Summary:

- Lithium Americas has faced challenges with construction financing and environmental lawsuits at its Thacker Pass property, while spinning off its Argentina mine as lithium prices collapsed.

- However, the Nevada-focused entity remains appealing for investment, with its low-interest DOE loan approval and GM investment providing the necessary capital to get U.S. lithium production going by late 2027.

- With a 40-year mine life and very low net mining cost projection for Thacker Pass, LAC shares are likely worth significantly more than the current quote to long-term owners.

- Technical momentum indicators have been bottoming since June, which could point to a reversal in the share price soon.

tadamichi/iStock via Getty Images

I mentioned Lithium Americas Corp. (NYSE:LAC) all the way back in 2021 here, as a play on quickly growing electric vehicle [EV] battery demand. Well, the whole investment story three years ago of owning a joint-venture lithium mine in Argentina under construction nearing completion (Cauchari-Olaroz) and another incredible development asset in Nevada (Thacker Pass) morphed into an unusual business saga, with a number of twists and turns.

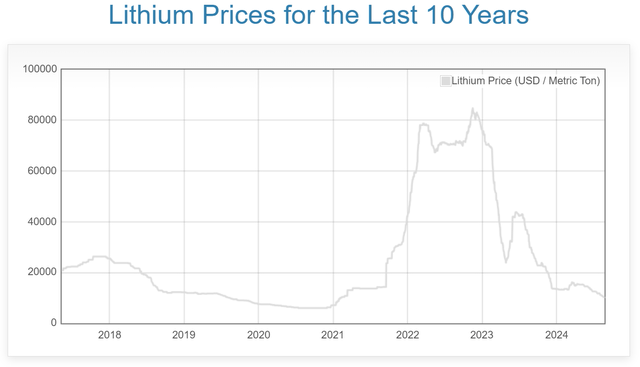

Several changes in possible financing options for the U.S. property, a President Biden-pushed green energy U.S. Department of Energy [DOE] loan incentive, General Motors (GM) wanting a piece of the action to lock-in lithium supplies, environmental lawsuit delays, and eventually a spinoff of the Argentina mine have made analysis of the investment opportunity quite tricky. Then, the price of lithium collapsed almost -90% from its late 2022 high, sliding from US$84,000 to $10,400 per metric ton in August 2024.

DailyMetalPrice.com – US$ Lithium Price, 10 Years

So, where do I stand on the two separate entities as investment options? The Lithium Americas Argentina Corp. (LAAC) name is too risky for my tastes given the political chaos in this South American country.

For sure, there are lots of balls to juggle for analysts and investors regarding the true worth of the remaining Nevada-focused entity, owning a major mine in the early stages of being built.

Yet, the Nevada property is very appealing to me, assuming lithium prices recover strongly in 2025-26. Believe it or not, after an expected and agreed to round of share issuance to General Motors later this year, the adjusted equity market cap of $900 million at $2.72 per share has the potential to rise above $10 billion over the coming 3-5 years. How many other investment choices have similar upside potential of 10x your money in today’s overvalued Wall Street setup? (Answer: Not Many)

Mine Development

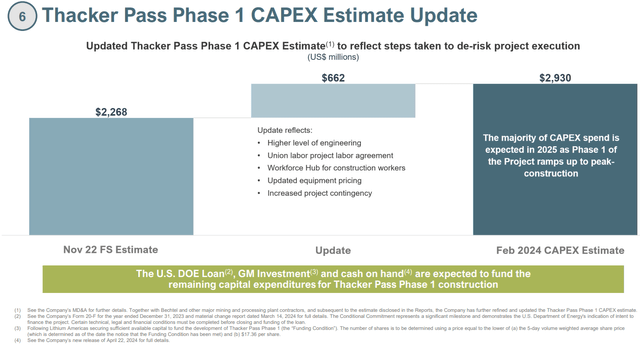

According to management a few weeks ago, the $2.93 billion -Phase 1- mine construction plan is close to receiving the go ahead.

