Summary:

- While LCID may be highly liquid, thanks to the sustained share dilution, it remains to be seen when the automaker may achieve sustainable profitability.

- Despite the partnership with Aston Martin, the management may do one more round of capital raise by the end of 2024, based on the quarterly cash burn rate of $0.9B.

- LCID’s production-to-delivery ratio remains underwhelming as well, likely attributed to the elevated ASPs and the elevated interest rate environment.

- With the highly shorted stock nearing penny levels, the volatility from aggressive short sellers may negate the potential upside from these bottom levels.

- LCID investors who remain in the game must be very careful indeed.

Edin

We previously covered Lucid Group, Inc. (NASDAQ:LCID) in July 2023, discussing the stock’s dim prospects for recovery, attributed to the worsening gross margins and growing operating expenses, leading to its lack of profitability.

While its liquidity remained robust, thanks to the consistent share dilution, it remained to be seen when the stock’s eventual reversal might occur, due to the impacted consumer demand as the elevated interest rate environment remained a headwind.

In this article, we will be discussing the LCID stock’s further decline in value, down by -18.76% since our previous article, compared to the SPY at -1.43%. It appears that market sentiments have turned even more bearish on its prospects, thanks to the widening gap in its production and deliveries.

With the highly shorted stock nearing penny levels, we also believe that anyone who continues to trade the stock may be burned by the potential volatility.

The LCID Investment Thesis Remains Unpredictable

For now, LCID has reported another ugly quarter, with FQ2’23 bringing forth revenues of $150.87M (inline QoQ/ +55% YoY) and worsening gross margins of -268.4% (-33 points QoQ/ -68.1 YoY).

Despite the stagnant top-line, its operating expenses have accelerated (yet again) on a QoQ basis to $431.22M (+8.1 QoQ/ +18.4% YoY).

While part of the headwind has been negated by the increased net interest income of $32.84M (inline QoQ/ +867.2% YoY), with the management making good use of its current liquidity, the fact remains that the automaker has yet to show improved margins and cost optimizations.

For now, we believe LCID may be able to achieve its FY2023 production target of 10K vehicles, with 4.48K units already produced by H1’23 (+219.3% YoY).

Then again, compared to the installed annual production capacity of 34K units and last reported reservation of 28K units in FQ4’22 (excluding Saudi Arabia’s reservation of 100K), the automaker’s deliveries have been unimpressive, in our opinion.

For example, LCID only delivers 2.81K units in H1’23 (+313.8% YoY), or the equivalent of a 62.7% in production-to-delivery ratio (-11.2 points YoY). This number is abysmal in comparison to its other start up peer, Rivian (RIVN), at 87.6% (+5.9 points YoY) in H1’23.

While there is supposedly a “significant number of vehicles that are in transit to Saudi Arabia,” LCID investors may want to note that the recent 10Q in FQ2’23 reports a growing sum of $522M (+193% YoY) in the inventory and firm purchase commitments write-downs.

This is to “reduce our inventories to their net realizable values, for any excess or obsolete inventories, and losses from firm purchase commitments.”

The increasing number is worrying indeed, since it suggests reduced demand for the automaker’s offerings, likely attributed to the premium ASPs of $107.47K (-25% YoY), based on the FQ2’23 revenues of $150.9M and 1,404 units delivered.

For now, thanks to the recent capital raise, LCID remains highly liquid, with $5.24B of cash/ short-term investments (+76.4% QoQ/ +22.1% YoY). Then again, while the management has maintained the narrative of “sufficient liquidity” through the start of Gravity production by early 2025, we are not so certain.

On the one hand, thanks to the partnership with Aston Martin (OTCPK:AMGDF, OTCPK:ARGGY), it appears that LCID may receive a total of $232M over the next three years, with another $225M through components/ integration fees.

On the other hand, based on the rate of its quarterly cash burn of $0.94B and the projected FY2023 capex of $1.2B at the midpoint, with $445.5M of capex already recorded in H1’23, we believe the management may need one more round of capital injection by the end of 2024.

