Summary:

- Lowe’s is a market leader in home improvement with competitive advantages like scale, private label brands, and strong vendor relationships, making it a buy.

- Despite a recent revenue decline, Lowe’s has a history of consistent long-term growth, supported by geographic expansion and organic growth in products and services.

- Lowe’s is a Dividend King with a 62-year streak of increases, supported by excellent dividend safety metrics and strong free cash flow.

- Lowe’s market leadership, profitability, and favorable dividend metrics justify a buy rating, with potential upside from declining interest rates.

JHVEPhoto

Lowe’s (NYSE:LOW) is a market leader in the home improvement market. Its competitive advantages include scale, leading private label brands, and strong vendor relationships. The stock price has gained considerably this year, but the valuation is still reasonable. Additionally, the firm is a Dividend King and Aristocrat with excellent dividend safety metrics and consistent long-term growth. I currently view Lowe’s as a buy.

Overview of Lowe’s Companies

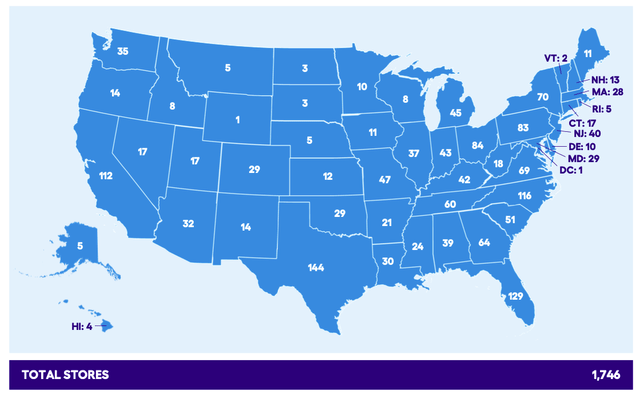

Lowe’s Companies was founded over 100 years ago, in 1921. Today, it is one of two leading home improvement retailers in the United States. It sells hardware, lumber, paint, tools, plumbing, electrical, appliances, lawn & garden, etc., through 1,746 stores in America and its website. Lowe’s also offers installed sales and repair services. The stores are massive, with 112,000 square feet of retail space plus an additional 32,000 square feet of outdoor space. They account for about 89% of sales, while e-commerce is responsible for another 11%.

The largest product categories are appliances, season & outdoor living, lumbar, and lawn & garden. The retailer sells national and private-label brands like Kobalt, allen + roth, MasterForge, Harbor Breeze, STAINMASTER, etc.

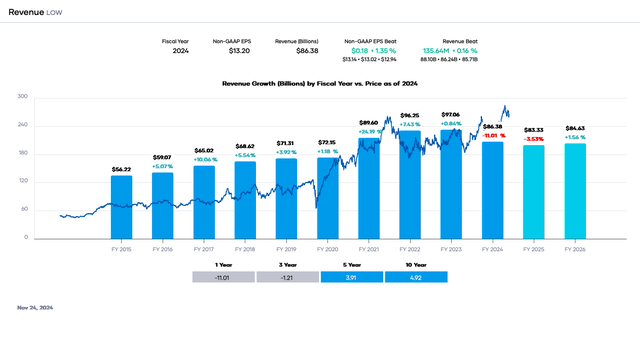

Total revenue was more than $86,377 million in fiscal 2024 and $84,023 million in the last twelve months (“LTM”). The firm’s fiscal year usually ends on the first Friday in February.

Revenue and Earnings Growth

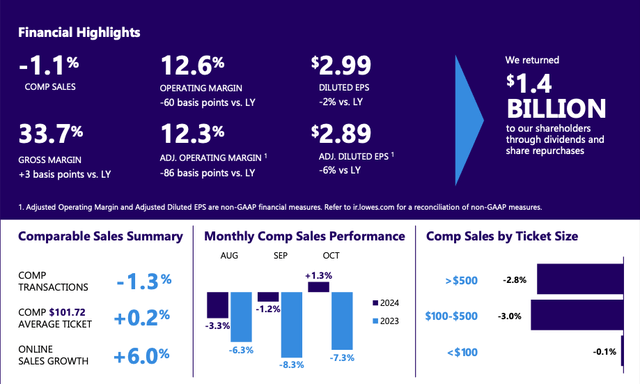

The firm announced third quarter fiscal year 2024 results on November 19, 2024, exceeding top and bottom-line estimates. However, revenue still declined by around 1.5% to $20,179 million, even though it beat estimates by $260 million. Adjusted diluted earnings per share (“EPS”) of $2.89 surpassed estimates by $0.08 but was still lower than last year by $0.07 because of less revenue and higher selling expenses, resulting in lower operating margins. The declines were caused by soft do-it-yourself (“DIY”) big-ticket discretionary demand offset by a boost from hurricane-related demand and Pro and online sales. A lower share count helped, too.

