Summary:

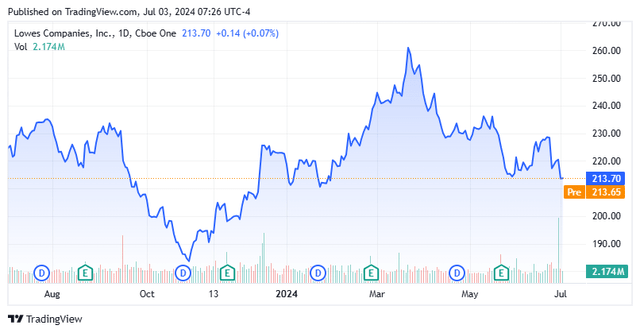

- Lowe’s stock has dropped 15% from recent highs, as same-store sales are dropping due to a punk housing market.

- Q1 results beat tepid expectations; the company also reaffirmed full-year guidance and boosted its dividend payout by five percent.

- Is it time to accumulate the shares after the recent drop, or could the stock drop further? An analysis of Lowe’s follows in the paragraphs below.

JHVEPhoto/iStock Editorial via Getty Images

Today, we put home goods and improvement retailer Lowe’s Companies, Inc. (NYSE:LOW) in the spotlight. The shares have moved down some 15% from their recent highs in late March and are priced at a slight discount to the overall market based on S&P 500 forward earnings. Is it time to buy the dip in the shares, or could more downside be ahead? An analysis follows below.

Lowe’s has more than 1,700 home improvement stores in the United States and some other operations in Canada and the United States. It is the second-largest competitor in the space behind giant The Home Depot, Inc. (HD). Currently, the stock trades for around $213.00 a share and sports an approximate market capitalization of $121 billion. It appears the company’s fiscal year begins on February 1st.

Recent Results:

Lowe’s posted its Q1 numbers on May 21st. The company delivered non-GAAP earnings of $3.67 a share, just over 70 cents a share over expectations. Revenues did decline just over four percent on a year-over-year basis to $21.4 billion, which was $300 million north of the consensus. Basically, the company stepped over a very low bar.

Management reaffirmed FY2025 sales guidance of $84 billion to $85 billion same-store sales are expected to decline two to three percent from FY2024 before inflation is taken into consideration. Leadership also boosted its quarterly dividend payout by five percent.

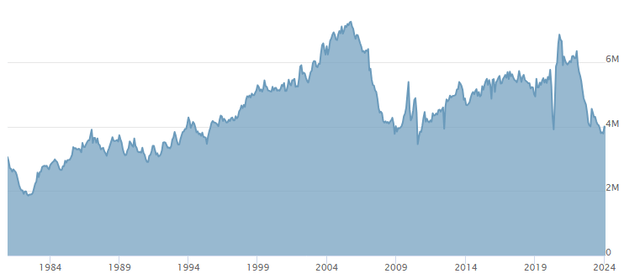

U.S. Existing Home Sales (Mortgage News Daily)

It is easier to understand the sales decline at Lowe’s factoring in the impacts on mortgage rates more than doubling since the Federal Reserve started to tighten monetary policy in March of 2022. Existing home sales fell to their lowest levels since 1995 in 2023. They are also only expected to marginally recover through 2025.

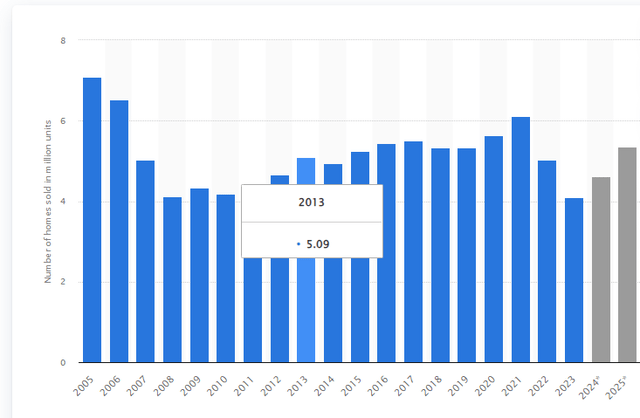

U.S. Existing Home Sales (Statista)

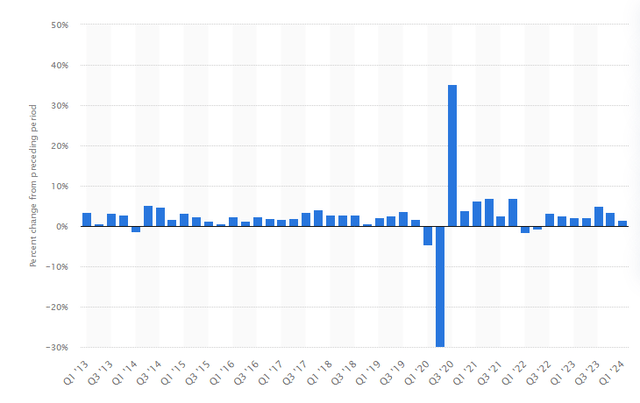

Same-store sales for the quarter declined by 4.1% from 1Q2024, which was better than the 5.6% pullback expected. Gross margins fell half a percent to 33.2%. Management expects adjusted EPS of $12.00 to $12.30 a share for FY2025.

