Summary:

- Lithium Americas took a massive hit via a public offering of shares.

- Given pending government loans and General Motors support, Thacker Pass will most likely be operational around 2027 give or take.

- Future expansions could be self funded and we have provided maps of potential target areas.

- Current share prices of LAC represent a ridiculous value for the patient long-term investor who is not risk averse.

gchapel

In a stunning display of self-immolation, Lithium Americas (NYSE:LAC) set itself on fire and incinerated 30% of its share price in one day via a public offering of shares. While some investors were aware LAC needed additional capital to bridge the gap in funding for its lithium mine (called Thacker Pass), some were not.

Both groups however were stunned when LAC announced it would issue 55 million shares (with the ability to issue an extra 15%) at a mere $5.00 a share. This resulted in the stock crashing and burning. The question now is should you still buy LAC and where does this go long-term?

History Repeats Itself

LAC is not a stranger to raising capital. Some many years back they raised capital for the south American lithium project, now a part of Lithium Americas Argentina (LAAC) which resulted in sending LAC into a tail spin. It was rather unpleasant and it took much time to heal but the stock did recover with time.

While investors endured short term pain, the long-term impact was the south American project was funded and is now producing its first showings of lithium production. Granted it is only technical grade as opposed to battery grade but I digress.

The point is funding these massive capex projects takes capital. With that comes dilution. The unexpected part was how low Lithium Americas set the public offering relative to the share price. Yet I understand it, you have to sweeten the pot to attract the capital. That does not mean I have to like it however.

Yet, for us long-term investors today’s drop really does not matter in a sense. I’m sure that sentence will draw much fire from traders and short-term investors but zooming out to a longer time period, today’s action will just be a blip hopefully on a chart. The real question is that of a macro picture concerning lithium and what does the landscape look like for EVs beyond 2030. If the macro picture pans out, LAC might be one of the better tickets to buy now in preparation for the shift to EVs.

Progress at Thacker Pass (Elko Daily)

The Trader Mentality

When I entered the investing game decades back, trading stocks was reserved for the wall street elites with large bank rolls. The commissions were simply too harsh for the average Joe to trade. My grandfather paid a 1% commission just to buy an aerospace stock and that was just to get in. Now days commissions are low or even non-existent. This has opened the door for traders to quickly enter and exit stocks be it seconds to just a few months of holding time. While I have traded at times, I ponder that I might have lost more potential gains through trading than simply buying and holding quality stocks for long-time frames.

Long-Term Value Investing In Lithium

For the value investor though, buying quality assets that have been beat down and stomped on can result in long-term gains if the company pans out.

When we look at LAC we see a company that has an utterly massive government loan of $2.26 billion pending (interest payments are part of the loan amount), the company has a treasury of $196 million as of December 31, 2023 and they are soon going to raise over $275 million via the recent public offering. Of course, you have General Motors (GM) that will enter eventually with its second tranche of funding. Now how that will play out is anyone’s guess. Expect additional dilution. In the end, Thacker Pass will be funded and should be coming online in the next few years.

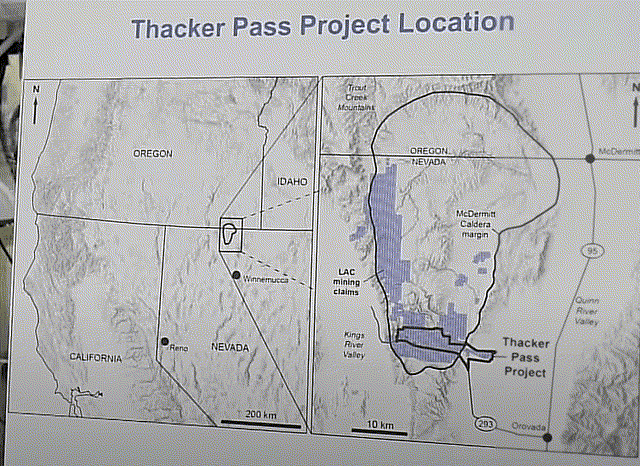

Thacker Pass and Future Expansions (Lithium Americas)

A Side Bar Digression – Risk

I’m going to go off on a side bar for a moment as I think this is important to keeping a balanced view of things. Various groups have tried to stop or hinder Thacker Pass and local interests in the past. These matters have been settled in court, but just because a court rules on them does not mean that other out-of-state groups will not engage in such activity by bringing up very similar matters to the U.S. Fish and Wildlife Service. One such group is now trying to bring up a point involving a rare snail.

While I do not think this is going to gain any ground verses big picture national defense you never know. Consider it something to keep an eye on. LAC’s Tim Crowley (vice president of government and external affairs) had this to say about the snail:

“There is no indication the spring snail would be impacted by the Thacker Pass Project based on more than 10 years of data collection, impact evaluation by federal regulatory agencies, and judicial review.”

and “We support this additional study by the U.S. Fish and Wildlife Service and are confident it will reaffirm that we’re building an environmentally responsible project with no impacts to the snail.” – Source: Ictnews

LAC should be considered a risky stock. While government funding is pending it is well, pending. Nothing is certain till the money is in the bank. The same could be said for General Motors funding. Also, we are in a strange economy and this is a very odd stock market as a whole. The Fed is trying to slow down the economy and stocks are inflating at the same time. Be careful. Lastly EVs are not a certainty. While I am following the money to the tune of billions of dollars flowing into EVs (be it car makers, battery producers, or research endeavors) the crux is, you also need to consider what happens to your investments if EVs utterly fail. While I think the odds are low it is a possibility. Hence plan on success but have contingency plans. Now let’s look at potential expansions that LAC could carry out given time.

