Summary:

- Pfizer’s stock has declined by 50% over several years, yet it maintains a nearly 6% dividend yield, making it a valuable long-term investment.

- The company’s quarterly performance includes $13.3 billion in revenue, $2.7 billion in R&D expenditures, and a $0.6 adjusted EPS, with respectable growth.

- Pfizer’s oncology investments, including the $40 billion Seagen acquisition, show substantial YoY revenue growth and a robust pipeline of new drugs.

- Despite industry risks, Pfizer’s strong cash flow, significant R&D spending, and ability to pay down debt make it an undervalued company with impressive shareholder returns.

carmengabriela

Pfizer Inc. (NYSE:PFE) hasn’t been becoming famous off of obesity drugs like many other pharmaceutical companies. In fact, the company has seen weakness in its share price, which has declined roughly 50% over the last several years. Despite that, the company has continued to pay its almost 6% dividend yield, and represents a valuable long-term investment.

Pfizer Quarterly Performance

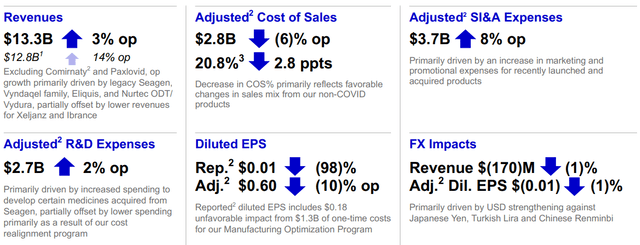

Pfizer saw $13.3 billion in revenue, with strong assets seeing 3% revenue growth.

The company’s R&D expenditures were $2.7 billion for the quarter and the company was able to earn $0.6 in adjusted EPS, with the manufacturing optimization program causing a one-time unfavorable GAAP charge. The company’s SI&A expenses were almost $4 billion affected by product launches, but costs for sales dropped below $3 billion (20.8% of revenue).

Overall, the company’s growth isn’t massive, but it’s respectable given its valuation.

Pfizer Oncology Investments

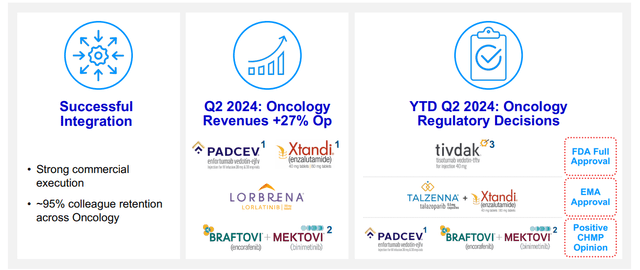

The company has continued to build up its oncology portfolio after a more than $40 billion acquisition of Seagen.

The company has had ~95% colleague retention after its Seagen acquisition and saw substantial YoY revenue growth. The company has continued to work for FDA approval for new drugs. Drugs like Tivdak are expected to see almost $2 billion in peak sales, and the company is continuing to build up its pipeline of assets.

Pfizer Pipelines

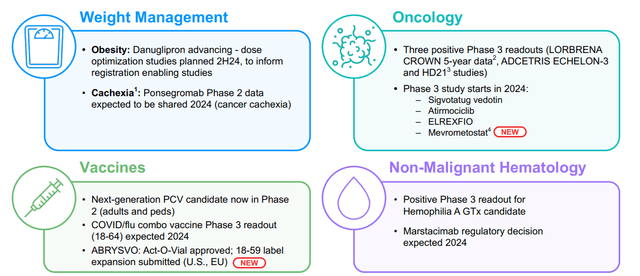

Overall, the company has an impressive pipeline of assets that will support future growth along its segments.

The company is a leader in vaccinations, as shown through its ability to build a vaccine for COVID-19. The company’s PCV vaccine is now in Phase 2 and the company has already been a leader in vaccines for diseases such as HPV as well. The company is building a combined COVID/flu vaccine with Phase 3 data expected soon.

The company is working on building up its obesity drugs, a market that has become one of the largest sources of pharmaceutical growth in the world. Danuglipron is a once-daily pill versus an injection which makes an enormous difference in accessibility and peak sales are modeled at almost $3 billion. The company’s scope means it has numerous drugs advancing through its pipeline at any one point.

Pfizer Shareholder Returns

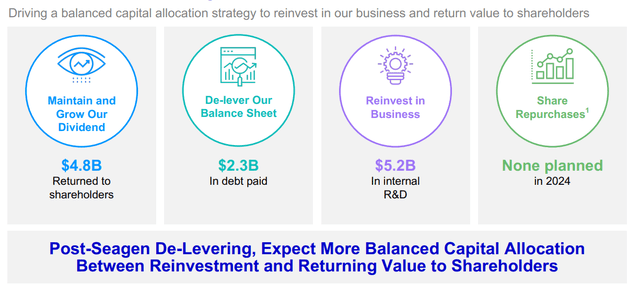

Pfizer is a $160 billion company that remains competitive on shareholder returns, with its recent share price weakness.

The company returned $4.8 billion to shareholders in the quarter, a 12% annualized yield. On top of that, the company’s annualized R&D spending is more than $12 billion, and the company paid off $2.3 billion in debt in the quarter. That’s a $10 billion annualized debt paydown rate, 6% of the company’s market cap.

This shows the company’s ability to continue driving impressive shareholder returns. The company has an almost 6% dividend yield that it can comfortably afford while paying down its debt. The company’s EPS puts it at a P/E of ~12, which shows its earnings, along with continued shareholder return potential, based on the company’s assets and growth potential.

Thesis Risk

The largest risk to our thesis is that pharmaceuticals are a competitive industry. The company needs to spend billions of annual R&D, more than $10 billion, and at any point, a new drug can come to the table from another financially well-off competitor (i.e., Ozempic) that changes the name of the game. That’s a constant industry risk.

Conclusion

Pfizer is an undervalued company right now with strong cash flow. The company has an almost 6% dividend yield that it can comfortably afford, and it managed to complete the massive Seagen acquisition with cash, something that’s a rarity today. The company has done a great job, on top of its dividend, of reducing its outstanding shares.

The company’s valuation has declined. However, we think that is a market overreaction and more excitement towards other pharmaceutical companies with GLP-1 drugs. As a result, overall, we think that Pfizer is a valuable investment for shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.