Summary:

- Lucid Group has faced challenges including disappointing earnings, missed production targets, and supply chain issues, leading to decreased investor interest and a drop in share price.

- Despite these issues, Lucid’s strong financial backing and growth initiatives, including expansion into China’s EV market and increased production capacities, provide some optimism for the company’s future.

- However, the company still faces intense competition within the EV industry, regulatory uncertainties, and commodity price volatility, leading to a recommendation to hold Lucid shares until further developments.

hapabapa

Introduction and Thesis

Lucid Group (NASDAQ:LCID), one of the major players in the electric vehicle (EV) market, has seen a lot of ups and downs in its stock performance, leaving investors uncertain. Disappointing earnings reports, repeatedly missed production targets, and heightened cash burn has led to a rocky journey for its stock, resulting in lowered investor interest and a drop in its share price. On top of that, ongoing supply chain problems have affected its production plans, adding to investor worries about Lucid’s long-term profitability. However, the company’s strong financial backing and ongoing growth initiatives give some hope in this tough situation. This article seeks to veer away from outright optimism or pessimism, instead offering a nuanced perspective on Lucid’s future, exploring the many factors influencing its stock performance, and offering an in-depth assessment of the potential roadblocks that could hinder its growth.

Company Overview

Lucid Motors is a top EV maker that specializes in high-end luxury electric cars. The company’s primary source of revenue is derived from the sales of its high-performance, luxury EVs that feature innovative designs and cutting-edge technology. Lucid Motors also makes money through potential partnerships, joint ventures, or contracts within the electric vehicle ecosystem, providing services such as charging stations or battery technology. These additional services complement its main business, further enhancing its value proposition and revenue generation.

Industry Overview

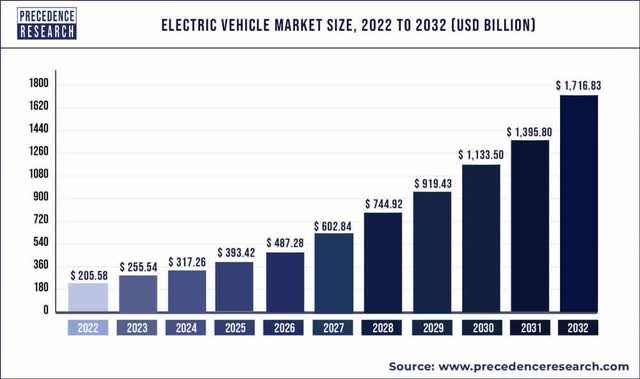

As of 2022, the global electric vehicle (EV) market is estimated to be worth $205.58 billion. The market is projected to grow at a 23.1% CAGR to $1.72 trillion by 2032 as environmentally conscious consumer behavior is accelerating worldwide, coupled with more stringent emissions policies from governments. This substantial growth can be attributed to the increasing adoption of electric vehicles due to environmental concerns, advancements in battery technology, and supportive government policies and incentives promoting the use of electric vehicles.

Competitive Analysis

Lucid’s main competitors are Tesla, the leading EV manufacturer, and traditional car manufacturers like General Motors, Ford, and Volkswagen, which are increasing their EV offerings. Additionally, newcomers like Rivian (RIVN), NIO (NIO), and Fisker Inc. (FSR) are competing for a slice of the fast-growing EV market. Lucid Motors differentiates itself from its competition through technological excellence, luxury design, and dedication to sustainability. While competitors struggle to integrate multiple types of monitoring, Lucid Motors stands out by unifying three pillars of observability, setting a new standard for collaboration and data sharing within the industry. Furthermore, Lucid Motors focuses on the luxury sector, appealing to customers who want high performance and lavishness. With a focus on efficiency, the company’s flagship vehicle, the Lucid Air, offers one of the industry’s longest ranges, thanks to proprietary tech and in-house developed parts. Lucid Motors’ green approach extends to its manufacturing processes, making them a truly eco-friendly carmaker. The company’s experienced leadership team, made up of industry veterans, ensures they stay ahead in EV technology and design, regularly outdoing competitors in innovation and elegance. Lucid Motors’ business model, focusing on luxury, efficiency, and eco-friendliness, allows them to fill a unique niche within the EV market, offering high-end electric cars that set the company apart in the global EV industry.

