Summary:

- Lowe’s stock is trading near its 52-week high, but the high multiples and recent negative news make it a risky investment now.

- Despite a strong cash position, Lowe’s has significant debt and liabilities, leading to a negative price/book ratio.

- Q2 results showed a 5.1% same-store sales decline, raising concerns about the company’s ability to adapt in a competitive market.

- While Lowe’s offers a 1.77% dividend yield, it’s below the sector median, and the priority should be paying down long-term debt.

jetcityimage/iStock Editorial via Getty Images

I???ll admit it, I???m not a handy person for repairs around the house. Earlier this year, I needed to have my entry door replaced, and I went to a contracted service through Lowe???s Companies (NYSE: LOW), which had a third party come and install it. It went great, and they got it done a lot faster than I would???ve thought possible.

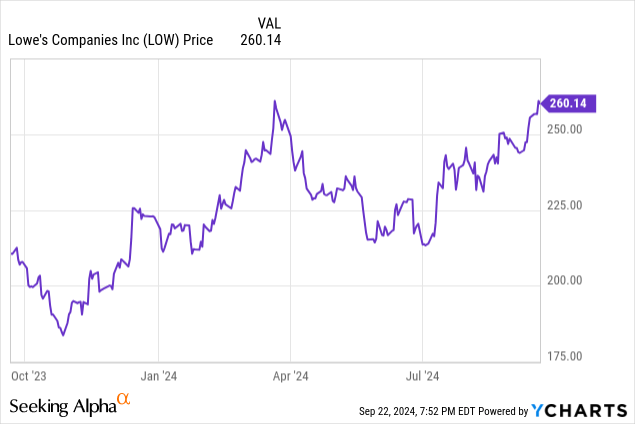

Today, I want to look at Lowe???s, which is trading near the top of its 52-week range. Is this a justified price to pay, or has the stock gotten ahead of itself in the competitive market of home improvement superstores?

Wells Fargo just last week said that they expect to see a continued rally in home improvement stocks, expressing hope that there will be a clearer outlook from the Federal Reserve.

Consolidated Balance Sheet

|

Cash and Equivalents |

$4.4 billion |

|

Inventory |

$17 billion |

|

Total Current Assets |

$22 billion |

|

Total Assets |

$45 billion |

|

Total Current Liabilities |

$18 billion |

|

Long Term Debt |

$34.6 billion |

|

Total Liabilities |

$58.7 billion |

|

Total Shareholder Equity |

($13.7 billion) |

(source: most recent 10-Q from SEC)

Lowe???s has a fairly strong cash position, better than it has reported in recent quarters. That???s a good sign, as the company is facing ongoing changes in the retail environment in which they engage.

That???s about where the good news ends, however, as Lowe???s has a fairly large amount of debt on the books, and more liabilities than assets. That means that with the sector median price/book value of 2.19, investors in Lowe???s are being asked to accept a negative price/book ratio.

Which isn???t to say that negative price/book companies are never okay, but Lowe???s is going to have to show some impressive reason why we would be paying such an amount for the company.

Q2 Results

The second quarter seems like it was really a wake up call that all things are not going perfectly at Lowe???s. They had mixed results in the earnings, seeing a same-store sales decrease of 5.1%. They also lowered full-year guidance.

Lowe???s was still pretty profitable, and it is noteworthy that the stock continued to perform strongly after these results came out. Clearly investors are seeing something above and beyond what may well be a one-off disappointment.

The Risks

As mentioned before, Lowe???s is engaged in a rapidly evolving retail environment, and they need to be able to adapt the business to changing consumer expectations.

The large home improvement retail sector has plenty of competition, and those companies would be more than willing to take some of Lowe???s market share if the opportunity presents itself.

The reason people go to Lowe???s is because the company offers a high level of product and service quality. They will need to maintain not only that level, but that perception, if they want to maintain a strong position in the marketplace.

Lowe???s is reliant on a number of vendors to stock products in its stores, and keeping those vendors in a good relationship is essential to avoid problems.

Finally, while inflation seems to be moderating, commodity prices could effect the demand and sales of potential problems. That is a constant risk, as there is no guarantee that Lowe???s will be able to pass on increased cost to consumers.

Statement of Operations

|

2022 |

2023 |

2024 |

2025 (1H) |

|

|

Net Sales |

$96 billion |

$97 billion |

$86 billion |

$45 billion |

|

Gross Profit |

$32 billion |

$32 billion |

$29 billion |

$15 billion |

|

Gross Margin |

33.3% |

33.0% |

33.7% |

33.3% |

|

Operating Income |

$12 billion |

$10 billion |

$11.5 billion |

$6 billion |

|

Net Earnings |

$8.4 billion |

$6.4 billion |

$7.7 billion |

$4.1 billion |

|

Diluted EPS |

$12.04 |

$10.17 |

$13.20 |

$7.23 |

(source: most recent 10-K and 10-Q from SEC)

Lowe???s has seen a pretty predictable profitability and a consistent gross margin in recent years. That???s a good sign for the company???s stability, and shows that the business, if not growing rapidly, is at least in a solid position.

Estimates are that this will roughly continue going forward. The expectation for this fiscal year is $82.9 billion in revenue and earnings per share of $11.82. Next year the hope is for revenue to grow to $85.0 billion and earnings up to $12.78.

At current prices, that would mean a P/E ratio of 22.02, and a forward P/E ratio of 20.36. In both cases, this is somewhat above the sector median, which is 18.70. Once again, the current stock price seems to be a substantial premium to what the sector generally commands.

As far as returning value to investors, Lowe???s does pay a dividend of $1.15 per quarter. That???s a 1.77% yield, which isn???t bad at all, but once again is worse than the sector median, which is a yield of 2.21%.

The company has a potential of increasing the dividend from its current yield, though likely the more pressing priority is paying down the long-term debt. That???s not to say that they can???t do both, and if they do they have the potential of being a good income stock.

Conclusion

I like Lowe???s services, and I like their stores as a retail player. They seem like they should do well going forward. That said, I cannot recommend investing new money into the company at current prices. It???s just too close to the 52-week high, and there is no obvious catalyst justifying the high multiples we???re being asked to pay. It’s a hold at these prices.

For investors who are playing the Lowe???s game, I would recommend keeping a close eye on the company???s same store sales, as the 5.1% decline in the last quarter is the most worrying trend right now, and if that continues they could have a serious problem on their hands.

Right now, I just feel like the market has not priced in all the negative news of the last couple of months, and this is not a desirable entry level for the company, even if in the long run they will likely do respectably.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.