Summary:

- Lucid Group, Inc. investors reacted positively to the Volkswagen-Rivian joint venture news.

- Lucid recently had an almost 30% short-interest ratio, suggesting some short-covering could have occurred.

- Lucid already has a cornerstone backer: the Saudi PIF. Don’t expect another strategic backer to emerge.

- The company still needs more cash flow to scale. Moreover, it has suffered from its inability to scale.

- Lucid is a fundamentally weak stock with a clear downtrend price action. Don’t expect significant changes. Read on.

Justin Sullivan/Getty Images News

Lucid Stock: Some Respite From Volkswagen-Rivian Joint Venture

Lucid Group, Inc. (NASDAQ:LCID) investors likely cheered the biggest electric vehicle (“EV”) news of the week, as Volkswagen (OTCPK:VWAGY, OTCPK:VWAPY) and Rivian (RIVN) announced a potentially “game-changing” joint venture. The JV involves Volkswagen investing $5B through 2026 as Europe’s leading legacy OEM seeks to lift its EV game. Rivian benefits from Volkswagen’s manufacturing expertise while getting much-needed liquidity to scale its vehicles.

As a result, I believe short-sellers in both LCID and RIVN likely decided to take some exposure off the table, as both stocks were relatively heavily shorted before the JV announcement. LCID’s short interest ratio of almost 30% highlights the market’s pessimism about LCID. Given LCID’s massive market underperformance and continued downtrend bias, I believe this week’s recovery will not likely be sustained. Why?

Lucid: Why The Saudi PIF’s Investments Aren’t Enough

Recall that Lucid already has a cornerstone investor: the Saudi Public Investment Fund. The PIF owns about 60% of LCID’s total holdings. Despite that, it has not stopped LCID short-sellers from hammering the stock, as LCID fell more than 50% over the past year. Its downward journey from its IPO in July 2021 has continued in earnest, with lower-lows and lower-highs assessed in LCID’s price action.

I expect the PIF to continue to help Lucid meet its liquidity needs as it works hard to scale over the next three years. However, that might not be enough to convince the market. The PIF is not dumb. They can also see that LCID stock is in a “falling knife” pattern. Lucid highlighted the PIF’s $6.4B investments since 2018, “including $1B in Q1 2024.” However, the PIF’s current stake is worth about $3.5B, suggesting significant unrealized losses in its LCID shareholdings. As more funding is anticipated, a falling share price could further dilute LCID shareholders, given the massive liquidity needs ahead.

LCID: Still Not Undervalued

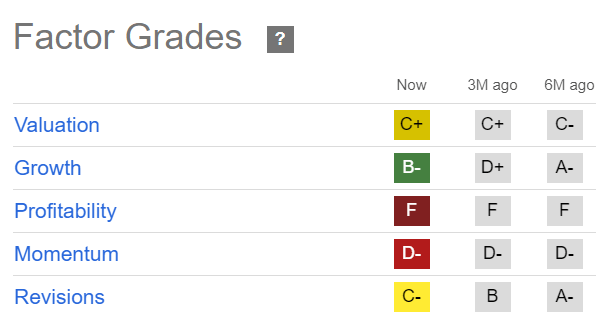

LCID Quant Grades (Seeking Alpha)

Consider this: Notwithstanding its stunning decline, LCID is still not assessed to be undervalued (“C+” valuation grade). While LCID’s “B-” growth grade might appeal to some EV growth investors, LCID’s worst-in-class “F” profitability grade should have raised red flags.

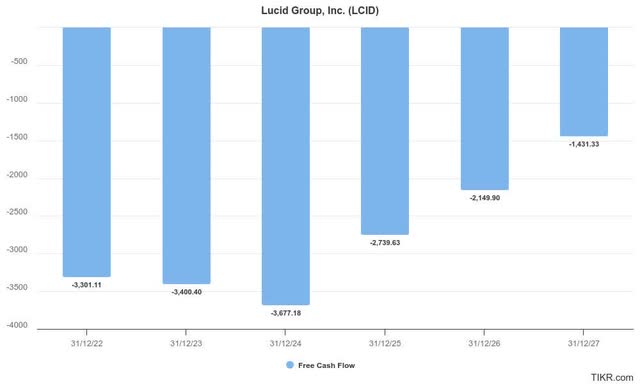

Lucid free cash flow estimates (TIKR)

As seen above, Lucid is still expected to post negative free cash flow through the 2027 forecast period. With a projected cash outflow of almost $10B through FY2027, Lucid’s current $5B liquidity isn’t enough to sustain its cash flow requirements.

Lucid management has highlighted that its liquidity is sufficient to “support the company through the start of the Gravity SUV production and into Q2 2025.” However, Lucid’s sub-scale production has also hampered its capabilities to move closer to FCF profitability.

The PIF has committed to a 100K vehicle purchase (over ten years) to demonstrate its conviction in Lucid’s thesis. However, the PIF isn’t considered a highly skilled, experienced auto manufacturer like Volkswagen. The Saudi PIF is a sovereign wealth fund that has diversified its bets across renewable energy and EV transition opportunities. Hence, I view the strategic commitment of Lucid-PIF as less critical to the PIF’s success than Volkswagen’s assessed benefits from leveraging Rivian’s EV tech stack.

Is LCID Stock A Buy, Sell, Or Hold?

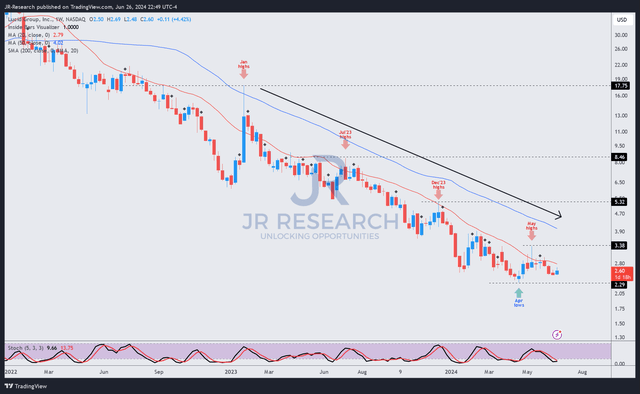

LCID price chart (weekly, medium-term) (TradingView)

LCID’s downtrend bias isn’t hard for even a novice price action investor to assess. The more significant challenges are timing the potential turning points, capital allocation, and risk management. However, the trend bias is clear, and it’s down.

Can LCID turn it around? Given the challenging macro environment afflicting the EV leaders, Lucid’s opportunities could narrow further. In addition, legacy OEMs could further bolster their EV transition efforts by forging tech partnerships with fledgling EV makers. Therefore, Lucid’s supposed tech advantage could also be narrowed further. In addition, the narrower market definition of Lucid’s offerings within the luxury EV space could see more intense challenges as luxury legacy OEMs up the ante across the US.

With LCID still not priced at a steep discount and not expected to be profitable in the next few years, I don’t see how Lucid can turn it around.

Investors should consider leveraging the recent enthusiasm spurred by the Volkswagen-Rivian JV to cut more exposure.

Rating: Maintain Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!