Summary:

- Modine Manufacturing’s shifted focus from auto engine to computer datacenter cooling is paying off on booming AI-related construction.

- The stock has experienced a +710% total return over 3.5 years since my last bullish article, outperforming nearly all U.S. equities.

- The current valuation is quite high with a forward P/E above 34x, despite only moderate forecasted company-wide sales growth of +10% and EPS gains of +20% yearly.

- I am downgrading Modine to Sell, recommending avoidance until a significant selloff occurs.

RichVintage

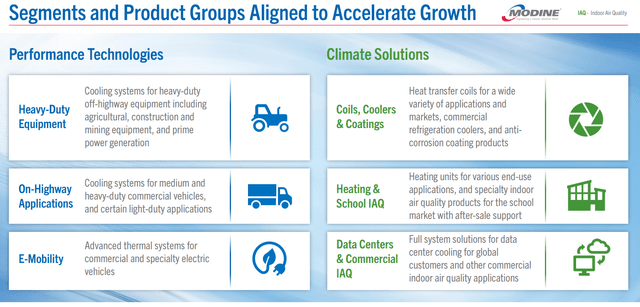

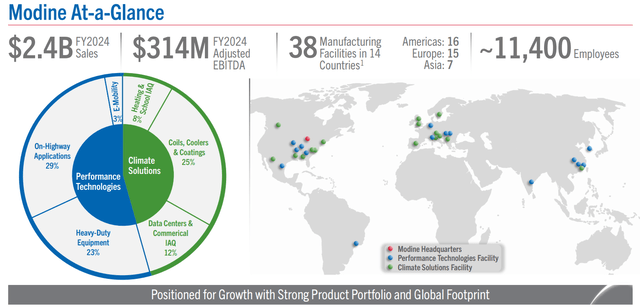

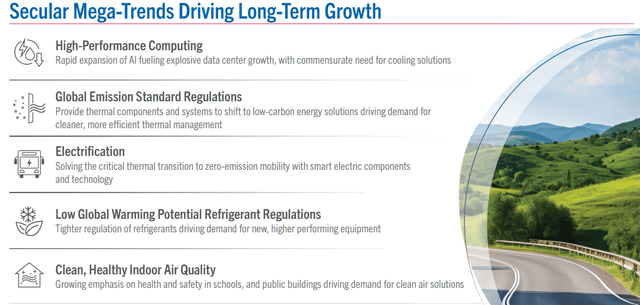

Three years ago, Modine Manufacturing Company (NYSE:MOD) was in the process of exiting its auto engine cooling businesses to focus on computer datacenters. The company paid off high debt levels with the proceeds from its asset sales, and has benefited incrementally from the explosion in AI (artificial intelligence) datacenter construction the last few years. Total company revenue generated from datacenter demand is projected by management to grow from 12% last fiscal year to 30% by 2027.

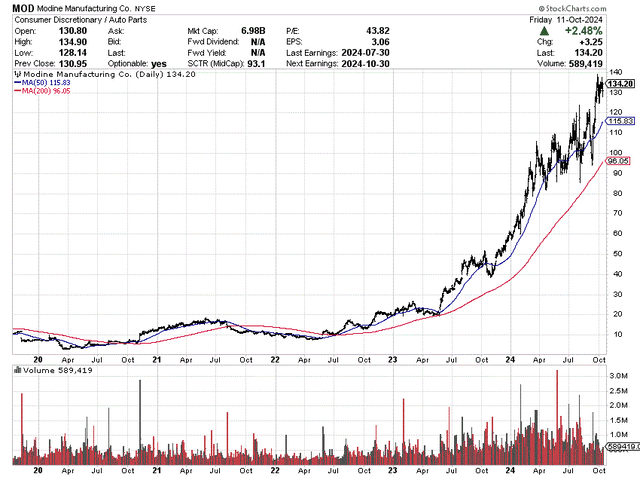

Following my initial Buy suggestion in May 2021 here, the stock quote languished into early 2022, then took off to generate market-leading gains for investors. Few other equities traded in America have bested the +710% total return outlined by Modine over the past 3.5 years.

