Summary:

- Lucid’s recent equity offering has added pressure on its shares’ performance, accentuating risks to the lack of clarity over its longer-term capital structure.

- Although its ongoing cost-savings initiatives are a plus, the real impact will come from ramping-up production and delivery volumes, which now faces growing demand risks.

- Its valuation premium to peers also lacks fundamental durability, likely subjecting the stock to further volatility ahead.

jetcityimage/iStock Editorial via Getty Images

It has been a roller coaster ride for the Lucid stock (NASDAQ:LCID) this year. After its valuation plummeted last year following the onset of monetary policy tightening, which punished growth stocks most, alongside an industry-wide supply chain disruption that restricted Lucid’s ability to ramp up productions, the stock regained some ground earlier this year on the coat-tails of a broader market rally. Yet, the momentum was short-lived, as the company faced emerging demand risks – which management had alluded earlier in the year to lacking customer awareness of the brand as well as evolving dynamics in market conditions.

And from the market’s perspective, Lucid’s unprofitable, yet capital-intensive, business amid the elevated borrowing cost environment is also dulling the appeal of its growth prospects. This is further corroborated by pressure observed on the stock’s recent performance after the company announced an incremental equity offering within the past month. Despite Lucid’s ongoing efforts in optimizing its cost profile, and improving its brand awareness as means to drive greater durability in sales growth, there are likely limited catalysts within the near term – especially considering uncertain market conditions ahead – with increasing execution risks pertaining to the underlying business’ longer-term growth initiatives, spanning Gravity SUV start of production and international footprint expansion. The combination of Lucid’s uncertain longer-term capital structure, fundamental challenges in ramping up output volumes and sales, and valuation premium still at current levels underscores risks that remain skewed to the downside for the stock, in tandem with anticipated broader market volatility ahead.

Uncertain Longer-Term Capital Structure

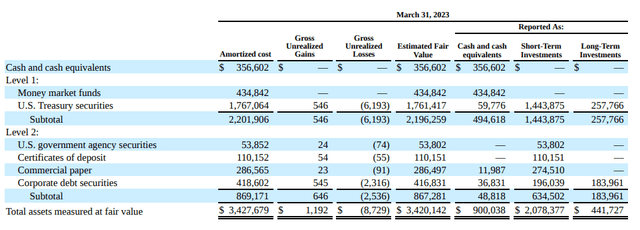

The capital-intensive nature of Lucid’s business, alongside still being unprofitable, remains an overhang on its valuation prospects, especially amid the currently uncertain market climate blighted by rising borrowing costs. According to management’s commentary during the first quarter earnings call, Lucid ended the period with $3.4 billion in cash and cash equivalents, as well as other sources of funding that would bring its liquidity up to approximately $4 billion:

Now moving to the balance sheet. We ended the quarter with just over $3.4 billion in cash, cash equivalents and investments with total liquidity of approximately $4.1 billion

Specifically, the company ended with about $900 million in cash and cash equivalents on its balance sheet, as well as close to $2.5 billion in short- and long-term investments currently classified as available for sale securities as of March 31st, which alongside its existing credit facilities provides total liquidity of about $4 billion.

Recall that Lucid has a long demonstrated its ability in maintaining a healthy pipeline of funding sources, including $1.75 billion in proceeds from a green convertible bond offering at 1.25% in late 2021, $1.5 billion from an at-the-market private placement in late 2022, a $1 billion asset-based revolving credit facility, and other working capital facilities and funding from the Kingdom of Saudi Arabia. While some of the related proceeds have been invested into ongoing growth initiatives, as well as other general corporate purposes, management had cited during the first quarter earnings call that Lucid’s total liquidity of approximately $4 billion as of March 31 was sufficient to sustain operations through the second quarter of 2024. This implies further capital raising efforts within the foreseeable future to support its longer-term growth initiatives – including the launch and SOP of the Gravity SUV later next year. Despite weak market conditions, Lucid had followed up with a $3 billion equity offering earlier this month, which pushed prices on its shares lower. Specifically, the company issued a public offering of 173,544,948 shares at $6.91 apiece for gross proceeds of $1.2 billion, as well as a private placement to Ayar Third Investment Company – an affiliate of the Saudi Arabia Public Investment Fund, its largest shareholder – of 265,693,703 shares at $6.77 apiece for gross proceeds of $1.8 billion.

