Summary:

- Lucid Motors reported better-than-expected sales and a narrowing of losses for the first quarter of 2024.

- However, the company continues to produce and deliver a very small amount of electric vehicles, falling far behind its initial outlook.

- The company’s stock classification remains at ‘Sell’ due to the unfavorable risk/reward relationship and ongoing financial losses.

hapabapa

Lucid Motors (NASDAQ:LCID) presented disappointing quarterly earnings for its 1Q24 on May 6, 2024 that triggered another huge stock drop. However, Lucid Motors had better-than-anticipated sales for the first quarter and reported a narrowing of losses.

With that being said, the company continues to produce and deliver only a very small amount of electric-vehicles that are trailing the initial outlook for Lucid Motors’ delivery potential by a mile.

Furthermore, the company is still losing a boatload of money. I think that the risk/reward relationship is not favorable at all anymore and my stock classification for Lucid Motors stays at ‘Sell’.

My Previous Rating

Lucid Motors guided for a total production of only 9,000 electric-vehicles earlier this year which was the main reason why I cautioned against an investment in the electric-vehicle company.

The company did see some robust delivery growth in the first quarter, but the overall production and delivery amount is disappointing. Together with the company’s weak 2024 production outlook, Lucid Motors will probably continue to face considerable business headwinds.

Better-Than-Expected Sales, Narrowing Losses, Reaffirmed Production Guidance For 2024

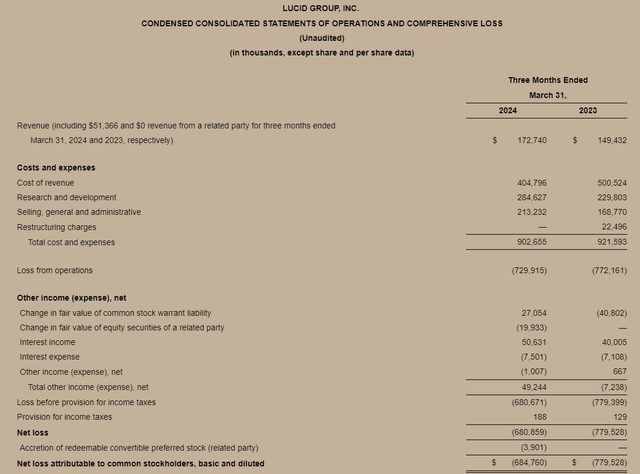

Lucid Motors’ sales for the first quarter amounted to $172.7 million, reflecting a YoY growth rate of 16%. The company’s 1Q24 sales came in ahead of the Street’s estimate of $157 million.

Lucid Motors’ operating loss also narrowed compared to the year-ago period, but remained sky-high at $729.9 million. So while the electric-vehicle company is seeing a bit of sales momentum, the company is still losing a lot of money per vehicle sold.

Because Lucid Motors overestimated demand for its electric-vehicles, the company continues to deliver only a small amount of EVs: in 1Q24 Lucid Motors delivered 1,967 vehicles, reflecting 40% YoY growth.

However, waning demand for electric-vehicles has broadly weighed on the sector and has resulted in a constant downward revisions of sales estimates for the EV company.

Lucid Motors also reaffirmed its production guidance for 2024, saying that it anticipates a full year production of 9,000 electric-vehicles.

Condensed Consolidated Statements Of Operations And Comprehensive Loss (Lucid Motors)

Solid Cash Position

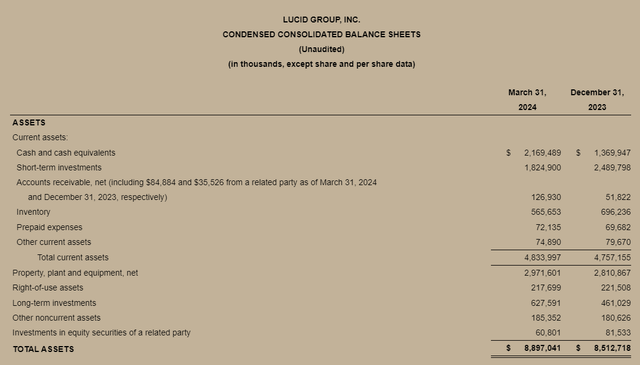

Lucid Motors may not deliver as many electric-vehicles as the market once hoped it could and the electric-vehicle company repeatedly under-performed its production estimates, but the company does sit on a lot of cash, which I think is a key competitive advantage for the EV company.

Lucid Motors had $2.2 billion in cash on its balance sheet as of March 31, 2024 which allows the EV company to potentially ride out any short-term sales weakness.

Furthermore, Lucid Motors could potentially tap its biggest sponsor, the Saudi Arabian Sovereign Wealth Fund, should it need another cash injection.

The company has said that it has enough cash at its disposal to ensure production of the Lucid Air as well as the Lucid Gravity. Specifically, management said that it anticipates its cash to last until 2Q25. Further equity offers and/or convertible bond offerings must therefore be expected.

Condensed Consolidated Balance Sheets (Lucid Motors)

Lucid Motors Is Cheap For A Reason

Of all the electric-vehicle companies in the U.S., Lucid Motors’ valuation multiple looks to me to be the most vulnerable. Lucid Motors is anticipated to produce $787.4 million in sales this year and $2.04 billion in the next. I think these estimates, particularly the 2025 estimates, are very optimistic in light of Lucid Motors’ poor overall growth and light forecast for 2024 deliveries. Lucid Motors’ sales estimates have reset lower in recent quarters, and the electric-vehicle company consistently disappointed.

I think that a $1.0-1.1 billion sales volume in 2025 is more realistic considering how low the delivery volume currently is. A 50% increase in YoY deliveries and an average sales price of $80K implies a $1.1 billion annual sales base, which is likely already a very optimistic assumption (implying a sales multiple of 5.7x).

Rivian Automotive Inc. (RIVN) is valued at 1.5x leading sales and the EV company is churning out a much higher annual production volume (more than 50K).

Taking into account Lucid Motors’ large operating losses, waning EV demand and low production volume, a more appropriate multiple may be 3x leading sales. In this case, Lucid Motors would have an intrinsic value in the vicinity of $1.50.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis May Not Pan Out

Lucid Motors has a shot of turning things around with the Lucid Gravity which is scheduled to go into production at the end of 2024, but I think the odds, given the present run-rate of deliveries, are against the electric-vehicle company in this regard.

Lucid Motors remains a highly-shorted EV stock as well and there is a chance that the stock will start to surge should the company narrow its losses further and report strong sales data.

With a short interest ratio of 29%, there is the possibility of a short squeeze that could negate many of the comments that I have made in this article against Lucid Motors.

My Conclusion

Though Lucid Motors beat sales estimates and narrowed its operating losses on a YoY basis, the delivery and production accomplishments are not particularly great.

Lucid Motors delivered only 1,967 vehicles in 1Q24 and the light (reaffirmed) production outlook for 2024 is likely to continue to weigh on the electric-vehicle company’s valuation in 2024. I also don’t see any major catalysts for Lucid Motors on the horizon.

Some may say that the production start of the Lucid Gravity may be such a catalyst, but I am not convinced as Lucid Air deliveries continue to disappoint and the company is already losing a boatload of money on its current production line configuration. Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.