Financials

Lucid Group’s Q1 2023 revenue of $149.43 million fell short of estimates by a significant $62.1M, and it also represented a 43.5% YoY decrease, reflecting the broader problems facing the EV industry due to supply chain constraints and manufacturing hurdles. This is not entirely unexpected, as Lucid has been struggling with production issues, a common challenge for new entrants in the car industry. Q1 production was reported at 2,314 vehicles, a decrease from the previous quarter, causing Lucid’s share price to drop by 7.13% after the announcement. Furthermore, the company hinted that full-year production will fall on the lower end of prior guidance. This reflects the uncertainty surrounding supply chain issues that the entire auto industry is currently dealing with. Despite the disappointing earnings report, Lucid’s management remains hopeful. The company ended the quarter with $4.1 billion in total liquidity, expected to sustain operations at least into the second quarter of 2024. Long-term debt stood at $1.99 billion at the end of the quarter, indicating a robust financial standing. For 2023, the company plans to manufacture more than 10,000 vehicles, as it continues to focus on ramping up production and deliveries. The company believes its initiatives will enable it to pivot to higher production volumes as market conditions allow. In light of these developments, investors will be closely monitoring Lucid’s upcoming vehicle launches and its capacity to overcome the supply chain and production hurdles that have recently impeded its growth.

From my perspective, I believe that Lucid’s future revenue growth will largely depend on its ability to overcome these supply chain issues, scale up production, and successfully market its vehicles. Given its robust liquidity position and the expected demand for electric vehicles in the near future, I am cautiously optimistic that Lucid will be able to increase its revenues going forward. The anticipated production of over 10,000 vehicles for 2023 and Lucid’s continued focus on ramping up deliveries are positive signs. Moreover, with the recent capital raise, Lucid has a golden opportunity to invest in expanding its production capabilities. If utilized wisely, this could lead to a significant increase in revenues in the next few years, especially considering the growing global EV market, which is projected to hit $1.72 trillion by 2030. However, it’s not all smooth sailing. The competitive landscape of the EV industry poses a significant challenge. With heavyweights like Tesla and emerging companies like Rivian, NIO, and Fisker Inc. all vying for a piece of the pie, Lucid will have to consistently innovate and deliver high-quality products to distinguish itself and capture a significant market share.

Key Catalyst

One of the primary upcoming growth drivers for Lucid Group is its strategic focus on expanding production capabilities, driven by the recent $3 billion capital offering. This capital will boost the company’s liquid assets to nearly $6 billion, empowering Lucid to greatly scale production to meet growing EV demand, which is expected to reduce customer waiting times and stimulate sales. Despite the 20% shareholder dilution this offering caused, the long-term benefits could outweigh the initial backlash, as seen in Tesla’s successful history of share dilution to fund production expansion. Lucid’s majority shareholder, the Saudi Arabian Public Investment Fund (PIF), is also significantly invested in this round, reinforcing its long-term commitment to Lucid’s growth and the larger goal of Saudi Arabia’s Vision 2030 to transition from fossil fuels. Another key catalyst for Lucid’s growth is its planned entry into China’s vast EV market, which provides a great opportunity to significantly increase sales. This is an ambitious move reminiscent of Tesla’s profitable foray into China, a venture made possible for Lucid by the recent capital raise. Overall, Lucid Group’s strategic drive to increase production, coupled with its expansion into new markets, represents a powerful growth driver. Despite short-term concerns around shareholder dilution and cash burn, these initiatives position the company for long-term success in the fast-evolving EV landscape.

Valuation

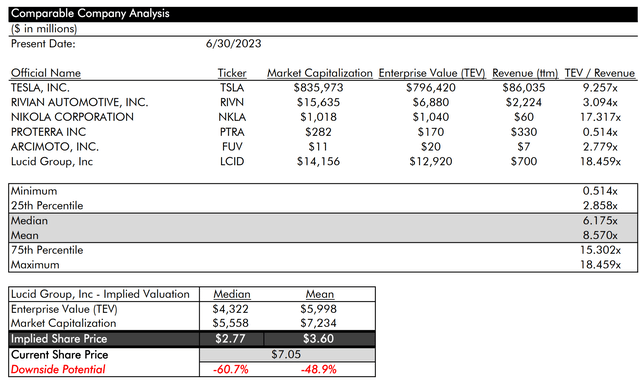

Valuing a company like Lucid can be difficult due to its early stage and evolving financials. Despite the company’s ongoing struggles, the stock’s current trading price of about $7.05 per share, which is close to its all-time low, presents a potentially appealing investment opportunity. Lucid has generated negative free cash flow for the past several years, with free cash flows of -$3,301,110,000, -$1,479,353,000, -$1,029,778,000, and -$339,589,000 in 2022, 2021, 2020, and 2019, respectively. Therefore, a discounted cash flow (“DCF”) valuation model wouldn’t be suitable in this situation. Likewise, valuation metrics such as P/E ratio and EV/EBITDA wouldn’t be suitable in this situation due to consistently negative earnings and EBITDA.

