Summary:

- Lucid Motors reported disappointing financial results, with a quarterly revenue miss and an operating loss of nearly $730 million.

- The company’s cash burn remains a major problem, despite another recent capital raise.

- Lucid’s valuation is still too high compared to its industry peers, even with major projected growth through 2025.

Khosrork

After the bell on Monday, May 6th, we received first quarter results from Lucid Group, Inc. (NASDAQ:LCID). The luxury EV maker has been one of the most disappointing names in this space in recent years, losing tons of money and burning through plenty of cash. While there were some small incremental positives in this week’s report, the company remains in a perilous financial situation that’s not likely to reward investors anytime soon.

My continued bearishness on the name:

I’ve had a sell rating on Lucid shares for almost two years now, going back to when the stock was over $18 a share. I’ve continued to discuss multiple disappointments when it came to the growth story, as Lucid still hasn’t gotten even halfway to the 20,000 units of Air sedan yearly production it originally called for in 2022. Management has been a bit more realistic in terms of its forecasts in recent periods, but that hasn’t stopped shares from plunging roughly 85% since I went bearish, while US markets are up quite a bit overall.

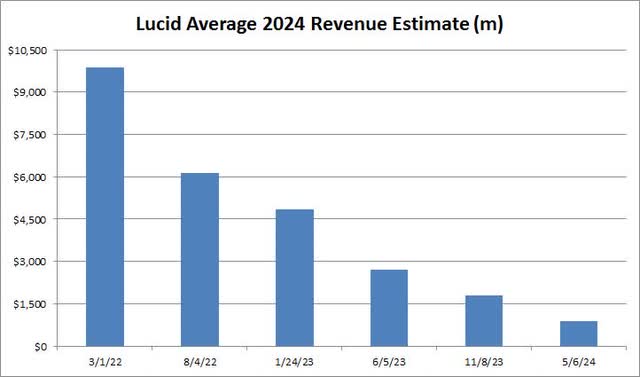

Lucid shares had actually held up fairly well in recent months before Monday’s report, being up every so slightly since I covered the company’s Q4 report, although that still trailed the S&P 500’s small gain since. Back in February, I continued to worry about the large revenue estimate cuts we’ve seen, a trend detailed in the chart below, plus Lucid’s inability to significantly reduce its losses or cash burn. As a reminder, when the company was preparing to go public through a SPAC a few years back, management was hoping for 90,000 vehicle deliveries this year. Total production guidance now for 2024 is for just 10% of that.

Lucid 2024 Revenue Estimates (Seeking Alpha)

The Q1 report:

Lucid set a quarterly record with 1,967 Air sedans delivered in Q1, and that number actually outpaced production for once. This did not lead to a revenue record for the company, however, as it has been delivering cheaper variants of its flagship product. For the quarter, Lucid reported revenues of almost $173 million. While this number was up more than 15% over the prior year period, it still missed street estimates by almost $10 million. Despite all those analyst estimate cuts I showed above, this was the sixth straight quarterly revenue miss, and the ninth miss in eleven quarters since going public.

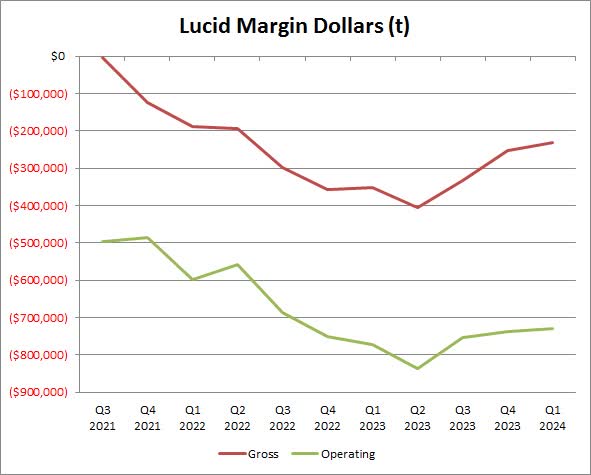

Perhaps the one bright spot in this report was that Lucid improved its vehicle cost structure, even if just slightly. As the chart below shows, gross margin losses came in at their lowest point since Q2 2022, and it actually was the best gross margin percentage in the 11 reported quarters that we’ve seen. Unfortunately, most of that progress was wiped out on the operating line, so the total operating loss, even though it improved sequentially, still came in at nearly $730 million.