Seeking Alpha – Paul Franke, Modine Manufacturing, May 10th, 2021 Article

StockCharts.com – Modine Manufacturing, 5 Years of Daily Price & Volume Changes

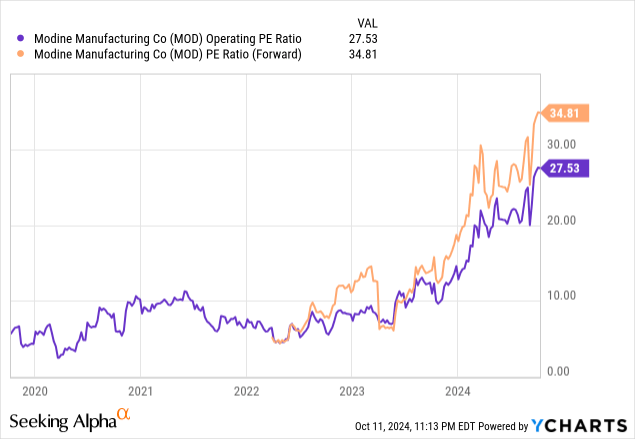

However, the bullish angle of purchasing an underfollowed stock priced at a forward P/E under 10x is a world away from today’s situation. Everyone in the tech world knows about Modine’s strong growth tied to the AI revolution, and the forward P/E is now up to 34x.

YCharts – Modine Manufacturing, P/E Ratios, 5 Years

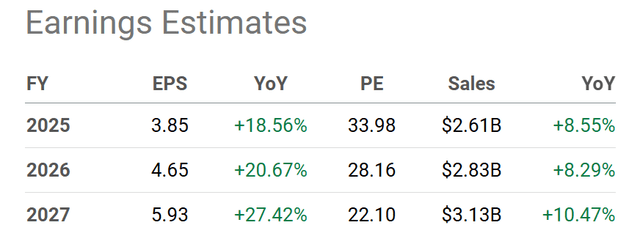

With company-wide sales growth projected by analysts to rise at a somewhat pedestrian +10% a year, with EPS gains projected at a rate closer to +20%, Modine has reached a full valuation to even overvalued range during late 2024. It’s become an AI darling, where actual business expansion could easily fail to match heightened investor expectations.

Seeking Alpha Table – Modine Manufacturing, Analyst Estimates for FY 2025-27, Made October 11th, 2024

As a consequence, I am downgrading my Modine view to Sell. I would avoid this security until a sizable selloff materializes. There’s little doubt in my mind that an AI-centered market meltdown will equally pull Modine down by -25% to -50% in price.

Modine Manufacturing – September 2024 Investor Day Presentation Modine Manufacturing – September 2024 Investor Day Presentation Modine Manufacturing – September 2024 Investor Day Presentation

Stretched Valuation

Unfortunately for investors, the only real difference between late 2024 and early 2021 is the growth path for the company is somewhat clearer, as computer datacenter (construction) demand takes off. However, the vast majority of company sales are not derived from the AI boom (80% other industries vs. 20% datacenters in fiscal 2025), leaving total revenue growth quite susceptible to a slowdown (recession) in the global economy.

The pertinent question for investors: is it worth paying 200% or 300% the valuation setup of 2021 to capture AI-related growth?

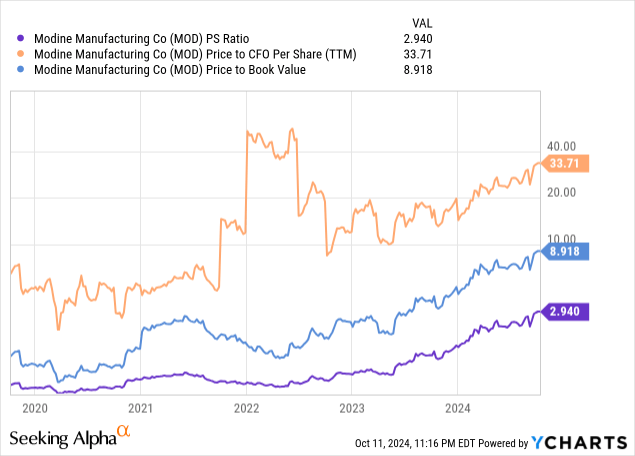

Below, I have drawn the swing in stock valuation metrics on trailing operating results since late 2019. Price to sales has jumped from 1x to 3x since late 2020. Price to cash flow has increased markedly, from around 6x to almost 34x. And, price to book value has spiked from 2.5x to 9x.

