Summary:

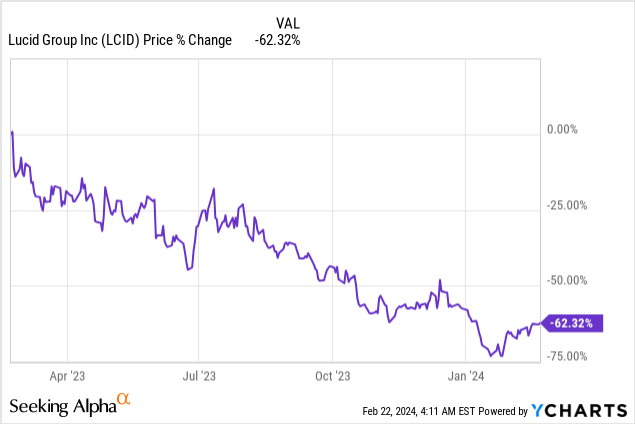

- Lucid Group’s Q4 revenues fell short of expectations and dropped 39% Y/Y due to weak demand for the company’s luxury electric vehicles.

- The company issued a very light production guidance for FY 2024, expecting only 7% growth year-over-year and a total production volume of only 9k EVs.

- Net losses are expanding as revenues are falling (in Q4) in a weaker-demand market.

- Lucid’s shares have no real catalysts, but significant downside risk should the current guidance also be down-graded.

Bloomberg/Bloomberg via Getty Images

Lucid Group (NASDAQ:LCID) submitted its earnings sheet for the fourth-quarter yesterday which fell short of top line average predictions and the outlook for the 2024 fiscal year, in terms of output volume, was a huge disappointment. In response to another week earnings report for the fourth quarter, shares of the EV maker slumped 8% in extended trading on Wednesday and I expect more downside pressure in today’s regular trading session.

Concerns over weaker demand for electric vehicles have led Lucid to expect only a 9k production volume in FY 2024 and the company’s net losses are expanding. Shares also don’t seem to have a real catalyst (maybe with the exception of the Gravity SUV production launch this year) which means Lucid may very well be dead money in 2024!

Previous rating

I rated Lucid a sell in November — Enough Is Enough — after the company’s third-quarter earnings report disappointed, the electric vehicle firm reported a weakening margin trend and gutted its production outlook again to 8,000-8,500 EVs. With the outlook for the 2024 fiscal year also being very light, I believe investors are going to see more downside pressure on Lucid’s revenue multiplier in the near future.

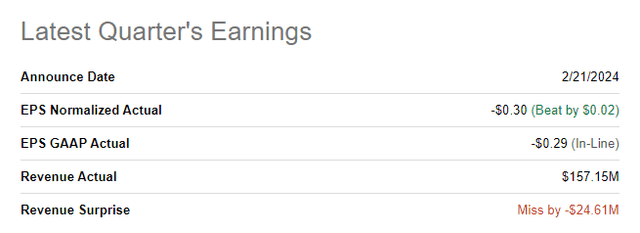

Lucid fails to impress: Misses big on revenues for Q4

Lucid reported $157.2M in revenues for the fourth-quarter, which was almost $25M short of the average revenue prediction. Revenues declined a massive 39% drop year-over-year chiefly due to softening demand for the firm’s electric vehicle products. The EV maker continued to make losses in the fourth-quarter, as expected, resulting in a per-share adjusted loss of $0.30 which was slightly better than the consensus expectation.

