Summary:

- Lucid Group, Inc. reported better-than-expected production and sales numbers for Q2, showing a 70% increase in deliveries.

- The company aims to become leaner through a restructuring plan to reduce its workforce by 6% and improve efficiency.

- Despite a positive product lineup and potential growth with the Gravity SUV model, Lucid Group’s high cash burn rate and valuation pose risks.

jetcityimage

Article Thesis

Lucid Group, Inc. (NASDAQ:LCID) has released production numbers that were better than expected by many, and sales volumes finally picked up meaningfully as well. Nevertheless, the company has a long way ahead of itself when it comes to gaining size and improving profitability. Lucid Group remains an electric vehicle (“EV”) player with an interesting product lineup but meaningful execution risk.

Past Coverage

I have covered Lucid Group, Inc. in the past, here on Seeking Alpha. My most recent article on the EV player is from mid-February, so around five months ago. I gave the company a neutral rating back then. I argued that the Lucid had strong tech (e.g., battery efficiency, range), but that its lack of scale was a problem, which also holds true for the high cash burn rate.

With more than a quarter passed since my last article on the company, and with Lucid Group reporting production and deliveries numbers that were up significantly on a sequential basis, it is time to take another look at the company today.

Lucid Group: Quarterly Results Show Some Growth

Lucid Group, Inc. announced its production numbers for the second quarter on Monday. In that report, the company also showcased its deliveries number for the quarter. Both metrics improved markedly compared to the previous quarter, with production coming in at 2,110 vehicles, while Lucid Group delivered 2,394 vehicles. This wasn’t the company’s earnings report, and thus we will not know the revenues being generated via those sales until around four weeks from now. Profits (or rather lack thereof) and cash movements will not be known until the Q2 earnings report in early August, either.

But the production and deliveries numbers give us some hints of how the quarter went on an operational basis. One year earlier, Lucid Group had produced 2,170 vehicles but sold just 1,400 of them. On a year-over-year basis, Lucid thus showed a small production decline, but sold way more vehicles — deliveries were up by around 70%! It is important to note that Q2 2023 was far from a strong quarter. Thus, the comparison wasn’t especially difficult. Also, Lucid Group remains a rather small EV player today, as even the much-improved Q2 deliveries pace totals less than 10,000 per year.

Still, delivery growth of 70% is pretty nice, and the fact that Lucid Group was able to show an appealing relative growth rate despite the macro headwinds for the EV industry is even better. EV sales are declining in some important markets due to lower tax incentives, e.g., parts of Europe, which is why many EV players have reported disappointing sales numbers for Q2.

Tesla (TSLA), the highest-valued EV player by far, had to report a decline of around 5% in sales volumes for the second quarter, relative to one year earlier. The fact that Lucid Group was able to outperform Tesla (on a relative basis) and show strong growth in a tough environment is encouraging, I believe. It is, of course, not certain that this is the beginning of a new trend, as we don’t know yet whether Q3 and Q4 will show equally strong relative growth.

It is also important to note that Lucid Group was able to sell more vehicles than it produced. In the recent past, Lucid Group has repeatedly produced more vehicles than it sold. This increased its inventory levels and was bad for its cash flow, as growing working capital results in weaker operating cash flows, all else equal. With that trend reversing in Q2, Lucid Group’s operating cash flows should see a bit of a boost when the company reports its financial results a couple of weeks from now — while operating cash flows likely were negative during Q2, the cash burn rate will, I believe, be not as bad as it was during the quarters where Lucid Group felt additional cash flow headwinds from rising inventory levels.

The fact that LCID was able to sell more vehicles could be the result of consumer taste changing or might be the result of happy customers being vocal about what they like about their vehicles, thus creating additional interest in the brand and Lucid’s products. It is, of course, also in the realm of possibilities that this was just some random fluctuation.

The market reacted positively to the better-than-expected production and sales numbers for the second quarter, with LCID ending Monday up by a nice 8%. That being said, shares are still down substantially so far this year, currently trading around 25% below the share price from the beginning of the year.

Lucid Seeks To Become Leaner

Another important development since my last update on Lucid Group is the company’s May announcement of a restructuring plan. Due to high operating expenses and a tough market environment, the company decided to reduce its workforce by around 6%. While this likely has resulted in some one-time expenses that will show up in the Q2 earnings report in August, improving productivity and efficiency is a positive goal that should help the company over the long run. The industry is competitive, and the fact that market growth, at least for now, is weaker than previously thought, has increased competitive pressures further. Focusing on productivity and on improving one’s cost profile is a good idea in an environment like this, I believe, which is why I see Lucid’s cost-cutting and restructuring efforts as positive.

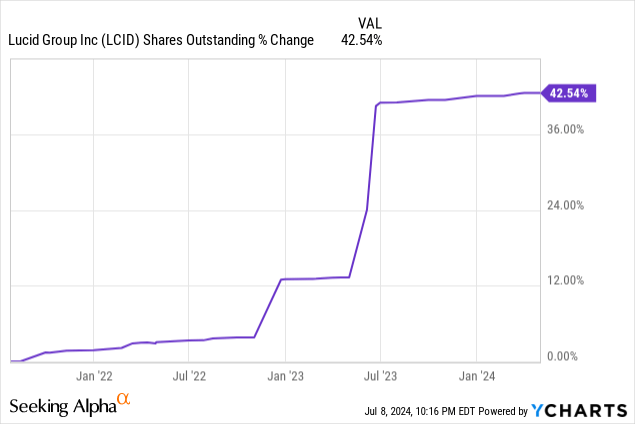

Lucid has been struggling with a high cash burn rate that forced the company to issue new shares at a substantial pace, as we can see in the following chart:

Since the company went public, Lucid Group’s share count has risen by more than 40% in just a couple of years. With the company increasing its focus on bringing down expenses and improving margins, the cash burn rate will hopefully improve, which could result in a slower pace of dilution going forward. Dilution will most likely not drop to zero any time soon, however, as Lucid Group still needs vast amounts of cash to grow its asset base to gain scale.

Is Lucid Group Attractive?

Lucid Group has efficient vehicles, has expertise as a Formula E supplier, and its Air model has won the 2022 MotorTrend Car Of The Year award. From a product perspective, there are thus many things to like about Lucid.

From a commercial perspective, the weak and uneven sales growth was an issue, however. This seems to have improved during the most recent quarter, although it remains to be seen whether Lucid Group can grow its business nicely during the second half of the current year as well.

The release of the Gravity SUV model that is planned for the end of 2024 could give Lucid Group a nice growth boost, although it is possible that we will see a delay or production ramp issues — that can always happen when automobile companies introduce new vehicles, especially when we look at young and comparatively inexperienced companies. The SUV market could be more attractive compared to the sedan market, which means that LCID could benefit a lot if the Gravity release is smooth and the model is well-received.

Lucid Group, Inc. is trading for around 9x this year’s expected revenue today, which is not a low valuation. Peers such as Tesla or Rivian Automotive (RIVN) trade at considerably lower valuations of 8x sales and 3x sales (2024 estimates), despite being in a better position from a scale perspective. I thus wouldn’t call LCID attractively priced today.

A large portion of Lucid Group’s shares are owned by the Saudi Arabian sovereign wealth fund, which naturally results in some takeover potential — the fund may decide to acquire the remainder of LCID as well, which would possibly happen at a substantial premium to the current share price. Considering all of these factors, I believe that LCID is a stock with potential, but also with significant risks and question marks. For an enterprising or risk-hungry investor, Lucid Group could be interesting, but I remain on the sidelines for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!