Summary:

- Lucid Group fell short of Q2 delivery estimates, raising concerns about its demand situation.

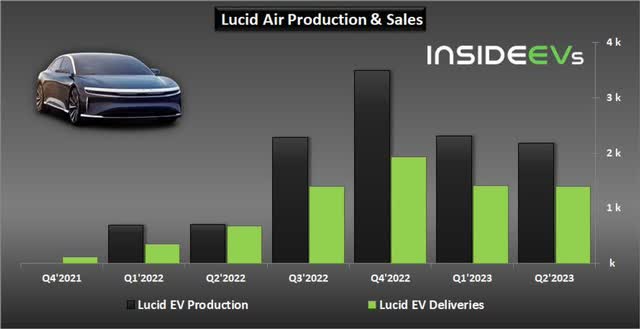

- The company produced 2,173 electric vehicles in Q2 and delivered 1,404 electric vehicles, falling short of the expected delivery volume of 2,000 EVs.

- Although Lucid has a strong balance sheet and lots of cash, the Q/Q drop in production and flat delivery growth indicate growing risks to the company’s FY 2023 production target.

- Revenue downside revisions could further add pressure on Lucid’s valuation.

jetcityimage

Lucid Group (NASDAQ:LCID), unfortunately, delivered a disappointing delivery card for the second-quarter yesterday (July 12) that calls into doubt the EV company’s full-year guidance, in my opinion. Lucid fell widely short of Q2 delivery estimates and actually saw a quarter over quarter production decline. Lucid only recently announced that it was raising $3.0B in new funds to finance its production ramp and international expansion, but the latest delivery card strongly suggests that Lucid may not see as strong demand for its EV products as initially assumed. Since yet another guidance revision has become more likely after the Q2 delivery report, I am downgrading Lucid from hold to sell!

Another delivery disappointment

After Lucid said that it was going to enter the Chinese EV market last month, I maintained a hold rating on the EV company and its shares. Considering the latest development, however, I have turned more bearish.

Lucid’s delivery accomplishments in the second-quarter were highly disappointing. The electric vehicle company said in a delivery update on Wednesday that it produced 2,173 electric vehicles in the second-quarter and delivered 1,404 electric vehicles. The delivery achievement fell widely short of analysts’ expectations, which called for a delivery volume of 2,000 EVs in Q2’23. Lucid’s production volume for the second-quarter actually declined 6% compared to the first-quarter, while the total delivery volume remained practically unchanged quarter over quarter.

Lucid produced 2,314 electric vehicles in the first-quarter, meaning the year-to-date production total currently stands at 4,487 which is less than half of Lucid’s 10 thousand EV production goal. With Lucid producing just about 45% of its lowered production goal after six months, despite having no funding issues, I believe demand for Lucid’s electric vehicles may not be as strong as the market previously thought it was.

Lucid guided, initially, for a 10-14 thousand electric vehicle production volume for the current fiscal year, but the company has softened its outlook when it submitted its first-quarter earnings: Lucid then said it was looking to just deliver “more than 10 thousand” electric vehicles in FY 2023. The soft downgrade already raised some concerns that electric vehicle demand may not be as resilient as initially assumed. Price cuts as well as high inflation and expanding product line-ups have weighed on the EV industry and make it harder for electric vehicle companies to achieve sales.

Lucid also recently announced a strategic technology partnership with Aston Martin, which will see Lucid sell powertrain components and battery systems to the British company, and take a 3.7% stake in the brand. However, I believe the consistent problems with the firm’s production ramp outweigh the benefits of an investment in Lucid.

