Summary:

- Thermo Fisher Scientific is well-positioned to benefit from the demand for innovation in the healthcare and biotech sectors.

- The company’s strategic acquisitions have improved its growth capabilities and deepened its relationships with biopharma partners.

- Despite a low dividend yield, TMO has a history of strong total returns and consistent dividend growth, making it a compelling long-term investment.

narvikk

Introduction

On April 24, I wrote an article covering Alexandria Real Estate Equities (ARE), a REIT that owns healthcare real estate, including laboratories.

This REIT is on my radar as a fantastic way to benefit from innovation in healthcare without having to figure out which biotech company will reveal a groundbreaking drug next.

[…] the company has provided the facilities that allowed for groundbreaking research, as the company noted that roughly half of all FDA-approved therapies over the past ten years were attributed to its tenants.

Buying real estate also protects investors against the current period of elevated patent losses among the big pharma companies.

In February, The Healthcare Technology Report wrote that the top 20 biopharma companies collectively face a $180 billion revenue patent cliff through 2028!

While this comes with risks, there are many ways to benefit from the related urge for innovation in this industry.

- Real estate: Alexandria has certainly found a way to benefit from this by leasing to some of the most stable tenants in the world. However, this somewhat limits the upside potential.

- Biotech companies: Finding attractive biotech companies with strong blockbuster drugs on the market or in their pipeline can be highly beneficial.

- Suppliers.

Point three is why I’m writing this article.

As I have a background in supply chains, I love companies that benefit from growth in a certain industry without massive competition, as they can supply a wide range of customers.

That’s where Thermo Fisher Scientific (NYSE:TMO) comes in.

Thermo Fisher is a holding of some family accounts and a competitor of the Danaher Corporation (DHR), which is a highly correlated company I bought a few years ago.

My most recent article on this fascinating dividend growth compounder was published on February 6, when I went with the title “Thermo Fisher’s Bright Future Makes It A Great Buy On Weakness.”

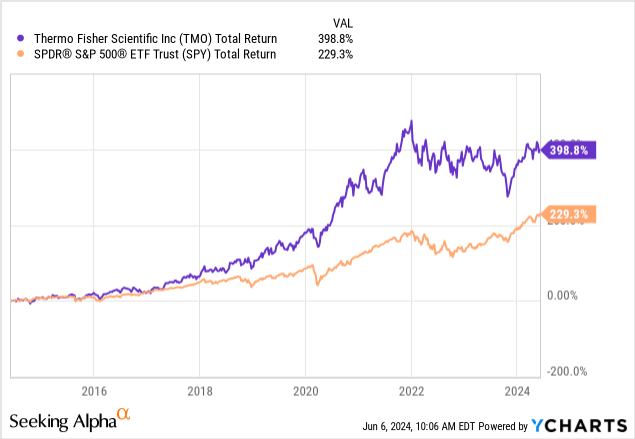

Since then, the stock has returned 3%, lagging the S&P 500’s 8% return.

Over the past ten years, TMO’s 400% total return beats the S&P 500 by roughly 170 points.

In this article, I’ll revisit my bull case and explain why I believe this company is in a terrific position to exploit strong tailwinds in the healthcare/biotech sector.

I also believe it continues to be a great dividend growth stock despite its low yield and what some may consider to be a lofty post-pandemic valuation.

So, as we have a lot to discuss, let’s get to it!

Buying Healthcare Innovation

I have often written in articles that I’m fascinated by healthcare innovation.

It’s truly fascinating to see how blockbuster drugs can fight serious illnesses and significantly improve the lives of many people.

However, picking healthcare winners isn’t easy, as it comes with a load of uncertainty, including regulatory approval risks, competition, funding risks, and others.

While I invest in biotech companies – I own AbbVie (ABBV) and have others on my watch list – I am a big fan of buying suppliers.

Although these companies also come with competition, they are often in a great spot to benefit from the general need for innovation in healthcare, as it increases demand for equipment and related supplies.

Headquartered in Waltham, MA, Thermo Fisher supplies a wide range of customers, including pharmaceutical and biotech companies, hospitals, clinical diagnostic labs, universities, research institutions, and others.

It sells through brands like Thermo Scientific, Applied Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services, Patheon, and PPD.

