Summary:

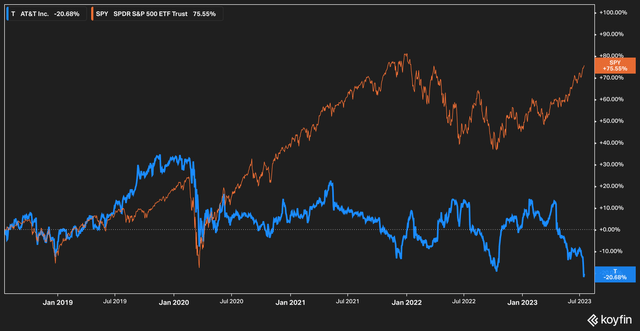

- AT&T Inc. has underperformed the market over the last five years, delivering a negative 20% return to shareholders, while the S&P 500 generated a 75% return in the same time frame.

- Despite concerns over AT&T’s high debt load, the company has made efforts to reduce variable debt, with over 95% of its debt now fixed at an average rate of 4.1%.

- AT&T’s shares are undervalued on a historic basis, and there is reason to think there is little air left to be let out of the balloon.

Justin Sullivan

Clear Signals

Investors in telecom giant AT&T Inc. (NYSE:T) can be forgiven if they find themselves frustrated. AT&T, after all, seems to be under attack from every angle: regulatory, legal, and rising competitive pressure from the increasing commoditization of its services.

And then, of course, there’s the share price. Over the last few years, AT&T has consistently underperformed the market.

Over the last five years on a total return basis (which includes reinvested dividends), AT&T has delivered a negative 20% return to shareholders, while the broader S&P 500 (SP500) has generated a 75% return in the same time frame.

AT&T is not alone in this underperformance. It’s competitors Verizon Communications (VZ) and T-Mobile US (TMUS) have suffered comparably in a market that has consistently devalued the stocks of communications and wireless carriers.

Many investors in these stocks, however, do not invest simply for the share performance, but for the famous dividends. As of this writing, AT&T’s dividend stands at just over 8% annually, an incredibly attractive number in today’s environment. An interesting aspect of AT&T’s investors base is these shareholders are largely individuals seeking to bolster returns in personal accounts. This is evidenced by Finviz data, which shows AT&T’s institutional ownership at roughly 54% (Verizon stands at 63%) as of this writing. Put another way, this means that roughly $45 billion of AT&T’s $98 billion market capitalization is held in non-institutional accounts.

Compare these figures with, say, Comcast (CMCSA), which has 83% institutional ownership, or other S&P 500 stocks, and it quickly becomes evident that institutions have largely avoided the large wireless carriers and AT&T in particular. More on that later.

In this article, we’ll dive into why we believe that AT&T shares are undervalued, and why we think the case could be made for upside potential in the future. Let’s dive in.

Getting The Lead Out

Anyone who watches the news will know that a recent Wall Street Journal report made major waves in the investing community when it alleged that AT&T and other telecom carriers could be on the hook for lead exposure in workers who spliced cables for the company. Another Wall Street Journal report states that:

Such cables fell out of use in the 1960s, as far as new installations go, but an unquantified number still sit under the water, in the soil and on poles overhead. The Journal’s investigation found evidence for more than 2,000 such cables, but stressed there could be many more. The investigation also found elevated levels of lead in soil samples near known cable sites. [Hyperlink in quote from original WSJ story.]

While this is of course concerning, anyone who has followed a company involved in potential large-scale litigation knows that: 1) things tend to move slowly; and 2) things are not always so clear-cut as they appear.

While we are not attorneys and do not offer legal advice or anything close to it, we are unsure exactly what sort of litigation the company could be open to as a result of these reports. Perhaps a class action from former employees who handled these materials over fifty years ago (AT&T states on its response page that placement of lead-clad cables was phased out in the 1950s)? Actions from communities who claim that lead-sheathed cables are impacting community health?

In any case, while it seems likely that the burden of proof would not be impossible to overcome, it would certainly be very difficult. A study from the National Institute of Health conducted in 2007 found that levels of lead in the blood of Americans had fallen precipitously since the 1960s and 70s (from 15 μg/dL to 1-2 μg/dL), when lead was present in gasoline, food cans, and other commonly used products. Anyone with elevated levels of lead would then need to have a plausible reason to show that lead-sheathed telecom cables were the culprit.

According to the same study, 80% of lead exposure came from the workplace. A 1978 OSHA study on lead exposure found that the “[i]ndustries most affected include lead mining, refining, and smelting; construction work involving paint removal, demolition, and maintenance of outdoor metal structures such as bridges and water towers; auto repair; and battery manufacturing and recycling.” While its absence is not a definitive indicator of industry safety, telecom companies are not present on the list.

The bottom line here is: yes, the reports appear to be alarming, and if lead is leaching into the environment then any responsible party should facilitate their removal. From our perspective, however, the road from there to massive class-action litigation appears to be a bit more fraught.

A Question of Debt

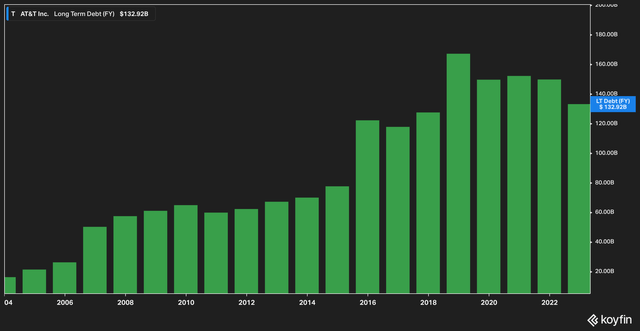

Concerns have lingered over AT&T for some time that its debt load is too high, and that the dividend may be in danger as a result.

