Summary:

- Lowe’s is a US-based home improvement retailer that has a strong dividend history of over 60 years of consecutive growth.

- Despite a decrease in revenue and comparable sales, Lowe’s is investing in new loyalty programs and rewards to drive growth.

- The poor sales performance can be attributed to lower consumer spend, likely caused by higher inflation and a higher interest rate environment.

- Although the dividend yield remains low at 2%, the high double-digit dividend growth rate makes this a strong contender for a dividend growth portfolio.

Althom/iStock Editorial via Getty Images

Overview

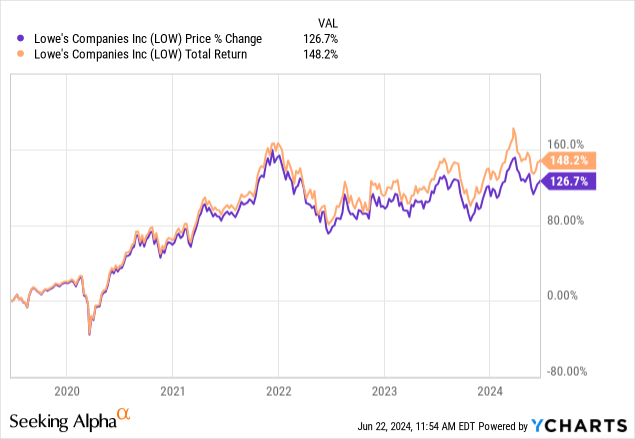

I became a homeowner over the last year, and I never thought I’d be visiting my local Lowe’s (NYSE:LOW) so often. I always knew that LOW had the reputation as a great company, but these frequent visits prompted me to take a deeper look into the company to see what growth prospects look like, as well as what the current performance in the current economic environment. We can see that LOW’s price and total return have remained strong and never fell back to those pandemic-era price levels of 2020.

Just for context, Lowe’s is a retailer that focuses on its portfolio of home improvement products. The company has been around for over 100 years, being founded in 1921. The company’s long history has amounted to LOW now having a market cap of over $130B and about 1700 locations across the US. While Lowe’s may seem a bit similar to Home Depot (HD), LOW instead focuses on products that have a greater emphasis on usability for the average homeowner. In comparison, HD has always felt like it was more catering towards contractors and professionals.

Additionally, LOW was always a company that I was interested in making a part of my dividend growth portfolio. This is because LOW has achieved the milestone of a dividend king by raising their dividend amount for over 60 consecutive years in a row. However, I noticed that in the early days of my dividend investing journey, I tended to shy away from starting a position in LOW due to its low starting yield. The current dividend yield sits at 2%, which isn’t too enticing in this current high-interest rate environment.

However, I feel we’ve now missed out on getting in at an attractive valuation. The price trades within a 10% window of its all-time high, which wouldn’t be the most ideal price range for entry. There’s also some uncertainty in the markets right now surrounding interest rates, inflation, and consumer spending. As a result, there’s a possibility that we see the price come down from these highs as well as see growth be stunted by these macroeconomic factors.

Financials & Vulnerabilities

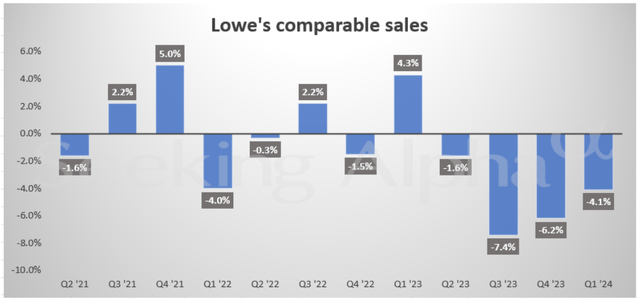

LOW recently reported their Q1 earnings and the results were a bit mixed. On one hand, revenue came in at $21.36B for the quarter and beat expectations by over $250M. However, this resulted in comparable sales being down 4.1% year over year and the reported revenue still amounted to a 4.4% decrease. Earnings per share landed at $3.06, which beat expectations by $0.11 but still undercut last year’s Q1 earnings per share amount of $3.67. This is the fourth quarter of consistent decreases in comparable sales, but this is likely due to external influences, rather than some fundamental issue with Lowe’s.

