Summary:

- Lucid Group, Inc.’s top-end Air Saphire model is impressive but costly, and the company struggles with massive losses and insufficient lower-end model sales.

- Despite beating revenue and EPS estimates, Lucid’s Q3 loss was nearly $1 billion, with a cash burn rate of $310M monthly.

- Continuous dilution and staggering losses raise concerns, with Lucid’s share count doubling since 2021 and stock price eroding by 97%.

- Lucid’s gross margin remains negative, and without significant changes, more capital raises and further stock declines are likely.

jetcityimage

Lucid Group, Inc. (NASDAQ:LCID) makes an excellent vehicle. Its top-end model, the Air Sapphire edition, packs over 1,200 horsepower, over 500 miles of range, and can jet from zero to sixty in about 1.9 seconds. Incredible!

The downside is that the Air Sapphire model costs about $250,000, and while Lucid has cheaper lower-end models, it’s not selling enough of them. As a result, it continues losing enormous amounts of capital as it operates deep in the red.

However, Lucid beat its recent earnings estimates, delivering higher-than-expected revenues (45% increase YoY) and better-than-anticipated EPS. Lucid also recently received an upgrade due to increasing Gravity (new SUV vehicle) orders.

Despite some “positive” factors, Lucid reported its most significant loss last quarter. Incredibly, the company lost nearly $1 billion ($932.5M) in Q3, increasing its cash burn rate to an immense $310M monthly. Annualized, this would equate to about a $3.72B loss.

While Lucid increased its Q3 deliveries to 2,781 vehicles, up 91% compared to Q3 2023, its losses are staggering. Lucid lost about $335,311 per delivered vehicle in Q3. Therefore, despite the increased sales being encouraging, there isn’t any profitability in sight, and the company will likely need to raise more capital, resulting in more dilution and further pain for existing shareholders.

I’m not a Lucid permabear. I was long the stock and made considerable money with the company after it went public. However, I dropped my buy rating over a year ago and continue to have a negative outlook for this stock.

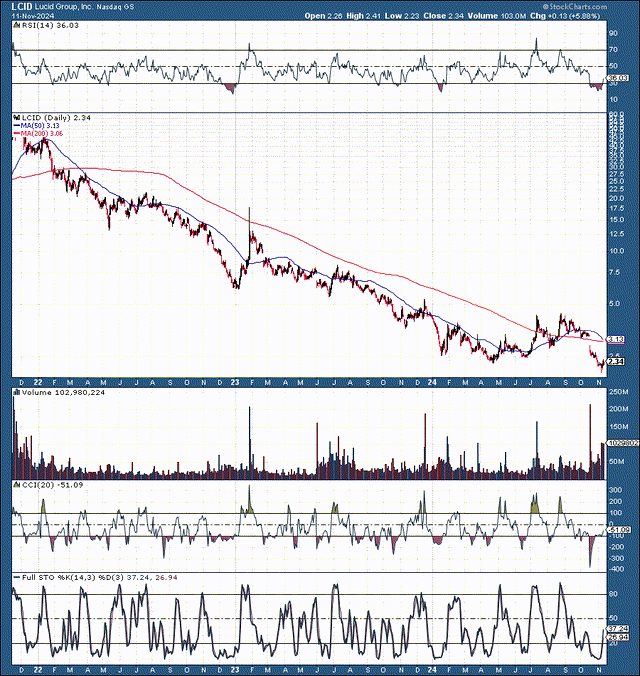

The Technical Image Remains Negative

Lucid began as a $10 SPAC. Shortly after going public, it surged to about $60. It’s been all downhill ever since. Lucid remains a downward spiral, and due to its staggering losses and perpetual dilution, the downward pressure could persist.

However, Lucid became significantly oversold recently. The RSI crashed to about 20, and other technical indicators illustrate a highly oversold dynamic. While I am not convinced Lucid can remain afloat over the long run, there may be a near-term opportunity here.

The stock is likely to rebound off these profoundly oversold levels, and it could close the gap at around $3. Still, caution may be warranted when dealing with Lucid, even in the short term, as this remains a high-risk stock.