Lucid’s valuation relative to other U.S.-based electric vehicle companies

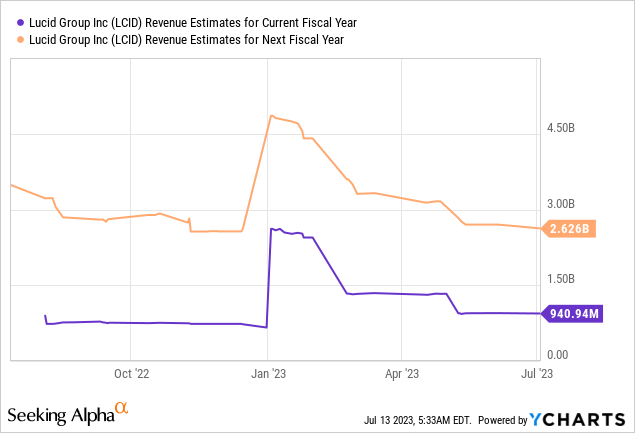

As a result of Lucid’s Q2 delivery update, shares of the EV maker slumped 12% on Wednesday and the company’s disclosure created a significant amount of new negative sentiment overhang. With production ramping up much slower than projected, I also expect analysts to downgrade their revenue estimates for the electric vehicle company… which could be a negative catalyst in itself.

Analysts currently expect Lucid’s revenues to grow to $2.63B in FY 2024, but the revision trend for the EV company has been very negative after a series of production estimate revisions in FY 2022 and this year. The delivery report for Q2’23 will likely lead to further revenue estimate downside revisions, which I would expect to weigh on Lucid’s valuation as well.

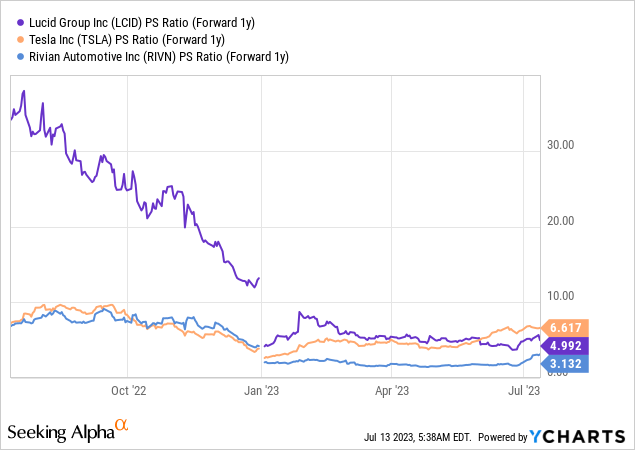

Shares of Lucid are currently valued at a price-to-revenue ratio of 5.0X (based off of FY 2024 top line estimates) which still makes Lucid one of the most expensive U.S.-based electric vehicle companies in the market. Lucid is also not expected to be profitable until FY 2027 and a potential delay in profitability, due to slowing delivery growth, is likely to be a negative catalyst for shares as well.

Lucid’s risk profile

Lucid did raise $3.0B from investors recently that included Saudi Arabia’s sovereign wealth fund and the company had approximately $3.0B of cash on its balance sheet at the end of Q1’23 (cash/cash equivalents as well as short term investments) that should ensure that company has enough liquidity to finance the ramp of the Lucid Air sedan until next year. However, I believe Lucid’s delivery numbers for Q2’23 have raised the risk that the company may have to lower its production outlook for FY 2023 again, if demand falters. Since Lucid already downgraded its production outlook twice in FY 2022 and once in FY 2023, I believe such an event would seriously hurt the company’s shares.

Closing thoughts

Lucid delivered yet again another massive disappointment when it comes to the company’s deliveries, and it was the final straw for me: I sold. Although I like Lucid’s product portfolio, strong balance sheet and international expansion plans, I just can no longer ignore that Lucid keeps disappointed on the delivery front. The most recent delivery report also strongly suggests, in my opinion, that Lucid is seeing weakening demand and that the high number of reservations is not necessarily translating into product sales.

A potential negative catalyst is that analysts are set to revise their revenue estimates to the downside, which could put further pressure on the EV maker’s valuation. As the risk profile has clearly deteriorated, my patience has also been exhausted. For those reasons, I am rating Lucid a sell!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.