YCharts – Modine Manufacturing, Ratio Analysis of Basic Fundamentals, 5 Years

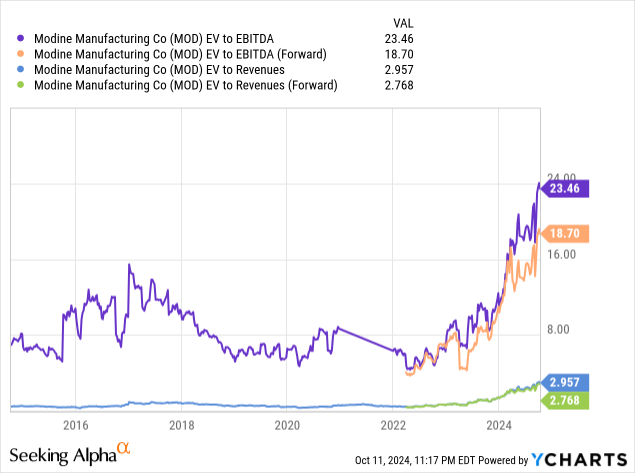

Using the enterprise value calculation as a yardstick, Modine looks equally extended for how Wall Street is pricing the company. When we include changing debt and cash levels, EV to trailing EBITDA of 23.4x and sales of 2.9x are triple the level of 2019-22.

YCharts – Modine Manufacturing, Enterprise Valuations, 10 Years

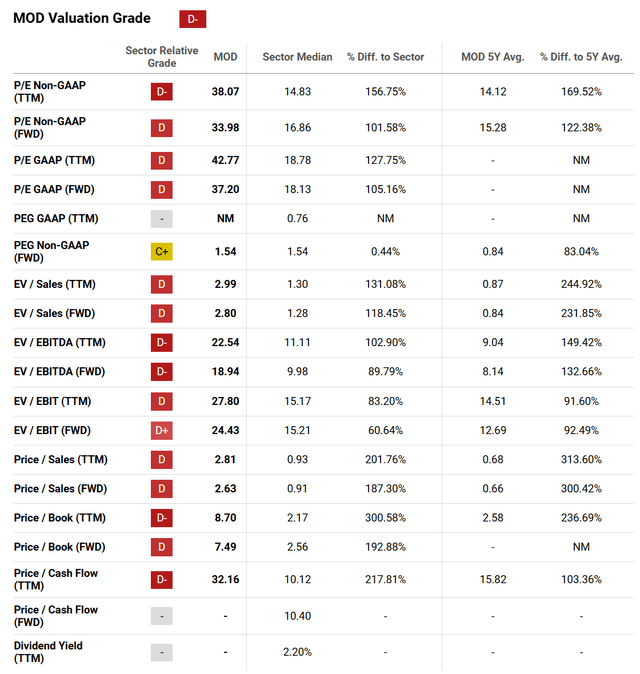

Seeking Alpha’s Quant Rating system agrees with my overvaluation assessment. The Valuation Grade is a “D-” looking at the stock’s 5-year trading history and comparing the current setup to industry peers and competitors.

Seeking Alpha Table – Modine Manufacturing, Quant Valuation Grade, October 11th, 2024

Final Thoughts

To me, after such a dramatic increase in the stock quote, today’s high valuation is not adequately supported by admittedly decent growth rate projections. I would prefer a much lower stock quote to buy into the evolving AI story.

How much lower? In my opinion, $80 to $100 per share would be an honest buy range, using 20% EPS growth rates. Reviewing PEG valuation ideas (price to earnings divided by earnings growth rate), a ratio closer to 1.0x would be the optimal setup to acquire a position. 20x to 25x forward estimated EPS results is the area I would consider purchasing shares.

Is a -25% to -40% price tank guaranteed to happen? No, but in stock market trading/investing, the price and valuation you pay upfront is often the biggest driver of investment returns over a holding period of one or two years. I would also add, from my analysis and experience, a -50% price crash to $65-70 is the line in the sand for me to raise my rating of this equity to a Strong Buy, all other variables remaining the same. The majority of investors in 2024 (buying at the AI-related peak) would likely panic sell on this outcome, while a PEG number below 1.0x would be available for new investment.

What could keep the share quote in an uptrend? It’s the Goldilocks scenario of falling interest rates, an expanding Wall Street boom in AI names, and an improving economy overall, adding to Modine’s sales and income.

It’s akin to a game of “Press Your Luck,” hoping that economic whammies don’t show up soon. For example, a crude oil spike (from Middle East turmoil and fighting) could force inflation and interest rates higher, while sending the economy into recession. If this scenario plays out, Modine will be back under $100 without much selling or warning.

For me, the odds of a flat to lower share price over the next 12-months are too great, having traded through a variety of stock market booms since 1986 (including the overall market, sectors and individual names).

My investment opinion is, now it seems to be the time in a stock trading cycle to tread cautiously, especially if you are contemplating acquiring a position. I am downgrading my official Modine Manufacturing 12-month outlook to Sell. Something of a breather and retracement period should play out into the spring or summer of 2025.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.