Summary:

- Lowe’s has a strong track record of shareholder remuneration through business expansion, dividends, and stock repurchases.

- Despite possessing moats and attractive fundamental indicators, Lowe’s faces challenges with projected timid growth, reasonable valuation, and increasing macroeconomic risks.

- The uncertain macroeconomic environment, weak growth prospects, and overvaluation make Lowe’s stock unattractive, leading to a sell rating due to opportunity cost.

slobo

Lowe’s (NYSE:LOW) – one of the largest home improvement companies in the world – has a consistent track record of remunerating its shareholders well through business expansion, dividend distributions, and stock repurchases.

Possessing moats – such as a large scale that guarantees market power, an extensive distribution network, and better supplier relationships – the company delivers some attractive fundamental indicators, such as an ROIC of almost 27% and a solid cash generation that allows for a shareholder yield of 5.45%. Even so, I don’t see it as enough to sustain a buy at the current prices, given the projected timid growth, only reasonable valuation, and increasing risks related to the macroeconomic scenario.

Lowe’s: Timid Growth With Uncertainty Ahead

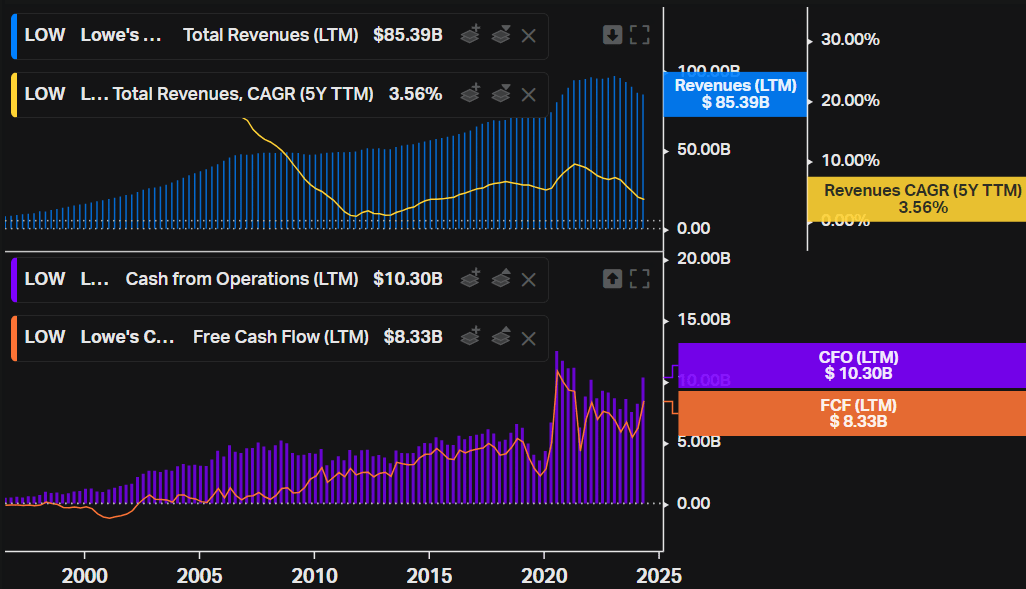

Looking at a long period of operation, the company was able to expand its revenue at an accelerated rate, especially pre-2008, where the CAGR (5y TTM) exceeded 10%. This growth was repeated in 2020, with a good part of the revenue converted into both cash flow generated by operations and free cash flow. The problem is that since mid-2021 this revenue has been stagnating/retracting, with the CAGR going to something close to 3.5% over the last 5 years, along with these two cash flow metrics that peaked in the quarter ending July 2020.

Koyfin

In 2023, this revenue was $86.38bn, while the company’s guidance for the full year 2024 is for total sales of between $84 and $85bn, i.e. even if the company reaches the top of the guidance or even surprises with a little above, management still expects there to be a retraction compared to 2023. This is in line with the outlook that comparable sales should fall between -2% and -3%, and diluted EPS should come in between $12 and $12.3. This shows that management expects not only Q1 to have been weak, but that the whole of 2024 will be affected by what they called a “challenging home improvement environment”, with uncertainties around inflation, interest rates, and consumer preferences.