Lucid Key Margins (Company Earnings Reports)

On the bottom line, Lucid is still running at a more than $2.7 billion annual loss pace. The net loss did improve from the year ago period, although some of that was due to other income items below the operating line. I’ll be curious to see if we see any major progress on the margin front during the remainder of 2024. With management reiterating guidance for 9,000 units of production, delivery volumes should be higher in remaining quarters. The key question will be does Lucid needs more price cuts to sell that much volume.

Cash burn still a major problem:

With large losses ongoing, Lucid’s biggest issue has been cash flow. The company has had to hit the debt and equity markets multiple times since going public to stay afloat. The latest of those raises came in Q1, with Lucid getting another $1.0 billion via a private placement to an affiliate of the Saudi Public Investment Fund (“PIF”), its biggest supporter to date.

Unfortunately, those funds were almost completely erased in Q1 alone. Like the margin picture, there was some sequential improvement, but cash burn was nearly $715 million for the period. Capital expenditures were less than $200 million in the first quarter, but management’s earnings presentation shows yearly guidance of $1.5 billion. The current plan says the business has enough cash to get through the production start of the Gravity SUV later this year and into the second quarter of 2025. Lucid had $4.62 billion in cash at the end of March against $2 billion in debt, but this balance sheet needs more help, so another capital raise this year wouldn’t surprise me.

Valuation still way too high:

Normally, the large losses and cash burn alone would probably lead me to continue keeping my sell rating on the stock. However, the thing that really clinches it for me is Lucid’s valuation. Because Lucid, along with a number of other EV players, is not profitable, the best valuation metric to look at is price-to-sales. Going into Monday’s report, Lucid went for more than 2.7 times its 2025 expected sales, and that was with analysts calling for revenues to surge more than 50% this year and another 162% next year.

Unfortunately, as the chart below shows, this valuation doesn’t really seem warranted given the company’s financial picture. The only other name with a 2025 price-to-sales ratio that’s even above 1.5 times is Tesla, Inc. (TSLA), and that name is at least profitable and has a very healthy balance sheet. If we look at other lower volume EV names that are unprofitable, like Rivian Automotive, Inc. (RIVN) and Polestar Automotive Holding UK PLC (PSNY), the numbers drop even more. Chinese players like NIO Inc. (NIO) and BYD Company Limited (OTCPK:BYDDY) (OTCPK:BYDDF) both go for less than one times their estimated 2025 revenues, and established automakers like Ford Motor Company (F) and General Motors Company (GM) go for less than 0.3 times.

2025 Price to Sales (Seeking Alpha)

Lucid might be projected to show a higher revenue growth percentage in the short term than some of these others, but it also has much worse margins and cash burn. We’ve also seen revenue estimates come down significantly over the years, so it’s no guarantee that Lucid will even hit the sales bar that analysts currently expect for next year. With another capital raise likely needed in the next 9-15 months, it’s hard to argue that I should upgrade to a hold rating on this stock until the valuation comes down towards some of its peers.

Until management proves that this can be a viable long-term business, it appears that the only major hope the bulls have is that the Saudi Investment fund just buys out what it doesn’t already own. However, I don’t see that likely right now because they could easily wait for shares to drop further to get the rest of Lucid at a much lower price. A short squeeze could be possible at some point if there is any really good news, since short interest is near all-time highs, but the latest report didn’t help with that respect.

Final thoughts and recommendation:

Ultimately, it was another downbeat quarter for Lucid. While there were some slight sequential margin improvements, revenues missed dramatically reduced estimates yet again. The company is still losing a tremendous amount of money and burning through a lot of cash on very small unit volumes. The Gravity SUV won’t be in production for another couple of quarters, and it likely won’t contribute much to overall revenues until some time in 2025.

With the company likely needing another capital raise in the next year, and a price-to-sales valuation that’s still well above many industry peers, Lucid remains a sell in my opinion. Shares were down about 8% in Monday’s after-hours session, but that still left them more than 50 cents above their all-time low. That low of $2.29 that could be easily seen again this year if we don’t see some significant financial improvement in the coming quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.