It is, however, possible to make use of the enterprise value (TEV)/revenue metric, and since LCID’s stock price, market capitalization, and enterprise value have been declining while revenues have been increasing (although expenses have also increased and still far outweigh revenues), its TEV/revenue ratio has reached all-time lows, currently 18.46x. For context, on 6/30/2022, LCID’s TEV/revenue ratio was 144.94x; on 6/30/2021, it was above 10,000x. While a lower-than-historical TEV/revenue ratio can indicate that a stock is undervalued and therefore a good investment, LCID’s TEV/revenue ratio is still far higher than those of comparable companies. The TEV/revenue ratio of TSLA is currently 9.26x, RIVN is 3.09x, NKLA is 17.32x, PTRA is 0.51x, and FUV is 2.78x. Based on the median and mean TEV/revenue ratios for LCID and comparable companies, I calculated implied LCID share prices of $2.77 and $3.60, respectively. These values are both well below the stock price at the time of writing of $7.33, suggesting that the stock is still overvalued despite being near its all-time low.

ESG

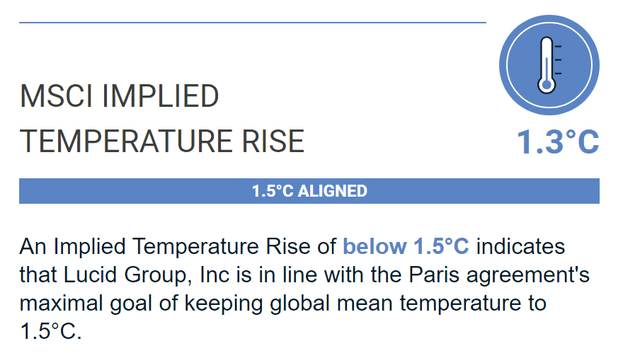

The MSCI ESG rating for Lucid is A, which is average compared to industry peers. The MSCI Global ESG Index categorizes Lucid as “ESG Laggard” in terms of product safety and quality, “Average” in terms of corporate behavior, product carbon footprint, labor management, and opportunities in clean technology, and “ESG Leader” when it comes to corporate governance. Having an Implied Temperature Rise of 1.3°C, Lucid meets both the Paris Agreement’s minimal goal of limiting global mean temperature to below 2.0°C and its maximal goal of limiting global mean temperature to below 1.5°C.

Lucid Motors places a strong emphasis on sustainability throughout its operations as a car maker. Their commitment to sustainability is evident in the design and production of their vehicles. The Lucid Air, their flagship electric vehicle, is engineered to be one of the most efficient EVs on the market, achieving exceptional energy efficiency ratings. They prioritize responsible sourcing by partnering with suppliers who adhere to sustainable standards and prioritize recyclability. Furthermore, their factory in Casa Grande, Arizona, is designed with energy efficiency in mind, aiming to minimize carbon emissions and explore renewable energy options. Lucid Motors actively works to reduce the environmental impact of its manufacturing processes and has obtained ISO-9001 certification for its commitment to quality. As a participant in the United Nations Global Compact, they align their operations with sustainable development goals and responsible business practices.

Risks

While Lucid Motors has potential, investors should be aware of the inherent risks associated with its operation. A central challenge is the intense competition within the EV industry. Rivals such as Tesla, Rivian, and traditional car makers moving towards EVs, like Ford and GM, possess established brand recognition, vast financial resources, and mature supply chains, potentially making it harder for Lucid to secure market share. Regulatory risks are also present. Any changes to government subsidies for EVs or alterations to environmental standards could affect Lucid’s sales and profitability. Additionally, the volatility of commodity prices, specifically lithium used in batteries, could disrupt the cost structure and margins. Global supply chain issues, particularly those related to battery components, present a risk as disruptions could delay production and delivery schedules. From a product perspective, Lucid’s current offering is limited to a single, high-end model, the Lucid Air. This narrow product range and high price point might limit the company’s market reach, particularly during economic downturns when consumer spending may be reduced. Operational risks are also notable. Lucid’s reliance on its state-of-the-art production facility means any setbacks or failures in ramping up manufacturing could impede its growth plans. The company’s future success also hinges on its ability to continue innovating and maintaining its technological edge in a rapidly advancing industry. Finally, the limited availability of EV charging infrastructure, particularly in certain geographies, could deter potential customers and impact Lucid’s sales. Nonetheless, Lucid’s strong focus on creating advanced, efficient, and luxurious EVs could help it navigate these risks and establish a strong foothold in the EV market.

Conclusion

While Lucid Motors’ strategic emphasis on luxury, technological excellence, and sustainability delineates its unique niche within the dynamic EV market, these strengths might not necessarily render it a compelling investment opportunity. The firm faces intense competition from established players and newcomers alike, alongside significant production and supply chain challenges that have adversely impacted its financial performance and stock valuation. Regulatory uncertainties and commodity price volatility further add to the risk profile of this investment. Most consequentially, despite the massive drawdown, it’s still not undervalued relative to its peers, presenting room for significant future downside if delivery targets are not met.

Still, potential growth drivers such as expansion of production capacities and planned entry into the lucrative Chinese market, backed by a robust financial standing and strategic capital offerings are positive developments that can turn the company around.

Therefore, my current recommendation is to hold Lucid shares until we have clearer signals of how these developments will play out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.