Summary:

- Lucid Group is raising $3B through an equity offering, with some shares being sold to Saudi Arabia’s sovereign wealth fund, the Public Investment Fund.

- The proceeds from the stock offering will be used for capital expenditures and working capital to finance the production ramp of Lucid’s first-ever production car.

- The capital offering may pose a short-term threat to the company’s valuation, as existing shareholders experience dilution due to the increase in outstanding shares.

David Becker

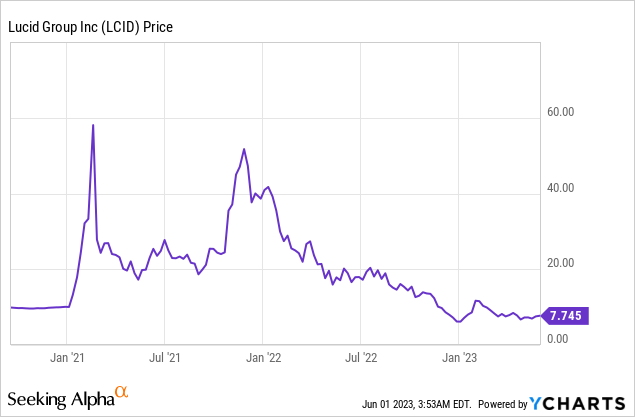

Lucid Group (NASDAQ:LCID) has suffered a material decline in its share price since reaching a high north of $60 in 2021. The market has grown increasingly concerned with the EV maker’s ramp of its first-ever production car in recent months… which partially relates to Lucid lowering its production forecast three times (twice in FY 2022 and once so far in FY 2023). On Wednesday, Lucid announced that it was doing another stock sale in order to finance the ramp of the Lucid Air and Saudi Arabia’s sovereign wealth fund is acquiring more shares in the EV start-up. The size of Lucid’s equity offering ($3B), however, is very large and poses a threat to the company’s valuation in the short term!

Saudi Arabia strikes again: A new stock sale in the amount of $3B

Lucid announced on May 31, 2023 that it was conducting another equity offering, this time in the amount of $3B, with shares being sold to the public as well as Saudi Arabia’s sovereign wealth fund, the Public Investment Fund.

Lucid said that it was pricing 173,544,948 shares of its common stock to the public in its latest stock offering which is expected to result in gross proceeds of $1.2B. Simultaneously, Lucid said that it entered into an agreement with an affiliate of Saudi Arabia’s Public Investment Fund, Ayar Third Investment Company, which states that PIF will acquire 265,693,703 shares of common stock from Lucid in a private placement for total proceeds of $1.8B.

Ayar Third Investment Company owns approximately 60% of Lucid and has participated in Lucid’s stock sales before. The $1.8B investment also represents approximately 60% of Lucid’s total equity offering so the Public Investment Fund sticks to its 60% investment in Lucid (maintains proportional ownership). Saudi Arabia is not only an investor in the electric vehicle start-up, however, but also signed an agreement that lays out terms for the delivery of up to 100 thousand electric vehicles over a ten-year period (the agreement between Lucid and Saudi Arabia included a 50 thousand initial EV purchase commitment plus the option for the delivery of another 50 thousand EVs).

Lucid has said that proceeds of the stock offering are going to be used for capital expenditures and working capital and Saudi Arabia will continue to finance the ramp of the EV maker’s production ramp which in previous quarters disappointed.

However, Lucid is not under any serious pressure to raise liquidity, as opposed to other EV manufacturers like Lordstown (RIDE). Lucid has an extremely solid balance sheet for a start-up and had $3.4B in cash available (+$700M in additional credit facilities) at the end of the first-quarter.

Lucid’s capital raise is not a small one: The EV maker currently has a market cap of $14.2B, meaning the $3.0B expected to be raised represent approximately 21% of the firm’s market value.

The event of a capital offering is usually a negative catalyst for a company’s share price because existing shareholders are getting diluted as more shares get issued… which is the reason why Lucid‘s shares dropped 5% after the equity offering was announced yesterday.

Long-term potential in the EV industry

Lucid didn’t exactly hit the ground running with the release of its Lucid Air electric vehicle. The ramp of the firm’s Lucid Air model was marked by production setbacks and disappointments that have been reflected in a large decline in the company’s share price.

