Summary:

- Lucid reported mixed Q2 results, beating revenue estimates but still seeing significant losses and cash burn.

- The company raised $750 million in equity capital and announced a term loan facility to address cash flow issues.

- Despite the upcoming Gravity launch, a high valuation compared to EV peers and ongoing financial challenges warrant a sell rating on the stock.

PM Images

After the bell on Monday, we received second quarter results from Lucid (NASDAQ:LCID). The luxury electric vehicle maker has been one of the most disappointing names in the market since going public over the years, as it has continually missed growth targets. The company’s inability to grow as fast as hoped has resulted in large losses and cash burn, with a repeat of that in Q2 requiring Lucid to again get assistance from an affiliate of the Saudi Public Investment Fund (“PIF”), its largest supporter to date.

Previous coverage on the stock:

I last took a name when the company reported its Q1 results. At that time, the company again missed street revenue estimates, while maintaining its yearly production guidance for about 9,000 vehicles. As a reminder, the original forecast for this year was 10 times that amount, with more than half of that expected from the Gravity SUV that won’t be available until later this year.

Interestingly enough, Lucid shares had actually rallied 14% since my previous article until Monday’s close. Part of that likely has to do with the Gravity launch approaching, but the company still has a lot of work left to do. Of course, we’re still talking about a stock that after Monday’s post-earnings rally is still trading in the low $3s, whereas it was above $18 when I went to a sell rating a couple of years ago.

Q2 results were quite mixed:

Lucid announced last month that it delivered almost 2,400 vehicles in the second quarter, a quarterly record. That translated into revenues of just over $200 million for the quarter, but revenue per vehicle delivered continued to decline, down about $4,000 sequentially and almost $24,000 year over year. The company did beat street estimates by about $8 million, although at least one of those estimates was rather low (and possibly quite outdated), which helped keep the average down a bit.

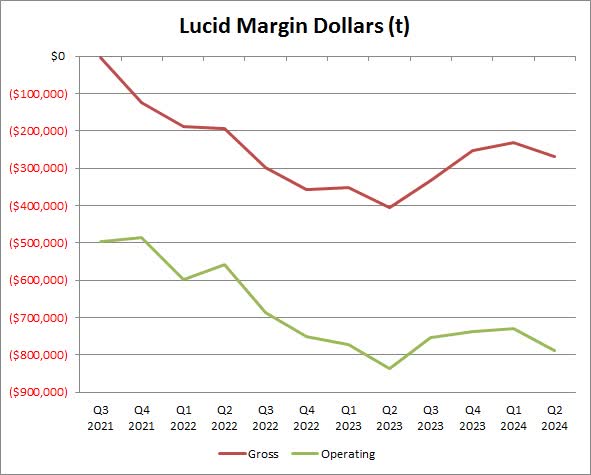

The main problem for Lucid is that its low production and delivery volumes are leading to tremendous quarterly losses. Despite the record amount of vehicle deliveries in the quarter, gross margin dollars declined sequentially (gross losses increased) as seen in the chart below. The gross margin percentage weakened slightly to negative 134.5%, and while operating margins improved sequentially, the company is still losing almost $4 per dollar of revenue on the operating line, even when taking out restructuring expenses.

Lucid Quarterly Margins (Company Press Releases)

Investors are hoping that once the Gravity has ramped production, overall margins will start to meaningfully improve. However, that will certainly take time, well into 2025, and the luxury EV market isn’t getting any less crowded these days. Fears of a potential US recession could also dampen overall vehicle sales, making it an inopportune time for Lucid to launch its next vehicle. The company also is planning on launching a more mass market vehicle in the future, but that’s a market that’s even more crowded at the moment.

Cash burn leads to capital raise:

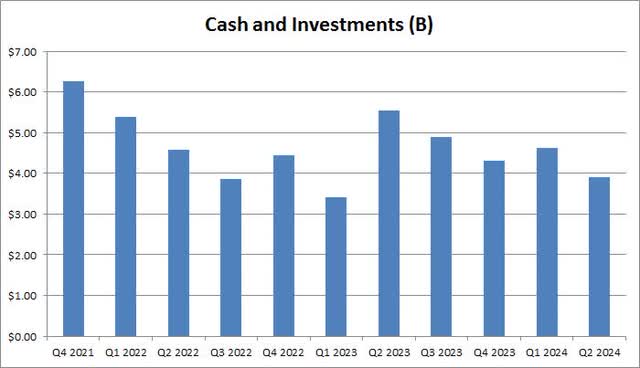

Unlike a lot of technology companies that may be losing a lot of money but are cash flow positive, Lucid is in a very capex intensive industry. During Q2, Lucid burned over $741 million; while that was an improvement over the year ago period, it was worse than the $715 million burned in Q1. As a result, the cash and investments balances dipped as seen below.

Lucid Cash Balance (Company Earnings Reports)

While the company wasn’t going to run out of cash in the near term, cash flow trends weren’t expected to dramatically improve rather soon either. As a result, Lucid went out and announced another capital raise, getting help from the Saudis yet again. The first part is a $750 million offering of preferred shares, which carry a 9% annual dividend, and can be converted at just under $4.38 per share, based on certain items detailed in the link above. The second part of the raise is a $750 million unsecured delayed draw term loan facility that matures in 2029. This debt facility, if tapped, carries interest at either a three-month adjusted Term SOFR plus an interest rate margin of 5.75% or an “alternate base rate” plus an interest rate margin of 4.75%.

At the Q1 report, after raising funds earlier this year, management said it had enough liquidity to get into the middle of 2025. With the latest capital raise under its belt, that timeline has been extended to at least the fourth quarter of 2025. Of course, this will depend on how smoothly the Gravity launch goes and if sales materialize as expected, but it also wouldn’t be surprising to see more funds raised at some point next year as well.

Valuation still too rich currently:

While Lucid is expected to show some decent revenue percentage growth in the coming years, it also remains a very expensive stock currently. As the chart below shows, only Tesla (TSLA) has a price to sales ratio, based on current 2025 analyst estimates, that is higher than Lucid. The other names in this space I’ve used as a comparison are Vinfast (VFS), Rivian (RIVN), Xpeng (XPEV), BYD (OTCPK:BYDDF), Nio (NIO), and Polestar (PSNY).

EV Price to Expected Sales (Seeking Alpha)

If you average the 7 names other than Lucid, the result is about 1.66 times expected 2025 revenue. Lucid closed Monday at 3.60 times, and that was before another mid to high single digit percentage gain in the after-hours session. If we exclude Tesla, the average drops to just 1.02 times, and this doesn’t include traditional US automakers like Ford (F) or General Motors (GM) that trade at around 0.30 times.

Final thoughts and recommendation:

Lucid had a mixed Q2 report on Monday afternoon. The company beat street revenue estimates for the first time in 7 quarters, but it still showed dramatic losses and cash burn despite a quarterly delivery record. Management was able to raise $750 million of equity capital, but with a costly preferred stock dividend, along with announcing a term loan facility that will add a bit to interest expenses if it is drawn upon.

For now, I am continuing to rate this stock a sell. The company trades at a very high valuation compared to other EV peers, and the financial situation remains extremely ugly. The upcoming Gravity launch will help grow unit sales and revenues, but management hasn’t yet shown an ability to significantly reduce losses or cash burn. Thus, another capital raise will probably be needed at some point, unless the Saudis just finally take the name private at some point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.