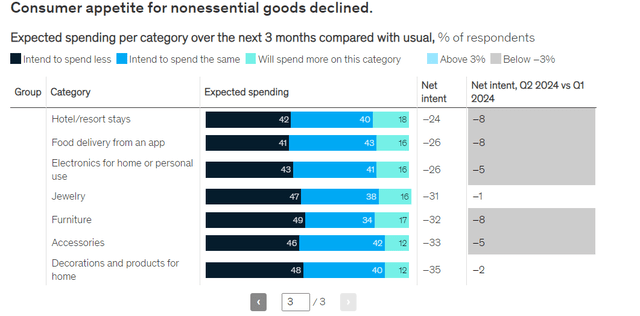

As inflation remains above the 3% mark, consumers are starting to adjust their spending patterns and lose their appetite for spending. As the average customer sees prices increase across the board, the natural reaction is to make a more conscious effort to cut back on spending where possible. This problem isn’t unique to LOW, and many consumer reliant businesses are going through the same headwinds at the moment. Realistically, LOW’s price may remain suppressed for an extended period of time, since the inflation rate continues to come in higher than forecasted.

Data compiled by McKinsey reinforces that the consumer appetite across many different sectors is decreasing. For most categories, almost 50% of consumers are making an effort to spend less money over the next three months to offset the higher costs of goods. This likely goes hand in hand with the current high-interest rate environment that we are in as well.

As interest rates remain at their decade highs, this can directly translate to lower consumer spend. For people who have debt on a variable rate basis, this means that the cost of that debt becomes more expensive to maintain through higher amounts of interest payments required. The Fed left rates unchanged at their most recent meeting, but it looks like the tide may be turning soon as the unemployment rate starts to tick above the 4% mark and inflation, although still higher than anticipated, starts to trend downward.

As a way to offset the lower sales volume, management has been pushing the use of their new loyalty program by offering customers many incentives to sign up through discounts and deals. This was clear during the last earnings call, where they also stated that by collecting a database of user history, they can better tailor the experience for customers.

Another exciting step forward for Lowe’s this quarter was the national rollout of our DIY loyalty program called Mylowe’s Rewards. This program is designed to reward customers for choosing Lowe’s for the home improvement needs by earning points toward MyLowe’s money, providing free standard shipping as well as other offers and gifts. As MyLowe’s Rewards program matures, the purchase data will allow us to better understand the specific needs of each customer, and tailor offers to their individual preferences. – Marvin Ellison, CEO

Taking these lower sale figures into account, LOW’s guidance for the fiscal year estimates comparable sales to be down between 2% to 3%, finding the total sales to fall between $84B to $85B. So while we may see some pain for the next several quarters until conditions improve, at least LOW has a strong liquidity profile. At the moment, LOW has enough capital to ride out these headwinds through cash and cash equivalents totaling $3.2B, which is the highest levels since 2021. However, their long-term debt does sit a bit elevated at $34B, which is near its all-time high over the last decade. On a more positive note, however, they can efficiently cover the interest on their debt with an interest coverage ratio of 7.26x, which remains higher than the sector median coverage of 6.96x. The company gets an A+ grade in profitability due to cash from operations totaling $10.3B and cash per share amounting to 5.6x. For reference, cash per share levels haven’t been this high since 2021. This strong profitability profile should help offset any weaknesses in the short term.

Lastly, LOW is still investing back into the business to continue growth despite these unfavorable conditions. They are actively trying to open new Lowe’s Pro supply branches around the country, which are more catered towards professional contractors and builders. Share repurchases for the quarter totaled $677M, which helps instill some confidence that management believes they are in great shape.

