Summary:

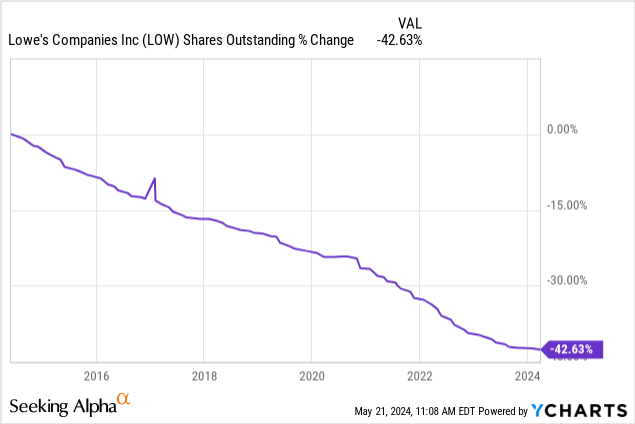

- Lowe’s has repurchased 42% of its outstanding shares in the past decade, making it an aggressive buyback company.

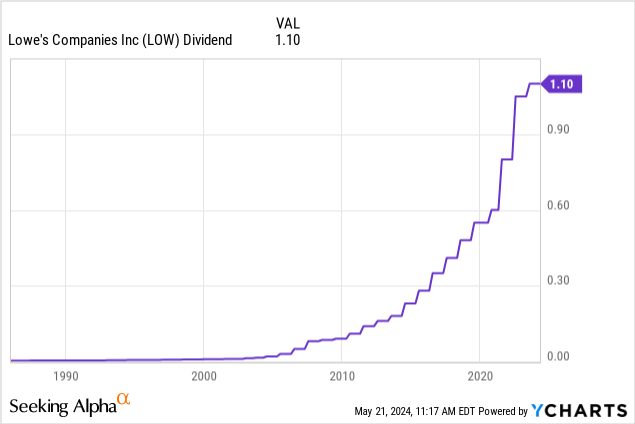

- The company has a Dividend King status with 60 consecutive years of dividend hikes and a low payout ratio.

- Despite economic headwinds and a drop in comparable store sales, Lowe’s strategic initiatives in the Pro segment and online sales provide potential for long-term gains.

jetcityimage

Introduction

42%.

That’s the percentage of the outstanding shares Lowe’s Companies, Inc. (NYSE:LOW) has bought back over the past ten years alone, making it one of the most aggressive repurchasers on the market.

It also has Dividend King status, having hiked its dividend for 60 consecutive years!

However, instead of having a slow growth profile, the company’s 1.9% yield is protected by a low 30% payout ratio and comes with a five-year CAGR of 18.0%, making it one of the best dividend growth stocks as well.

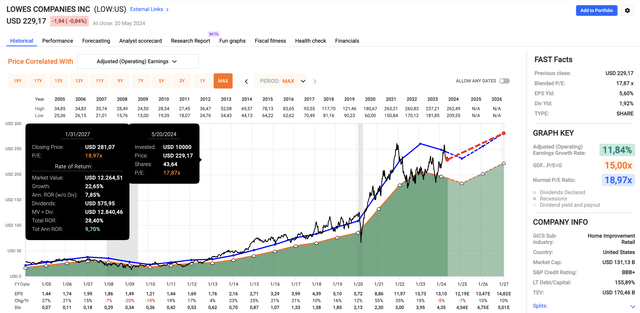

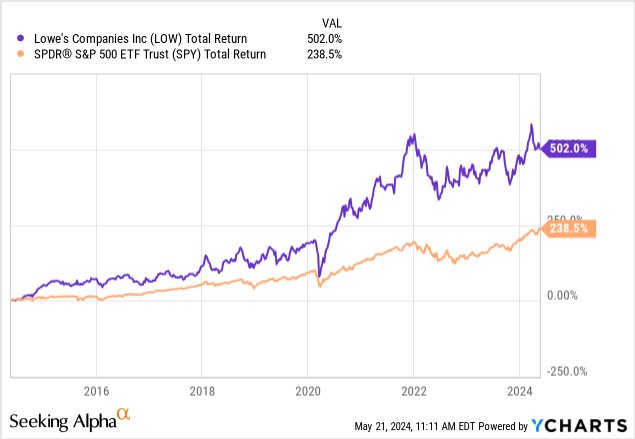

As a result, it was able to outperform the S&P 500, as it returned 502% over the past ten years, more than twice the 239% return of the S&P 500.

In other words, it’s fair to say Lowe’s is a highly impressive stock that truly has it all: elevated dividend growth, aggressive buybacks, and alpha.

My most recent article on the stock was written on December 28, when I wrote the following:

While economic headwinds have impacted the stock, particularly in the DIY customer segment, Lowe’s resilience and strategic initiatives are noteworthy.

