Summary:

- The YieldMax TSLA Option Income Strategy ETF (TSLY) offers exposure to Tesla via options positioning, sacrificing some capital gains potential for option premium income of around 3-4% per month.

- While the surge in Tesla’s stock has seen TSLY underperform TSLA since November, the stock has once again become extremely overvalued, with less potential for significant gains.

- This should allow the TSLY to outperform TSLA significantly over the coming months as the 3-4% monthly income from call sales far exceeds their losses.

NicoElNino

The YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY) offers exposure to Tesla via options positioning while sacrificing some capital gains potential in exchange for hefty option premium income by selling out of the money call options. I expect the TSLY to significantly outperform Tesla (NASDAQ:TSLA) itself as the prospects for sharp gains in the stock from these overvalued levels are low, and option income is highly likely to exceed capital gains on the stock. However, as TSLY holds long positions in Tesla it is at significant risk of downside reversal that could easily outweigh income payments.

One option for Tesla bears like myself is to take a short position in TSLA and a simultaneous long position in TSLY. This allows investors to generate significant income and most likely strong returns unless Tesla’s share price continues to rise rapidly. It is not a way of shorting Tesla per se as both long and short positions in the stock would cancel out, but it is a way of benefitting from the extreme greed on display in option markets. The TSLY sells 5-15% out of the money call options to offer monthly premium income of around 3-4%. While losses are unlimited in the event of a significant spike in the stock, markets are now offering huge insurance premium hedge against this risk.

The TSLY ETF

The YieldMax™ TSLA Option Income Strategy ETF is an actively managed fund that seeks to generate monthly income by selling/writing call options on TSLA. TSLY pursues a strategy that aims to harvest compelling yields, while retaining capped participation in the price gains of TSLA.

The following screenshot from the YieldMax website outlines the core strategy of the fund.

elevateshares.com

In short, the fund takes a synthetic long position on Tesla’s stock fully equivalent to a long position in the stock, while holding USTs as collateral which generate income. It then sells call options on Tesla with a maturity of one month or less that are around 5-15% above the spot price, which will generate income but suffer capital losses in the event that the stock rises by more than this amount in any given monthly period.

3-4% Monthly Income Preferable To Tesla Stock Upside

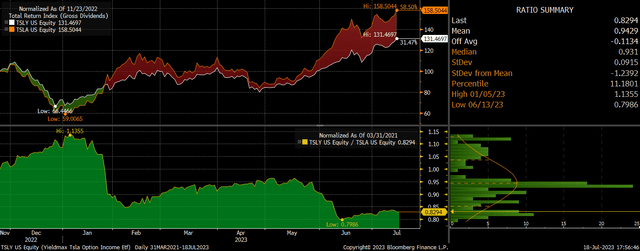

By holding the TSLY and shorting TSLA, investors would be effectively undertaking an uncovered short call position, benefitting from guaranteed income but with potential losses should the stock surge higher. Since its inception in November last year, the TSLY has generated total returns of 31% compared to Tesla’s 58% gains, meaning that the long-short strategy would have resulted in a 17% loss.

TSLY Vs TSLA Total Return Rebased (Bloomberg)

This loss resulted almost entirely from sharp jumps seen in Tesla’s share price in late-January and early-June when the stock posted monthly gains in excess of 30%. This caused losses on call sales to exceed the income received and paid to ETF holders.

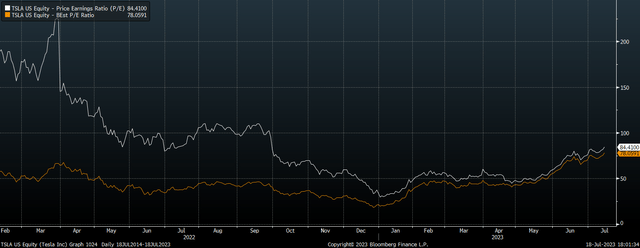

My assertion is that further sharp gains in Tesla’s stock are unlikely as the company’s valuation has once again moved into extreme territory. Such large moves are far less likely now than they were at the start of the year after the stock had crashed 73% in 2022. At the January low Tesla traded at a PE ratio of 30x and this has since risen to 84x. Meanwhile, Tesla’s market cap as a share of the MSCI World Autos Index is back up to 47% from below 30% in January despite generating less than 5% of global sales.

TSLA Trailing And Forward PE Ratios (Bloomberg)

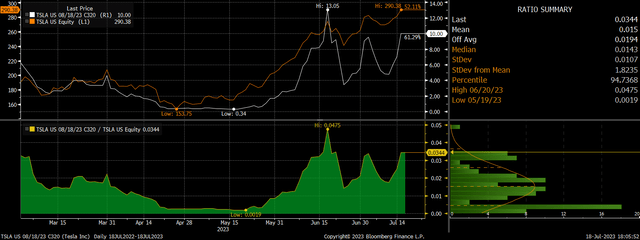

What is particularly beneficial for the TSLY relative to TSLA right now is that the rise in optimism towards Tesla has also been partly reflected in the implied volatility based on options prices. 1-month implied call volatility is now back at elevated levels and above that of put volatility. Spikes in call volatility in the past have tended to come at or near short-term peaks in the stock, which in itself is good news for Tesla short positions, but it also allows the TSLY’s strategy to generate high income.

TSLA Aug 18 Call Price, % of TSLA Share Price (Bloomberg)

1-month 10% out of the money call options are currently trade at $10, equating to a premium of 3.4%, which is what the TSLY should be able to generate in monthly returns, in addition to the returns on its Treasury holdings. It would therefore take a 13.4% rally in Tesla’s stock over the next month for this strategy to lose money.

While we only have a few months of data on the performance of TSLY, it has managed to outperform TSLA even when the latter has posted strong gains. So far this month, for instance, the TSLA has risen by an impressive 11%, yet TSLY’s huge income receipts have allowed it to gain 12%.

Risks Are Real But Well Rewarded

The risk to this strategy is that we see speculative sentiment towards Tesla continue to rise and/or the company manages to generate breakneck growth allowing earnings to catch up with valuations. This would raise the potential for significant further gains in the stock that are required for TSLY to underperform TSLA. An additional risk comes from a rise in TSLA’s realized volatility. If Tesla’s stock heads lower but with sharp intermittent rallies, it is still possible for losses on call options to exceed income. Finally, there is the risk that the TSLY is still a relatively new ETF employing derivative bets which are subject to their own counterparty risk. However, these risks are handsomely compensated by the monthly yield which is likely to exceed 3% per month.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.