According to the Q2 2024 press release,

“Our team is focused on closing the DOE Loan and GM investment to move Thacker Pass into major construction by the end of the year,” said Jonathan Evans, President and Chief Executive Officer of Lithium Americas. “We have been working closely with the U.S. DOE and GM, while concurrently continuing to de-risk execution readiness by advancing detailed engineering, project planning and procurement packages. Earthworks and site preparations are complete, and Thacker Pass is ready for the next phase of construction once we make the final investment decision later this year.”

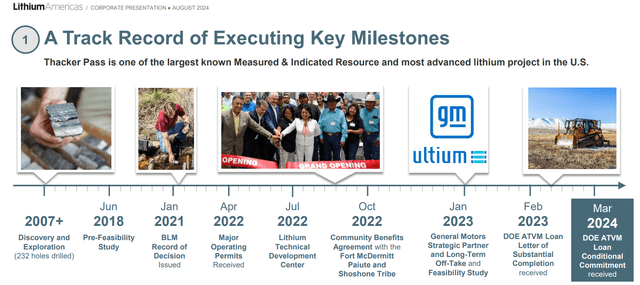

Lithium Americas – August 2024 Investor Presentation

The company held $375 million cash vs. $27 million in total liabilities at the end of June, as a development organization. A $2.26 billion DOE loan financed at prevailing Treasury rates (likely in the 4% to 5% range for annual interest expense) is due for approval by the end of 2024. And, General Motors agreed to a second funding round of $330 million through new LAC share issuance (in January 2023), once the DOE loan became reality.

For more specifics about mine preparation progress, again from the Q2 press release,

On March 12, 2024, the Company received from the U.S. Department of Energy (“DOE”) a conditional commitment for a $2.26 billion loan (the “DOE Loan”) under the Advanced Technology Vehicles Manufacturing Loan Program, to fund eligible construction costs of the processing facilities at Thacker Pass to produce an initial 40,000 tonnes per annum of battery grade lithium carbonate (“Phase 1”). The Company continues to work closely with the DOE and expects to close the DOE Loan in the second half of 2024 (“2H24”).

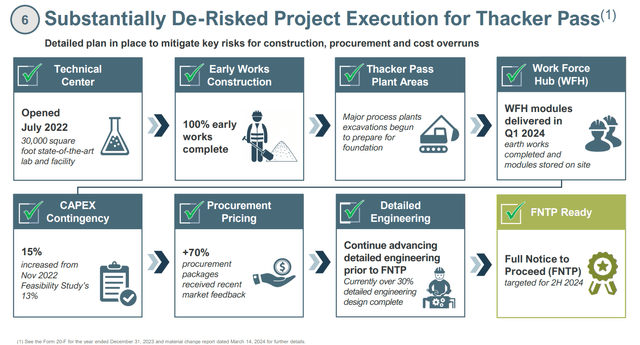

Site preparation for major earthworks has been completed, and Thacker Pass is prepared for the commencement of major construction following issuing full notice to proceed (“FNTP”), expected in 2H24 following closing of the DOE Loan.

The Company continues to focus on increasing the level of detailed engineering, currently over 30% design complete, alongside advancing procurement and execution planning. Throughout Q2 2024, procurement packages and executable purchase orders were put in place in preparation for FNTP.

During Q2 2024, the Company advanced site preparation for the Workforce Hub (“WFH”), a planned all-inclusive housing facility for construction workers. The WFH will be built to align with Thacker Pass Phase 1 construction schedule.

In August 2024, the Company received a $11.8 million grant from the U.S. Department of Defense to support an upgrade of the local power infrastructure and to help build a transloading facility.

During the three months ended June 30, 2024, $27.7 million of construction capital costs and other project-related costs were capitalized…

In April 2024, the Company completed an underwritten public offering (the “Offering”) which, together with the DOE Loan, satisfies the funding condition to closing General Motors Holdings LLC (“GM”) second tranche investment (“Tranche 2 Investment”). The DOE Loan and the GM Tranche 2 Investment are expected to close in the second half of the year, and together, with the cash on hand, are expected to fund Thacker Pass Phase 1 construction capital expenditures…

GM has exclusive access to 100% of the lithium production from Phase 1 for up to 15 years and has a right of first offer on Phase 2 production.

