Summary:

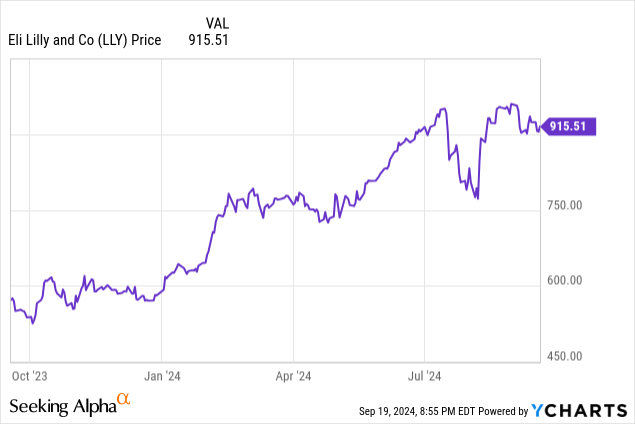

- Eli Lilly’s stock trades at a high premium with a price/book ratio of 63.94, raising concerns about overvaluation compared to the sector median of 2.47.

- Despite strong revenue and earnings growth projections, the P/E and forward P/E ratios suggest the stock is priced for extreme optimism.

- The company’s dividend yield of 0.57% is below the sector median, indicating a need for higher returns to attract income investors.

- Eli Lilly’s substantial cash flow is crucial, but unless more value is returned to shareholders, the stock remains expensive; hence, I rate it a hold.

jetcityimage

Everybody takes some medicine. In the modern era, it’s almost impossible to advance to even middle age without amassing some permanent prescription medications. And if you’re on medication, there is a good chance you’re immediately familiar with the catalog of a company like Eli Lilly (NYSE:LLY), one of America’s biggest drugmakers.

Today I want to take a closer look at Eli Lilly, which looks like it might be approaching a market capitalization of a trillion dollars, and asking whether the company’s dominance is justified in its current premiums on the market.

Eli Lilly is so ubiquitous that it feels unnecessary to offer a full introduction. Suffice it to say, they produce multiple drugs for diabetes patients, offer myriad cancer treatments, and immunology products. They make a lot of products, and many of them are virtually household names.

Consolidated Balance Sheet

|

Cash and Equivalents |

$3.2 billion |

|

Total Current Assets |

$30 billion |

|

Total Assets |

$72 billion |

|

Total Current Liabilities |

$27 billion |

|

Long-Term Debt |

$23.7 billion |

|

Total Liabilities |

$58.2 billion |

|

Total Shareholders Equity |

$13.6 billion |

(source: most recent 10-Q from SEC)

Multinational drug companies are a cash-intensive business. It costs a lot to research drugs, and it is important that Eli Lilly have a substantial cash position which will allow them to maintain present operations with little difficulty.

On the other hand, at current prices, they trade at a price/book ratio of 63.94. A premium is justifiable for a company this size, but I’m not sure such an extreme premium is warranted. By comparison, the sector median for price/book ratio is 2.47. While this is just the start of analyzing a company this size, it certainly points to the possibility of being overpriced.

The Risks

As mentioned, research and development costs a lot for a company like Eli Lilly, and while they have a track record of making life-changing medications, there is no guarantee that any given investment is going to pay off with a working drug, let alone one that justifies the expenses.

Not that they have much choice. The industry is huge, but developing drugs is an intensely competitive process, and that face a lot of competition from other major multinational companies.

Safety and efficacy are hugely important for new products, and if one of their drugs starts getting a bad reputation, that could hurt its profitability and impact the bottom line.

That could be a bigger deal than it seems at first blush, as despite Eli Lilly’s massive size, much of their revenue comes from comparatively few of their products. That could mean if their sales on any one big drug falls off, their estimates might be overly optimistic.

Finally, they have a constant risk of litigation based on their potential liability from various products. So far that hasn’t been an issue, but its a concern that investors need to remain aware of in this day and age of high-profile class action suits.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Revenue |

$28.3 billion |

$28.5 billion |

$34.1 billion |

$20 billion |

|

Operating Income |

$6.2 billion |

$6.8 billion |

$6.6 billion |

$6 billion |

|

Net Income |

$5.6 billion |

$6.2 billion |

$5.2 billion |

$5.2 billion |

|

Diluted EPS |

$6.12 |

$6.90 |

$5.80 |

$5.76 |

(source: most recent 10-K and 10-Q from SEC)

Eli Lilly is a substantial company, but that doesn’t mean they don’t have a possibility of growing revenue going forward. That’s important because for a company this size, they need to justify an extreme premium to their book value.

Estimates are that the company is going to come in at $46.2 billion in revenue this year, with an earnings per share of $16.34. They are expected to grow more next year, with revenue of $57.5 billion and earnings per share of $22.57.

Obviously, that’s just estimates, but the company has recently come in ahead of the estimates by quite a bit, which suggests to me that they are fairly conservative estimates of what is to come, and more can be hoped for realistically.

But once again, those estimates give us a P/E ratio of 55.39 and a forward P/E of 40.10, neither of which is really value-friendly. The sector median for big drug makers is quite high anyway, at 31.49, but Eli Lilly seems to be priced for extreme optimism.

Cash Flow and Dividends

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Operating FCF |

$7.4 billion |

$7.6 billion |

$4.2 billion |

$2.6 billion |

|

Investing FCF |

($2.9 billion) |

($3.8 billion) |

($7.1 billion) |

($3.4 billion) |

|

Financing FCF |

($4.1 billion) |

($5.4 billion) |

$3.5 billion |

$1.2 billion |

(source: most recent 10-K and 10-Q from SEC)

Eli Lilly is a big company, and capable of generating a lot of cash. That’s important because they need to service their debt and continue to afford costly operations in being a multinational drug company.

Right now, the company is paying $5.20 per share in dividends, which comes in at just 0.57%. That, like everything else for Eli Lilly, is worse than the sector median, which in this case is 1.41%.

I would hope that Eli Lilly would consider increasing their dividend substantially from where it is now because half a percent a year just isn’t going to cut it for income investors, and their cash flow could easily support a more respectable yield.

Conclusion

Eli Lilly is a hugely important company, and I can see why people would be interested in them just on general principle. That said, it feels like the company’s stock is commanding too much of a premium, and just doesn’t offer enough to make it worthwhile for a new investor. I’m rating this a hold.

For investors, I would keep a close eye on their cash flow, which is the one thing most noteworthy about their operation. The question for me would have to be whether the company intends to use more of that cash flow to return some value to shareholders because if they don’t, the stock seems awfully expensive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.