Summary:

- The lithium market is recovering, with Arcadium Lithium’s $6.7B takeover by Rio Tinto signaling rising future lithium prices due to increasing EV demand.

- Lithium Americas stock is undervalued, with positive developments at Thacker Pass and potential DOE funding, making it a strong investment opportunity.

- LAC’s technical momentum is improving, with a long-term bottoming pattern and favorable risk-reward ratio, suggesting significant upside potential.

- Future lithium carbonate prices could triple, boosting LAC’s revenue to $1.1B-$2B by 2028, making current projections seem highly pessimistic.

Olemedia

After years of underperformance due to oversupply issues and a sluggish economy, the lithium market is finally charging up again. I recently discussed why “It was time to go long” Arcadium Lithium (ALTM), and just weeks later, mining giant Rio Tinto (RIO) announced the stock’s takeover.

The deal valued Arcadium Lithium at about $6.7B, which is cheap. This dynamic could be why Rio wanted the deal done quickly and quietly, as a seismic shift appears to materialize in the lithium market. Lithium prices will likely rise in future years as electric vehicles, “EVs,” and other lithium-related demands recover and the transitory oversupply issues dissipate.

Lithium Americas Corp. (NYSE:LAC), is another exciting company in the recovering lithium industry. Recently, LAC received excellent news regarding its joint venture with General Motors (GM) at Thacker Pass. Also, LAC could see more positive developments as its DOE funding may be finalized soon.

LAC stock has been clobbered during the lithium downturn. Thus, its stock is relatively cheap, and given the positive developments in the lithium market, LAC’s price will likely move much higher as we advance. Another critical factor is that lithium stocks should recover well before lithium prices, which is likely why the stock is moving here.

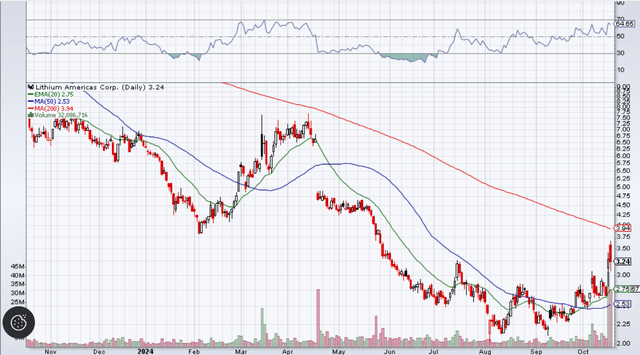

Technically – $2 Was Likely The Bottom

LAC became massively oversold during the drop in April and May, a decline that persisted into the summer and even the fall. However, the bottom may have occurred when the early August mini-crash happened, and LAC dropped to $2. About a month later, LAC retested the $2-2.25 support zone.

This appears like a long-term bottoming pattern, and the technical momentum seems to be shifting to a more favorable pace. The 20-day MA recently went above the 50-day MA, and we may see continued progress as the 50-day MA approaches the 200-day MA.

The momentum shift is critical as it impacts sentiment. As sentiment has been extremely poor for a long time, improved sentiment could drive this stock much higher as we advance. Moreover, positive news flow and sentiment are all LAC will have because the company will unlikely have any substantial sales until 2027 or 2028.

From a technical perspective, LAC could bounce around the $3-4 range before breaking out to the $5-7 level, potentially closing the gap. Crucial support remains around $2.80-2.50, and we can institute stop-out levels below support points, just in case. Despite the potential for more volatility and turbulence, the risk-reward ratio appears favorable in LAC.

What Makes Lithium Americas Special – Thacker Pass

The market may not care about what the company made today or yesterday. It’s primarily about what a company can make tomorrow or a year from now, which puts LAC in a highly favorable place. The company received a conditional commitment for a $2.26B ATVM loan from the U.S. DOE earlier this year. Now that GM is “all-in” on Thacker Pass, it’s likely only a matter of time before more constructive developments regarding the DOE loan are revealed.

For anyone unfamiliar with it, Thacker Pass is a massive project with North America’s largest known and measured lithium reserves. LAC has exclusive rights to develop and operate the vast mine, which should provide approximately 40,000 tonnes of battery-quality lithium carbonate in phase one.