Analyst Commentary & Balance Sheet:

The analyst community is very split on Lowe’s near-term prospects. Since first quarter results hit the wires, nine analyst firms, including Wedbush, Stifel Nicolaus, and Citigroup have maintained/assigned Hold ratings on the stock. The same number of analyst firms, including Jefferies and Bank of America, have reissued/assigned Buy ratings on the equity. Price targets proffered by the optimistic part of the analyst complex range from $264 to $290 a share.

According to the 10-Q filed for 1Q2024, Lowe’s ended the quarter with just over $3.2 billion of cash and marketable securities on its balance against just over $34.6 billion in long-term debt. The company recorded a net interest expense of $352 million in Q1. The company bought back $743 million worth of stock in the first quarter.

One company insider sold just over $8 million in stock early in March, which represented a good chunk of his holdings. He disposed of the equity at an average of just over $240.00 a share. It was the first insider activity in the stock since last September. There have been no insider transactions in the shares since.

Conclusion:

Lowe’s made $13.10 a share in FY2024 on sales of nearly $86.4 billion. The current analyst consensus has profits slipping to $12.21 a share in FY2025 as sales fall by two percent in the current fiscal year. They project earnings to rebound to $13.45 a share in FY2026 on three to four percent revenue growth.

Lowe’s is a fine company. However, profits in FY2026 are projected to be up only slightly from what the retailer made in FY2024. The stock trades at 18 times forward earnings and sports a dividend yield of just over two percent. While that is a slight discount to the overall forward P/E on the S&P 500 of nearly 22, it is hardly compelling.

This is especially true as the housing sector is likely to remain punk until average 30-year mortgages fall substantially. Lowe’s is hardly the only name in this space experiencing these headwinds. Home Depot noted the consumer is pushing back big-ticket purchases when they reported first quarter results as well. Management at Lowes had the same theme in its commentary on its first quarter results.

LOW is cheaper than HD which trades at 22.5 times forward earnings. However, Home Depot is expected to have slight growth in EPS and sales this year. Personally, I think Lowe’s would be better served paying down its debt load rather than buying back stock at these valuations.

The stock would seem to be fairly valued in an economic scenario where U.S. GDP growth was expected to be at least two to three percent in FY2024. However, that seems unlikely right now. GDP growth cooled to just 1.4% in the first quarter of this year from the 4.9% rise in the fourth quarter and the 3.4% increase in the fourth quarter of last year.

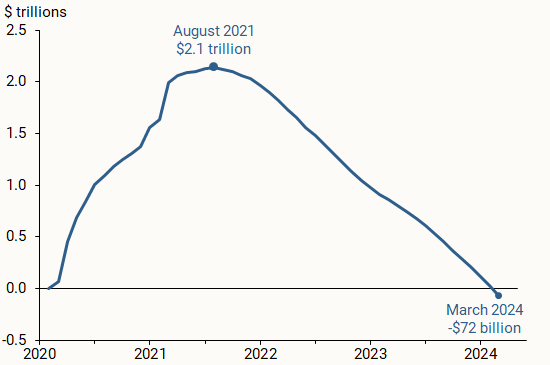

U.S. excess personal savings (Bureau of Economic Analysis)

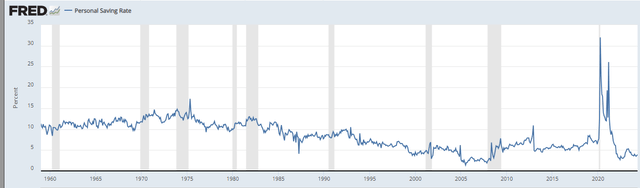

In addition to the tepid housing sector backdrop, consumers are increasingly tapped as all the excess savings from various Covid stimulus programs have not been spent. Credit card debt is at all-time highs, and the unemployment rate has ticked up recently to four percent from 3.5% earlier this year. Last week the stocks of Walgreens Boots Alliance, Inc. (WBA), NIKE, Inc. (NKE), and Levi Strauss & Co. (LEVI) all got shellacked due to worsening consumer demand. With U.S. personal savings near historical lows and half their pre-pandemic levels, it is not surprising consumer demand seems to be tapering off at an accelerated rate.

U.S. Personal Savings Rate (Federal Reserve Bank of St. Louis)

Given those consumer and housing sector headwinds, it is hard to find a compelling reason to own LOW here. Little to no revenue or earnings growth for a stock trading at 18 times forward earnings with a small dividend yield? This is when one can get over 5.3% in short-term and risk-free treasuries. Talk about a lack of ‘risk premium’. Therefore, further downside seems ahead for Lowe’s, especially if economic growth continues to slow.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: I present an update of my best small and mid-cap stock ideas that insiders are buying only to subscribers of my exclusive marketplace, The Insiders Forum. Our model portfolio has more than doubled the return of its benchmark, the Russell 2000, since its launch. To join our community and gain access to our market beating returns, just click on our logo below.