Summary:

- Lucid’s Q2 revenues of just over $150 million missed street expectations of $205 million, marking the company’s third consecutive quarter of missing revenue targets.

- The company’s operating loss surged almost $280 million year over year to nearly $838 million in Q2 2023.

- Lucid burned over $904 million in the period, forcing the company to raise another $3 billion in capital.

Justin Sullivan

After the bell on Monday, we got second quarter results from Lucid (NASDAQ:LCID). The luxury electric vehicle maker has been one of the most disappointing growth companies in recent years, failing to hit both production and sales targets. The latest report showed more of the same issues, further cementing the major troubles this company is facing in my view. With the stock jumping on Tuesday, selling into strength could be the best idea here.

In my previous time covering Lucid, my main issue with the company has been its ability to grow its deliveries and revenues as it had previously hoped. When the name was going public through a SPAC a few years back, management was calling for over $5.5 billion in revenues for 2023 as seen in the graphic below. A year ago, street analysts were starting to really doubt that number, with their average revenue estimate being around $3 billion. That pessimism has only continued to increase, as going into Monday’s report, the street was looking for less than $1 billion this year, and Lucid’s guidance called for deliveries to be about 20% of this previous expectation.

Lucid SPAC Figures (Company Presentation)

For Q2, Lucid had already announced essentially flat deliveries on a sequential basis. While analysts were quick to cut their revenue estimates, I think they didn’t do enough on that key metric. Lucid’s second quarter revenues came in just over $150 million, handily missing street expectations for $205 million. This is the third straight quarter where the company missed on the top line, and its sixth miss in the last eight fiscal periods. Don’t forget, Lucid’s guidance for last year was originally 20,000 units, and that was cut multiple times.

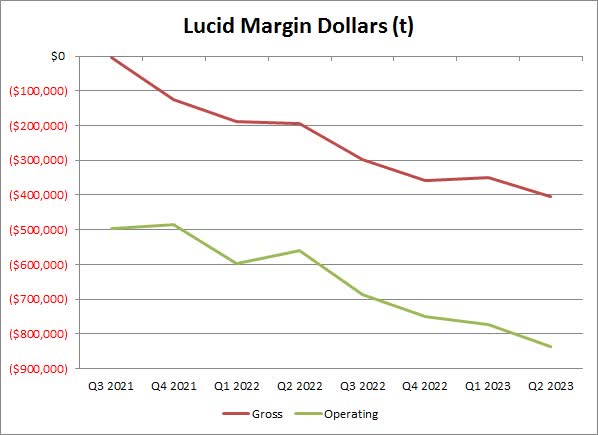

While sales have always been a struggle for Lucid, costs have always been the bigger problem. As the chart below shows, margin dollars on both a gross and operating basis continue to get weaker by the quarter, with the operating loss surging almost $280 million year over year to nearly $838 million in Q2 2023. The company’s net loss was a little less overall for Q2, only because of more interest income thanks to another dilutive equity offering as well as a reduction in the company’s common stock warrant liability due to the continued decline in share price.

Lucid Quarterly Margin Dollars (Company Earnings Reports)

These significant ongoing losses have led to a massive amount of cash burn in recent years. Lucid burned over $904 million in the period, more than the year ago amount, forcing the company to raise another $3 billion in capital during the quarter. The company’s cash balance was up by over $2 billion sequentially to over $5.5 billion, but there are now over 2.28 billion shares outstanding, up from 1.65 billion just 18 months earlier. The Saudi Investment Fund continues to be a major backer here, and at some point might just give in and buy all of Lucid, but dilution will likely continue at a brisk pace for some time until the cash flow situation improves dramatically.

Lucid shares were up nearly 10% in Tuesday afternoon trading. That probably is a result of the company reiterating its production guidance for more than 10,000 vehicles this year. Unfortunately, we’ve come to the point where not cutting guidance further is considered a win. Over the weekend, Lucid cut pricing on most Air sedan variants, suggesting sales troubles are still ongoing, which will hurt margins in the near term. The other item to remember here is that Lucid had dropped in recent weeks going into this report. Shares went from $8.12 just before it announced its Q2 delivery disaster, to $6.41 by the end of Monday.

Until Lucid starts to show some major improvement, I will continue to rate the name a sell. With Tuesday’s rally to more than $7 a share, Lucid currently trades for more than 6.51 times currently expected 2024 revenues. That’s actually about a 5% premium now to EV leader Tesla (TSLA), which goes for 6.18 times its expected revenues for next year. I would feel a bit more confident in Tesla at these valuations given its decent profitability and cash flow, plus its diversification into energy and storage products a bit that reduce its EV sales reliance. I should note that the average price target on the street for Lucid is $8.22 currently, but that stood at nearly $30 just a year ago.

For me to upgrade Lucid to a hold, or perhaps even a buy, I need to see three items improve significantly. First, I would like to see deliveries more closely track production, as in the past twelve months, the company has built more than 4,100 vehicles above what it has delivered. Second, I need to see Lucid show some significant margin improvement. Operating losses of more than $3 billion in the past 12 months have been growing and this is not a sustainable business model. Finally, I need to see management show it can limit its cash burn to perhaps just a few hundred million per quarter, so investors are not constantly worried that another round of dilution is right around the quarter.

In the end, Lucid announced its full quarterly results on Monday, and the troubling story just continued. Revenue estimates fell well short of analysts’ estimates, while losses are increasing and dramatic cash burn continues. The company recently cut prices as it looks to get its unit sales growth going, but investors continue to be diluted significantly over time. Shares are currently less than two dollars away from their all-time low, a level that could easily be taken out when another round of disappointment comes, with history suggesting that could be just months away.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.