Summary:

- Lucid Group cuts production forecast for FY 2023, indicating waning demand and potential revenue downward revisions.

- Revenues for Q3’23 came in well below expectations as EV demand wanes.

- Lucid now expects a production volume of 8,000-8,500 EVs in FY 2023, marking an up to 20% decline from its previous low-case guidance.

- Analysts will likely lower their top-line forecasts for Lucid, leading to growing selling pressure and a negative outlook for Lucid’s shares.

Khosrork

Lucid Group (NASDAQ:LCID) just cut its production forecast for FY 2023 again which is a clear sign that the EV firm is poised for a new round of estimate downward revisions. The bombshell was not received well as shares dropped 6% in pre-market trading.

The second guidance cut this year is a bitter pill to swallow for Lucid investors as was the fact that Lucid’s revenues came in well below expectations in Q3’23. With a lowered production forecast and continual revenue/margin challenges, it will be very hard for the shares of Lucid to revalue higher. I don’t believe investors, at the current time, have any reason to own shares of the EV company and I would expect growing selling pressure as analysts are lowering their top-line forecasts after the Q3’23 report. I have had enough and I rate Lucid a sell!

Previous rating

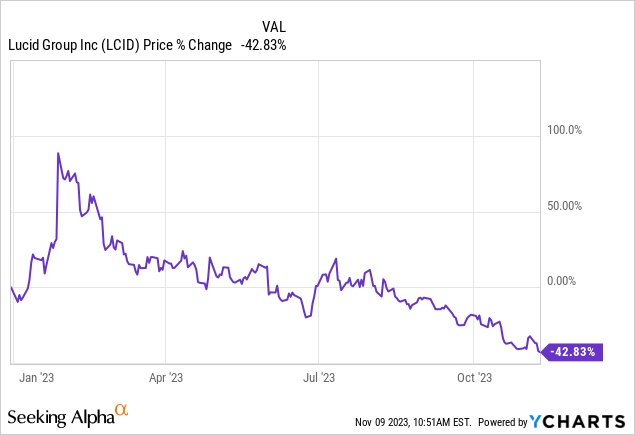

I rated Lucid a hold previously due to the risk of a potential guidance cut as well as the launch of a low-priced version of the Lucid Air which posed margin headwinds for the electric vehicle company. The last guidance cut is a seriously alarming negative development for the EV company and I am downgrading to sell as my patience is exhausted. Since my hold rating from October 9, 2023, Lucid’s share price declined 21%.

Disappointing revenue performance, expanding losses

Lucid has sent many signals in the last year that the production and demand situation was deteriorating. Lucid drastically cut prices of the Lucid Air Pure in August, the firm launched a lower-price EV model, it stopped reporting reservation numbers and Lucid just announced a number of time-limited price cuts for its EV product line-up ahead of the holidays.

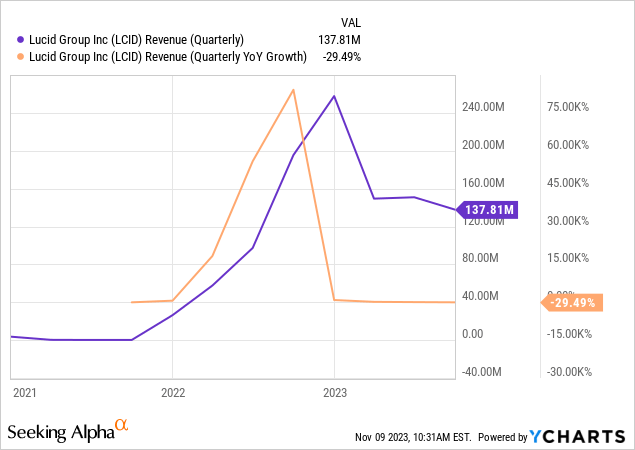

Another sign that the demand situation is not as great as many investors have thought is that Lucid recorded just $137.8M in revenues for the third quarter… which was well below the Street estimate of $183.8M. Year over year, Lucid’s revenues declined 30% Y/Y in Q3’23 while Rivian Automotive (RIVN)’s revenues increased 149% Y/Y.

