Summary:

- The electric vehicle market is transitioning towards slower, more profitable growth, with established legacy manufacturers competing with Tesla.

- Consumer spending power is declining due to higher interest rates, impacting EV sales and growth, specifically lowering demand for luxury vehicles.

- Comparing Lucid to Tesla requires considering it took nearly two decades to earn a profit and up to $100B in inflation-adjusted capital investments.

- Although Saudi Arabia has a knack for flashy investments, I doubt it can finance Lucid’s losses long enough that it will compete with Tesla.

- Without strong PIF backing, I would expect Lucid to fail by 2025, with potentially limited acquisition interest due to associated warranty and other liabilities.

jetcityimage

The electric vehicle market is experiencing one of its most essential periods since Tesla’s (TSLA) initial rise. In my view, the industry is facing two critical trends. One is maturation and a transition toward extreme growth toward slower and more profitable growth. This is seen in the slowdown of Tesla’s sales and the rapid growth in legacy vehicle manufacturers’ development and operations in electric vehicles. Today, most major conventional vehicle manufacturers have developed their own supply chains and R&D for electric vehicles, pushing prices lower and finally creating competition for Tesla.

The second major trend facing the EV sector is the overall decline in consumer spending power due to higher interest rates and other troubling economic signals. Although the number of companies producing EVs is surging, the rate of demand growth is slowing. In my view, this is directly attributable to higher interest rates pushing EV car payments up close to $1.1K per month, dramatically lowering the pool of people who can afford it and pushing delinquencies up—a trend mirrored in credit cards.

To a large extent, negative macroeconomic headwinds are impacting the European and other Western markets similarly to the US. The only area of strong global EV growth is China, which is increasingly dominating the Asian market by offering much more affordable products, likely given the lower production costs in that country.

In my view, combining these two trends—the industry’s maturation toward profitability away from growth—and the macroeconomic strains creates an increasingly competitive environment that will ultimately benefit consumers by eliminating those who cannot adapt. To that end, we may look to Lucid Group (NASDAQ:LCID) and others (Rivian, NIO, etc.) that have tried and seemingly failed to compete with Tesla and older auto companies.

Assessing Lucid’s Bankruptcy Risk

Looking simply at LCID’s trend, down 55% YoY and around 70-90% from its 2021 highs, combined with its higher 10% short interest, many are likely wondering if it will go bankrupt. That is a complicated and largely impossible-to-predict question because Lucid is primarily funded by the Kingdom of Saudi Arabia’s public investment fund. The fund has, by now, put around $6B into Lucid through a series of infusions to keep it alive. While they may eventually cut losses, the PIF has close to $1T in assets and some borrowings, so it should not necessarily be viewed as an infinite supply of capital.

Saudi Arabia’s fund is likely willing to play the long game with Lucid, looking to own a company that can compete with Tesla and other top auto producers. But is that realistic? Tesla was created in 2003 and sold its first car in 2008, but it was not profitable until 2021. It has taken a tremendous amount of investor capital (I estimate around $50B to $100B based on its previous CapEx and asset growth record) over multiple decades to build Tesla, and the company still has not returned capital through dividends or buybacks. Further, I highly doubt Tesla would have pulled this off if not for the extremely high valuation its equity has usually retained, giving it a stupendously low equity cost of capital compared to its peers.

Given that Saudi Arabia is also looking to build a 105-mile “Line City,” which many urban planners see as nonsensical, we must consider that Saudi Arabia’s investing ambitions are not necessarily founded on high returns on investment. Those who have traveled to that part of the world may know the extent to which that is true, though it is evident in the tremendous negative cash flows created from its numerous megaprojects.

This further complicates Lucid’s situation. On the one hand, Saudi Arabia’s leaders are not necessarily focused on earning a stable profit from investments, causing an excess focus on high-appearance perception investments such as Lucid’s vehicles, megaprojects, and more. However, crucially, that may also mean that the PIF will continue to fund Lucid’s losses, perhaps until it lacks capital.

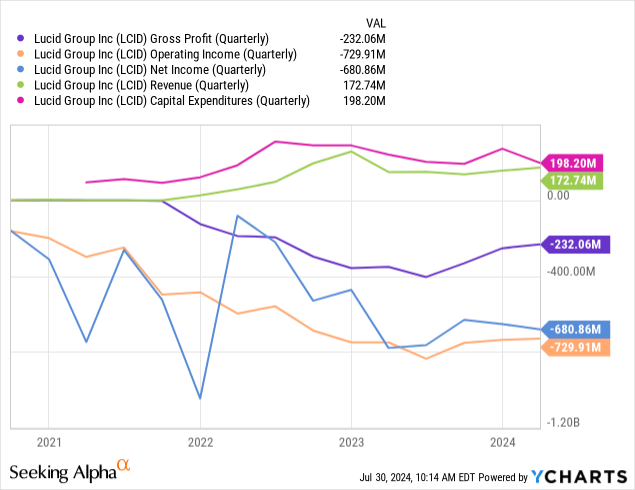

To me, the company’s income statement points to many years of cash infusion needs. Its revenue growth is also not non-existent, likely due to the high price of its vehicles and today’s economic shift toward cheaper cars due to higher borrowing costs. Lucid’s gross margins are negative, meaning it is losing money on each vehicle it sells, while its overall net loss is running around $2.72B, annualizing its last quarterly report. See below:

