Summary:

- Lucid Group shares have lost 60% of their value over the past year, but I remain bullish on the stock due to the setup of a huge short squeeze.

- Lucid’s Q2 2023 results showed increased revenue and EV deliveries, but higher net losses and cash burn than expected.

- Lucid’s entry into the Middle East EV market, along with plans to enter the China market, show promising moves for the company despite its struggling stock price.

Justin Sullivan

Lucid Group (NASDAQ:LCID) remains one of my favorite EV stocks to own, even though the market thinks otherwise.

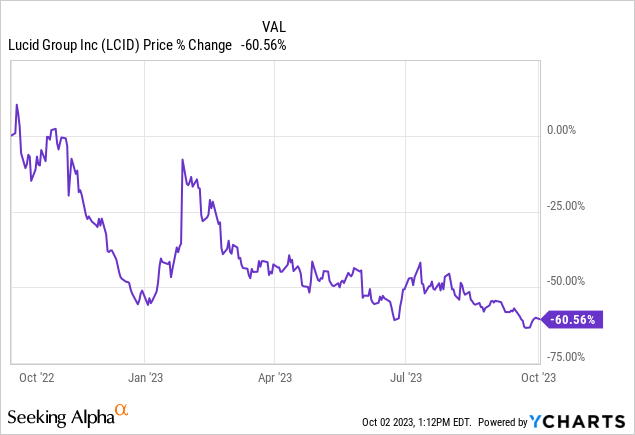

After an epic 2021 bull run during the SPAC boom, Lucid Group shares have been completely destroyed and lost 60% of their value over the last year.

The funny thing is that the demand for LCID’s SPAC IPO was so high that CCIV debuted at $13, unlike most $10 SPAC agreements.

Now, LCID shares are in the doghouse as many investors have given up and searched for gains elsewhere.

I’m not going to lie: It’s been hard watching LCID stock plummet, since I’ve been so bullish on the company since it debuted in late 2021.

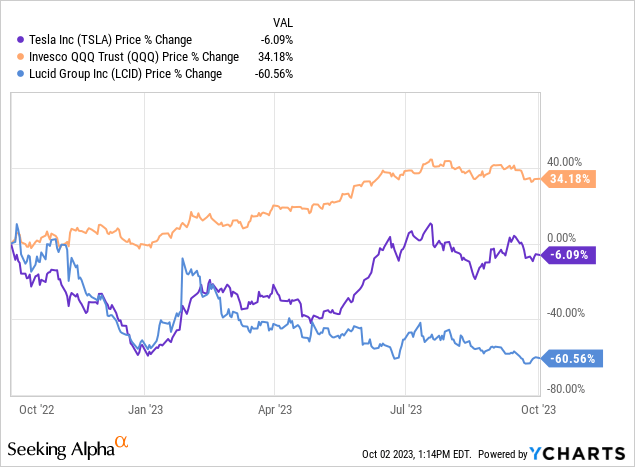

You would have done better buying the Invesco QQQ Trust (QQQ) or Tesla (TSLA) stock than holding LCID over the last 52 weeks.

Index ETFs can provide superior safety than holding individual stocks because you spread out risk more evenly.

So what’s so special about Lucid even though LCID shares continue to fall due to a massive short interest?

Well, you don’t make your money buying stocks that everyone wants at all-time highs. Sometimes, you can do far better by being contrarian and buying stocks nobody else wants to hold.

Lucid’s Q2 2023 Results

Lucid’s Q2 2023 results weren’t as bad as people think. The company generated $150.9 million in revenue (Up 89% YoY) and delivered 1,404 EVs.

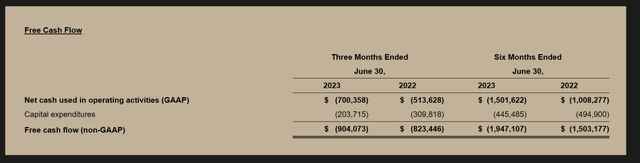

However, Lucid suffered higher net losses and more cash burn than investors expected. The company lost $764 million (-$0.40 cents per share). Capital ex decreased in the quarter YoY to $203 million but net free cash flow nearly reached -$1 billion.

Lucid Free Cash Flow (lucidmotors.com)

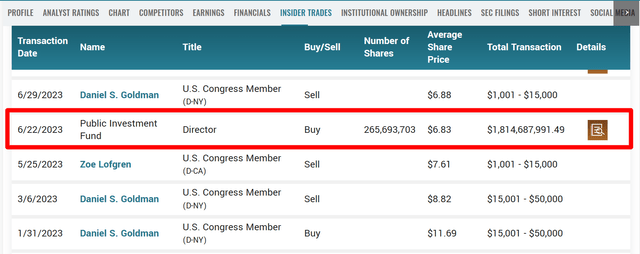

Lucid is dealing with extremely high levels of cash burn, but the Saudi PIF injected $1.8 billion in fresh capital to help Lucid bolster its balance sheet.

Lucid has $6.8 billion in cash on hand, which is enough to fund the production of the Lucid Air SUV and keep the company in business until 2025.

Lucid is Entering the Middle East EV Market

I’ve said time and time again that Lucid reminds me of Tesla in its early days because of its recent struggles and passionate investor community.

The truth is, Lucid has done something no other EV company managed to accomplish, enter the Middle Eastern electric vehicle market.

Lucid began production at AMP-2, the only EV production facility in Saudi Arabia. The company plans to produce 5,000 vehicles annually with the goal to reaching a full capacity of 155,000 once fully scaled.

