the past without any concept of the present market difference. The clay lithium mining concepts are new and constantly being refined.

Lithium Prices

As much as one wants to get deep into the weeds on the economics of any particular mine project, what ultimately matters to the stock price is the price of the related commodity. For Lithium Americas, with mine production not until 2027, lithium prices will move the stock price.

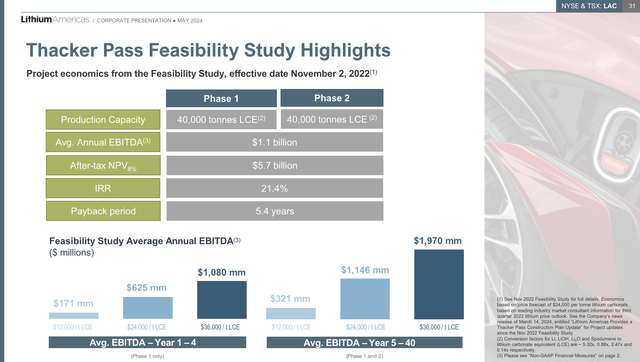

The unit economics remains strong for the project. Lithium Americas has forecast the company being EBITDA positive on lithium prices of only $12,000/t LCE due to low production costs.

Source: Lithium Americas Q1’24 presentation

Bleecker Street Research disagrees with a forecast that the project would be uneconomic, despite Lithium Americas suggesting only $7K/t costs. The market won’t actually know for years whether the company is accurate or the short report.

Remember, a big part of the low costs is the size of the mine. The short report already agrees the targeted 80,000 tonnes of LCE amounts to nearly 8% of the LCE global market. The scale of the project is one of the major reasons the Thacker Pass project is expected to be economical.

The major point of the investment in Lithium Americas is based on a supply shortage of lithium when the project hits the market in 2027 and an experienced management team. CEO Jonathan Evans was the CEO of the Old LAC since May 2019 and primarily responsible for taking the mine to production. Not to mention, GM is a prime investor and a lot of the prior missteps in the EV sector were overdramatized by the report considering the company eventually cancelled the Nikola (NKLA) investment before even officially agreeing to the deal to invest in the company, supply equipment and build the Badger pickup.

The CFO, EVP – Capital Projects, SVP – General Counsel, and VP – Resource Development all had various experiences working for the Old LAC. The management team has vast and recent experience with developing a new lithium mine.

Lithium Americas has over $400 million in cash after the recent secondary offering. Along with the $2.26 billion DoE loan and the additional GM tranche of $330 million, the company forecasts having all the cash needed to fund the lithium mine project without needing an additional dilutive offering.

The company has already spent $250 million on capex for the project, leaving just around $2.7 billion left to fund the mine. If anything, Lithium Americas now has excess funding by up to $300 million with access to nearly $3 billion in funds, but nothing is guaranteed in the stock market and especially with new mines.

Morningstar analyst Seth Goldstein confirmed a $12 price target on the stock following the short report. The research already assumed the costs and lithium output is below forecasts to achieve this target on a now $4 stock. The upside potential is from the company actually hitting targets.

Takeaway

The key investor takeaway is that the Bleeker short report definitely brings up some valid questions. Unfortunately, the report appears to overly stress on some historical facts not necessarily relevant now.

Investors should realize Lithium Americas is a highly speculative stock. The stock offers solid risk/return potential for those believing in the long-term potential of lithium.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market in May, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to start finding the best stocks with the potential to double and triple in the next few years.