Summary:

- The General Motors funding de-risks the project and triggers conditions to unlock a pending $2.3 billion DoE loan, expected to close in weeks.

- LAC has expansion capability beyond the initial mining phases being reported.

- The long-term outlook for Lithium Americas is strong, driven by increasing lithium adoption, be it transportation or fixed storage.

- Despite macroeconomic risks, Lithium Americas represents a top-tier lithium investment, with favorable mining conditions in Nevada and significant growth potential.

Olemedia

In our last article concerning Lithium Americas Corp. (NYSE:LAC) we wrote that General Motors Company (GM) could possibly mimic Standard Lithium Ltd. (SLI) and go with project-level financing due to the low share price of the stock. With the news out on Wednesday about LAC and GM, that is precisely what has occurred. In this article, we will look at the GM financing news and more importantly what investors can expect next (in order to profit).

General Motors Loan Explained

Looking over the press release put out on 10/16/2024 we see highlights of GM and LAC forming a joint venture. Note I have summarized the press release to reduce clutter and make for simplistic reading.

- Lithium Americas will have a 62% interest in Thacker Pass.

- GM will have a 38% interest in Thacker Pass.

- GM will commit $625 million total.

- Lithium Americas will contribute $387 million of funding to the JV for its 62% ownership in the Project:

- $211 million to be contributed on the date of the JV closing.

- The remainder is to be contributed upon FID (Final Investment Decision) for Phase 1.

- Expenditures on capex (after August 2024) are being credited against and reducing this amount, along with other adjustments.

- As of June 30, 2024, Lithium Americas had approximately $376 million in cash and cash equivalents.

- LC Facility provided by GM to the JV as part of its consideration for its equity interest will have no interest and maturity consistent with DOE Loan requirement that will be withdrawn once replaced with cash that is generated by Thacker Pass.

Future Short-Term Catalysts To Profit From

Now that GM has formed a joint venture with LAC and taken ownership of 38% of the project, the DoE loan can move forward. LAC was also gracious enough to tell us the timelines concerning the DoE loan via:

“The Company continues to work closely with the DOE and expects to close the DOE Loan in the coming weeks. The Company and GM are targeting making the FID and issuing full notice to proceed for Thacker Pass by the end of the year, following the closing of the DOE Loan and the JV Transaction.”

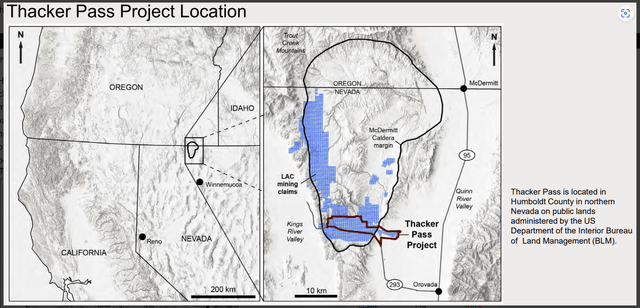

That is about as simple as you can get. Now, how much could the DoE loan of $2.3 billion closing push the stock up? Impossible to say. How much is factored in already or will be by the time the DoE loan closes? Short-term guesses aside, long-term this project is now at the watch as it is being constructed and waiting. The project is estimated to take three years to complete phase 1 (40,000 tonnes target output with phase 2 being an additional 40,000 tonnes). This brings me back to a point I have often made that Lithium Americas has much expansion potential if you look at maps provided by the company such as:

Lithium Americas Land Holdings (Lithium Americas June 2023 PDF)

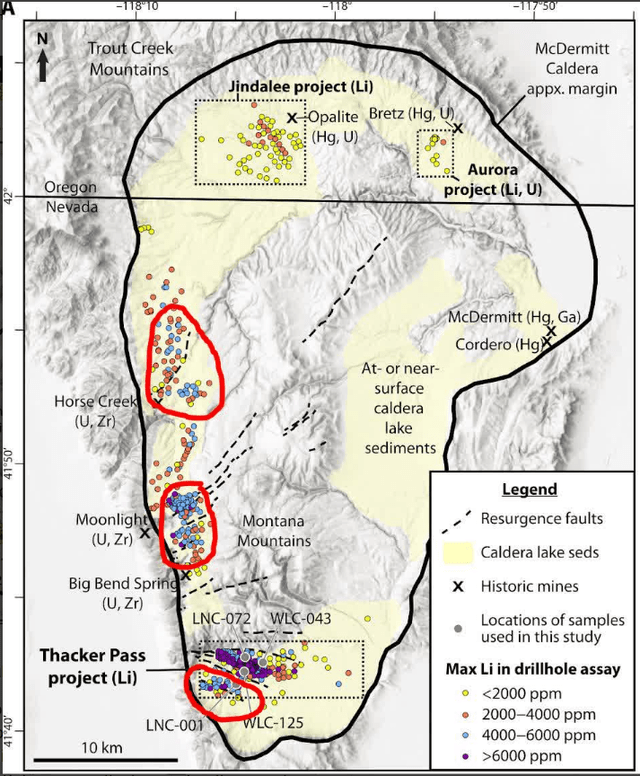

And future probable project locations based on lithium concentrations.

Potential Expansion Locations (Benson, Coble, & Dilles (with author markup in red))

We might assume three years to get Phase 1 completed (or a little longer with Mr. Murphy lurking). At an unknown time frame, we have Phase 2 kicking off for the additional 40,000 tonnes. The most likely expansion after those are just across the road from Thacker Pass on the south side. The northern properties could be expanded upon in the future. It would depend upon lithium demand of course, but it is an interesting wild card to ponder for the long-term investor.