How this all plays out, after several years of construction ahead (targeted for mechanical completion by the end of 2027), and depending on lithium prices by the time actual production begins, Lithium Americas shares could be nearly worthless to potentially valued at $10+ billion.

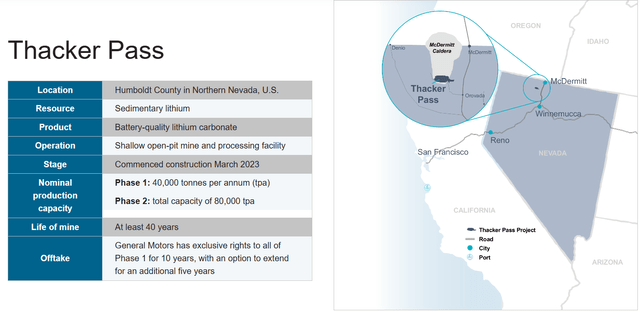

Thacker Pass is projected to turn into a world-class lithium carbonate mine producing 40,000 tonnes annually in Phase 1 with a ramp in Phase 2 to 80,000 over time, using an estimated mine life of 40+ years. As it is developed, Thacker Pass may become the premier strategic lithium reserve asset for the U.S. In terms of measured & indicated resources, it is the largest lithium reserve in all of North America. That’s the main bullish argument to research further.

Lithium Americas Website – Thacker Pass Summary & Map

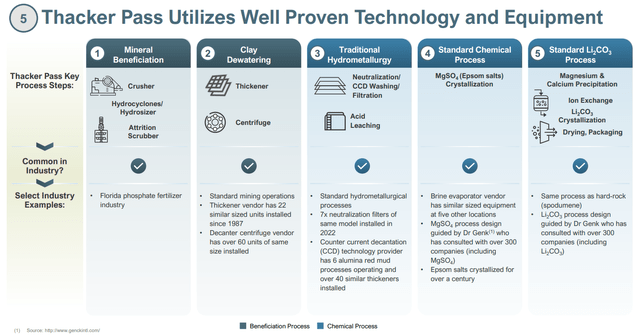

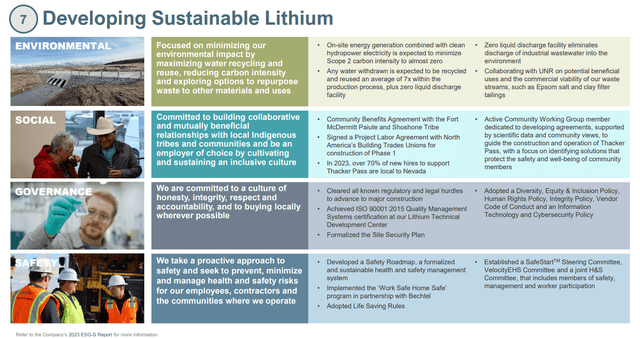

Some additional background and history on the Thacker Pass development is outlined below, available in the August 2024 Investor Presentation.