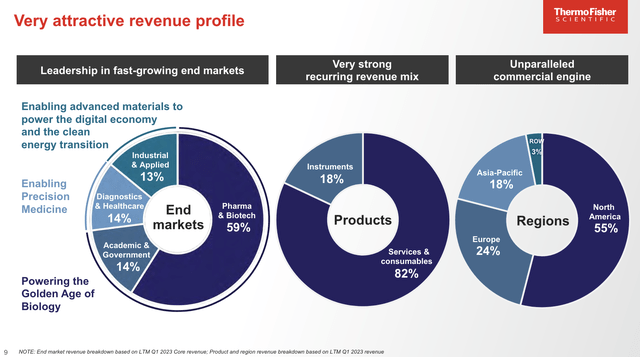

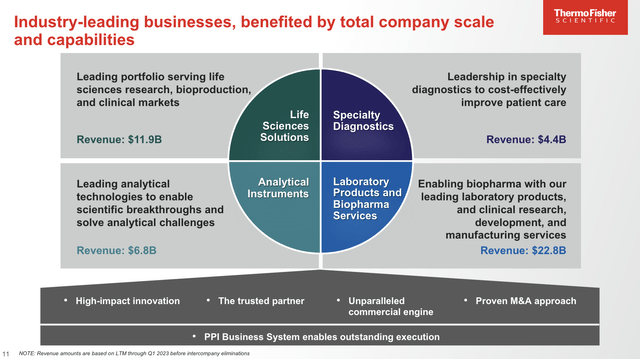

As we can see below, the company sells its products through four major multi-billion dollar segments that each target a specific area of the healthcare/biotech sector, including Life Sciences, Specialty Diagnostics, Analytical Instruments, Laboratory Products, and Biopharma Services.

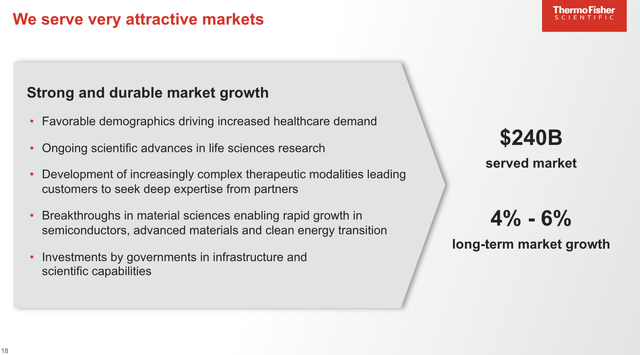

Putting all things together, almost 60% of its revenue comes from the pharmaceutical and biotech sectors, which are expected to grow between 4% and 6% annually.

These numbers used to be 3-5%.

However, because the company made internal changes with a bigger focus on growth markets, it now sees consistently higher growth.

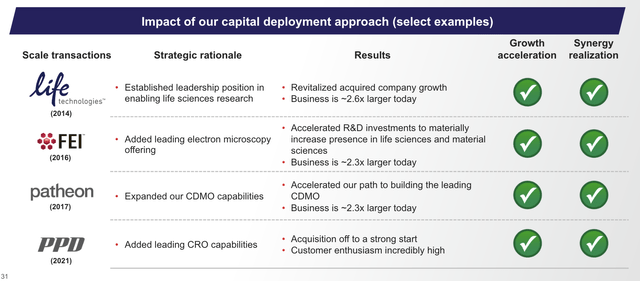

During the Bank of America Health Care conference last month, the company explained that strategic M&A has played a major role in growing at a faster clip.

This includes PPD and Patheon, which have significantly improved the company’s service offerings and deepened its relationships with biopharma partners.

According to the company, these acquisitions have broadened its capabilities and positioned it as a trusted partner in the development and manufacturing processes for pharmaceutical companies.

Adding to that, the company believes its exposure to China is a huge benefit.

Last year, 18% of its revenue was generated in the APAC region.

Despite the economic slowdown in China in 2023, the company expects to benefit from the Chinese government’s multiyear fiscal stimulus program focused on capital equipment.

This program is expected to have a positive impact on the Analytical Instruments segment.

While China comes with post-pandemic weakness, the company expects revenue benefits to materialize in late 2024 and into 2025, which is great news for the entire industry, in my opinion.

Furthermore, the company’s focus on high-end research and cutting-edge technologies, including the Thermo Scientific Orbitrap Astral mass spectrometer, positions it well to capture growth in what has become a rapidly evolving life sciences sector.

The Orbitrap Astral Mass Spectrometer achieves this by analyzing samples in just 8 minutes injection-to-injection, allowing acquisition of 180 samples per day. Each injection can identify 8,000+ proteins in a standard cell lysate sample, breaking through the bottleneck of sample analysis. This faster throughput enables the analysis of over 1.4 million cumulative protein group measurements across 180 samples in a single day, meaning a single Orbitrap Astral Mass Spectrometer can measure tens of thousands of samples in a year. – Thermo Fisher

As good as all of this sounds, what does this mean for shareholders?

Not Cheap, But Far From Expensive

Thanks to a strong performance and demand recovery, TMO hiked its guidance in the first quarter, as it now expects to generate at least $42.3 billion in revenue.

This is expected to lead to an EPS range of $21.14 to $22.02.

During its 1Q24 earnings call, the company also announced strategic partnerships, including its partnership with German healthcare giant Bayer to develop a next-generation sequencing-based companion.

This bodes well for shareholders.