Dividend

LOW maintains its dividend king status with a recent dividend raise of 4.5%. As of the latest declared quarterly dividend of $1.15 per share, the current dividend yield is 2%. Despite the low dividend yield, the growth has been strong at a high double-digit rate. Over the last ten-year period, the dividend has been increased at a CAGR (compound annual growth rate) of 19.84% which is strong enough to show some meaningful growth over time. Even on a smaller time frame of only three years, the dividend has been increased at an even stronger CAGR of 23.25%.

Long-term shareholders have been rewarded handsomely with a fast-growing yield on cost due to these large dividend increases. For example, shareholders that have held for the last decade are now approaching a yield on cost that is close to 10%! Now only has the dividend growth been strong, but it remains well-covered as well. The current dividend payout ratio sits at about 35%, which closely aligns with the sector median payout ratio of 34.5%. Additionally, LOW has slightly improved this over time because over the last five years their payout ratio has hovered closer to 38%.

This high-growth rate is impactful enough to see sizeable growth in dividend income when held with a long-term outlook. In order to demonstrate this, let’s take a look at the back test data from Portfolio Visualizer. This data represents an initial investment of $10,000 in 2015 and also assumes that you added a fixed contribution of $500 every single month to your position throughout the entire holding period. Lastly, this graph also assumes that every single dividend that was received was reinvested back into LOW, which helped accumulate more shares.

In 2015, your dividend income would have been almost immaterial, amounting to a measly $184. However, fast-forward to the full year of 2023 shows that your dividend income would now have grown to $3,123. Not to mention, your position would now be valued slightly over $172,000. This is a great example of how a lower starting yield can be offset by a high rate of growth when held over the long term.

Valuation

When looking at some valuation metrics, LOW seems to be pretty trading near fair value. For instance, LOW trades at a price to earnings ratio of 18.36x, which closely aligns with its five-year average price to earnings ratio of 18.43x. In addition, LOW has a price to cash flow ratio of 13.85x, which also closely aligns with its five-year average of 13.48x.

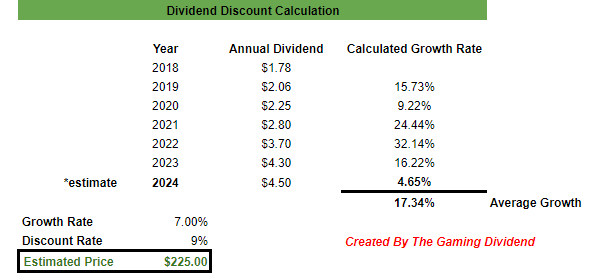

However, Wall St. analysts seem to believe there’s still some solid upside potential here. The average Wall St. price target sits at $251.14 per share, which represents a potential upside of 9.8% from the current levels. The highest price target sits at $290 per share and the lowest price target is at $201 per share. Since this is such a wide price range, I decided to conduct an additional valuation through a dividend discount calculation as a way to determine another source of an estimated fair value.

I started by compiling all the annual dividend payout amounts dating back to 2018. Additionally, I projected an annual payout for 2024 to be $4.50 per share since it was just raised, and I do not expect another one for the year. Forward EBITDA growth has averaged 7.6% over the last five-year period, which, I thought, would be a fair estimate for growth going forward once conditions improve. A lot of the growth here depends on when interest rates start to get cut and whether or not inflation continues to trend downward.

Author Created

With these inputs in mind, we can see that I get an estimated fair value of $225 per share. This actually sits under the current price and represents a potential downside of about 1.5%. Therefore, we can conclude that LOW trades near fair value at the moment and since consumer spending shows no signs of strengthening yet, I believe that we will likely trade sideways or downward until market conditions improve.

Takeaway

In conclusion, LOW is a solid company that has been affected by unfavorable macroeconomic conditions rather than any internal weakness. Liquidity remains strong, and they have plenty of cash on hand to navigate these conditions for now. Similarly, the dividend remains well-supported, and the payout ratio leaves room for future growth. However, the stock remains a bit expensive at the moment and trades at a premium to the fair estimated value determined using a dividend discount model. If you are already a shareholder, I do not see any red flags that would be a reason to sell. However, I am rating LOW as a hold as I await a better entry opportunity or for market conditions to improve.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LOW over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.