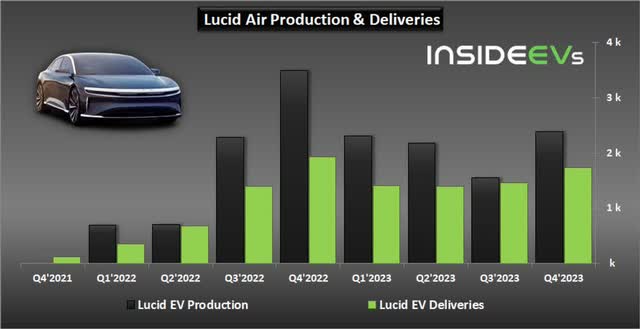

Production accomplishments in FY 2023

Including a Q4 production volume of 2,391 EVs, Lucid produced a total of 8,428 electric vehicles in FY 2023, showing 17% year-over-year growth. Lucid’s actual production results came in at the top end of Lucid’s revised guidance for FY 2023 (8,000-8,500 EVs).

During the same time period, Lucid made total customer deliveries of 6,001 electric vehicles, implying a Y/Y growth rate of 37%. Lucid has stopped reporting reservation numbers in FY 2023, however, a decision that I criticized in the past because it stokes fears about a weakening reservation/demand situation for the luxury EV maker.

The production and delivery growth trend for Lucid is not satisfying and unless Lucid sees a reversal in production, I believe the company’s shares are going to have a very hard time revaluing higher in FY 2024.

The real take-away from Lucid’s earnings release for the fourth-quarter on Wednesday was that the company guided for a production volume of only 9k in FY 2024 which implies a dismal year-over-year production growth rate of 7%. This comes at the heel of Lucid cutting its production guidance numerous times in the last two years, lowering investors’ confidence threshold and weighing heavily on the company’s market valuation.

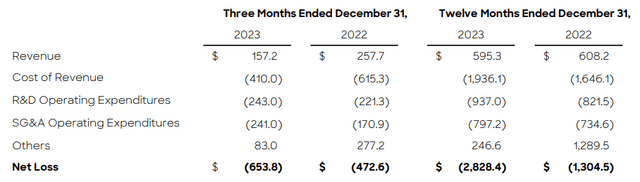

Lucid continues to see expanding losses

Falling revenues at a time when the EV company ramped up its production led to a predictable result: a massive increase in net losses for Lucid. In Q4’23, Lucid’s net loss, relative to the year-earlier period, increased 38% to $653.8M while full-year losses expanded to $2.83B (+117% Y/Y). These losses are here to stay, in my opinion, and investors better don’t expect a major change in Lucid’s profitability profile.

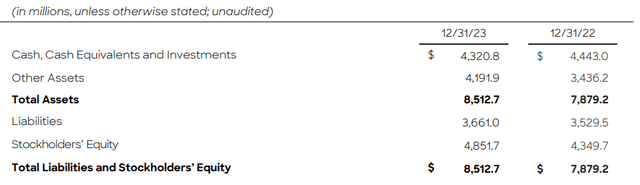

Expanding net losses at a time when demand is softening is obviously a big problem for EV companies. Lucid, however, has a relatively solid balance sheet and $4.3B in cash piled on it… which I consider to be redeeming quality. The $4.3B in cash gives the company a liquidity run-way of approximately 4-5 quarters, based off of $915M in average quarterly operating expenditures that were incurred in FY 2023. I do expect Lucid to raise additional capital in FY 2024, however, either through an equity raise or a new debt offering in the second half of the year, especially because its liquidity needs are set to increase with the planned Gravity SUV production start later this year.

Expectations for FY 2024

Lucid is in a challenging situation as it ramps up its production for its Lucid Air EV model just at a time when the market began to show demand weakness. There are a number of catalysts, however, that could drive the company’s valuation multiple higher in 2024:

- Lucid is set to start production of the Gravity sport utility vehicle, its latest EV product, in late 2024 which may help improve investor sentiment toward the EV company

- The EV company may have to turn to headcount reductions again in order to account for softening demand for its luxury EV products and cut operating expenditures. Lucid cut its headcount 18% last year and may focus more on cost-cuts in FY 2024 than on growing production volumes

- Considering that Lucid cut its EV production goal three times in the last two years, investors unfortunately don’t have a lot of confidence in the EV maker’s production guidance. If Lucid were to see strong demand for its Gravity SUV and if the EV maker were to avoid yet another guidance cut, then I could see a scenario in which investor confidence returns in FY 2024

- Lucid is highly shorted with a short interest ratio of 31% (based off of float). Any positive news with regard to Lucid’s production, revenue and demand situation could trigger a short squeeze.