Taken together, Lucid’s liquidity profile has been boosted to about $7 billion. Based on its quarterly cash run-rate in the first three months of the year, inclusive of $801 million net cash used in operating activities and $242 million capex, and management’s guide for full year 2023 capex at $1.5 billion at the mid-point, its current liquidity profile will likely last through 2024 and support the SOP of its Gravity SUV. But given its core vehicle sales business remain long ways from being self-sufficient, we expect further longer-term uncertainty to Lucid’s capital structure, which would remain a significant overhang on the stock’s prospects. At a time when investors crave profitable growth and a strong balance sheet, the lack of clarity over Lucid’s longer-term capital structure, as it continues to struggle with ramping up its early-stage growth aspirations, will likely further amplify downside risks to the stock.

Cost Optimization Efforts Have Yet to Make a Dent in Narrowing Losses

Admittedly, auto manufacturing is a cost-intensive business for even well-funded incumbents – hence, the surge in loss-making EV programs amid legacy automakers’ transition to electric – let alone for vertically integrated, greenfield start-ups like Lucid. While the company’s best-in-class vehicle design and battery technology have enabled differentiation through its flagship Air sedan’s record range per charge, ramping up productions remain a bottleneck that is still precluding it from reaching economies of scale. Meanwhile, coming off of unprecedented supply constraints in the past year that has roiled the broader auto industry – specifically start-ups like Lucid with little negotiating power with suppliers – is followed by looming demand risks due to deteriorating macroeconomic conditions. And related concerns are already getting picked up by the Wall Street community, as corroborated by Guggenheim analyst Ron Jewsikow’s inquiry on how management aims to address demand headwinds facing the luxury EV segment, as well as rising competition, during the first quarter earnings call:

Ron Jewsikow

Good evening, and thanks for taking my question. Peter, just wanted to get your thoughts on kind of competitive dynamics in the market right now. From our vantage point, it feels like a pretty challenging market for luxury electric vehicles, but wanted to get your view on if price cuts from your — one of your large domestic competitors on their luxury line of vehicles is having any impact on demand for used vehicles?

Peter Rawlinson

Well, I think what you’re referring to is perhaps a different part of the market. I believe that there is a challenge to the entire market right now because of macroeconomics and because of interest rates, which actually do affect this place of the market. We’re seeing key competitors from Germany discounting their products very heavily that’s not just the U.S. manufacturer that you may be referencing the Germans are heavily discounting their vehicles, and I think there are challenges right across the marketplace. I think what we need to do is just amplify awareness just how compelling our product is.

Source: Lucid 1Q23 Earnings Call Transcript

To address said immediate fundamental risks facing its business, Lucid has followed the footsteps of its peers across the broader industry to cut costs and focus on improve profit margins, while also prioritizing “growth and brand awareness” to drive realization of sales on its P&L.

Cost Optimization

On the cost optimization front, Lucid has reduced its workforce by about 18% earlier this year, which resulted in a one-time restructuring charge of $22.5 million during the first quarter. The company is expecting another one-time restructuring charge of $2 million in the current quarter attributable to the “final part” of its talent optimization efforts. Taken together, Lucid expects annualized cost savings of as much as $91 million from streamlining its workforce alone, which will have a more evident impact on its bottom line through the year as related efficiencies are already in effect and can be observed through a “lower base staff compensation” spend during the first quarter.

In addition to job cuts, Lucid has also worked to further reduce its vehicle bill of materials by negotiating new supply contracts. The new agreements stipulate improved “piece price cost” by leveraging incremental volumes on Lucid’s new vehicle programs – including the latest addition of new Air sedan variants in production, as well as its upcoming Gravity SUV (80% of related parts have been sourced). The implementation of “engineering changes”, spanning improvements to the assembly line and incorporation of “new lower cost parts”, have also enabled reductions to Lucid’s vehicle BoM, contributing further to its ongoing margin expansion efforts.

The company also sees continued reductions in freight costs following the acute post-pandemic logistics bottlenecks experienced earlier last year. In addition to efficiencies realized by bringing the logistics function in-house, Lucid has also transitioned from “air transit to sea” for international freight late last year. Paired with newly negotiated freight contracts during the first quarter, Lucid expects to realize cost savings of 2x to 3x on logistics going forward, which will “start to show up more in Q2 and Q3”.

However, the aforementioned cost optimization efforts will likely be partially offset by ongoing LCNRV impairment charges on inventory, as well as firm purchase commitment write-offs within the foreseeable future. According to management’s commentary during the first quarter earnings call, the build-up of Lucid’s raw materials inventory over the past year in response to lingering supply chain uncertainties are now resulting in higher costs pertaining to storage and obsolescence, especially after recent engineering changes aimed at reducing its vehicle BoM:

Over the balance of the year, we expect a significant reduction in raw material days of inventory on hand, yet supply chain pressures eased somewhat. We obtained more predictability in the transportation channel and we refine our inventory management processes and systems… Over the past 18 months, we have held additional inventory due to concerns on part availability and logistics slowdown… However, this excess inventory has significant storage costs, reduces our ability to benefit from commodity price reductions that are now occurring and also increases risk for obsolescence in some parts expire or are updated due to engineering changes. We believe that there is significant savings as we unwind some of this excess inventory to simultaneously refine our tracking and inventory systems.