This suggests another dilutive capital raise, with LCID already reporting 1,912.46M of shares by FQ2’23 (+80.73M QoQ/ +225.64M YoY), worsened by the $279.75M of share based compensation (-57.3% sequentially) over the last twelve months.

As a result of these gloomy developments, we are not surprised that Mr. Market has similarly turn bearish on the stock.

So, Is LCID Stock A Buy, Sell, or Hold?

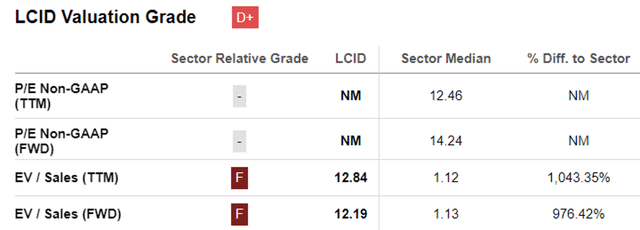

LCID Valuations

Seeking Alpha

With LCID unlikely to achieve profitability anytime soon, one of the viable metrics that we may use to measure its prospects is through the FWD EV/ Sales valuation. Even then, it is apparent that the stock is still expensive compared to the automotive sector median of 1.13x.

Even if we are to compare against the premium automotive peers, such as Mercedes-Benz Group AG (OTCPK:MBGAF, OTCPK:MBGYY) at FWD EV/ Sales of 1.06x, Rivian (RIVN) at 3.38x, and Tesla (TSLA) at 8.28x, it is immediately apparent that LCID still trades at eye-watering valuation.

This is despite the drastic correction from the November 2021 peak valuation of 82.07x and July 2023 of 15.54x.

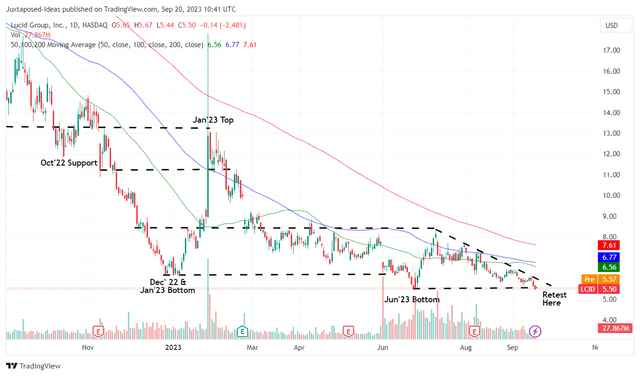

LCID 1Y Stock Price

Trading View

In addition, LCID may remain highly volatile ahead, attributed to the elevated short interest of 24.40% at the time of writing, despite the stock’s current retest of the June 2023 bottom at $5s.

Based on its lower lows and lower highs since the July 2023 top, we may see the critical support level breached in the near term, potentially reaching a penny stock status: “a small company’s stock that typically trades for less than $5 per share.”

The dangerous combination of being highly shorted and its (potential) penny stock prices means that LCID investors whom remain in the game must be very careful indeed.

This is because the investment thesis has changed drastically, with it no longer trading based on fundamentals, and now “considered speculative, high-risk investment as it experience higher volatility and lower liquidity.” This is a situation similarly observed with Carvana (CVNA) at 45.16% of short interest.

As a result of the potential volatility and capital losses, we do not recommend investors to add here, since LCID may be a new battleground stock, despite the management’s optimistic forward commentary in the latest earnings call:

We expect deliveries to be up the back half of the year, and we expect Q4 to be our largest quarter of the year as we ramp sales to customers in the government of Saudi Arabia, ramp Pure all-wheel drive and introduce our most affordable variant, Pure rear-wheel drive in September. (Seeking Alpha)

We maintain our Hold (Neutral) rating for the LCID stock, since the volatility from aggressive short sellers may negate the potential upside from these bottom levels.

On the same note, we similarly believe that anyone still holding in the hopes of a highly speculative buy out from the Public Investment Fund of Saudi Arabia [PIF] may be sorely disappointed as well.

With the stock already losing -89.9% of its value since the February 2021 peak and -53.3% from the January 2023 peak, we are not certain if that speculative event is worth waiting for, due to the drastic capital losses thus far.

Only time may tell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.