Summary:

- The FCF loss for 2022 was a staggering $3.3 billion.

- The cash on the balance sheet is evaporating quickly.

- Only 4,369 cars were delivered in 2022 despite the fact that 7,180 were produced.

Gregg DeGuire

Introduction

My thesis is that the financial statements for Lucid (NASDAQ:LCID) are frightening.

At the time of this writing, €100 is equivalent to $107.

The Numbers

The Lucid 4Q22 results show that they produced 7,180 vehicles in 2022 but they delivered less than 2/3rds of this number – 4,369 vehicles. Lucid’s 2022 revenue was $608.181 million with a cost of revenue of $1,646.086 million for a gross profit of $(1,037.905) million. The revenue works out to about $139,162 for each car delivered.

Per the 4Q22 call, they are not going to get to scale anytime soon as they are forecasting a 2023 production range of just 10,000 to 14,000 vehicles. Ferrari’s (RACE) 2022 20-F shows that they only shipped 13,221 cars in 2022 but they are apples and oranges relative to Lucid. Ferrari’s gross profit for 2022 was €2,446.301 based on revenue of €5,095.254 million. Ferrari brings in about €385,372 in revenue for each car shipped. Ferrari enjoys nearly 3 times as much revenue per car so they can do many things that other carmakers can’t. Ferrari’s economics are like a luxury retailer whereas Lucid’s economics are those of a carmaker. Lucid cars are more expensive than most but they don’t have the pricing power to have Ferrari type margins; Lucid needs scale.

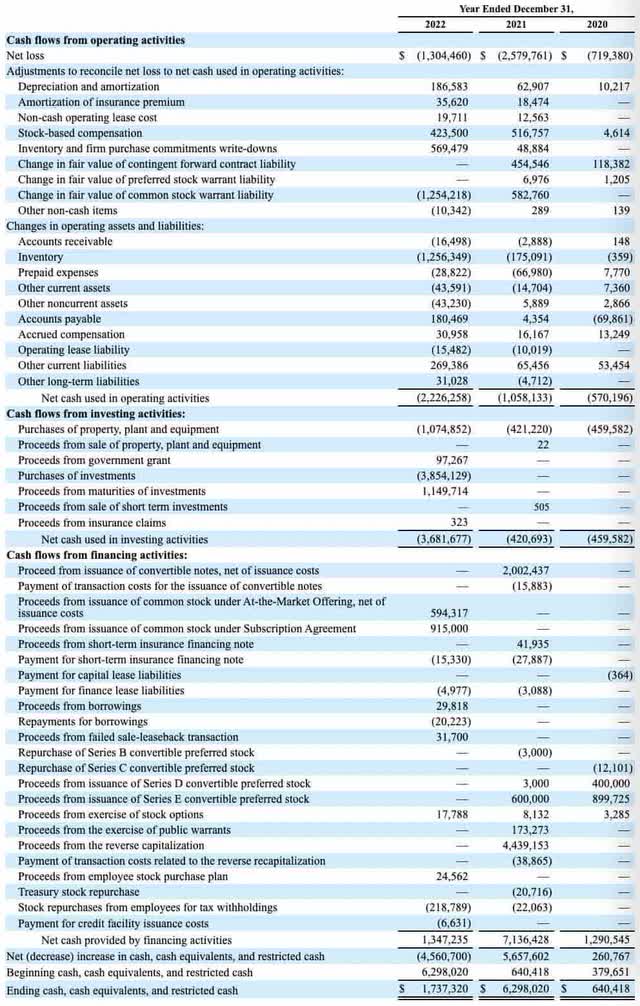

The above income statement figures for Lucid are plenty frightening but the cash flow statement is worse. A 2012 article talks about the way legacy carmakers used misleading accounting practices before the financial crisis to inflate gross margins in the income statement. I’m not saying Lucid is doing this but it is worrisome that their delivery numbers are significantly worse than their production numbers. I believe their free cash flow (“FCF”) is more meaningful than their net loss from the income statement.

The 2022 10-K shows a cash flow statement that is beyond scary. Cash lost in operating activities for 2022 was $2,226 million and there was capex of $1,075 million such that free cash flow (“FCF”) was $(3,301) million:

cash flow statement (2022 10-K)

This FCF loss of $3,301 million is much worse than the net loss we see on the income statement. The above destruction of cash was more tolerable a year ago when interest rates were lower and it was easier to borrow.

Valuation

Today’s valuation is nebulous given the wide range of possible outcomes. Unless Lucid is taken private or acquired soon at a premium then my feeling is that LCID stock has little to offer at this time. The 10-K shows a share count of 1,830,450,459 as of February 22nd. Multiplying this by the March 6th share price of $8.82 gives us a market cap of $16.1 billion. The balance sheet consists of $1,736 million in cash and equivalents plus $2,177 million in short term investments. Partially offsetting this is $1,992 million in long-term debt along with $244 million in long-term lease liabilities which make up the bulk of the other long-term liabilities line. Given these balance sheet considerations, the enterprise value is a few billion below the market cap but that cash is burning quickly.

Disclosure: I/we have a beneficial long position in the shares of TSLA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.