Lucid Amp-2 Factory in Saudi Arabia (lucidmotors.com)

The Kingdom of Saudi Arabia made a 100k Lucid Air EV order and owns a massive 60% stake in the company.

It’s obvious that Saudi Arabia understands more consumers will switch to electric vehicles in droves as high gas prices create pain at the gas pump.

Even American sports celebrities are feeling the pinch of out-of-control gas prices for ICE vehicles.

NBA Superstar Jimmy Butler of the Miami Heat went viral on social media after complaining about high gas prices and saying, “I’m going electric.”

There is an addressable market for both standard and luxury EVs that can fulfill both consumer segments.

Lucid is aiming for the more affluent, wealthy consumer with its top-notch design, EV range, and overall luxurious experience.

The fact is that Lucid owners love their Lucid Air vehicle and understand you get exactly what you pay for.

Upcoming Lucid Short Squeeze

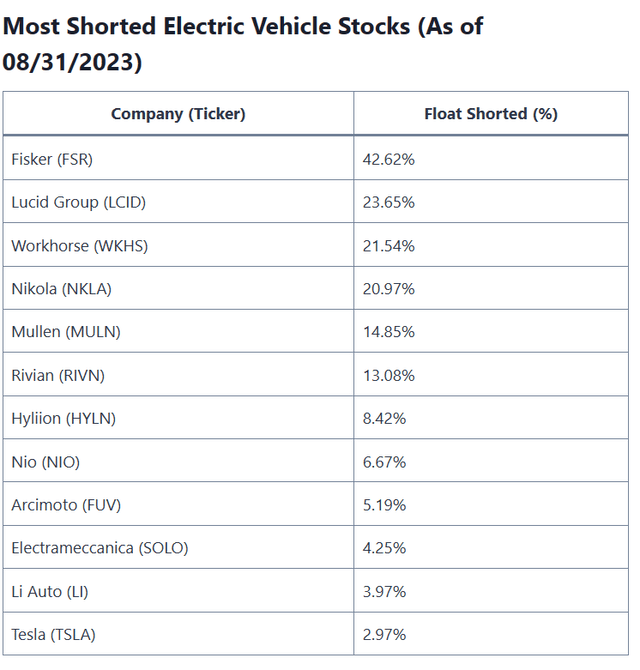

LCID is one of the most shorted stocks on the NASDAQ and ranks #2 as the most shorted EV stock, behind only Fisker (FSR).

Most Heavily Shorted EV Stocks (investortrip.com)

Short sellers have made billions of dollars betting against Lucid and helped drive the stock to its current low levels.

As short sellers ganged up on LCID, many long term bulls have given up on Lucid stock and sold to limit their losses.

In the short run, LCID shares are down, but the company is moving in the right direction over the long term.

Expansion into Saudi Arabia along with plans to enter the China EV market show Lucid is making the right moves despite its struggling stock price.

All signs point toward the Fed’s lower interest rates in 2024, which would help drive a lot of pent-up EV demand from cash strapped buyers.

EV battery costs decline over the long run, and a lot of short sellers will get caught once Lucid shows signs of profitability.

That would trigger a massive short squeeze and send LCID shares back towards its all-time high of $60.

Get In While It’s Still Cheap

LCID shares trade at all-time lows under the $6.83 insider buy from the Saudi PIF.

LCID Insider Buying Activity (marketbeat.com)

There is a chance that LCID stock heads lower in the near term, but I think the risk-reward ratio at these price levels remains extremely attractive to long term investors.

It’s important to understand that Lucid is not just an electric car company. Lucid Group has everything it needs to compete with the best in big tech since management has experience working at big tech companies such as Tesla, Microsoft, and Apple.

I don’t see any reason why a struggling stock price should encourage LCID investors to dump their entire stake and look elsewhere for gains.

As long as you practice healthy risk management, you can hold LCID stock and wait for the bullish thesis to play itself out.

Better yet, sell covered calls against your shares to generate income then use the capital to reinvest in more LCID stock, pay your bills, or build up an emergency fund.

Risk Factors

- More Share Dilution: Dilution is the main issue at the moment, since the company only has enough cash on hand to last until 2025. Right now, there are just under 2 billion LCID shares outstanding, but another share offering would send LCID stock falling in a hurry.

- Lack of Execution: Lucid has a history of moving extremely slow with all of its rosy promises. The company reduced its delivery estimates for 2 years in a row and made claims to enter China without a concrete game plan. LCID investors are worried that all of Peter Rawlinson’s promises won’t come true.

- Rising Interest Rates: Higher interest rates are a simple way to destroy the demand for Lucid’s luxury EVs. As interest rates climb, lenders become more selective on loans and many consumers get priced out due to rising interest payments. If the Fed continues rising interest rates, then Lucid may have to lower prices and suffer from dwindling demand.

- More Competition: It seems like every legacy automaker is launching their own EV these days. Competition in the luxury EV space from companies such as Mercedes, BMW, Jaguar, Rolls Royce, Audi, and others makes it even harder for Lucid to stand out amongst the crowd.

My Game Plan for Lucid Stock

I jumped back into LCID around $5.15 after a long wait for cheaper prices. I still believe the entire stock market is overvalued at current prices, and expect another major pullback before things get better.

If the Fed continues rising interest rates, then don’t expect small cap stocks like LCID to attract investors away from 5%+ zero risk returns from bonds, money market funds, and high yield savings accounts.

I’m playing the long-term game and will continue buying in anticipation of a major turnaround in 2025 once interest rates begin to fall and consumers aren’t getting crushed by inflation.

Don’t expect massive gains right away. Play the long game and retire like a boss with LCID shares in your portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.