Summary:

- Lucid Group, Inc. reported weaker-than-expected Q2 revenues.

- Lucid confirmed its production target of 10,000 or more electric vehicles in FY 2023, however.

- Lucid saw growing operating losses in Q2 ’23 and has been forced to lower EV prices in order to stay competitive.

- The company raised $3 billion in a successful capital raise in Q2, extending its liquidity runway and allowing it to finance the ramp of its EV portfolio.

David Becker

Luxury electric vehicle startup Lucid Group, Inc. (NASDAQ:LCID) reported weaker than expected second quarter results on Monday, August 7th. While the electric vehicle (“EV”) company confirmed its production target of 10,000 or more electric vehicles in FY 2023, Lucid reported expanding losses in the second quarter.

Additionally, pricing pressure in the electric vehicle market is forcing the EV company to lower prices for its key EV products by as much as $12,400… which is an additional headwind that comes at a time when the firm is struggling to move towards profitability. Given the mixed nature of Lucid’s Q2 report, I am raising my rating for the electric vehicle manufacturer to hold!

Previous rating

Lucid submitted a very disappointing delivery card for the second-quarter, which caused me to downgrade the firm’s shares to sell in July: Q2 Delivery Update Was The Final Straw. Since Lucid started making deliveries to Saudi Arabia in the second quarter and raised $3B in equity successfully, ensuring the company’s production ramp into FY 2025, I believe a rating upgrade is now justified.

Revenue disappointment, confirmed guidance for FY 2023

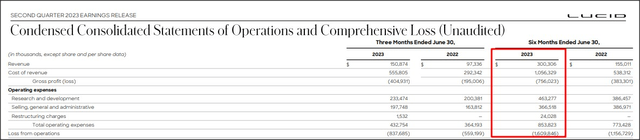

Lucid generated $150.9M in second-quarter revenues compared against an estimate of $205M, which was not a surprise to me. As mentioned, Lucid reported disappointing delivery numbers for the second quarter last month, and the company’s production and delivery ramp is going much slower than initially expected. Lucid’s slow production and delivery growth was the main reason why I down-graded shares of the EV maker.

Although revenues came in below expectations, Lucid did confirm its FY 2023 production forecast and continues to expect to produce “10 thousand or more” EVs this year. Lucid also started to make deliveries to Saudi Arabia in the second quarter, following an agreement between the EV company and Saudi Arabia last year. Saudi Arabia and Lucid signed an agreement in April 2022 that will see the electric vehicle marker deliver 50 thousand electric vehicles to the government of Saudi Arabia over a ten-year period. The agreement contains an option for another 50 thousand electric vehicles.

Increasing pricing pressure

Lucid announced last week that it was reducing the prices for its electric vehicle products by up to $12,400. Tesla (TSLA) kicked off a price war earlier this year by lowering the prices for its most popular models in a bid to spur demand, and many EV manufacturers have followed suit since and also lowered their EV prices to remain competitive as well. The result of the recent wave of price reduction in the EV segment has been a 20% drop in average electric vehicle prices between June 2022 and June 2023.

Lucid thus is only the latest company that is jumping on the bandwagon and lowering prices at a time when the company is still reporting expanding operating losses. Lucid generated an operating loss of $1.6B in the first six months of 2023, and the company’s losses are growing. The EV maker reported a Q2 operating loss of $837.7M compared to a loss of $559.2M in the year-earlier period.

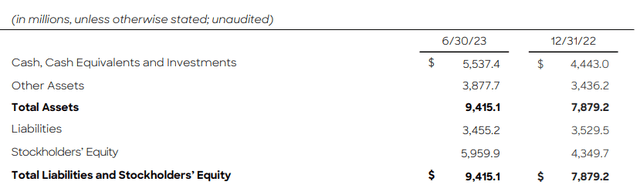

Successful capital raise gives Lucid a multi-year liquidity runway

Lucid raised $3B in a capital raise in the second quarter, with Lucid’s largest shareholder, the Public Investment Fund of Saudi Arabia, participating in the stock offering. At the end of the second quarter, Lucid reported cash and investments of $5.5B, which extends the company’s liquidity runway from FY 2024 to FY 2025. Adding credit facilities to the company’s liquidity pool, Lucid has access to a total of $6.25B in cash to finance the ramp of its EV portfolio.

Lucid has operating expenses of approximately $140M per month. Assuming a similar level of operating expenses going forward as well as ~$180-190M in monthly cost of revenues, the current liquidity position should ensure enough room to finance the EV maker’s operations between 19–20 months, not counting any incremental revenue growth from higher product sales.

Lucid’s valuation

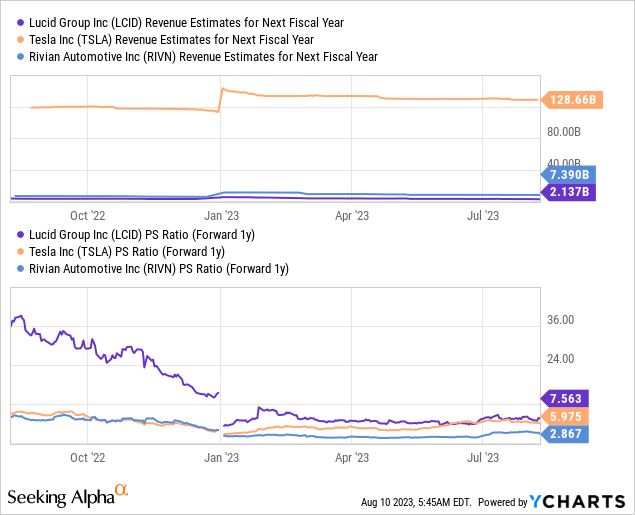

Lucid remains the highest-valued electric vehicle company in the U.S. market, and the firm’s revenue potential is even more expensive than that of Tesla… which is delivering millions of cars a year. While Tesla is already generating billions of dollars a year in annual profits and free cash flow, Lucid is expected to be profitable for the first time in FY 2027… which would be one year earlier than Rivian Automotive (RIVN) is projected to become profitable.

Lucid is currently valued at a price-to-revenue multiplier factor of 7.6X, which makes the company the most expensive EV firm that investors can buy right now. Rivian Automotive (RIVN) is trading at less than half this revenue multiplier factor (2.9X) and already has a significantly higher revenue volume than Lucid. Rivian just raised its guidance to 52 thousand EVs, but I have a hold rating on the shares due to the firm’s high valuation as well.

Risks with Lucid

The biggest risk that I see for Lucid still relates to the company’s production timeline. Lucent has disappointed with its production and delivery achievements more than once in the past, which means I am more cautious about Lucid’s guidance than I am with other EV companies. Lucid is also not profitable and losses are still in the phase of expansion, which may be a headwind for the EV maker’s valuation going forward.

Closing thoughts

Lucid delivered a mixed bag with its second quarter earnings report: Lucid confirmed its production target of 10,000 or more electric vehicles for FY 202,3 and the company said that it started EV deliveries to Saudi Arabia. On the other hand, Lucid’s Q2 revenues came in way below expectations and the company is forced to lower prices to compete, which is set to weigh on margins at a time when the company is still seeing expanding operating losses. Considering that Lucid is still highly valued based off of revenues and has a relative small delivery volume, the Q2 report is only good enough to justify a hold rating, in my opinion!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.