The share price fell after the results were released but is still higher for the year on optimism about improving monthly comparable sales, which turned positive. Hence, the share price is up almost 19% year-to-date. It has risen ~33.4% in the last twelve months.

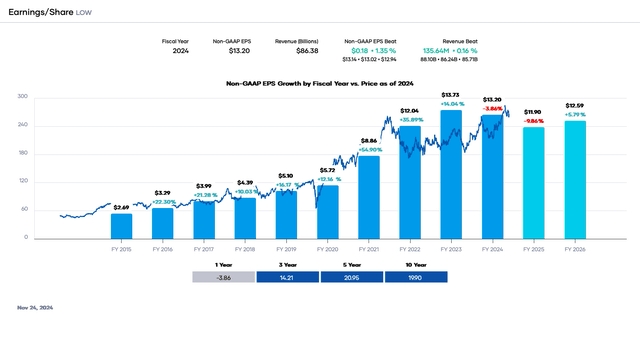

Lowe’s revenue has gained each year from fiscal 2015 to 2023. Pandemic-related spending caused a significant boost in revenue because of the federal government’s largesse. However, an end to benefits and higher interest rates have affected the housing and DIY markets. Consequently, revenue will decrease in fiscal 2024. The 5-year growth rate is less than the 10-year at 3.9% compared to 4.9%, signifying the slowdown.

Lowe’s has successfully increased revenue in the past because of geographic expansion and organic growth. However, it now has 1,746 stores across the country, and the pace of store addition has slowed. Additionally, Lowe’s has exited the Mexican and Canadian markets.

Today, the firm emphasizes organic growth in products and services for contractors and consumers. Lowe’s Pro offerings and online sales are growth drivers. We expect low-to-mid single-digit revenue increases once the American housing market stabilizes, and interest rates fall further. We do not anticipate significant acquisitions. Most acquisitions, such as STAINMASTER in 2021, have been small relative to Lowe’s size and are an incremental revenue driver.

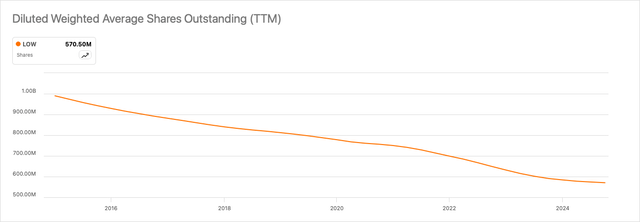

Similarly, EPS has risen every year since fiscal 2015. It is expected to decline in 2024 because of lower revenue. The EPS has risen faster than revenue because of climbing margins from productivity initiatives. Massive share buybacks have also appreciably lowered the share count by nearly 400 million in the trailing decade. The mid-point of updated guidance is for $11.85 per share in fiscal 2024, a decline from 2023. However, the long-term average shows double-digit growth at 21% for five years and 19.9% for ten years because of organic growth and sales of the Mexican and Canadian businesses.

Portfolio Insight Seeking Alpha

Looking forward, I expect Lowe’s revenue and EPS to continue rising in the foreseeable future because of aging homes. Aging homes will cause homeowners to spend money on upgrades and maintenance in the DIY or contractor market. Also, recovery of the housing market and sales of existing homes because of lower interest rates should boost home improvement spending. In either case, Lowe’s will win a substantial percentage of future expenditures as the second largest home improvement chain. Continual productivity improvement should permit margins to keep climbing and improve profitability.

Recent Challenges and Risks

Lowe’s main challenge is the intense competition in the home improvement retail space. Besides the market leader, Home Depot, smaller retailers compete in various categories. In addition, Walmart, Target, Amazon, and many smaller online retailers are players in different categories. Lowe’s also faces risks from factors largely beyond its control, like interest rates, the housing market, and tariffs. These may result in lower sales and higher expenses. That said, Lowe’s has successfully navigated many of these issues in the past.

Competitive Advantages

Lowe’s competitive advantage is its position as the second largest home improvement retailer and scale, allowing it to spread fixed costs like inventory, technology, distribution, and supply chain over a large store base. The company has also developed deep vendor relationships and invested in private labels that would be difficult for a new entrant to replicate.

Dividend Analysis

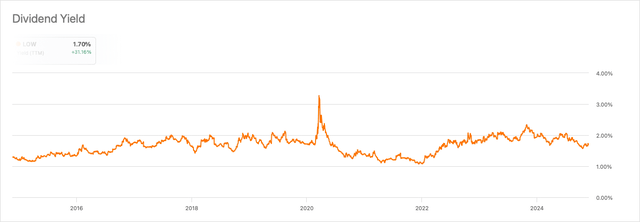

Lowes’s rising share price has caused the dividend yield to fall slightly below its 5-year average of 1.77%. The forward yield is now about 1.74%. This implies a fair valuation.