Therefore, LAC has an extraordinary opportunity to develop the Thacker Pass project provided the DOE and other loans and profit from the lithium production in the coming years. LAC’s market cap has dwindled to around $700 million as the lithium route persists.

However, the Thacker Pass mine could be operating at full capacity (phase one) in 2028, enabling LAC to realize $1B+ in annual revenue as the initial phase of lithium production comes online. Phase two production is expected to yield double, approximately 80,000 tonnes of lithium carbonate annually, and the mine’s life expectancy is estimated to be at least 40 years.

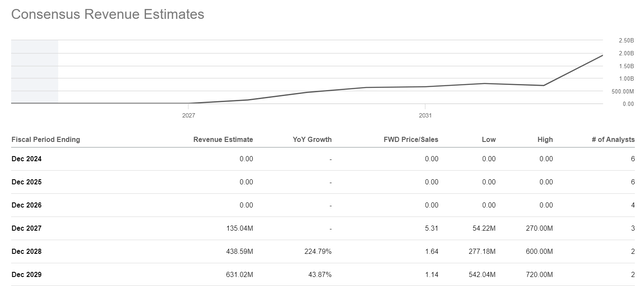

LAC’s Estimates Could Be Low

Few analysts cover LAC’s future earnings potential, and the estimates may be lowballed here. “Consensus” sales estimates are only about $135M in 2027 and $440M in 2028, presumably when Thacker Pass will be at full production (phase one). This seems highly pessimistic, and LAC sales could be much higher as market dynamics stabilize and improve.

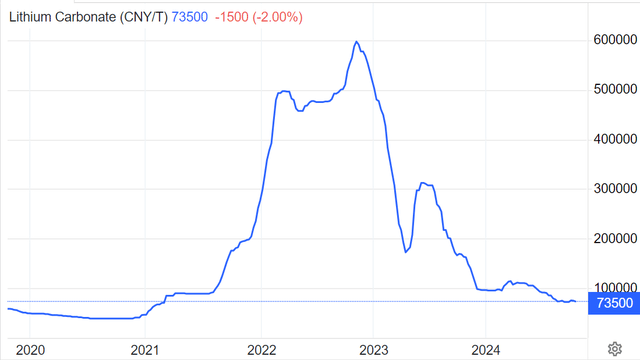

Lithium Carbonate

Lithium carbonate (Trading Economics)

Lithium carbonate prices have collapsed due to transitory oversupply and lower-than-anticipated demand for EVs. Moreover, the global slowdown and high interest rates have slowed various economic segments, heavily impacting the lithium space.

The price has cratered from a high of around 600,000 Yuan per tonne to just around 73,500 per tonne. If we translate to USD, it’s like lithium crashing from about $85,000 a tonne to just about $10,000 here.

Future estimates for LAC and other lithium miners could be predicated on current rock-bottom lithium prices and likely don’t factor in much room for growth. However, things could turn out much differently, as lithium carbonate prices could increase substantially in the coming years.

EV Demand Likely To Skyrocket Again

Whether EV demand will improve is a subject of some debate, but substantial growth will likely return. The automotive world is becoming more electrified daily, and many markets even have targets to phase out ICE sales. For instance, the UK plans to ban purely gasoline and diesel sales by 2030.

Denmark intends to ban ICE sales by 2030 and hybrid sales by 2035. Germany has approved a resolution to allow only emission-free cars on the road after 2030. Many countries, including the most significant car market globally, China (2040), have dates set to phase out ICE and, in some cases, hybrid vehicle sales.

Therefore, whether we like it or not, the world is going electric, and it will need much more lithium carbonate in the future. Global EV growth continues to be staggering, as sales as a percentage of new vehicle sales have increased from just 1% in 2017 to 18% in 2023.

