Summary:

- The competitive benefits of being a BCBSA licensee has helped ELV grow its member base faster than UnitedHealth, especially on the higher margin commercial side.

- I pinpoint Elevance’s strategy and what differentiates it from UnitedHealth.

- I cover several risk factors that could hurt Elevance’s benefit costs – a key long-term driver of operating margins.

- On balance, Elevance’s strategy has it poised to achieve its long-term operating margin guidance. I see this stock headed to $550 in the next 12 months – the mid-point of its long-term chart channel.

RiverNorthPhotography

Introduction

This article will focus on key margin dynamics that I think investors should weigh when it comes to evaluating the prospects of healthcare managed care provider Elevance (NYSE:ELV). I will include some important background information on the business to help us understand what is driving margin performance. Throughout this article, I will also provide some comparisons to its major competitor, UnitedHealth (NYSE:UNH), the largest player in the healthcare managed care industry and a Wall Street darling.

Business Strategy and Margin Dynamics

Elevance serves approximately 47.5 million Americans through its various health plans. Previously Anthem, the company changed its name to Elevance in 2022 (prior to that it was WellPoint before changing its name to Anthem in 2014).

The story begins with the fact that ELV is an independent licensee of the Blue Cross and Blue Shield Association (BCBSA), an association of independent health benefit plans that spans all 50 U.S. states and has more than 115 million members. ELV is either the Blue Cross or Blue Cross and Blue Shield licensee in 14 states, notably in California, New York, Ohio, and Georgia-4 of the 10 most populous states in the U.S. Overall, ELV provides services to approximately 33 million Blue Cross and/or Blue Shield enrollees.

In Jan 2023, ELV acquired BCBS of Louisiana which is expected to close in H1 2024. This will put them in their 15th state and increase their BCBS membership to 34.6 million.

Being a large BCBSA licensee has competitive advantages for Anthem as the most recent 10-K notes:

Being a licensee of the BCBS association of companies, of which there were 34 independent primary licensees including us as of December 31, 2022, provides significant market value, especially when competing for very large multi-state employer groups. For example, each BCBS member company is able to utilize other BCBS licensees’ substantial provider networks and discounts when any BCBS member works or travels outside of the state in which their policy is written. This program is referred to as BlueCard® . BlueCard® host members are generally members who reside in or travel to a state in which an Elevance Health subsidiary is the Blue Cross and/or Blue Shield licensee and who are covered under an employer sponsored health plan serviced by a non-Elevance Health controlled BCBS licensee, which is the “home” plan.

Roughly 70% of all ELV plan members are in a BCBS plan.

ELV also provides non-BCBS health plans under the following names: Amerigroup, Freedom Health, HealthSun, MMM, Optimum Healthcare, Simply Healthcare, HealthLink, and UniCare. ELV collectively refers to this group of non-BCBS plans as its Wellpoint plans. The Wellpoint plans collectively represent about 30% of its overall member base.

The competitive benefits of being a BCBSA licensee has helped ELV grow its member base almost 4 times faster than UnitedHealth over the last 7 years. ELV’s membership has averaged 2.7% growth over the last 7 years versus .7% for UNH. Over this time period, ELV’s membership has grown from 40.3 million to 47.3 million and roughly 2.4 million of this growth has come through BCBS plans.

An important trend in the managed healthcare industry is the provision of supplementary products and services to keep members healthier and reduce hospitalizations which drive up insurance costs. Elevance’s most recent 10-K uses the phrase “lifetime, trusted health partner” seven times to emphasize this type of focus. It outlines this strategy as follows:

Our strategy is to become a lifetime, trusted health partner through the following four core focus areas:

• Whole Health – Partner to address physical, behavioral, social, and pharmacy needs to improve health, affordability, quality, equity, and access for individuals and communities.

• Exceptional Experiences – Put the people we serve at the center of all that we do, to exceed expectations and optimize health outcomes.

• Care Provider Enablement – Be the easiest payer to work with by supporting care provider partners with data, insights, and tools they need to deliver exceptional care for our consumers.

• Digital Platform – Use digital technologies to improve efficiency and experiences, convert data into insights, and create a platform that connects stakeholders from across the health ecosystem.