Lucid’s revenues initially soared, but the company has clearly not been able to sustain this revenue momentum… waning EV demand, pressure on pricing as well and logistical challenges last year have weighed on Lucid’s ability to ramp up its production and deliveries. In other words, the market has been way too optimistic about Lucid’s production and revenue growth. The company’s share price development reflects these trends, unfortunately.

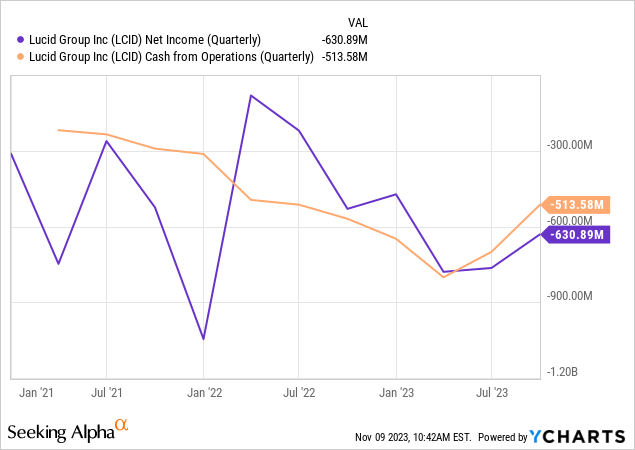

Lucid reported a total net loss of $630.9M, an expansion of 19% compared to the year-earlier period. In other words, while Lucid is underperforming revenue expectations by a large margin and guiding for a lower production volume this year, the EV company is also disclosing expanding losses.

Lucid, as a start-up, obviously should not be expected to generate profits. The firm this year raised $3.0B in capital from investors but still has a very high cash burn… which could make it likely that Lucid will have to raise capital again next year. Lucid, as of the end of September, $4.9B in cash.

Forward-looking commentary

Lucid has disappointed multiple times with its production outlook in FY 2022 and FY 2023 which has created a negative sentiment overhang. Therefore, investors may find it harder to trust management’s estimates about production numbers going forward. The release of the Gravity SUV could make a positive impact on investors (and investor sentiment) and I believe it makes sense for the company to broaden its EV product portfolio so that Lucid doesn’t just have to rely on its sedans to drive sales. The Gravity SUV is set to go into the production stage at the end of FY 2024.

Given Lucid’s cash burn, investors are likely going to see another capital raise next year which poses dilution risks. For the foreseeable future, however, Lucid should be expected to remain cash flow-negative while the firm’s production is likely to remain unimpressive.

Yet another guidance cut

Lucid cut its production guidance yesterday from a production volume of “more than 10 thousand” to a new range of 8,000-8,500, showing a decline of up to 20% at the lower end of guidance. This is an exceptionally large decrease and shows that the company is facing materially lower demand for its products than initially expected.

It also is not the first time that Lucid cut back on its production expectations. Lucid cut its guidance last year and initially guided for a 10-14 thousand production volume for FY 2023. The outlook was subsequently lowered to “more than 10 thousand” EVs in Q2’23. The sequential declines in guidance have done some serious damage, in my opinion, to investors’ confidence in management’s guidance, production or otherwise.

