Summary:

- Lucid declares the company is producing “the very best car in the world” but for me as an investor financials and certainty regarding future growth are the most important.

- Demand for EVs is weakening and it is highly likely that the company will be forced to revise production guidance for 2023 down.

- There is vast uncertainty regarding the company’s future prospects, so I believe near-term business performance, which I expect to be weak, will prevail over valuation estimates in affecting the stock price.

jetcityimage

Investment thesis

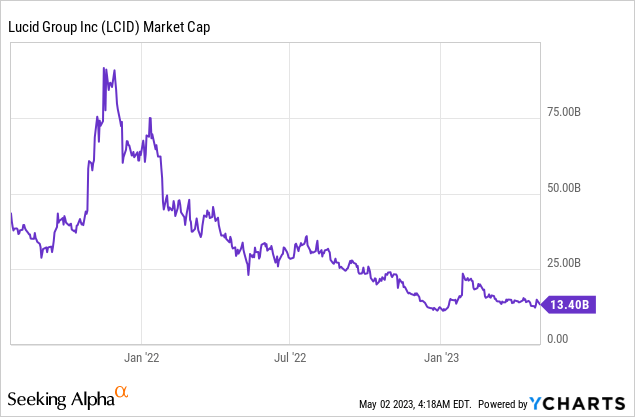

Lucid Group’s (NASDAQ:LCID) stock price is now almost 90% down from November 2021 highs. Given the substantial uncertainty related to the company’s sales growth and breakeven timing, I believe such a dramatic selloff was fair. The company is burning cash rapidly, and current cash reserves would be enough to finance operations only until Q1 2024, according to the company’s CFO. Moreover, my valuation analysis suggests the stock is still significantly overvalued.

Company information

Lucid is an American electric vehicle company based in Newark, California. The company was founded in 2007 under the Atieva name and initially focused on developing electric vehicle components and battery systems. In 2016, the company shifted its focus to developing and producing luxury electric vehicles. The company is backed by several high-profile investors, including Saudi Arabia’s sovereign wealth fund.

Lucid’s first vehicle, the Lucid Air, is a luxury electric sedan with over 500 miles on a single charge, making it one of the longest-range electric vehicles on the market. The company is also working on an electric SUV called Lucid Gravity. The company expects to start production of the Gravity model in 2024. In addition to its electric vehicles, Lucid is developing advanced battery technology and energy storage systems for homes and commercial buildings.

The company operates in one operating and reporting segment, with the fiscal year ending December 31.

Financials

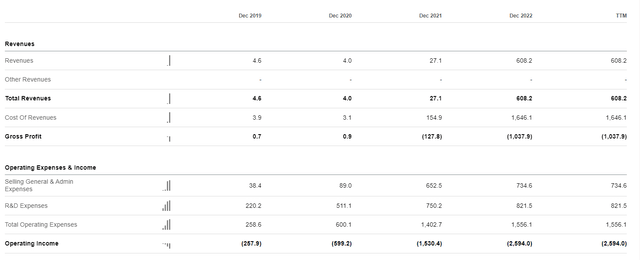

Lucid is a relatively young company in the stock market. Thus financial performance has been available only since FY 2019, and so arguably not very informative.

Based on the above table, we can only conclude that the company had been ramping up its production last year and that costs by far outweigh revenue. So we need to dig down to details to understand when the company is expected to turn profitable. and what are the future growth perspectives.

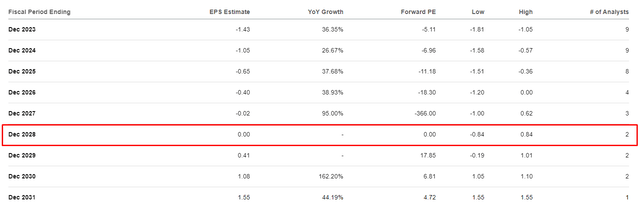

If we turn to consensus estimates, we can see that analysts expect the company to break even in terms of EPS in FY 2028, which is rather far from now, so I believe the level of uncertainty here is substantial.

From the topline perspective, consensus estimates project revenue growth from approximately $1.4 billion in FY 2023 to $24.4 billion in FY 2032, representing a 10-year forward CAGR of above 33%. Any figure can be helpful only compared to context, so I would like to compare projected LCID topline growth with the expected EV market growth. According to Precedence Research, the EV market size is estimated at approximately $1.7 trillion in 2032, meaning the market will compound at about a 23% yearly rate. Therefore, I believe that LCID revenue projections for the next decade are way too optimistic because they are significantly higher than the overall market growth trajectory.

What I also would like to mention regarding the company’s future growth perspectives is the weakening demand for the overall EV market. Tesla (TSLA), the undoubtful EV market leader, reported Q1 2023 deliveries and financials in April, indicating a very modest 4% sequential deliveries growth. I believe decelerating growth for a market leader like Tesla means a more severe decline in demand for cars from much smaller automakers like Lucid.

Moreover, during the latest earnings call, Peter Rawlinson, the CEO, underlined that the company has more than 28,000 reservations. Compared to the number of deliveries guidance for 2023, the number of reservations might indicate a substantial certainty of future revenues. But let me add context here. First, these reservations are non-binding, meaning potential customers can cancel without penalty. Second, the number of reservations declined sharply if we compare it to the Q2 2022 earnings announcement when management reported 37,000 units in reservations. I believe that a 25% decline in the number of reservations within six months tells us a lot about the extent of weakening demand for Lucid vehicles.