ELV’s Carelon segment is mainly where this strategy is playing out. Investors should continue to see organic investments and acquisitions focused on deepening and expanding Carelon’s offerings. At present, from a revenue standpoint, Carelon is mainly comprised of CarelonRx, a pharmacy benefits management (PBM) business.

Carelon is ELV’s counter to UNH’s Optum business. One notable difference though is that Optum Health includes significantly more clinical sites that treat patients. UNH can direct members to its own (non-hospital) clinical sites within its network which helps drive down costs. For example, it is cheaper to treat common issues at an urgent care facility than a hospital emergency room. In 2022, UNH had $324 billion of consolidated revenues, $71 billion of which came from Optum Health. Optum Health’s $6 billion of operating earnings was almost 25% of UNH’s overall earnings. More importantly, Optum Health’s operating margins are in the mid-8% range-almost 300 basis points higher than its core healthcare insurance business.

ELV does own a smaller clinical business specializing in the treatment of chronically ill patients at home. Clinical sites could become an acquisition target for ELV, however, management seems to have a different strategic focus (keep reading).

Carelon has grown from 3% of revenues in 2019 to roughly 13% of revenues this year. Its margin profile is slightly higher.

67% of Elevance’s health plan members are in commercial (non-government) plans versus 58% for UNH. This is notable because commercial plans have historically had twice the operating margins of government plans (generally 7% versus 3.5%).

ELV has been able to grow its commercial membership slightly (+3%) over the last 7 years by adding 1 million members whereas UNH’s has declined by roughly 2.5 million members (down 8.3%). This is important because government plan membership is growing much faster as the Baby Boomer generation ages and retires. By growing its commercial segment, ELV has been able to offset some of the lower margin impact of government plans gradually becoming a larger piece of its overall membership.

ELV’s strategy has so far been to leverage the national BCBSA network and its brand strength along with an industry leading digital platform versus owning its own network of clinical sites. This has resulted in stronger membership growth, especially on the higher margin commercial side, but the overall business has so far struggled to raise operating margins. Management is guiding for 6.5% to 7% operating margins in 2027 which would be a 250 basis point improvement at the midpoint. 250 bps translates to about $6.5 billion of additional operating income in 2027 (based on its 2023 Investor Day revenue guidance).

Management has championed a strong digital platform to help push margins higher and they are now down to only 2 backend systems versus 5 a few years ago. Senior VP & Chief Digital Officer, Rajeev Ronanki, mentioned the following during their 2021 Virtual Investor Conference:

All the examples I cited are built on Anthem’s digital platform. This is the industry’s largest platform, integrating our immense data assets and proprietary AI and machine learning algorithms. Now 7 of the 10 most valuable companies in the world today are platform businesses. And they’ve effectively digitized supply and demand, but none of these companies are health care companies. With our platform, we’re able to digitize knowledge and connect it to our supply of physicians and hospitals. We’ve virtualized the delivery of care without needing to acquire expensive bricks-and-mortar care delivery infrastructure. We’re able to predict demand for care and connect the right care at the right time to our consumers, seamlessly blending digital, virtual and physical care.

The statement that I bolded here reveals ELV’s strategy which differentiates it from UNH and its Optum Health infrastructure.

If management hits its 2027 margin target, then the stock will likely double over the next 3 to 5 years assuming a modest 13.5 multiple. To summarize so far, ELV has 2 core strengths or avenues to make this happen:

- Growing BCBSA licensee footprint with strong brand recognition to help maintain and grow higher margin commercial membership.

- Carelon ancillary products and services to drive better overall patient outcomes and reduce costs. In my model, management hits its 2027 targets with 86% benefit costs (versus premiums) and operating expenses at 11.5% of revenues. 86% benefit costs are higher than pre-Covid levels in the ~80% range but I’m assuming a greater cost impact as Baby Boomers age. To the extent that the Carelon strategy can reduce benefit costs, then additional margin expansion could be achieved.

Risk Factors

Outside of poor insurance underwriting which I am less concerned about given ELV’s strong and consistent historical performance, I see the following prominent risk factors:

- Tougher provider negotiations.