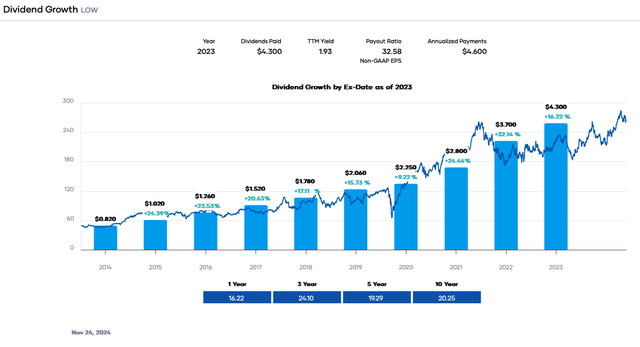

Lowe’s is a Dividend King and Aristocrat with a 62-year streak of increases, making it one of the few companies with more than a six-decade record. In the past 5-years and decade, the growth rate has been approximately 20%. Although the rate may decline because of an increasing payout ratio, we expect at least high-single-digit increases as the firm’s revenue grows.

The dividend is supported by outstanding safety. The forward payout ratio is a modest 39%, based on an estimated fiscal 2024 EPS of $11.85. This value is exceptional and under my requirement of 65% or better. The firm usually generates free cash flow (“FCF”) above $6 billion, which more than covers the dividend requirement of roughly $2,548 million. The FCF usually ranges between $6.2 and $9.3 billion. Conservatively assuming $7,000 million of FCF in this fiscal year gives a dividend-to-FCF ratio of 36.4%, well below our desired value of 70% or better.

A negative aspect is Lowe’s leverage. It carries $2,576 million of short-term and current long-term debt and $32,906 million of long-term debt. It is only offset by about $3,606 million in cash and equivalents. Hence, the leverage ratio is ~2.8X. The firm’s net debt continues to rise because of robust share buybacks. Therefore, the firm receives a BBB+/Baa1 lower-medium investment grade rating.

However, Lowe’s receives an ‘A+’ dividend quality grade from Portfolio Insight, placing it in the 95th percentile. It measures earnings performance, revenue performance, dividend performance, profitability, and financial strength. At the same time, the Seeking Alpha Quant system gives an ‘A’ for safety, an ‘A’ for growth, and a ‘A+’ for consistency.

Despite the leverage surpassing 2.5X, investors should be confident regarding Lowe’s dividend safety. Little likelihood currently exists for a cut or suspension.

Valuation

Lowe’s rising share price has caused the valuation to increase this year. Although below its all-time high, the increasing stock price has resulted in a forward price-to-earnings (P/E) ratio of ~22X.

The mid-point of the company’s guidance for adjusted diluted earnings is $11.85 per share in fiscal 2024, less than in fiscal 2023. We will use 20X as a reasonable, fair-value multiple near the decade average, accounting for rising margins. As a result, our fair value estimate is $237. The present share price is ~$264.68, indicating that Lowe’s is significantly overvalued.

Applying a sensitivity calculation using P/E ratios between 19X and 21X, we obtain a fair value range from $225.15 to $248.85. Hence, the stock price is approximately 106% to 118% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

19 |

20 |

21 |

|

|

Estimated Value |

$225.15 |

$237 |

$248.85 |

|

% of Estimated Value at Current Stock Price |

106% |

112% |

118% |

Source: Dividend Power Calculations

How does this calculation compare to other valuation models? Portfolio Insight’s blended fair value model, combining the P/E ratio and dividend yield, estimates a fair value of $252.53 per share. The two-model average is ~$244.78, indicating that Lowe’s is overvalued at the current price.

However, Wall Street analysts are more bullish, with an average price target of $281.50, or 6.35% higher than the current value and more than our two-model average. That said, analysts are divided in their ratings with 17 strong buys, four buys, 14 holds, two sells, and one strong sell. In addition, the Seeking Alpha Quant system rating is a hold at 3.28 because of valuation and growth. However, the profitability and momentum scores are favorable, suggesting Lowe’s may surprise investors.

Final Thoughts

Lowe’s is a retailer operating in a market with defensible characteristics. Moreover, its scale and geographic footprint in home improvement make it difficult for new entrants to gain traction. That said, strong competitors exist. However, Lowe’s has generated long-term growth and profitability, creating shareholder value through rising share prices and dividend distributions. The firm is probably fairly valued, but we do not expect it to become significantly undervalued because of its market leadership and declining interest rates. Because of its reasonable yield, excellent dividend safety metrics, and consistent growth, I view Lowe’s as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.