While it is true that debt levels have ballooned over the last 20 years, management has made considerable efforts to shore up the balance sheet recently.

On the most recent conference call, for instance, management pointed out that considerable effort has been made to reduce variable debt, and that “more than 95% of our debt is now fixed at an average rate of 4.1%.”

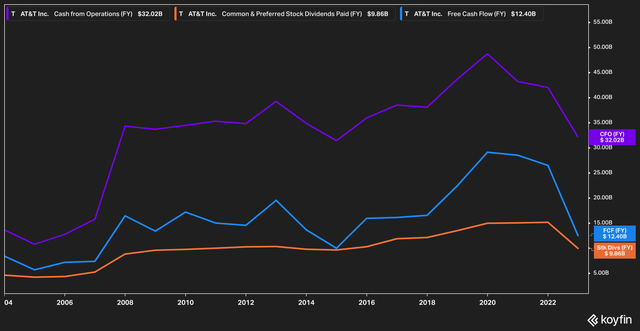

The above chart looks back 20 years at AT&T’s cash from operations (purple line) against its free cash flow (blue line) and dividends paid (orange line). While the most recent year seems to show that AT&T is cutting it close when it comes to free cash flow versus dividend payments, this is the result of an 18% increase in capital expenditures by the company largely related to 5G implementation.

Bears in this scenario will say that these metrics don’t account for the company’s debt–in particular, the $13 billion current portion of its long term debt.

Moody’s, however, recently issued a note regarding AT&T’s credit picture in relation to its May 2023 bond issuance (where it assigned a Baa2 rating) and stated that:

The stable outlook reflects Moody’s expectation for continuing improvements in operating performance. It also assumes that the company will reduce leverage to about 3.4x (including Moody’s adjustments) in 2024. Additionally, it reflects Moody’s view that AT&T’s maturity towers will be managed to under expected annual free cash flow levels. Finally, it includes an expectation that the company will invest in 5G and fiber to advance its competitive position to sustain if not improve its wireless market share and reap the future benefits of IoT enterprise applications which we believe will be significant over the long term. Moody’s also anticipates that the degree of structural subordination in AT&T’s capital structure will be managed to moderate levels.

Valuation

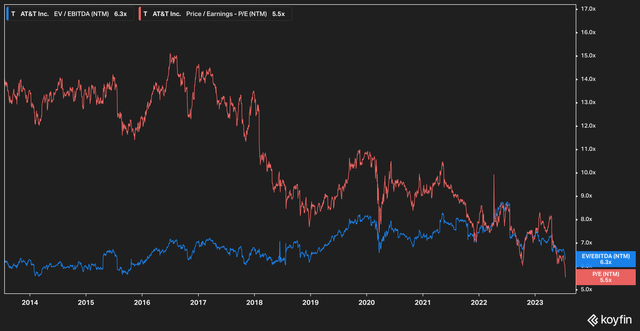

As plenty of commentators have pointed out, AT&T is cheap. Very cheap.

Looking back ten years shows just how far the company’s stock has fallen in terms of forward valuation. Today the shares can be bought for 5.5x forward earnings, and just 6.3x EV/EBTIDA. In recent weeks, these valuations have further plunged due to the negative lead-sheathed cable headlines described above.

The Investor Base

As mentioned previously, roughly $45 billion of AT&T’s market capitalization is held by non-institutional accounts, leaving roughly $53 billion in the hands of large institutions. According to filings ending March 31, 2023, almost $22 billion (or 41% of that) amount was held by Vanguard and Blackrock–companies which largely manage 401k plans. Third on the list was State Street, which owned roughly $5.5 billion.

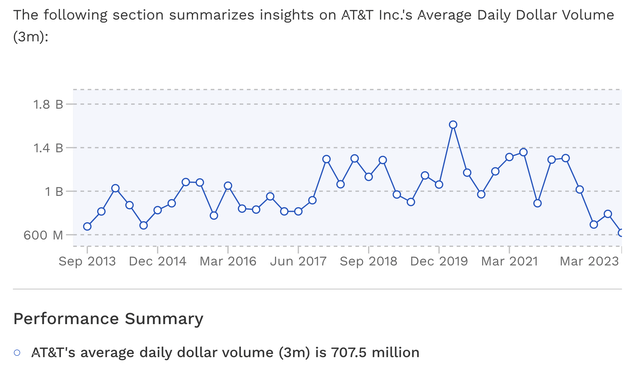

The point we are attempting to make here is that AT&T is largely held on either a passive basis or by individuals. The stock itself is fairly non-volatile with a beta of only 0.77, and the daily dollar volume according to Finbox data is relatively low, with a three-month average of 707.5 million.

This means that the overall churn of the stock is low, and we can reasonably infer from this that investors–in very broad, general terms–tend to be holders rather than sellers of the stock.

We believe that this shareholder behavior is important because, absent a mass-selling event, it seems that there is little air left to be let out of the balloon, so to speak, as prices and valuations become further depressed.

The Bottom Line

While the headlines paint a negative picture about AT&T, we find that there are reasons to be cautiously skeptical about what the actual financial repercussions to the company might be. We also think that the company’s historically depressed valuation along with a low volatility and a steady shareholder base make the stock attractive at these levels. Risks to our thesis include regulatory action concerning the cables mentioned in the Wall Street Journal story, as well as public opinion turning against the company. Today, however, we think that the risks are likely not outweighed by the potential upsides.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.