Impact Of Politics On Thacker Pass

With the upcoming elections, we are faced with two outcomes that frankly are both most likely beneficial for lithium. Now we can’t speculate on who will be better for the overall economy, but we can look at the track record of both concerning EV and lithium. If Vice President Harris wins the election, we might assume she will continue the EV push per the continued policies of the Biden Administration. President Trump, on the other hand, started the critical elements list and could continue his push for lithium independence from China. Ignoring the economy and just focusing on the politics I think lithium could benefit from either politician. The biggest risk, however, is the economy.

Long-Term Outlook For Lithium Americas

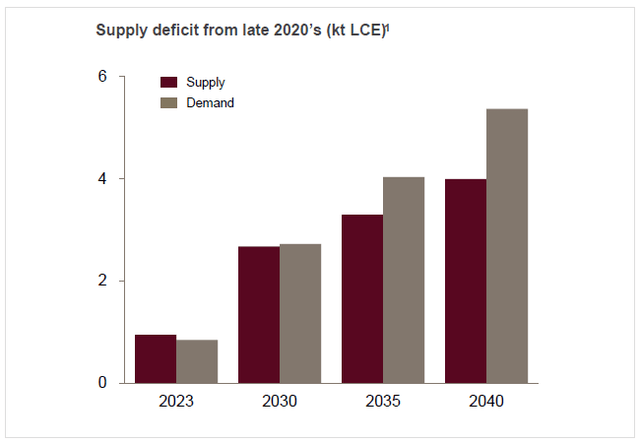

If we ponder what the future looks like I think we will see a world that is much quieter (due to ICE engines losing market share). Charging stations will continue to be built out. Consumers will continue to adopt EVs in increasing amounts each year as we are currently seeing. An inflection point will be reached where it does not make financial sense to run two R&D lines for ICE and EV. Carmakers could stop ICE production. Of course, this could be 20 years out or maybe 10. Very hard to say currently, but it is fun to think about how the world will change. With this change, should come an increase in demand as illustrated below.

Lithium Demand Guesses (Arcadium Lithium (via Benchmark Mineral Intelligence))

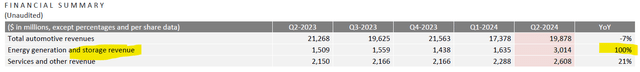

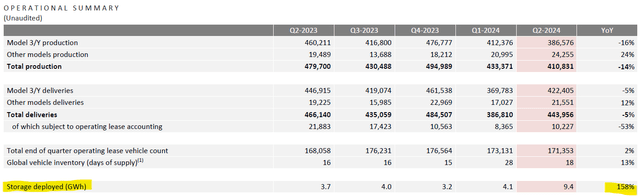

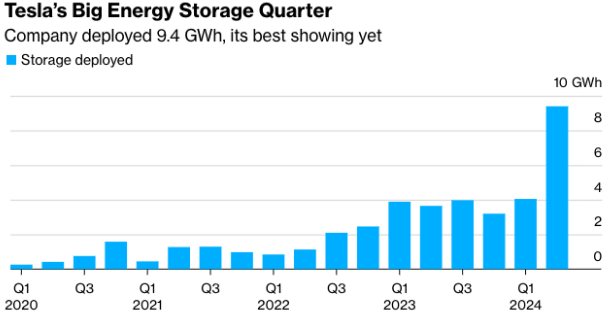

This brings me back to demand. Where is this demand going to come from? Lithium demand from cars and power tools is growing now. Aircraft, trains, and boats might come later on. Fixed power storage is another source of lithium demand and that sector is growing rather fast if we look at Tesla, Inc.’s (TSLA) sales numbers from July 2024. We can also see energy storage growing per Tesla’s July financials:

and

Tesla Storage Deployed (GWh) yoy (Tesla)

Per Tesla’s July 2024 IR slide deck:

“The Energy Storage business continues to grow rapidly, setting a record in Q2 with 9.4 GWh of deployments, resulting in record revenues and gross profits for the overall segment.”

And we can see this growth illustrated below:

Tesla Fixed Storage Growth (Bloomberg via Tesla) |

Lithium Americas Risk Factors

The news that General Motors is funding Lithium Americas for $625 million (for 38% ownership in Thacker Pass) is a massive de-risking moment. This funding from GM should trigger conditions to unlock the pending DoE loan. The remaining risk is generally macro risk from the broad economy and inflation. If the economy continues to deteriorate, then, obviously, people will find it challenging to purchase big-ticket items such as an automobile. Yet, the mine is at least three years away from being operational. Hopefully, by then, the economy will have ironed out various issues we are seeing.

You Ain’t Seen Nothing Yet

Lithium Americas is one of my favorite lithium stocks. Nevada is a very favorable mining jurisdiction, and with GM/DoE funding, I have no worries that this project will see competition. Now that is not to say that Mr. Murphy will not delay it some. When it comes to mining, expect if not demand delays.

Lithium prices do need to come up and part of the problem of low lithium prices stems from China dumping lithium in the market, but that is a topic that might be covered in my next article. I do think that price, however, will start to rise with time. Geopolitics aside, I do not think China wants to keep selling at a loss forever.

For the long-term investor Lithium Americas represents the best-of-breed lithium project. That is not to say that others such as Standard Lithium or Century Lithium Corp. (OTCQX:CYDVF) are not equally good. They are, but in different ways and subject to different share prices and stages of progress. Digressions aside, we have been and will continue to increase our position in all lithium companies listed in this article.

The future is changing and lithium will power that future. What we are seeing now is akin to what the microprocessor market looked like in the 1980s. You could see the change coming and those that got in early profited over the next decade. With the expansion potential of Lithium Americas property (and future evolving lithium demand) it makes me think “You ain’t seen nothing yet”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC, SLI, ELBM, CYDVF, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.