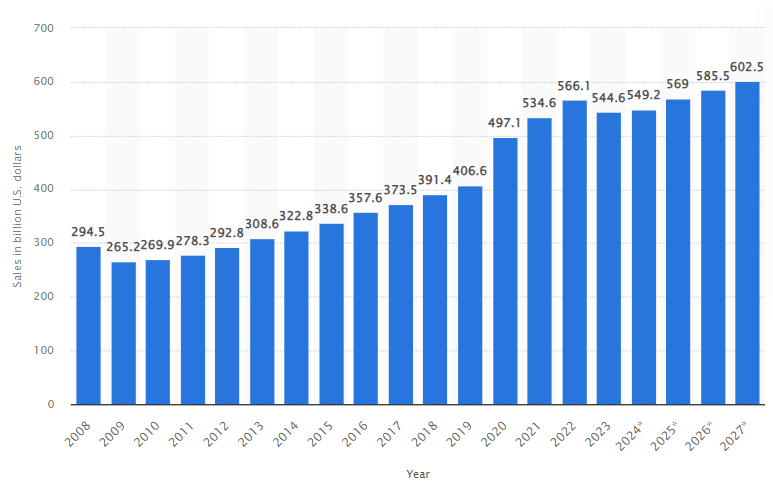

The main problem is that even if we take macroeconomic pressures out of the equation, Lowe’s growth is unlikely to pick up aggressively. For FY 2024, analysts expect revenue in line with the guidance, at $84.5bn, while for FY 2025 there is greater optimism with something close to $87.3bn and returning to the $90.3bn level only in 2026. If we consider this to be true, the average growth in revenue over the next 3 years will be 1.7%. According to Statista, only in 2025 will the market size exceed the level of 2022, until it reaches something close to $600bn in 2027, note that even in 2026 and 2027 where it is possible to see a greater recovery of this market, growth is only 2.9% per year.

Home improvement market size in the United States from 2008 to 2027 (Statista)

Eventually, the company can expand its margins and cash generation in a better environment and with better efficiencies, but even so, it is very difficult to envision a scenario where EBITDA and the like grow above a mid-single digit. One of the strategies that the company can carry out is to continue with the buybacks so that EPS grows above net income.

On the positive side, Lowe’s highlighted in Q1 some strategies that help it to circumvent the more challenging environment, such as a new DIY loyalty program “My Lowe’s Rewards” and expansion in same-day delivery. In Q1, the company achieved a market share of 7%, compared to 6.7% in Q4 2023, while important competitors such as Costco (COST) and Home Depot (HD) lost market share in the same period. Among the drivers for market share expansion, Lowe’s is betting on the online business, expanding installation services, elevating assortment, and driving Pro penetration.

Despite this, Lowe’s business has a very cyclical nature, which translates into uncertainty for operations and consequently for shareholders. If we analyze both the growth in market size and Lowe’s revenue in the two figures above, we can see that in the period from 2008 to around 2013 the performance of this segment stalled.

The (Macroeconomic) Risks Are Increasing

The US economy has proved to be resilient over the last years, with a buoyant demand and job market, even with high interest rates. On the other hand, some sectors are more sensitive to these changes in the macroeconomic scenario. Lowe’s is one of those that feels this impact the most.

Just by being linked to the construction segment, demand for the company’s products is already affected, but this is further catalyzed by other factors, such as the population’s disposable income, unemployment, and even consumer preference. As mentioned in the last earnings call, the consumer has shown a greater preference for discretionary services, and experiences ended up affecting home improvement demand.