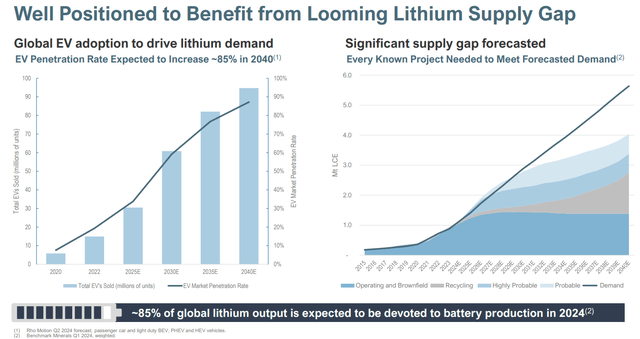

Lithium Americas – August 2024 Investor Presentation

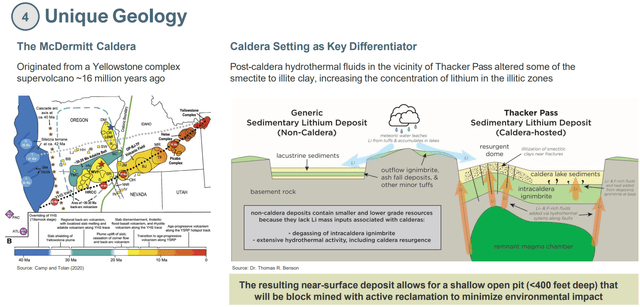

Lithium Americas – August 2024 Investor Presentation

Lithium Americas – August 2024 Investor Presentation

Lithium Americas – August 2024 Investor Presentation

Lithium Americas – August 2024 Investor Presentation

Lithium Americas – August 2024 Investor Presentation

Back of the Envelope Math

If the targeted GM share issuance were to happen tomorrow (under the terms laid out in 2023), I am coming up with a total equity market cap of $900 million at $2.72 per share. In a best-case scenario (with little new share dilution after this year), LAC could have around $1.1 billion in accounting book value against $2.4 billion in debt (mostly low interest-rate DOE loans) by the time production starts in late 2027.

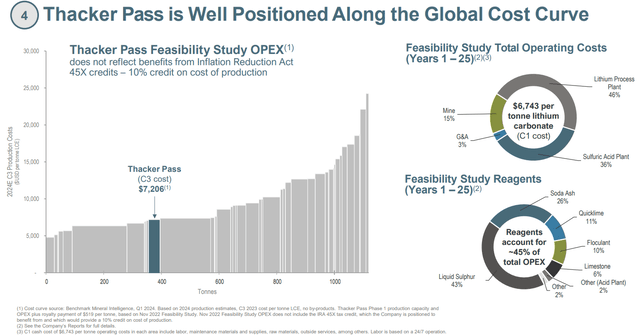

At the depressed US$10,400 per tonne price for lithium today, Thacker Pass could still be exceptionally profitable, assuming Technical Report forecasts prove correct.

Lithium Americas – August 2024 Investor Presentation

$10,400 x 40,000 metric tons annually (Phase 1) works out to $416 million in revenues. Using a “net” cash/royalty/tax-credit cost structure around $6,500 per tonne for production, then adding $115 million in interest costs on $2.3 billion in debt (at 5% interest rates), I am calculating $45 million in pre-tax profits per year as a final destination during 2028-29. But that’s assuming the currently very depressed lithium price remains.

For example, if lithium springs back to $20,000 per tonne, future sales would be roughly $800 million per year, generating pre-tax profits of approximately $525 million, all other variables remaining the same.

If you want to dream a little about a serious lithium shortage globally reappearing like 2021-22, with metals pricing returning to $50,000 per tonne – Lithium Americas could be producing around $2 billion for revenues annually, with $1.62 billion in pre-tax income by late 2028.

So, it’s easy to understand LAC now holds considerable “leverage” to any lithium price advance for owners at $2.72 per share.

Technical Momentum Reversal?

Looking forward to the good news events of DOE loan disbursement, receiving the GM capital, and moving into heavy construction buildout during 2025, now may be the perfect moment to acquire shares on the cheap.

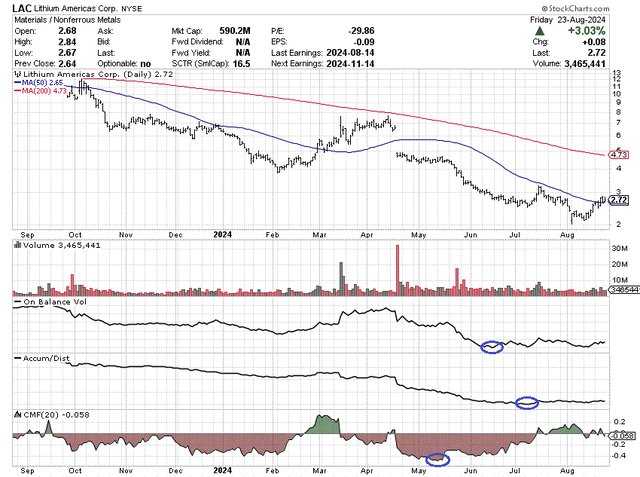

The abnormal/oversized turnover in share ownership since March on high trading volume indicates to me serious long-term investors have been taking share supply from shorter-term traders and existing owners. The vast majority of retail investors have been giving up on LAC as lithium prices cratered.