[…] Despite near-term concerns about EPS expectations, LOW’s current undervaluation and historical performance suggest potential for future growth.

As an investor, keeping an eye on LOW for a buying opportunity during market downturns could be a prudent move.

In this article, I’ll update my thesis using the company’s just-released earnings.

Even if you don’t care about the company, it reveals a lot about the strength of the U.S. consumer and important trends that may have an impact on other investments in your portfolio.

So, let’s dive into the details!

The Consumer Is Struggling

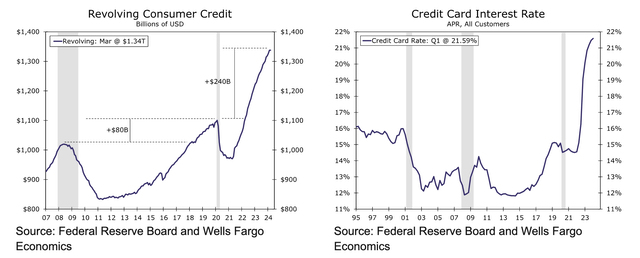

Earlier this month, Wells Fargo wrote that the mix of rapidly rising consumer debt and higher rates raises doubts about the ability of credit to continue to make up for the shortfall between modest real income growth and “aspirational spending.”

After all, an economy fueled by debt benefits most when rates are low, as it stimulates consumers to take on debt to consume and invest.

Right now, that’s not the issue.

- Revolving consumer credit has exploded – adding $240 billion since 1Q20.

- Rates on credit have exploded to more than 21%!

While this does not yet suggest a full-blown consumer meltdown, the trend is in the wrong direction, especially when looking at loan delinquency rates, which have seen significant momentum in credit card and auto loans.

Wells Fargo

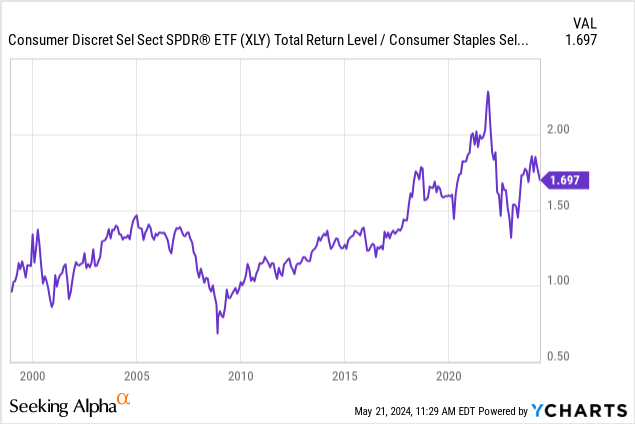

As a result, we see pressure on cyclical consumer stocks, as the ratio between consumer discretionary (XLY) and consumer staple stocks (XLP) proves.

Including dividends, the XLY ETF, which has 25% Amazon.com, Inc. (AMZN) exposure, hasn’t been able to start a sustainable rally compared to XLP since 2018!

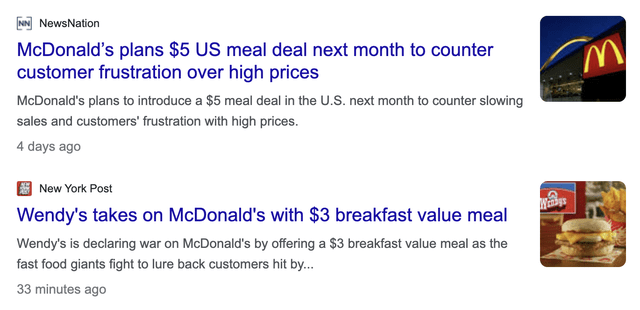

More recently, we have seen negative headlines from companies like McDonald’s Corporation (MCD) and Starbucks Corporation (SBUX), who are starting to notice that middle-class consumers are increasingly struggling.

This brings me to Lowe’s.

What About Lowe’s?

Lowe’s is feeling the heat, too.

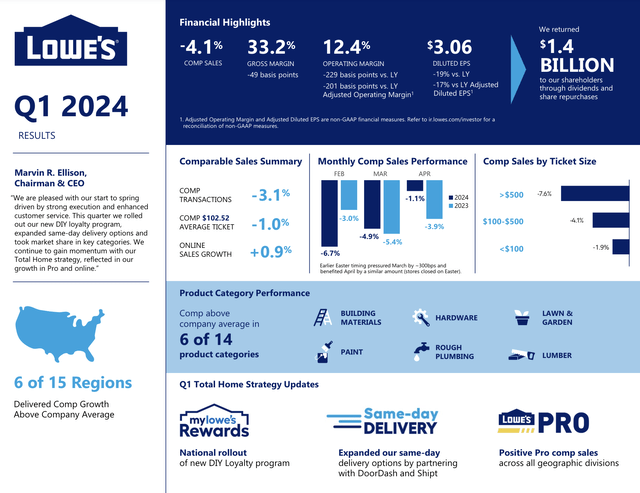

Using the overview below, we see the company reported a 4.1% decline in comparable store sales. This decline was blamed on ongoing pressures in the home improvement sector, particularly in big-ticket discretionary spending, which makes perfect sense in light of what we just discussed.