U.S. EV Sales Likely To Surge

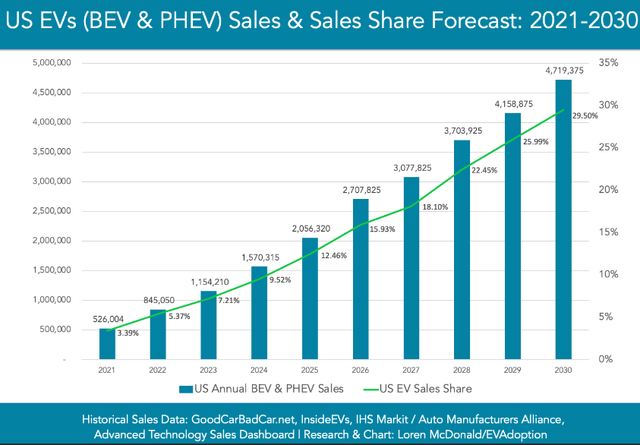

The U.S. is no exception, and despite the recent slowdown in growth, EVs should continue capturing more and more market share from aging ICE technology in future years.

US EV growth estimates (EVAdoption)

EVs accounted for about 7% of new vehicle sales in the U.S. last year. This year, the percentage of EV unit sales will likely be close to 10% and may reach close to 5 million vehicles, or roughly 30%, by 2030. Therefore, the growth potential for lithium carbonate is immense. This dynamic is why we see GM securing its future lithium by partnering with LAC.

Moreover, LAC will likely make much more than its estimates imply in the coming years. Looking back on LAC estimates, the consensus estimate is around $440M, or roughly $11K per tonne for its anticipated 40,000 tonne production.

Really? Lithium carbonate is around $10K per tonne now, an 88% drop from the 2022 highs and back down to around the early post-coronavirus era when EV sales and sales, in general, were essentially dead. These analysts believe lithium carbonate will be at $11K in 2028. There is a bullish target for $600M in sales for 2028, suggesting the bullish case incorporates a price of roughly $15K per tonne, which seems very lowballed.

The Bottom Line: LAC Stock Likely Has Solid Upside Ahead

No one knows exactly where the price of lithium will be in 2028, as it’s 3-4 years away. Nonetheless, markets have a tendency to correct themselves over time. Lithium prices were too low in 2020 as the EV rush began. However, lithium became overbought, and oversupply flooded the market in late 2022 and 2023.

After a prolonged two-year bear market, prices have probably become too low and may be much higher than $10-15K per tonne in three to four years. Even if we see a relatively modest recovery, lithium carbonate could be at about 200-250K Yuan per tonne in the next 2-3 years, in my view.

This dynamic suggests that prices for lithium carbonate could double or triple in a relatively short time frame. Therefore, if translated to dollar terms, a tonne of lithium carbonate could sell for approximately $25-30K in future years.

LAC’s phase one production is expected to yield 40,000 tonnes of lithium carbonate in 2028. Using the midpoint of our lithium carbonite price estimate of $27.5K, LAC’s revenues could be around $1.1B or higher as it enters full production capacity at phase one. If lithium carbonite is around $30K in 2028, LAC’s sales could be $1.2B. If it’s at around $50K per tonne in 2028, LAC’s sales could be about $2B.

Also, there is likely a higher probability that lithium carbonate will be closer to $50K than $10K per tonne in several years. Therefore, I find the current LAC and other lithium minor projections absurd, as they seem to be predicated on a lithium carbonite price that will move up by 10-50% over the next 3-4 years when, in reality, prices could triple or more by then. LAC appears very underpriced here, and my one-year price target range for LAC is $5-6, almost 100% higher than its current price.

Risks to LAC

Of course, with great reward potential come significant risks. LAC is still in the development phase of the Thacker Pass project, and due to its immense size and scale, the development could take longer than expected. The costs could also be higher than we expect. Therefore, dilution or additional debt is possible in the future. LAC introduced 55M of new stock, pricing it at about $5, when it diluted shareholders earlier this year. This was a substantial increase in share count, and we want to avoid future dilution. Other risks may include unforeseeable issues at Thacker Pass, depressed lithium prices, worse-than-expected profitability, and other factors. Investors should consider these and other risks before investing in LAC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC, ALB, SQM, RIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!