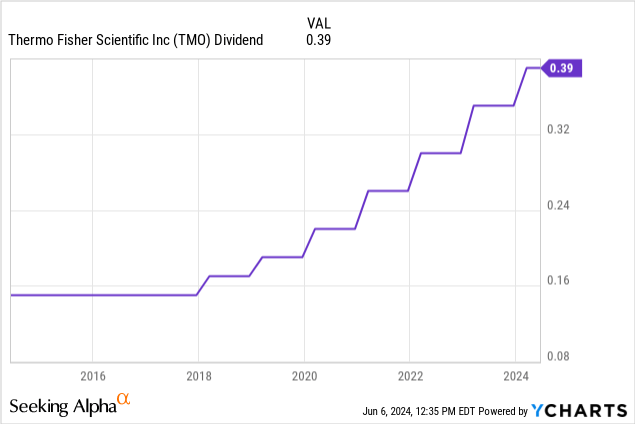

In the first quarter, Thermo Fisher repurchased $3 billion of shares and increased its dividend by 11.4%.

Currently, it pays $1.56 per share per quarter, which gives us a yield of 0.3%.

0.3% is not a lot. A $10,000 investment will get you $30 in pre-tax dividends. That’s two trips to the fast-food chain with the big yellow “M” – for one person.

However, please keep a few things in mind.

It’s not TMO’s fault that its dividend yield is so low.

The five-year CAGR is 15.5%!

Its yield is low because capital gains offset dividend growth, which explains why it has such a fantastic total return.

Obviously, if you require dividend income, TMO is wrong for you.

Everyone else, however, may still benefit from buying low-yield dividend growers.

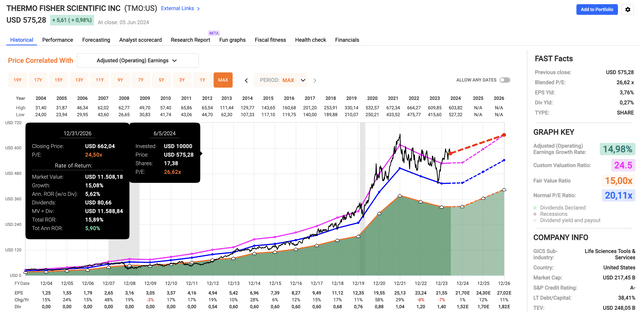

That said, using the FactSet data in the chart below, analysts agree with the company. After a few challenging post-pandemic years, EPS growth this year is expected to be 1%.

In 2025 and 2026, EPS growth is expected to be 12% and 11%, respectively.

Currently, TMO trades at a blended P/E ratio of 26.6x. This is a bit above its five-year normalized P/E ratio of 24.5x and way above the two-decade normalized P/E ratio of 20.1x (the blue line in the chart above).

The reason why TMO isn’t selling off is that investors know there’s a path to consistent double-digit annual EPS growth, fueled by mid-to-high single-digit revenue growth.

Everyone knew the post-pandemic years would be challenging. Selling into expected weakness is not something investors will do when the favorable longer-term outlook keeps getting confirmed.

While the company’s returns could remain subdued in the next 1-2 years, I still expect mid-single-digit to high-single-digit annual returns.

Since 2004, TMO has returned 16.7% per year!

Although I don’t expect to see these returns anytime soon, I have little doubt that this powerful business model is capable of elevated double-digit returns once we leave the slow post-pandemic years behind us.

That’s why my family keeps buying TMO.

The only reason I don’t own it is my investment in DHR. I like both and have no favorite.

Takeaway

Thermo Fisher Scientific is a fascinating company in the healthcare and biotech sectors, which consistently benefits from the industry’s demand for innovation.

Despite a low 0.3% dividend yield, TMO’s strong organic growth and strategic acquisitions have driven impressive total returns.

Given a favorable growth outlook, TMO remains a compelling investment for those seeking long-term growth rather than elevated income.

While the post-pandemic period presents challenges, the company’s strategic positioning and partnerships make sure it remains a key player in healthcare innovation, with what, I believe, is a very promising future.

Pros & Cons

Pros:

- Strong Growth Potential: TMO is well-positioned to exploit significant tailwinds in the healthcare and biotech sectors.

- Strategic Acquisitions: Past acquisitions like PPD and Patheon improve TMO’s growth capabilities.

- Innovative Edge: Cutting-edge technologies allow the company to stay on top of the latest trends.

- Long-Term Returns: TMO has a history of spectacular total returns and consistent dividend growth, which I expect to last.

Cons:

- Low Dividend Yield: At just 0.3%, the dividend yield is nothing to write home about.

- Valuation: Trading at a blended P/E ratio of 26.6x, TMO is slightly overvalued, which means it needs to deliver on its guidance (no room for error).

- Short-Term Challenges: The post-pandemic recovery phase may pressure returns in the next 1-2 years, potentially limiting short-term gains.

- China Exposure: Dependence on the Chinese market comes with some risks, including political and cyclical post-pandemic risks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.