Furthermore:

- Comparable transactions dropped 3.1%, indicating fewer trips to the store.

- Comparable average ticket declined by 1%. Despite higher inflation, the average ticket fell, another indication consumers have become more careful.

- Online sales were up 0.9%.

Moreover, regarding my big-ticket discretionary spending comment, comparable sales of tickets of at least $500 were down 7.6%, with sub-$100 tickets being down only 1.9%.

The good news is that despite these challenges, Lowe’s noted stronger-than-expected results in its spring seasonal sales as it adapted its strategy to capture early spring consumers through data-driven marketing campaigns and a more attractive (seasonal) product assortment.

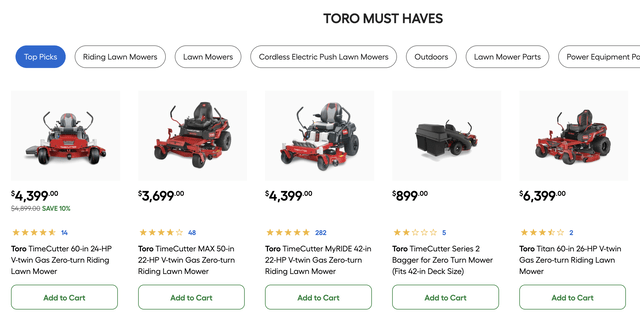

According to the company, a driver partially offsetting consumer weakness was its deal with Toro, which added a whole new line of mowers and related products to its lineup.

Moreover, the company is making progress in its Pro segment, which is a segment I’m very upbeat about.

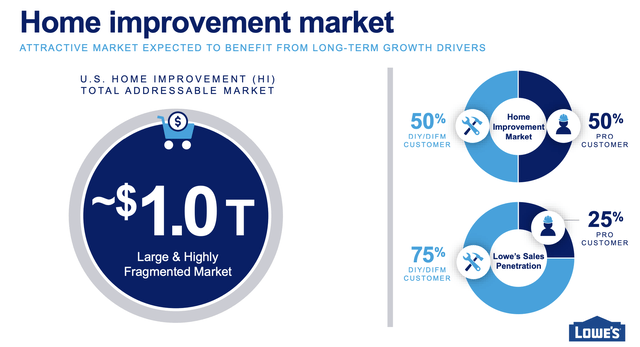

As I wrote in my prior article, this is a $1 trillion market that consists of 50% professional sales. Lowe’s has not penetrated this market very far, which offers opportunities.

Even better, as I wrote in a different article, the average commercial building in the United States was 53 years old in 2022!

This comes with tremendous commercial demand on a long-term basis.

While consumers may have finished a lot of DIY projects during the pandemic, I have little doubt that LOW and its peers enjoy many decades of secular growth in the Pro segment.

According to the company, it saw positive growth in both its Pro and online sales segments as growth initiatives paid off.

These investments include efforts to improve service levels and expand the brand portfolio, which now includes client tools.

Moreover, these efforts improved relationships with small and medium-sized professionals, including repair contractors, remodel contractors, property managers, and tradespeople.

This customer segment accounts for roughly half of the $500 billion Pro market, which offers tremendous fragmentation opportunities, as I already briefly mentioned.

Meanwhile, online sales benefitted from initiatives like same-day deliveries with DoorDash and Shipt.

Doordash

Personally, I thought DoorDash was only for food. However, as it turns out, it’s expanding, with Lowe’s being its first DIY retailer client.

The company also partnered with soccer superstar Lionel Messi in an effort to target consumers who may not be into NFL football, which is a market the company has been targeting intensively for many years.

It’s All About Macro

As much as I like the company’s efforts to grow in this challenging environment, they clearly show that Lowe’s has a limited impact on its revenues.

While I have no doubt that Lowe’s actions put it in a great spot to gain market share in critical areas and improve the customer experience, the bigger macro picture is what matters more.

During its 1Q24 earnings call, the company noted that the current macroeconomic environment comes with several challenges, including uncertainty around interest rates, persistent inflation, and a consumer preference for services over home improvement projects.

Readers who have followed my work for a while may know that these are the issues I have discussed in countless articles, as I believe in “higher for longer” interest rates and inflation.

The good news is that despite these challenges, the company has confidence in its medium to long-term outlook for its industry.