Lucid’s valuation, estimate downside revisions incoming, risk vs. reward

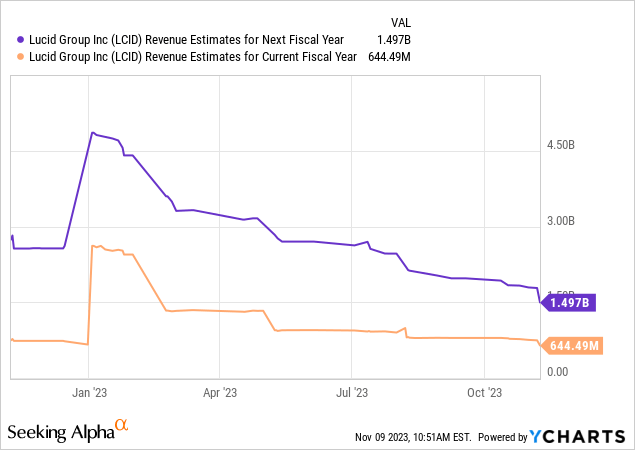

Lucid is set for a new round of top-line estimate corrections to the downside after the release of poor third-quarter earnings. The electric vehicle manufacturer is currently projected to generate revenues of $615M in FY 2023 (based off of consensus estimates, Lucid doesn’t give full-year top-line guidance). But with this earnings report and yet another cut to the production guidance, shares are at risk of performing badly in the short term, in my opinion.

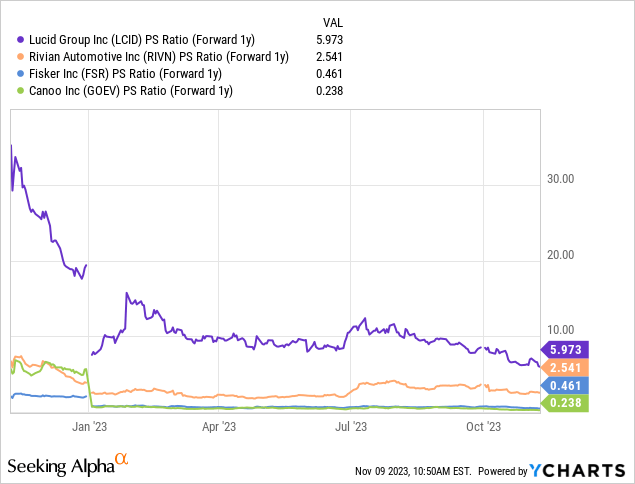

Shares of Lucid are currently valued at a price-to-revenue ratio of 5.9X which makes the EV company much more expensive than other EV start-ups and even more expensive than a company like Rivian Automotive (RIVN)… which has enormously strong production momentum. Lucid’s valuation multiplier is set for a serious correction following the earnings report and the risk profile greatly deteriorated.

I believe Lucid could trade, given its premium positioning in the market for luxury sedans and the firm’s growing EV product pipeline, at 5X revenues… which is a generous multiplier factor. Tesla has traded at an average P/S ratio of ~5X in the last year and although Lucid is no Tesla in terms of production output or profitability, the EV firm is expected to grow its top line materially faster than Tesla in the next five years.

Lucid is projected to generate (estimated) annual revenue growth of 81% between FY 2023 and FY 2028 while Tesla is expected to grow its top line by 22% annually on average. A 5X multiplier factor would give Lucid a fair value closer to $3.50 per share. However, Lucid’s fair value could rise rapidly if the company managed to get a grip on its revenue and production ramp.

Risks with Lucid

The biggest commercial risk for Lucid right now, as I see it, is possibly a significantly lower revenue trajectory going forward as waning electric vehicle demand bites. The gross margin situation could also be much more seriously affected as Lucid generates lower delivery and revenue growth. Estimate revisions could hurt Lucid’s shares as well as a delayed timeline for profitability.

On the other hand, stronger-than-expected revenue growth going forward could make investors miss out on upside revaluation gains, especially if the EV firm were to also report stronger delivery numbers. Lucid is set to unveil its new EV product, the Gravity SUV, which is slated for production in FY 2024. Strong reservation numbers (if they are released) could also help in changing investor sentiment for the better.

Closing thoughts

Enough is enough. Lucid disappoints in terms of production growth time and again. Lucid is in a tough situation now as EV demand is waning and the second production guidance cut this year clearly shows that there are few catalysts that could turn things around for the electric vehicle manufacturer.

In many ways, the Q3’23 earnings report was a bitter pill to swallow for investors. What irritated me the most was the steep drop in revenues for the third quarter which was utterly unexpected. Combined with the second downside revision of the FY 2023 production guidance, I believe the revenue situation is set to get much worse which should also lead to pressure on top-line estimates. There is now no reason to own Lucid and I am adjusting my rating to sell!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.