Summary:

- Lucid Group, Inc. announced a $1.7 billion equity raise, causing a 15% stock drop and significant dilution for investors, highlighting its reliance on cash infusions.

- Despite a 16% QoQ increase in Q3 2024 deliveries, Lucid’s low production volume and high cash burn present an unfavorable risk/reward relationship.

- Lucid’s stock is overvalued with a 2024 sales ratio of 9.2x, and profitability remains years away, making it a high-risk investment.

- Rivian Automotive, with a lower sales multiple and higher production volume, is better positioned for EV market growth compared to Lucid Motors.

hapabapa

Lucid Group, Inc. (NASDAQ:LCID) announced yet another equity raise on October 16, 2024, causing the stock to tumble 15% at the time of writing this article. The stock sale means considerable dilution for investors and underscores, in my opinion, that Lucid Motors cannot yet succeed without the consistent infusion of cash by one of its main sponsors.

A high cash burn rate and more challenging market conditions have led to a substantial decline in the company’s stock price, and even relatively robust third quarter deliveries didn’t breathe new life into Lucid Motors’ stock.

I think that it might take years for investors to see a return on their capital. Lucid Motors did see growth in delivered in Q3 2024, but the total production volume is still quite low, leading to an uncompelling risk/reward relationship.

My Rating History

After the last equity raise, I called Lucid Likely Dead Money. The EV company went on another capital raising round that included the EV company’s biggest stockholder, Ayar Third Investment Co, which is an affiliate of the Public Investment Fund of Saudi Arabia.

My last stock classification was thus “Sell,” and I see no reason to depart from this classification in light of yet another dilutive stock sale.

Another 262.5 Million Shares Will Be Sold

Lucid Motors announced this week that it was yet again diluting shareholders by offering 262.5 million shares of its common stock to investors. Ayar Third Investment Co., Saudi Arabia’s Public Investment Fund, committed to purchase 374.7 million shares of its common stock. The raised funds will be used, according to the EV manufacturer, for general corporate purposes, including capital expenditures and working capital.

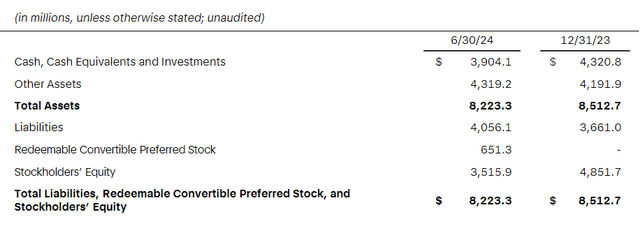

In August, Lucid Motors raised $1.5 billion via a convertible preferred stock offering and term loan facility. As of June 30, 2024, Lucid Motors had $3.9 billion in cash, cash equivalents and investments. The capital raise is poised to add $1.7 billion more to the company’s cash coffers, money that will surely be used to develop the Gravity SUV, Lucid Motors’ next big EV model, and help scale deliveries.

Convertible Preferred Stock (Lucid Motors)

A Positive Sign: Deliveries Surged In 3Q24

Not all is bad at Lucid Motors, however. In the last quarter, 3Q24, Lucid Motors delivered 2,781 electric vehicles, up 16% QoQ. Rivian Automotive, Inc. (RIVN) delivered 10,018 electric vehicles in 3Q24, down 27% QoQ. Lucid Motors’ delivery upsurge, however, was partially driven by discounted offers and the availability of cheap financing options for buyers.

I don’t anticipate Lucid Motors to raise its delivery target when it reports 3Q24 earnings, though, and think that the EV company will continue to try to deliver about 9K electric vehicles in 2024.

Rivian Automotive, Inc. (RIVN) just slashed its full-year production goal to 47-49K electric vehicles, down from 57K, amid a shortage of critical auto parts.

High Risks But High Sales Multiple

Lucid stock is selling for a rich sales multiple, which is surprising considering that the EV company has not made that much tangible progress in terms of scaling up production in the last couple of years.

While Lucid Motors got a good start in 2021 and its cars earned recognition related to industry-leading range achievements, the stock quickly faltered afterward as high investor expectations about production and deliveries could not be met.

The market presently models $825.3 million in sales this year and $1.61 billion next year. With that said, though, sales projections have fallen consistently for a very long time as the company scaled back its projected delivery volumes and investors have continuously been too optimistic as a consequence.

Lucid Motors’ market valuation implies a 2024 sales ratio of 9.2x, which is very high indeed considering that the EV company is not set to achieve profitability for years. Based on next year’s sales, the luxury electric vehicle manufacturer is selling for 4.7x sales. My last stock classification accompanied an intrinsic value target of $2.10 per share, which I am not modifying for the moment because I want to wait for the company’s third quarter earnings before adjusting my valuation estimate.

Rivian Automotive is selling for 2.2x this year’s sales and 1.8x next year’s sales. I think that Rivian Automotive, even in light of its reduced production outlook, is considerably better positioned to participate in the growth of the EV market. This is partially because it operates on a much higher volume level and because Rivian Automotive appeals more to the mass market, whereas Lucid Motors is more exclusively orientated toward high-income buyers of luxury EVs.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis Might Not Work Out

Lucid Motors has so far not been able to prove that it has a valid business model that can be sustained without constant and substantial cash infusions from major backers. Lucid Motors clearly is dependent on new cash injections as the EV company, despite higher deliveries in 3Q24, is unlikely to sustain itself. Dilutions are thus a considerable risk for investors, as are the company’s high losses.

Lucid also slashed its guidance multiple times throughout the last couple of years, so it is the EV company I unfortunately now have the least amount of trust in.

My Conclusion

Lucid Motors is raising capital yet again, this time $1.7 billion. This is set to lead to more dilution and highlights, unfortunately, that the EV company has not yet succeeded in creating a stand-alone electric vehicle business that can sustain itself through its sales. Lucid has heavily diluted shareholders in the past, and the stock has declined substantially in the last couple of years as a consequence.

Though it is also true that the company’s third quarter deliveries saw a nice jump QoQ, the total delivery volume is relatively low, which only serves to highlight the much higher-than-average risks that investors are taking here.

While it is good for Lucid Group that it could tap yet again a major stockholder for additional cash, I think it also makes clear that Lucid is on an uphill climb that might last many more years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in LCID over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.