Why?

Core drivers, including real wage growth and home price appreciation, continue to support spending.

But then again, the average customer remains cautious due to concerns about higher living costs and the overall state of the economy.

Real wage growth and home price appreciation are solid, but the home improvement customer is still on the sideline, expressing concerns about the higher cost of living and the state of the overall economy. – LOW 1Q24 Earnings Call

That’s where PPI comes in.

PPI stands for “perpetual productivity improvement” initiatives.

Essentially, these initiatives are designed to improve the performance across all functional areas of the business, allowing the company to navigate the current challenging macroeconomic environment as effectively as possible.

[…] we are also executing against a multiyear road map of PPI initiatives, which will continue to unlock productivity well beyond 2024. We are well-positioned to capitalize on home improvement demand when the market recovers and continues to deliver sustainable shareholder value. – LOW 1Q24 Earnings Call

In general, I like how effectively LOW manages its costs, with quarterly SG&A expenses falling to 18.8% of total sales. That’s an improvement of 137 basis points.

Unfortunately, the operating margin declined by 201 basis points.

Where’s The Shareholder Value?

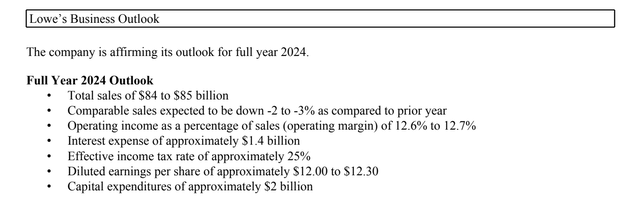

The good news is that despite challenges, the company affirmed its full-year 2024 outlook, with an expected revenue range of $84 to $85 billion and an expected decline in comparable sales between 2% and 3%.

This is slightly worse than The Home Depot, Inc.’s (HD) expected 1% comparable sales decline.

While the company expects easier comparisons in the second half of this year, it does not expect an uptrend in consumer demand this year, which has resulted in a modest stock price decline of roughly 3% after earnings (while I am writing this).

Moreover, going forward and with regard to dividends, the company will continue to target a 35% dividend payout ratio. It is currently slightly below that number, as I mentioned at the start of this article.

It will also maintain a balance between dividends and buybacks. In the first quarter, it returned $1.4 billion to shareholders. Roughly $740 million of this was spent on buybacks.

Valuation-wise, LOW trades at a blended P/E ratio of 17.9x, which is roughly a point below its normalized P/E ratio of 19.0x since 2004.

This year, EPS is expected to decline by 7% after a 5% EPS contraction last year.

Next year, EPS growth is expected to rebound to 10%, which analysts expect to be maintained in the year after that, indicating a return to “normal” after this year.

Personally, I believe that LOW has a bright future.

Investments in better services, a bigger product portfolio, and a larger Pro segment will likely continue to pay off handsomely for many years to come.

The problem is the macroeconomic environment, which continues to hurt the consumer.

Unless rates come down quickly, I do not expect that the company will be able to report the currently expected growth rebound after 2024.

Yet, I remain bullish, as LOW is not overvalued and is a good long-term stock with a focus on shareholder distributions.

As I own Home Depot, I apply a strategy of buying more shares on stock price weakness.

While I do not expect to see a sudden stock price upswing (the macroeconomic headwinds are just too severe), I’m happy to use potential stock price weakness to expand my favorite investments.

Takeaway

Despite current economic headwinds, such as rising consumer debt and higher interest rates, Lowe’s continues to adapt and find opportunities, mainly in its Pro segment and online sales.

While short-term challenges persist, the company’s long-term outlook remains promising due to its strategic investments and market position.

For investors, keeping an eye on Lowe’s during market downturns could be a smart move, allowing for potential long-term gains once economic conditions improve.

To use Jim Cramer’s words: “Own it, don’t trade it.”

Pros & Cons

Pros:

- Aggressive Buybacks: Lowe’s has repurchased 42% of its outstanding shares in the past decade, boosting the per-share value of its business.

- Dividend King: With 60 consecutive years of dividend hikes and a low payout ratio, it’s a fantastic dividend growth stock.

- Outperformance: The stock has consistently outperformed the S&P 500, delivering a 502% return over the past ten years.

- Strategic Initiatives: Strong growth in the Pro segment and online sales, in addition to innovative partnerships, provide fertile ground for future gains.

Cons:

- Economic Headwinds: Rising consumer debt and higher rates are squeezing consumer spending.

- Poor Sales: Recent numbers show a 4.1% drop in comparable store sales, reflecting the aforementioned market challenges.

- Competition: While the Pro segment is highly fragmented, the company is increasingly competing with giants like Home Depot and new emerging players looking to capture growth in an increasingly promising segment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.