Summary:

- Lucid Group, Inc. delivered 1,404 vehicles in Q2, missing street estimates by almost 475 units and marking a sequential decline from Q1.

- The company’s production has outpaced deliveries by over 4,100 vehicles in the past year, indicating potential sales issues and negatively affecting operating cash flow.

- Analysts have significantly reduced revenue estimates for Lucid, with the company unlikely to meet its forecast of over $5.5 billion for 2023 revenues.

Khosrork/iStock Editorial via Getty Images

When we look at the electric vehicle (“EV”) race that has developed over the last couple of years, perhaps the big name that has disappointed the most is Lucid Group, Inc. (NASDAQ:LCID). The luxury vehicle maker has continued to cut guidance and fall short of analyst estimates, while large losses and cash burn have led to significant dilution. Wednesday morning, the company announced its Q2 production and delivery figures, and the troubling story continued.

Not The Growth Story Investors Wanted

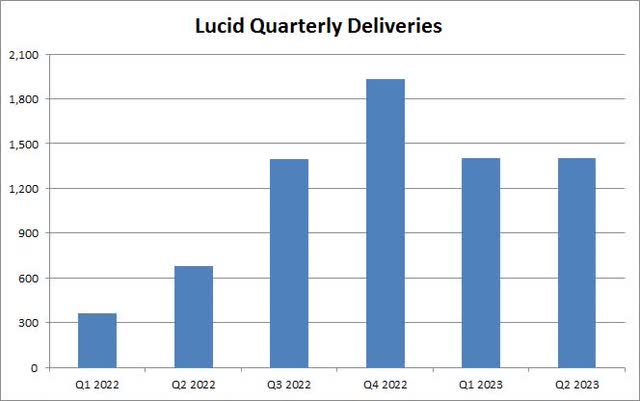

For the second quarter, Lucid delivered 1,404 vehicles. This was more than double what the company did in the prior year period, but it’s actually a sequential decline of two vehicles from Q1, and it missed street estimates by almost 475 units. As the press release notes, the company has begun material shipments to the Kingdom of Saudi Arabia, so it’s possible that in-transit vehicles were up a bit. As the chart below shows, however, this is not exactly the growth story investors were buying into.

Lucid Quarterly Deliveries (Company News Releases)

In the last twelve months, Lucid has delivered a total of 6,140 vehicles. This was a company that two years ago people thought would do roughly triple that in 2022. Perhaps worse yet, production has outpaced deliveries by over 4,100 vehicles in the past four quarters. That not only says there might be some serious sales issues here, but it can be a major headwind to operating cash flow as inventory builds. If these delivery numbers don’t start improving significantly in the next few months, Lucid may need to cut pricing a bit to get demand to where it needs to be.

If Lucid was reporting full Q2 results today, there likely would have been a dramatic revenue miss. With deliveries basically flat on a sequential basis, there probably won’t be a major revenue difference from Q1, especially if more lower-priced Air variants were delivered. However, analysts were expecting revenues to soar from just under $150 million in Q1 to over $233 million in Q2. The street will likely be cutting its numbers quite a bit between now and the company’s August 7th report.

Not Just A One-Time Issue

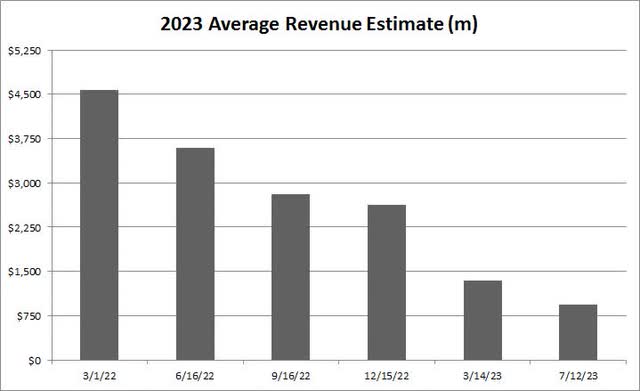

If this was just a one-time issue, investors might have just shrugged it off. However, this is an ongoing pattern of more and more disappointment for Lucid. As the chart below shows, analyst revenue estimates for this year have been reduced quite dramatically since early 2022, sitting below $1 billion going into this Q2 delivery disappointment. As a reminder, Lucid management forecast over $5.5 billion in its SPAC presentation for 2023 revenues, but it is quite obvious that the company won’t come anywhere near that.

2023 Average Revenue Estimate (Seeking Alpha)

With the ongoing cut in revenue estimates, we’ve seen analysts cut their price targets as well. A year ago, the street saw the name worth nearly $30 a share, but that figure was down to $8.38 going into Wednesday. It would not surprise me to see the average target on the street have a 7 handle in the coming weeks, although it may take until after earnings to get enough price target changes to get to that point.

The only good news for Lucid currently is that it has a balance sheet that can support this major sales trouble. The Saudi Investment Fund, the majority owner of Lucid, has continued to be a major backer of Lucid, taking part in the latest major capital raise for the firm. These funds will allow the company to get through 2023 and launch its next vehicle in the coming quarters, but more capital could eventually be needed if results don’t improve soon. It remains a possibility that eventually shares get low enough that the Saudis just buy the rest of the company that they don’t already own, taking the company private.

Until Lucid gets its act together, I will continue to rate the name a sell. While the stock had recently jumped amidst a rally in a number of electric vehicle stocks, shares are down about 10% in early Wednesday trading. It will take quite a bit of improvement for me to upgrade this name to a hold. I just cannot justify paying roughly the same price to sales multiple (on 2024 expected revenue) for Lucid as Tesla (TSLA) when the EV giant is expected to have well over 2 million vehicles sold next year, along with the potential for some decent profits and positive free cash flow. Tesla recently announced a record quarterly figure for deliveries, with the biggest upside surprise being its luxury Model S and X vehicles. The Model S is a direct competitor to the Lucid Air.

Conclusion

In the end, Lucid announced another major disappointment on Wednesday. Q2 deliveries came in well short of street estimates, and actually showed a sequential decline. Production continues to outpace deliveries, which isn’t good for cash flow, and revenue estimates will keep coming down. I continue to believe that the public trading low of $5.46 could be tested later this year or early in 2024 as the company continues to miss growth targets, report large losses, and burn through substantial amounts of cash.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.