Source: Lucid 1Q23 Earnings Call Transcript

While management remains focused on transitioning its raw materials inventory into finished vehicles, and reduce the company’s “raw material days of inventory on hand”, the alleviation of related margin pressures are not expected to become meaningful until later in the year.

Demand Risks

Yet, much of Lucid’s ongoing cost optimization and margin expansion efforts will depend on its ability to both ramp up production as well as sending cars out the door to customers. Recall from earlier this year during the fourth quarter earnings call, management had already alluded to a lack of brand awareness that has been hampering its sales volumes:

Look, we’ve sold production that is not the gating issue here now. My focus is on sales. And here’s the thing. We’ve got what I only believe to be the very best product in the world. And we’ve just too few people are aware of not just the car but even the Company, and so we need to amply focus now away from production to amplifying customer awareness that we’ve got this amazing car with unprecedented range technology efficiency, incredible driving machine, a great driver’s car, just unbridled joy of ownership that we are getting feedback from owners who have experienced this. We need to amplify that message and broaden the awareness, which in turn will drive sales. And that is the focus right now. It’s not that we’re production-constrained.

Management no longer discloses order volumes growth, citing that “production and deliveries are a better representation of the progress of [Lucid’s] business”, which provides little clarity on its demand environment at the moment – specifically, some of its Air sedan variants are taking pre-orders but are not yet in production, and current delivery volumes do not reflect that pent-up potential demand. But based on observations of Lucid’s sequential delivery declines during the first quarter (4Q22 delivered 1,932 vehicles vs. 1Q23 delivered 1,406 vehicles), and management’s cautious optimism on the pace of ramp-up over the remainder of the year, a lot still hangs on progress in assembling the Air Pure variant, as well as market conditions. Specifically, based on management’s commentary during the first quarter earnings call, deliveries are expected to pick up in the current quarter, with further increase through the fourth quarter, though much still depends on the ramp-up of output volumes in the real-world drive Air Pure variant which goes into production later this year:

We’re on track to produce over 10,000 vehicles in 2023 with company-wide initiatives ongoing that will enable higher volumes as market conditions allow… For Q2, we are targeting deliveries to be up sequentially… We expect that Q3 production and delivery numbers will ultimately be determined by how fast we are able to ramp the pure buildable configuration. And as for Q4, we are expecting that to be our largest quarter of the year.

Source: Lucid 1Q23 Earnings Call Transcript

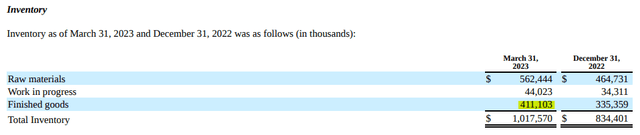

Meanwhile, finished inventory volumes continue to grow, which is consistent with ongoing production ramp-up. However, it is difficult to exclude considerations of the growing balance’s implication of looming demand risks. Considering management’s repeated acknowledgment of lower delivery volumes during the first quarter as anticipated given ongoing efforts in shoring up brand awareness, and its cautious optimism over delivery prospects through the year, Lucid likely faces risks of a weakening demand environment, which could be further exacerbated by deteriorating financial conditions and, inadvertently, consumer sentiment.

Specifically, the company finished the first quarter with more than $400 million of finished goods inventory. Based on first quarter cost of revenue of about $500 million on deliveries of about 1,400 vehicles, or about $356,000 per vehicle (excluding cost considerations attributable to non-core software and other service sales), Lucid’s finished goods inventory as of March 31 totaling $411 million implies more than 1,150 units available for sale. Admittedly, the number could be even lower, considering potential for finished vehicles produced at a higher cost in prior quarters as output continues to ramp towards economies of scale on a forward going basis.

While management has alluded to the implied finished goods inventory balance based on units to be inclusive of “test fleet vehicles, loaner vehicles, [and] showroom cars” not yet available but ultimately will be available for sale, the situation implies Lucid no longer experiences a supply-constrained environment. This accentuates the company’s urgency in furthering its brand awareness to drive sales growth, in line with management’s strategic prioritization over the initiative this year – which was mentioned more than ten times during the first quarter earnings call, with CEO Peter Rawlinson accentuating that the Lucid Air is much more affordable than media preaches during the conference:

And also as we amplify brand awareness. And also I come back to this misconception which seems to be out there. But yes, people believe it’s a $200,000 car Actually, the entry level price is $87,400. It’s probably conceivable that people think of it as a $300,000 car dollar count because it’s so amazing, but actually, it’s much more attainable, and we need to spread that word as well.