Yet, technical momentum has actually been bottoming since June, after the clearly oversold readings of May were reached. Getting above the important 50-day moving average this past week for the first time since April could be the initial bullish signal a price reversal is ready to begin.

I have drawn a 12-month chart of daily price and volume trading activity below. Circled in blue are the bottoms in On Balance Volume, the Accumulation/Distribution Line, and the 20-day Chaikin Money Flow indicator. The bullish chart readout is early August’s price drop to multi-year lows was not “confirmed” by many momentum indicators. So, if selling pressure has been exhausted and company-specific good news on the mine construction front is next, a page-turning inflection point of sorts could be close at hand.

I know the seeds of a turnaround are hard to see today, but that’s usually how individual company price bottoms look after a wicked decline, especially in a cyclical sector of the market.

StockCharts.com – Lithium Americas, 12 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

What could go wrong with my bullish thesis?

Further dilution efforts could appear through new share issuance to fund any cost overruns constructing the mine and/or pay for day-to-day management in the meantime. Unfortunately, more dilution for existing LAC owners would act to reduce potential upside estimates for the share quote.

Political risk is another consideration. If former President Donald Trump wins the November election, he has promised to eliminate (or at least reduce) green energy government incentive programs, especially in the EV sector. Given demand for EVs in America is downgraded, lithium prices could stay lower for longer.

My hope is the DOE loan is approved before any January inauguration of the Republican candidate. For sure, the bull case for Lithium Americas would be improved if the Democratic candidate Vice-President Kamala Harris wins. Such a victory would likely be considered great news for LAC’s future, as new tax-breaks and direct incentives could be on the way for the renewable energy sector.

Questions about the EV growth curve have also appeared in 2024. Why? Changing consumer preferences in the ICE vs. EV auto battle, less confidence in the safety of battery-powered vehicles (lithium-ion fires as one example), doubts about the creation of fully autonomous driving capabilities (which are a major selling point for future EV adoption), and a weakening global economy this year have all worked together to downgrade demand (temporarily if you are a bull) for the new-age invention of lithium-necessary vehicles.

Without doubt, Lithium Americas is a highly speculative investment security. Don’t kid yourself. Enough could go wrong with lithium demand and its pricing future to hurt the chances of a big reversal in the share quote.

In summary, I feel the upside potential is hard to pass up, especially after the monster price slide in 2024 has forced weak-hand shareholders to sell and move on. Strong-hand holders like GM (with ownership potentially as high as 40% of outstanding shares after the 2024 capital raise), insiders, and long-term thinkers are replacing the hot-money crowd of 2021-22.

Looking forward, the likely positive news events of receiving final financing and moving into full-scale construction at Thacker Pass will force analysts and investors to reevaluate LAC’s future of profitable production several years down the road. Again, the most supportive investor news would be a sustainable rebound in lithium prices, alongside valuations of the company’s enormous reserves.

I now rate shares a Buy under $3 per share and own a small/growing position in recent weeks. In my mind, the chances of LAC’s stock price falling to zero are about the same as price leaping to $30 over the next 3-5 years. If this is true, statistically speaking, the odds are nicely tilted in favor of Lithium Americas ownership. A reversal in price to $5 next year and $10 by 2028 works out to the potential for compounded gains of +35% to +50% annually, albeit through taking on higher-than-normal risk.

Another possible catalyst for oversized investment gains during 2025-26 could come from a General Motors decision to acquire all of Lithium Americas. If the company can achieve 35% to 40% ownership of the company later this year, while lithium prices rebound strongly sooner rather than later, it may prove more economical for America’s largest automaker (17% market share) to completely own LAC’s low-cost U.S. lithium supply for its EVs.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.