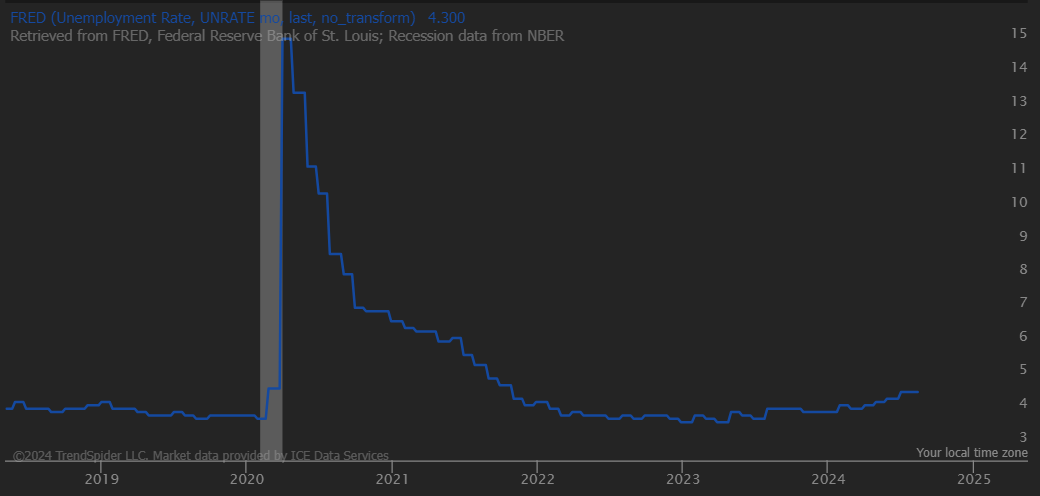

Recently, the unemployment rate reached 4.3%, a level that is not historically high, but which has already raised a certain fear among economic agents and has surprised negatively. Not only that, but the latest indicator was that nonfarm payrolls grew by 114 thousand, while the expectation was over 170 thousand. With higher unemployment, the goods and services sold by Lowe’s are directly affected, causing some of these consumers to postpone the purchase or opt for a cheaper alternative, which could also cause competition to increase and some level of reduction in the average ticket.

TrendSpider

Combining these two employment indicators with the impact of the interest rate increase in Japan, the fear that a recession could materialize increased even more. The term “recession” appeared much more frequently in Google searches, along with economic newspapers and investment banks addressing the topic and betting on greater probability.

This topic has already been discussed since the Fed raised interest rates to a more restrictive level, but the US economy proved to be firm even in this scenario, causing many economists to miss this prediction. Therefore, the main point of this section is not to try to project a recession but to emphasize that in a scenario of greater economic turbulence, Lowe’s shareholders will be harmed.

Lowe’s Valuation Is Not Attractive

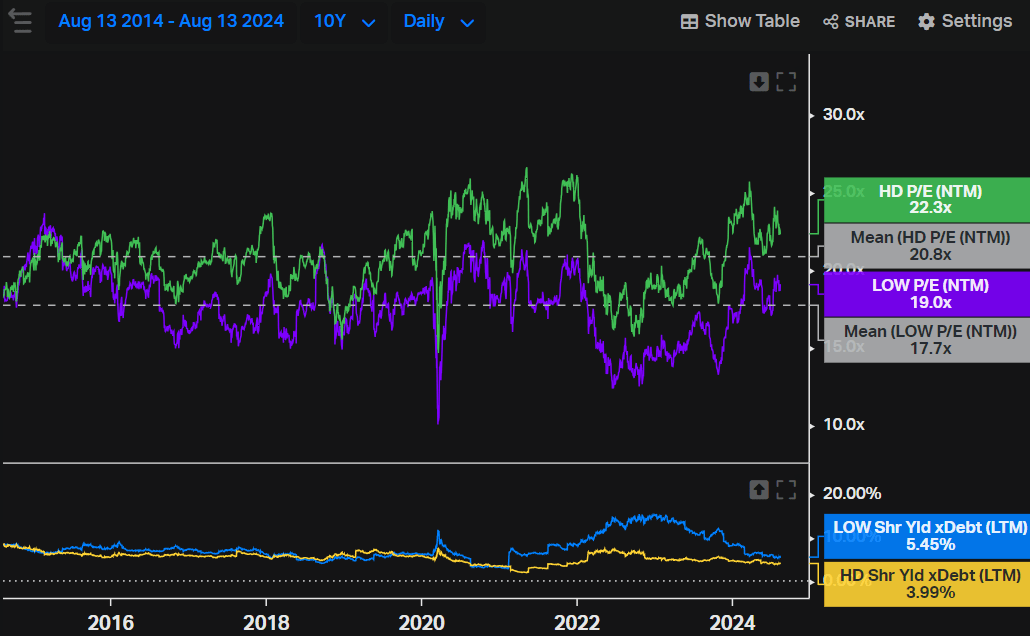

One of the points that can be made in defense of LOW Stocks’ valuation is that its multiples are lower than those of its competitor Home Depot, and that eventually this gap can be closed. I don’t see this as likely in the short and medium term, especially given that this gap is historical and not momentary. While Lowe’s forward price-to-earnings average over the last 10 years is 17.7x, HD’s is 20.8x. The shareholder yield also reflects this, with Lowe’s stocks remunerating at a better level.

