Summary:

- Lucid’s Q3 results highlighted ongoing struggles, with large losses and cash burn continuing to pile up.

- The Gravity SUV is launching this quarter, creating high revenue growth expectations for 2025.

- Despite anticipated revenue growth, Lucid’s high price to sales ratio makes it an expensive stock, especially compared to peers like Rivian, XPeng, and traditional automakers.

Maskot/DigitalVision via Getty Images

After the bell on Thursday, we received third quarter results from Lucid (NASDAQ:LCID). The luxury electric vehicle maker has been one of the most disappointing names in the market since going public over the years, as it has continually missed its long term growth targets. While the company made some small progress during Q3, the financial situation is still ugly, and the stock remains too expensive for my liking.

Previous coverage of this stock:

Last month, I detailed how it was time for this company to finally step up to the plate. Lucid was about to launch its Gravity SUV, through which both management and investors hoped would send revenue growth soaring to new heights. However, I did caution everyone that more capital would likely be needed to support the launch and ongoing operations, and shortly thereafter a very large capital raise was announced.

I’ve had a sell rating on Lucid shares since the stock was in the high teens, as its low volume sales model has been leading to large losses and cash burn. With sales unable to reach the lofty levels that management guided to when preparing to go public, we’ve seen numerous debt and equity offerings to keep the name afloat, with a lot of help coming from the Saudi Public Investment Fund (“PIF”). Since my most recent article, Lucid shares have plunged roughly 33%, while US markets have been rising to new highs.

The Q3 report:

While the company reported record deliveries for the quarter, it didn’t totally translate to the top line. Despite almost 400 extra vehicles sold over Q2’s level, revenues actually dipped sequentially to just over $200 million. That number was up 45% year over year and did beat the street by a couple of million, but total revenues per delivery (including leases) dropped by almost $12,000 quarter over quarter.

Management was able to make some progress on the margin side, but it still remains heavily in the red. Gross margins in Q3 were negative 106%, although this was the best number in the Air sedan era. However, not all of this improvement made it to the operating line, where the company is still running operating losses at a more than $3 billion annual pace, and the quarterly number worsened by about $18 million over last year’s period. Operating margins improved by about 7 percentage points sequentially, but still came in at negative 385%, which is not a sustainable business model. The net loss was nearly a billion dollars in Q3, but about a quarter of that was due to the change in fair value of certain securities and derivative liabilities.

The balance sheet and cash flow situation:

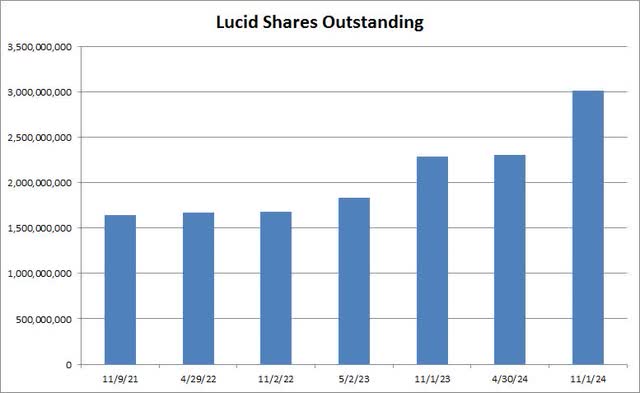

With these massive losses continuing, Lucid’s cash burn has really piled up. $622 million was burned in Q3 alone, but that was a roughly $84 million improvement over last year’s period. However, the company has burned over $2 billion already in the first nine months of this year, which resulted in another major capital raise that has recently sent the share count soaring.

Lucid Shares Outstanding (Company Filings)

Lucid finished Q3 with a little over $4 billion in cash, against roughly $2 billion in debt. Total liquidity was $5.16 billion at the end of September, and this did not include the roughly $1.75 billion raised in the major equity sale. The company says it has the financial flexibility to get well into 2026, but if cash burn trends don’t start to improve meaningfully, there will be a need for future debt and or equity raises.

Here comes the Gravity:

Thursday was not just the day the company reported its Q3 results. At noon eastern, Lucid opened orders for its Gravity SUV. Initially, the Grand Touring version, priced at $94,900, will be available, with production starting late this year. The Touring edition, starting at $79,900, is planned for late 2025, and it is unclear at this point if that base model will be eligible for any federal US tax credits given how this week’s election turned out.

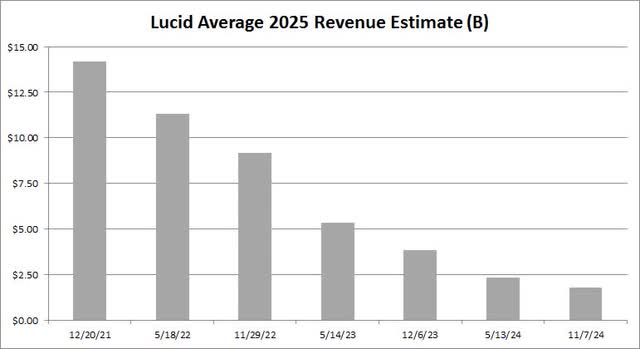

Going into Thursday’s report, the average street revenue estimate called for 130% top line growth for Lucid in 2025. While that may seem impressive at first, the chart below reminds us just how much estimates have come down over the past three years. Lucid management originally called for nearly 130,000 units of the Air sedan and Gravity to be sold in 2025, before the Gravity was delayed by a year, but it may be hard for the company to even hit 20,000 between the two vehicles unless the production ramp goes really well.

Lucid 2025 Revenue Estimate (Seeking Alpha)

A look at valuations:

While Lucid is expected to show some decent revenue percentage growth in the coming years, it also remains a very expensive stock currently. As the chart below shows, only Tesla (TSLA) has a price to sales ratio, based on current respective 2025 analyst estimates, that is higher than Lucid. The other names in this space I’ve used as a comparison are VinFast (VFS), Rivian (RIVN), XPeng (XPEV), BYD (OTCPK:BYDDF), NIO (NIO), and Polestar (PSNY).

EV Company Price To Sales (Seeking Alpha)

If you average the 7 names other than Lucid, the result is about 2.31 times expected 2025 revenue. Lucid finished Thursday going for about 3.12 times, a significant premium to this comparison group. If we were to exclude Tesla, however, that average drops to just 1.33 times, and these numbers don’t include traditional US automakers like Ford (F) or General Motors (GM) that trade at around 0.30 times their expected revenues for next year.

There are currently two risks for those betting against the name. The first one is that the Saudis just take this company private, buying out the rest of Lucid that they don’t already own. The second risk here is that there’s a meaningful improvement in the company’s financial results in 2025, sparking some enthusiasm for the midsize platform expected to arrive the year after. With a whopping 25.6% of the reported float short currently, any piece of good news could potentially lead to a decent short squeeze.

Final thoughts and recommendation:

Lucid’s Q3 report showed many of the same themes as prior quarters. While revenues did actually beat for once, large losses are still ongoing, resulting in a massive amount of cash burn. The Gravity SUV is launching this quarter, so expectations are for a significant revenue rise next year, but analyst estimates have come way down from where they were in prior years. It will take some time for Gravity sales to really materialize, especially as Lucid remains in the luxury segment of the market.

With a valuation that’s still much higher than many electric vehicle peers, I have to keep my sell rating on the name for now. The company is losing way too much money, and the production ramp of a new vehicle will likely make things even worse in the short term. While the capital raise certain helped the balance sheet, it resulted in a tremendous amount of dilution. Perhaps there will be more to like when the company launches its more affordable vehicle, but that’s not even an item to think about in 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.