- Uncertainty of benefit costs due to aging demographics.

- Strained Federal governmental funding of Medicare and Medicaid.

- Election cycle.

I have a few comments on each of these factors.

Clinical providers are strapped for financial resources. This could lead to higher costs of care and tougher negotiations with health insurers.

As I mentioned, I’m modeling 86% benefit costs. Based on management’s 2027 guidance, it seems that they are doing something similar. 86% is significantly higher than pre-Covid levels that were in the ~80% range. It seems management is assuming a greater cost impact as Baby Boomers age. There is a risk that 86% could be too low.

Alongside the uncertainty over future benefit costs from an aging demographic, we have the risk of inadequate funding of Medicare and Medicaid which are mainly used by the elderly. This could add to benefit costs. This is the most significant risk that I see and bears watching closely.

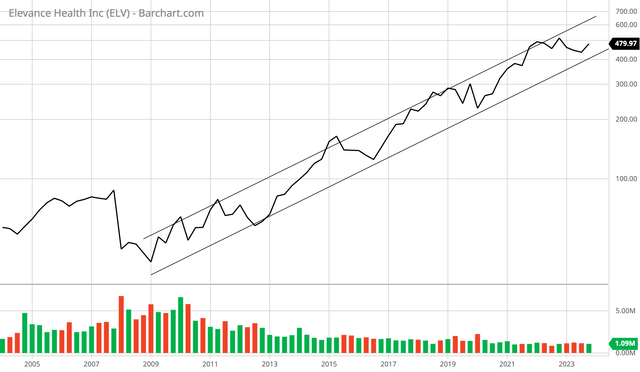

I’ve probably said this before and I’ll probably say it again, I love long-term charts. You can learn a lot from them. Here is a long-term quarterly log chart of ELV with my monthly trend channels left in place:

The monthly chart almost touched the lower trend channel line and you can see here that the quarterly is in a bullish breakout posture.

Notice how the stock dove into 2012, 2016, and 2020. The pattern correlates with the U.S. Presidential election cycle. As Presidential elections draw near the stock starts to sell-off due to uncertainty over what a new Presidential administration will mean for health insurance. We could see this impact the stock in 2024 and perhaps drag it back down to the lower trend channel. Clearly though, this stock has huge long-term support at about $450.

Strategic Conclusion

Elevance is a core long-term holding for me. My 12-month price target is $550 which is derived from a Moderately Bullish target multiple of 13.5 on an estimated $40.6 of free cash flow per share in 2024. It is important to point out that $550 is roughly the mid-point of the above chart channel looking out 12 months. This gives me a greater degree of confidence in my fundamental outlook.

I would typically use a multiple of Bullish target multiple of 16 for ELV, given that I think it can grow earnings annually at a 16% clip, but I’ve decided to take things down a notch while we are in the election cycle. My target price would be $650 at a multiple of 16.

Keep in mind that UNH is trading for 21.6 times average 2024 analyst estimates versus only 14.2 for ELV. ELV could potentially capture some of this valuation gap in the market if it can outperform on its margin dynamics. It has a solid track record and a sound strategy in place so it will be interesting to see how this plays out.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ELV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information presented here is general in nature and designed for do-it-yourself and professional investors. It does not have regard to the investment objectives, financial situation, and the particular needs of any person who may read this. Recommendations are not personalized investment advice specific to the situation of any one individual, family, or organization. In no way should it be construed as personalized investment advice. True Vine Investments will not be held responsible for the independent financial or investment actions taken by readers. This content is never an offer to buy or sell any security. This content includes a disclosure of any relevant securities held by Joshua S. Hall or his immediate family. Client portfolios managed by True Vine Investments may hold positions in securities covered here. Securities in these portfolios may be bought or sold at any time in order for True Vine Investments to satisfy its fiduciary obligations to clients. All data presented by the author is regarded as factual, however, its accuracy is not guaranteed. Investors are encouraged to conduct their own comprehensive evaluation of financial strategies or specific investments and consult a professional before making any decisions. Positive comments made regarding this content should not be construed by readers to be an endorsement of Joshua Hall’s abilities to act as an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.