Lucid’s capital expenditures are also more significant than its sales, indicating an extremely high need for consistent capital infusions. Again, to compete with Tesla, I expect Lucid will need a total of $50B, and likely more (considering inflation) given Tesla’s capital investment record over the past two decades. I imagine the company may look to grow slowly by focusing on high-end vehicles, but again, I think that is ill-timed from a macroeconomic standpoint. Of course, it may be that wealthier people would not want to buy a high-end vehicle in a company that may not exist long-term, particularly when they have many options from very established companies.

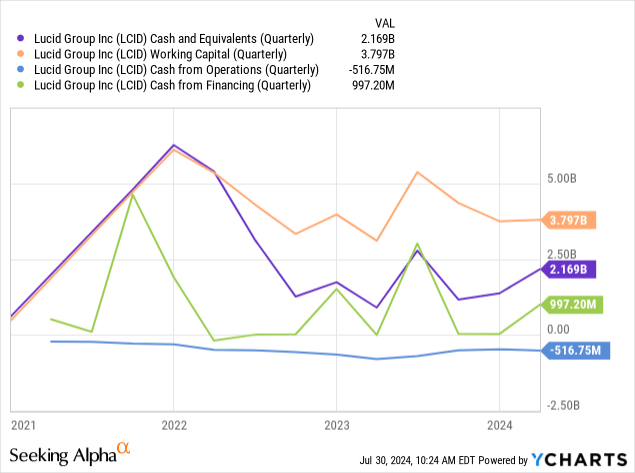

Lucid’s annual cash needs are at least $2B (based on its negative CFO) and likely higher if we account for capital expenditures. It had around $2.17B in cash last quarter, with a decent working capital of $3.8B, but that is not necessarily sufficient to offset its losses. See below:

Some point to Lucid’s ample production growth earlier this year as a sign that its prospect will recover. Although that is a good sign, it may accelerate losses, considering its highly negative gross margins. The fact is that Lucid would likely need to sell its vehicles at twice or more their current price to get close to a positive gross profit.

For most buyers, its current price of ~$90K for most vehicles (not counting “air credit’) makes little sense when a Model S is cheaper. The “Air Touring” model has a max HP of 620, a 3.4 second 0-60, and a 382-mile range. The Model S has a 1020 max HP, a 1.99 second 0-60, and a 352-mile range, making it a superior vehicle besides a slightly lower range. In my view, Lucid’s current models are already not competitive at their prices, but may not sell at all if it doubled those prices such that its gross profits were positive.

If it were 2010 and electric vehicles were still avant-garde that wealthy people would pay excess to buy them early, Lucid may have a place. However, I feel Lucid is operating on a paradigm in the EV industry that has not existed for a decade. To me, Lucid is not a competitor to Tesla; legacy car companies are.

The Bottom Line

If Lucid were not backed by one of the wealthier governments in the world, I would be virtually certain it would go bankrupt by next year. However, the fact is that Lucid may have access to an immense (but not infinite) capital pool, given the PIF’s willingness to fund Lucid despite its inability to grow sales.

Given that vehicle prices are rising, fuel isn’t getting any cheaper, and most people in the West feel their wages are not keeping up with inflation, EV opportunities are heavily skewed toward low-cost “middle-class” companies. The era of wealthy people buying EVs for their own sake is seemingly ending as they become far more common.

Indeed, a group of wealthier people may want EVs but do not like Elon Musk and would prefer a niche brand over the large manufacturers. However, I imagine that is not a sufficiently large cohort, particularly when buyers must weigh the risk that they will struggle with vehicle maintenance should Lucid eventually cease operations.

Although some of Lucid’s R&D may be of value for potential buyers, its products are not necessarily superior to those of Tesla and established car companies. After accounting for warranties and other possible liabilities, Lucid may be too risky to be bought out. Even then, buyers may wait until it is in liquidation.

Consider the bankrupt Fisker. Owners of Fisker vehicles are now left with cars that cannot be easily sold and, given they’re electric, cannot be fixed by most mechanics. It would likely be illogical for another car company to take on those warranty liabilities, given that it would require them to manufacture custom parts and service vehicles with differing computer systems, etc.

I am bearish on LCID and do not see financial value in the company. That said, I would not bet against it because it seems likely that the PIF will continue to finance its losses. At this point, the PIF may have invested so much that cutting losses would hamper its pride. Further, it may be that the PIF can invest so much that Lucid can be profitable, though I doubt that can occur this decade. Further, PIF investments are not necessarily bullish for investors because they will dilute equity directly or hamper the company with debt.

The company will publish its quarterly earnings on August 5th. As its production rose, I expect its losses may have as well. The company also signed a non-binding agreement with a graphite battery-part company. I think that is an interesting decision, but not necessarily one that will correct its immediate need to reduce cash burn.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.