Koyfin

In my view, the worst thing is that even with weak growth prospects for the next 3 years and a macroeconomic environment that will be challenging, to say the least, both are still trading at multiples above the historical average. 19x earnings isn’t a high multiple for a large company with moats and a good track record of shareholder remuneration, but it’s also not attractive considering all the obstacles.

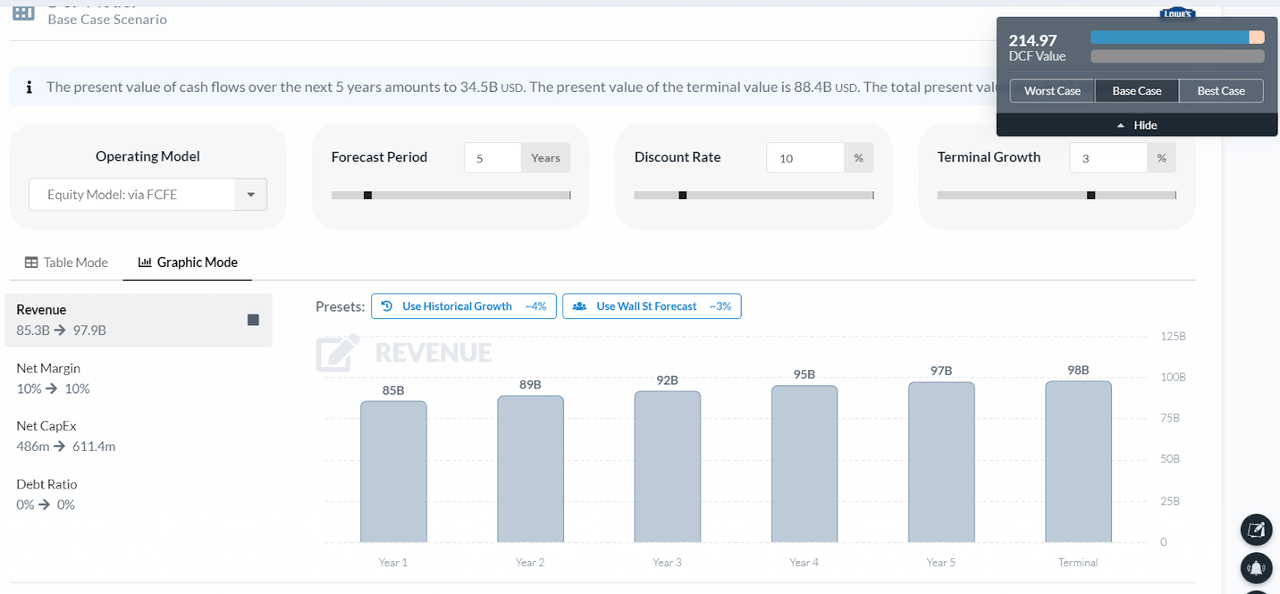

Using Wall Street’s forecast for revenue and net margin over the next few years to project cash flow, and bringing this cash flow to present value considering a discount rate of 10% (seeking an average performance with the market) and a terminal growth of 3% (in line with inflation), it is possible to find a fair price of $214.97 for LOW Stocks, i.e. an overvaluation of 9%.

In this base case, the conservative assumptions may even come close to remunerating the shareholder at a healthy level, considering that some positive surprises may occur, be it a more robust growth in revenue, net margin, or a very conservative terminal growth. But this is enough to demonstrate that the margin of safety in the current case is close to zero. In this thesis, the investor incorporates a greater risk in order to perform something close to the market, which in stock picking makes no sense.

Opportunity Cost Makes it a Sell Rating

In view of the first sections, even with a multiple of 19x, my rating for Lowe’s stocks would be “hold”, given their financial strength and good shareholder remuneration even in a troubled environment. On the other hand, we must incorporate opportunity cost into the equation.

Thinking of an investor who already owns Lowe’s, the company is withdrawing a portion that could be allocated to other opportunities in the market, and currently, there seem to me to be options that combine a better relationship between risk and return.

Mentioning a few alternatives, for those investors who still want some exposure to the retail segment, Amazon (AMZN) after the dip looks more interesting and is even more resilient to crises. As for dividends, some REITs like Realty Income (O) or VICI Properties (VICI) can also fulfill this role and combine a higher dividend yield with more predictable growth. Not to mention the options available via ETFs (whether growth or dividend), which can limit this risk.

Therefore, assuming that some more viable options deliver a higher, more predictable return with less risk than Lowe’s, my rating is a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.