Continuous Dilution Is A Huge Concern

Lucid’s share count has roughly doubled to around 2.3 billion since 2021. Not surprisingly, Lucid’s stock price has eroded by about 97% since its highs in 2021. As per its history, Lucid lost $258M in 2019, $599M in 2020, $1.5B in 2021, $2.6B in 2022, and about $3.1B in 2023 on an operating basis. On a net loss basis, Lucid has lost about $2.42B this year, and the full-year 2024 loss could be about $3.35B.

Therefore, the losses are accelerating, and Lucid may need another capital raise soon. This dynamic could lead to more dilution, resulting in more downward pressure on Lucid’s stock. Despite its $2-3 price tag, Lucid is worth about $7 billion. So, there could be plenty of downside ahead, and the stock could go through a reverse split if necessary.

Recent Q3 Earnings Optimism

Lucid recently reported EPS of -$0.28, a 3 cent beat. Revenue came in at 200.4M, a 45.4% YoY increase. However, to put things in perspective, QoQ sales were roughly flat. Therefore, the sharp increase in YoY sales is partly due to an abnormally slow quarter in Q3 2023.

Lucid delivered 2,781 vehicles last quarter. Yet, it produced only 1,805 in Q3, saying it was on track for 9,000 vehicle production for the whole year. While there are claims that Lucid can manufacture hundreds of thousands of vehicles annually in the future, we see limited, relatively niche production trends today.

I am concerned because the company is losing nearly $1B per quarter. Furthermore, there are many questions regarding the efficiency and efficacy of its supply chain network, infrastructure, servicing, and more. I’m looking at the numbers here, and I am perplexed.

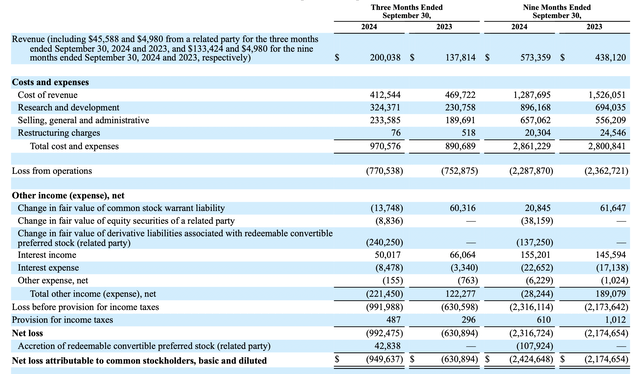

Statement of Operations

Income statement (ir.lucidmotors.com )

Even excluding research and development, SG&A, and other operating expenses, Lucid’s revenue cost was about $412.54M last quarter. Therefore, its gross profit/loss was around—$212.5M. This dynamic illustrates highly inefficient production. Given this dynamic, Lucid lost about $76,400 per delivered vehicle in Q3.

We’re not talking about being net profitable here. We’re simply discussing Lucid’s ability to manufacture vehicles without perpetually being in the red. Anyone still believing Lucid may be the next Tesla may be in for a rude awakening, as Tesla’s gross margin during its most challenging phase of the Model 3 ramp-up was about 14%. In 2012-2013, Tesla’s gross margin briefly dipped below 10% but never went negative.

Lucid has never had a positive gross margin. Lucid’s gross margin was -132% last quarter. The positive element is that it improved over the previous quarter’s -162%. Nonetheless, Lucid is very far away from being profitable, and as I mentioned earlier, it is nothing akin to Tesla manufacturing-wise.

The Bottom Line

Lucid is a $2 stock for a reason. The company has let down investors essentially at every corner. By now, Lucid could be selling 10-20K vehicles per month instead of the under 1,000 average. Lucid manufacturing facilities have the capacity to produce 100-200K (or more) vehicles annually. Furthermore, Lucid should be gaining traction and becoming increasingly profitable by now.

At the very least, the company could be manufacturing vehicles profitably, posting positive gross margins, and working on becoming net profitable. Unfortunately, Lucid doesn’t appear to be anywhere near profitability, providing a loss of about $335,000 per vehicle delivered last quarter. Unless concrete changes are made to make Lucid increasingly profitable quickly, the company will require more capital raises, and the sock will keep skidding lower, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!