Lithium Americas Ridiculous Expansion Potential

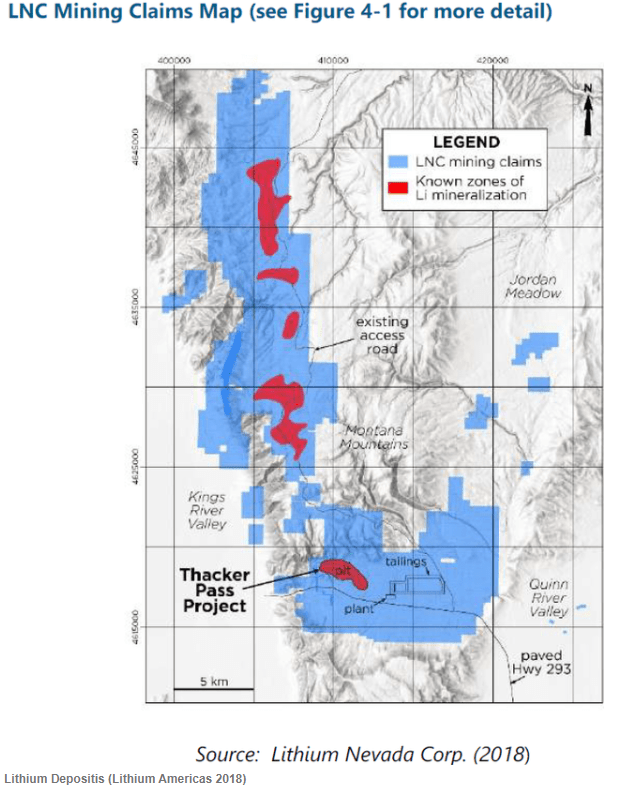

Over the next two to three years we will watch Thacker Pass continue to progress towards construction. Land will be molded, buildings constructed, and eventually lithium will be produced. Eventually 40,000 tonnes of lithium will be produced per year. While this is nice, I have my focus set on what comes after Thacker Pass? The land south of the highway is lithium rich and they might be able to expand to it, but the northern properties interest me more. Granted these are years out, but at some point, I see the company drawing up detailed feasibility studies on these lands to see what they might hold. This old picture from 2018 offers a tantalizing glimpse into one possible future.

Lithium Hot Zones (LAC)

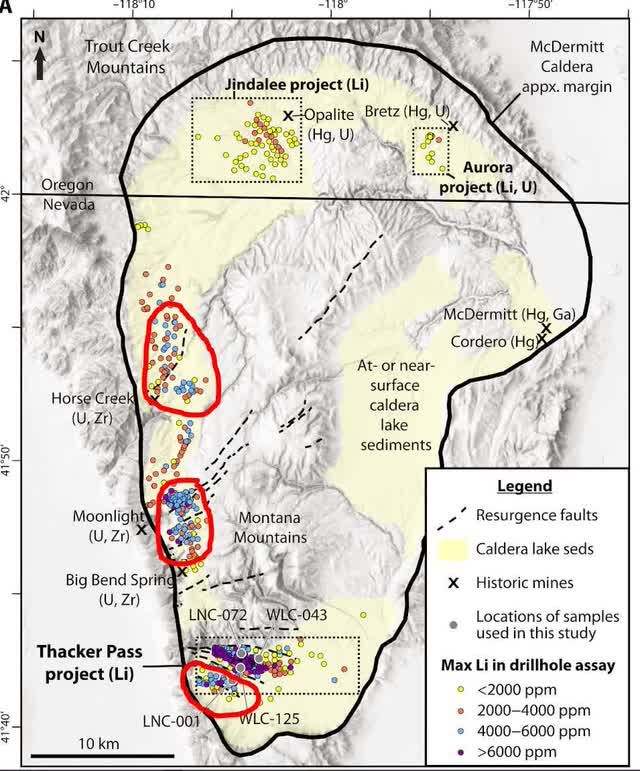

Multiple Thacker Passes (Benson, Coble, & Dilles)

I have highlighted the three most rich expansion areas in red. If we look into the initial lithium grades on these north LAC lithium deposits, we see very rich grades in purple followed by blue. It should be noted that very rich lands are also south of the project on the other side of the highway by Thacker Pass.

Conclusion

The new stock offering has put a damper on the share price of LAC and where shares end up short term is anyone’s guess. Long-term Thacker Pass is going to expand to stage 2 and ramp lithium production past 40,000 tonnes. The other three properties I pointed out hold much potential in my opinion. For the long-term investor Lithium Americas might represent a great stock to buy and hold if one is willing to wait outlandish time periods (10 years). While Thacker Pass should be coming online in the next two or three years I am looking at the bigger prize. That will take time. Recent stock price action, while painful, might just be a speed bump to the patient investor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC, LAAC, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.