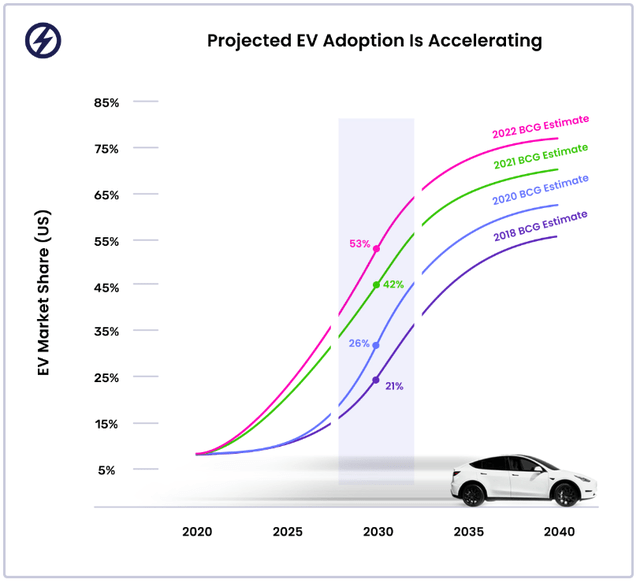

However, Lucid is still a relatively young start-up in the competitive EV space and, with EV adoption expected to rise strongly in the coming years as companies launch more products with larger ranges and at more attractive price points. Adoption of EVs is accelerating and, according to projections by Boston Consulting Group, electric vehicles are expected to achieve a more than 50% market share by 2030.

Source: www.recurrentauto.com

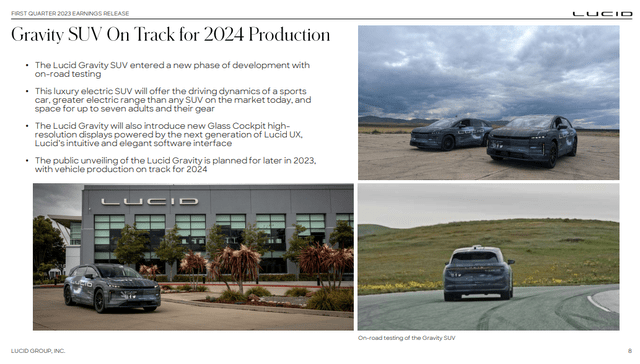

Lucid should therefore be seen as a long term bet on the EV market and not just as a rebound play related to the latest stock offering. Lucid is investing heavily into its production capacity (in Arizona and Saudi Arabia) and is set to launch a new EV product next year, the Gravity SUV… which will open up a new market segment for Lucid as well.

Source: Lucid

Lucid’s premium valuation

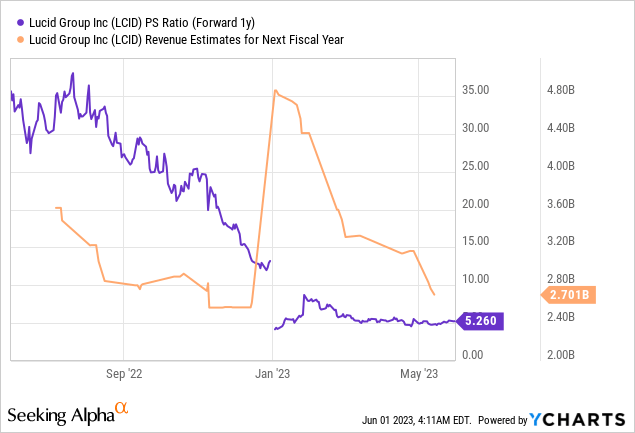

Despite a significant decline in the company’s market cap and valuation factor since 2021, Lucid is still highly valued based off of revenues… which is partially due to the raving reviews the firm’s first-ever production car, the Lucid Air, has received as well as to Lucid’s considerable capital strength. Lucid has one of the best balance sheets in the EV sector, largely because it has been backed by Saudi Arabia’s sovereign wealth fund.

Lucid is currently valued at a P/S ratio of 5.3X… which is significantly below the valuation levels of 2021 and 2022. In the short term, Lucid could see an even lower valuation, I believe, as investors have reasonable concerns about the firm’s production ramp. The equity offering itself may also continue to weigh on Lucid’s valuation factor.

Risks with Lucid

The two biggest commercial risks for Lucid are: (1) Slowing demand for its electric vehicles as the line-up of EV products in the marketplace grows, and (2) A potential guidance down-grade for FY 2023 if the EV maker fails to ramp up production for its first-ever production car. Lucid has so far revised its production forecast down three times (twice in FY 2022 and once in FY 2023) and now expects about “10 thousand or more” produced EVs this year. The capital offering, and the dilution that tends to come with it, are also headwinds for Lucid’s shares, but only in the short term, in my opinion.

Final thoughts

Saudi Arabia is Lucid’s anchor investor and the sovereign wealth fund keeps investing a considerable amount of money into the EV start-up which should be seen as a vote of confidence. Considering that Lucid’s share price and market cap have declined considerably in the last two years, it is comforting to see that Lucid’s anchor investor continues to participate in stock sales on a proportional basis (PIF is maintaining its ~60% ownership stake in Lucid). Lucid also has a very strong balance sheet and has, from a liquidity perspective, the least ramp up risks of any EV manufacturer, perhaps with the exception of Rivian Automotive. While short term headwinds exist in terms of stock dilution and production growth, it is also true that Saudi Arabia keeps investing into Lucid despite significant valuation declines and EV adoption in the U.S. is accelerating!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.