Source: Lucid 1Q23 Earnings Call Transcript

But even at a starting price of $87,400 for the entry level trim Air Pure, Lucid’s flagship offering effectively prices out the majority of prospective car buyers in its core American EV market based on recent market research reported by Bloomberg News:

To afford an EV, though, consumers need to be pretty well off. About one-third of American households make more than $100,000 a year and about 15% make between that and $150,000, according to IBISWorld… Since most households own two or more vehicles, that lowers the number of families that can afford EVs at today’s prices to even fewer. Because for a household to buy two EVs, you’d need two people making more than $100,000. Most EVs are priced well above the average car, making the dollars-and-cents assessment even tougher for most Americans. Throw all of those numbers together and that tells me that less than 15% of U.S. drivers can afford a battery-powered set of wheels.

Source: Bloomberg News

While Lucid’s primary strategy is to target the more affluent, less recession-prone cohort, its business is not immune to looming macroeconomic weakness ahead. While EV sales have remained resilient, whether Lucid can take advantage of that will likely depend on its ability to ramp up bot output and delivery volumes on the lower priced Air Pure and Touring trims as it continues to work on bolstering its brand awareness. The endeavour continues to suggest tremendous execution risks within the foreseeable future, especially given the global EV price war instigated by industry leader Tesla (TSLA) – which, admittedly, as the gross margin leverage to do so – adding further pressure to unprofitable rivals like Lucid. And management has clarified their stance on the tightening pricing strategy observed in the industry today, rejecting the idea of optimizing volume by compromising on price during the first quarter earnings call:

First thing, I would say that from a principal perspective and given where we are in the life cycle maturity of our company, we do think it’s important to balance between volume and price not to optimize one to the detriment of the other.

Source: Lucid 1Q23 Earnings Call Transcript

The combination of demand risks and slim margin improvements within the near term despite ongoing cost optimization efforts implies Lucid remains long ways from achieving profitability. Paired with significant capital outlays required to sustain its ongoing growth initiatives – spanning overseas expansion and new vehicle R&D – Lucid’s near-term fundamental prospects continues to bode unfavourably with the currently uncertain market climate, which harbingers further volatility to the stock ahead.

Relatively Overvalued

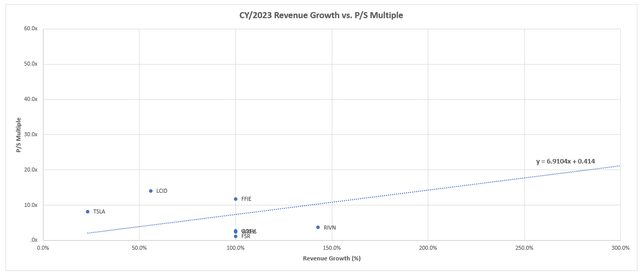

Despite ongoing fundamental headwinds as well as macroeconomic challenges to market conditions, which has wiped out the bulk of the Lucid stock’s value over the past year, it still trades at a premium to its peers at current levels.

Lucid’s premium to peers despite near-term fundamental headwinds risks a downward adjustment amid ballooning uncertainties in the market climate. (Author, with data from Seeking Alpha)

The premium implies that market continues to price the stock as if Lucid could double its sales within the next 12 months. Meanwhile, the stock’s short float of 8% remains significantly lower than its peers with comparable growth profiles, including Rivian’s (RIVN) close to 10% and Fisker’s (FSR) more than 34%. The combination of market observations underscores resilient investors’ confidence in the stock despite looming macroeconomic challenges and fundamental risks facing the underlying business. Admittedly, the stock’s resilient premium could still benefit further on the coattails of market tailwinds – especially as valuation gains realized by industry leader Tesla could potentially drive multiples across the EV sector higher. However, we think risks remain skewed to the downside for Lucid as its valuation premium lacks durability, especially given the underlying business’ challenging fundamental outlook and limited near-term catalysts for driving incremental upsides. Lucid’s current market valuation premium to peers will likely subject the stock to greater vulnerability to a downward rebalancing amongst its peer group valuations.

The Bottom Line

While Lucid continues to benefit from a technological advantage as well as broader longer-term secular growth trends on the back of the global transition to electric, its near-term fundamental prospects remains blighted by burgeoning execution risks. The evolving macroeconomic dynamics, though expected to be transient, also remains a persistent pressure that is weighing on the appeal of its valuation prospects, which are underpinned by cash flows further out in the future. Taken together, we expect risks to remain skewed to the downside within the foreseeable future for the Lucid stock, with limited catalysts to mitigate its exposure from greater volatility in tandem with the broader market ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!