Seeking Alpha

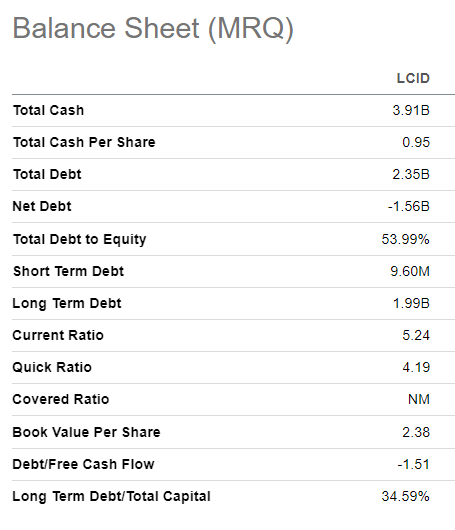

The company’s balance sheet might look healthy with negative net debt and very high liquidity ratios. But in our balance sheet analysis we must incorporate the very high cash-burning pace. In FY 2022 the company’s net change in cash was negative $4.5 billion, meaning the company is highly likely to run out of money by the end of 2023 or early 2024. My forecast is backed by the company’s CFO, Sherry House, who indicated during the latest earnings call, that the capital is sufficient into the first quarter of 2024. For me, that is a huge red flag, since the company will face a need to raise additional finance next year meaning new or extended credit line facility or diluted shareholder capital, both bad news for equity investors.

On April 13, the company announced its Q1 2023 production and deliveries of 2,314 and 1,406, respectively. This represents a 34% decline in output and a 27% decline in deliveries, both compared sequentially. As Peter Rawlinson mentioned during the latest earnings call, the sequential slip in production was expected due to the planned downtime at production facilities. I would like to underline the difference between the expected quarterly revenue decline compared to the deliveries decline.

As per consensus estimates, revenue is expected to be at $211 million for the upcoming quarter, which is 18% lower sequentially. I see a high probability that the company will miss its 1Q 2023 revenue estimates since the number of deliveries declined substantially more. The company did not change either the product mix or pricing strategy; therefore, I believe revenue will decrease in line with the change in deliveries. For a growth company like Lucid, missing revenue can highly likely cause a selloff since revenue growth matters much more for investors than profitability in my view.

Valuation

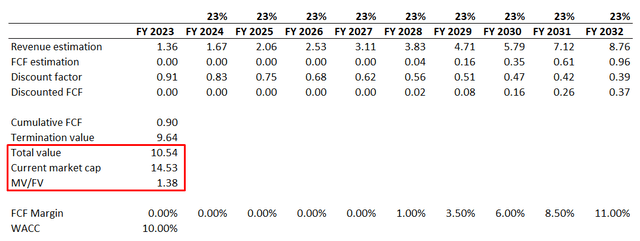

LCID is a growth company so for the valuation I use the discounted cash flow [DCF] approach. As we saw in the “Financials” section above, the future growth of LCID’s topline is very uncertain for me. I consider consensus estimates as too optimistic, so for valuation purposes I use the expected EV market CAGR up to 2032 which is also outlined in the section above. For free cash flow [FCF] I expect the company to turn profitable in FY 2028 delivering a 1% FCF margin which will expand by 2.5 percentage points each year. For WACC I prefer to be conservative due to very high uncertainty, so I round up WACC for LCID to 10%.

After incorporating all the assumptions together, I arrived at a fair market cap of approximately $10.5 billion which is about 40% lower than the current market cap, indicating the stock is massively overvalued at the moment.

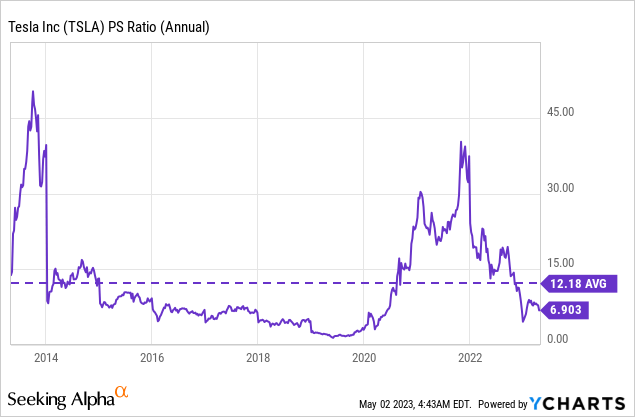

From the perspective of the valuation multiples, there is not much to analyze since the company is relatively young with a short horizon for historical averages, and has not yet turned profitable. What I would like to emphasize here is the company’s above 20 Price to Sales TTM ratio. I would like to add some context here by showing the average P/S ratio of TSLA over the last decade, which was substantially lower.

To summarize the Valuation section, I believe that LCID stock is overvalued given rather fair assumptions.

One remote risk for my bearish thesis

What stock market movements taught us in the last three years is the fact that the Fed’s monetary policy affects valuations a lot in the modern world. We all saw how Lucid’s market cap skyrocketed in 2021 when the company produced less than a thousand vehicles per quarter.

Thus, in case there is a sharp pivot in the Fed’s funds rates policy, or a new QE injection is implemented in case of a severe credit crunch, then my thesis will not work out.

But I see the probability of the Fed’s sharp movements as very low. The labor market is still very strong, and the US economy demonstrated modest 1.1% growth in Q1 2023. Meanwhile, the inflation at 5% is still much higher than the Fed’s target level of 2%. Therefore, I see the risk of the Fed’s decisions moving valuations to the North as low.

Bottom line

To conclude, investing in LCID stock is substantially risky, and the potential benefits for investors are very uncertain. The stock is a sell for me since my analysis indicates that weak operating and financial performance in the foreseeable future is highly likely mainly due to the weak momentum in the EV industry. Moreover, the breakeven point timing for the company’s business is very uncertain and will likely face headwinds in the nearest future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.