Lucid’s valuation

Lucid’s shares are still relatively expensive considering how often the EV maker disappointed in the last two years. Lucid repeatedly cut its production outlook, in part due to logistics challenges that were born out of the COVID-19 pandemic, but also because the demand profile for the company’s electric vehicles was not as strong as initially predicted (resulting in the company no longer reporting reservation numbers for its Lucid Air EV as well its numerous higher-price models such as the Lucid Air Grand Touring).

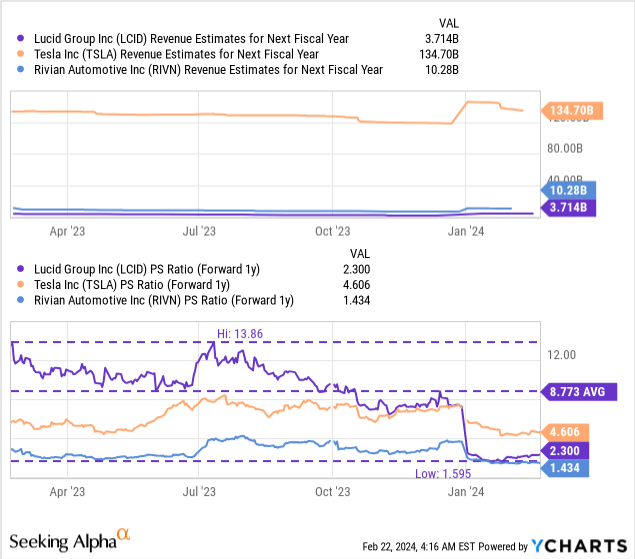

Shares of Lucid are currently trading at a P/S ratio — which I use because the company is not yet generating positive net income — of 2.3X which makes the EV company more expensive than Rivian Automotive (RIVN), but cheaper than industry leader Tesla (TSLA). In my opinion, Rivian currently represents the deepest value in the large-cap EV market due to its solid growth in production in FY 2023 as well as significant expansion in its revenue base. Tesla needs no introduction and the company’s biggest advantage is that it is already producing and delivering millions of electric vehicles to customers around the world. Tesla is also already profitable and has convinced investors with its growth story for a long time, resulting in a market-leading P/S ratio of 4.6X.

Lucid is trading significantly below its 1-year average P/S ratio — implying a 74% discount — which is a reflection of the market growing more skeptical about the company’s revenue growth prospects in a softer EV market. My fair value estimate of $3.50 per-share has not changed since my last coverage and neither did my sell rating. Considering that the production outlook as well as the revenue trajectory in Q4’23 deeply disappointed, I believe the risk profile remains skewed to the downside.

Risks with Lucid

The biggest commercial risks with Lucid, as I see it, relate to the demand profile, the revenue trend as well as expanding net losses as discussed in this article. The EV maker is not selling nearly as many electric vehicles as I thought it could in 2023 (20-30k) which in turn is delaying the profitability timeline and is leading to an unfavorable business setup. I am carefully going to monitor the company’s production growth, revenue trajectory and how well the company executes against its production target in FY 2024. Right now, not owning Lucid may be the best decision.

Final thoughts

The combination of a light FY 2024 production outlook with softening demand for new electric vehicles and expanding losses paints a challenging picture, not just for Lucid, but for the entire electric vehicle sector. Lucid’s Q4 revenue miss was also quite significant, indicating that analysts are going to upgrade their top line estimates in the near future… which may add to growing valuation pressure for Lucid’s shares. Investors at this point have no reason to own shares of Lucid, in my opinion, and I believe that the risk profile remains highly unattractive with the current production guidance for FY 2024 in place!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.