Summary:

- Roku’s aggressive growth in platform sales is being offset by negative gross margins for their device sales, leading to widening losses and potentially slower top-line growth.

- The company is struggling with slowing ad growth and platform sales due to inflation and recessionary pressures, and viewership of the Roku Channel remains a concern.

- Roku is quickly burning through cash and may require selling additional shares to the open market next year if operations don’t turn around.

Justin Sullivan

Roku (NASDAQ:ROKU) is in a critical position in building their business away from growth at all costs to managing for longevity. As they continue to grow their market share for TVs sold to a whopping 43%, Roku continues to operate at a widening loss. Despite having $1.6b in cash on their balance sheet, their burn rate continues to flow as their cash position shrank by -$331mm, or -17% sequentially to cover operations. Despite their aggressive growth in platform sales, management is still contending with negative gross margins for their device sales, which may continue to worsen as they move into developing their own branded TVs and get into smart home security. With slowing ad growth and platform sales due to inflation and recessionary pressures, Roku will be navigating challenging waters throughout the next year or so. One of the biggest red flags, which have been continuously raised throughout the years, is the viewership of the Roku Channel, which is Roku’s free to watch, ad-supported channel that ads are promoted through. Despite this ambiguity, other operating challenges are beginning to show cracks, which will result in wider bottom-line losses and potentially slower topline growth. With this in mind, I give Roku a sell recommendation with a price target of $28.33/share for a market cap of $4b, a -61% pullback from today’s price.

Financial Performance

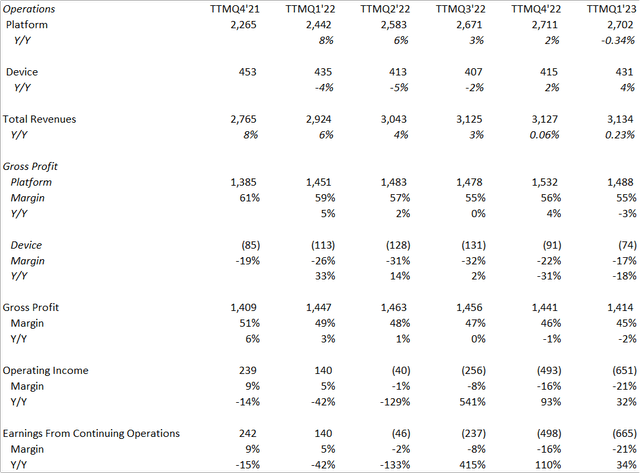

It appears that Roku’s financial position is feeling the pressures of the economic shift and inflation. Both top and bottom-line growth have stagnated and compressed. Total revenue grew a staggering 23bps Y/Y on a TTM basis for q1’23 with net margin taking a nosedive to -21% for the same period. Despite the stagnant topline growth, or even their previous quarters’ 2-6% growth, Roku’s net loss appears to continue to widen.

10-Q Financials

What I find most interesting is the 17% draw from their cash reserves on their balance sheet to cover operational costs. This last quarter alone cost Roku an additional $332mm just to operate. Stock-based compensation expense appears to be one of Roku’s biggest hindrances to becoming profitable, eating away at nearly 25% of gross profits, or 12% of total revenue. Management hinted at positive adjusted EBITDA for 2024; however, controlling for stock comp expense, Roku still experienced an operating loss of $171mm, or aEBITDA of -$84mm for FY22. With this in consideration, stock comp also grew by nearly 40% for q1’23 and will potentially further dig Roku into a profitability hole going forward. Now, despite stock comp expense being removed to compute adjusted EBITDA, I don’t believe this metric will necessarily be an indicator of profitability and definitely won’t be a good metric as an external shareholder whose shares will continue to be diluted as stock compensation grows or as more shares are issued to support the company’s operations.

The ultimate challenge Roku faces is the ability to continue growing their advertisement sales in a downcycle. According to Statista data, media advertising spend for CY23 is expected to grow at a 6% rate from CY22 figures. With the assumption that Roku’s platform revenue can grow at that same rate, which considering their previous quarters’ growth of sub-6%, and assuming all margin metric hold from FY22, Roku will still perform at an operating loss of -$453mm, holding all else equal.

The most challenging bridge to cross is the lack of profitability on their devices. Though this is the necessary evil to land and expand their money-making platform, selling devices at a deeper gross loss will only make achieving profitability that much more challenging for Roku. TVs aren’t necessarily the kind of durable goods that appreciates in value over time; in fact, like many other tech products, it’s a race to the bottom, which Roku has made perfectly clear on their 10-k and earnings calls. Given that Roku has taken the initiative to design their own proprietary TV, this factor may only become more challenging to the state of operations.

Valuation

Roku’s value has come down to earth in recent years from a whopping $65b (20x sales) valuation to a more reasonable $10b (3.26x sales). Though shares are trading significantly low on a historical basis, I do believe the current economic environment deems a more modest valuation. Considering the operating challenges Roku faces in terms of topline growth and worsening bottom-line margins, 2.5x sales or lower might be a more realistic valuation.

SeekingAlpha

SeekingAlpha valuation comps provides a 1.22x sales multiple for Roku’s selected industry, which may be the median Roku’s shares deviate towards. In either case, the price target will either be $58.04/share (2.5x) or $28.33 (1.22x).

Lastly, on a technical basis, Roku may be poised for one more wave down before seeing any turnaround in future stock pricing. Though I would never claim to be a market technician, wave theory appears to be in line with my valuation expectations in which Roku’s performance has more room for a continued downcycle. Unless there’s a massive earnings surprise, I believe this direction supports the fundamentals. To conclude, I give Roku a sell recommendation with a price target of $28.33/share.

TradingView

Taking A Position

For those looking to follow this short recommendation, I highly recommend doing your own research and due diligence prior to executing any trades. Shorting stocks have unlimited downside risk and given the level of volatility of Roku shares, a trade can go sideways fast. Purchasing put options to fulfil a short position would be a “safer” way to execute a short position in which your risk is limited to the purchase price of the option. Selling calls offers similar risks to a short position in which there is unlimited downside risk. The borrowing cost for Roku shares currently sits at 25bps, according to Atom Finance. Given that Roku’s earnings release is right around the corner, I currently own the August 4 puts with a strike price of $72. The purpose of these short-dated options is to play the pre-earnings volatility. My trading recommendation after you do your due diligence is to purchase puts going into earnings and sell a portion of your holdings pre-earnings to take advantage of the pre-release volatility. Given that the stock can go in either direction, this will mitigate some downside exposure. For long-dated options, holding puts with my recommended upper price target in mind will allow for some breathing room pre/post-earnings. If your experience in trading is limited, please reach out to a professional advisor for execution and further consultation for this trade.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.