Summary:

- Lucid reported solid Q2 results last week.

- Q2 deliveries surged, but the EV company did not upgrade its delivery outlook for the current fiscal year.

- The electric vehicle company also announced that PIF would invest another $1.5B into the EV maker to support the production ramp of the Gravity SUV.

- The risk profile remains skewed to the downside, in my opinion.

jetcityimage

Lucid Group (NASDAQ:LCID) got a new $1.5B lifeline from Saudi Arabia’s Public Investment Fund that is set to help the electric vehicle company support the production ramp of its newest electric vehicle model, the Gravity SUV. The company also delivered mixed results for its second fiscal quarter last week, and Lucid maintained its production guidance of 9k EVs for FY 2024. Lucid did see an upswing in deliveries in the second quarter, but the EV maker remains widely unprofitable and faces a challenging uphill climb going forward!

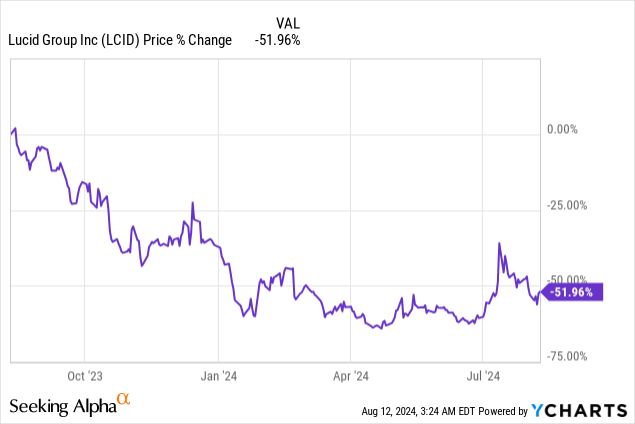

Previous rating

I rated shares of Lucid a strong sell in my prior work on the EV maker — The Next Fisker? — as the electric vehicle company faced a weak demand outlook, slowing top line growth and an unfavorable earnings picture. However, Lucid tends to have no issue raising capital from its rich Saudi Arabian backer, the Public Investment Fund, which just committed another $1.5B to the struggling electric vehicle maker. Since delivery growth came in also stronger than expected, I am changing my rating to hold.

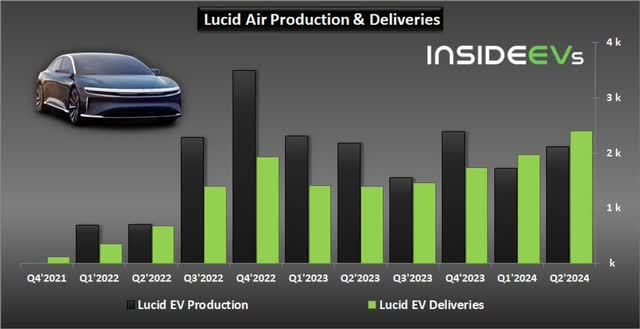

Stronger than expected delivery ramp

Two of my key reasons for down-grading shares of Lucid to strong sell in April were Lucid’s underwhelming delivery ramp, as well as weakening demand for electric vehicles more generally. However, deliveries in the second fiscal-quarter picked up for Lucid and the electric vehicle company delivered 2,394 electric vehicles, showing a year-over-year growth rate of 70%. At the same time, however, Lucid’s production totaled only 2,110 electric vehicles, showing a 3% decline year-over-year.

Importantly, Lucid did not raise its electric vehicle production target for FY 2024, indicating that the EV maker continues to see an overall weak demand picture. Lucid expects to produce 9,000 EVs this year, implying a very moderate 7% year-over-year production growth rate.

Lucid, however, has one competitive advantage over other electric vehicle companies which is that Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, is an anchor investor. Just before Q2’24 earnings, Lucid said that the Public Investment Fund agreed to invest another $1.5B in the form of preferred stock and loans into the electric vehicle company in order to help finance the production ramp of the Lucid Gravity SUV, Lucid’s second major EV model.

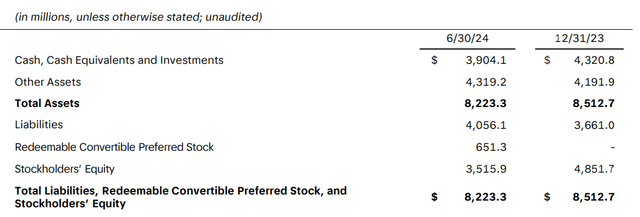

The Gravity SUV is set to see the start of production at the end of the current fiscal year. The $1.5B in cash are much needed as the company continues to lose a ton of money even on its current production that includes only the Lucid Air and its various higher-spec models. At the end of the June quarter, Lucid had $3.9B in cash sitting on its balance sheet, showing a decline of $417M since the end of FY 2023.

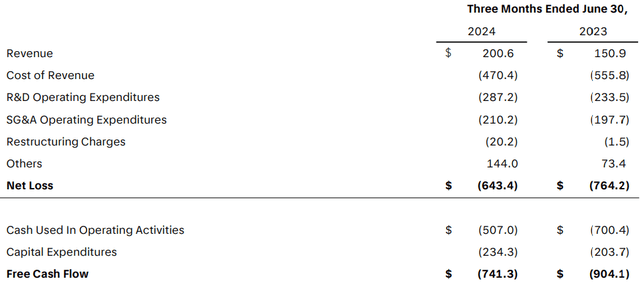

What I dislike about Lucid, fundamentally speaking, is the very unfavorable earnings and free cash flow picture. The EV maker lost a solid $643M in the June quarter, and its free cash flow is highly negative as well. In the near future, investors will likely see a further decline in free cash flow as the company ramps up its spending in order to prepare its production lines for the production of the Gravity SUV.

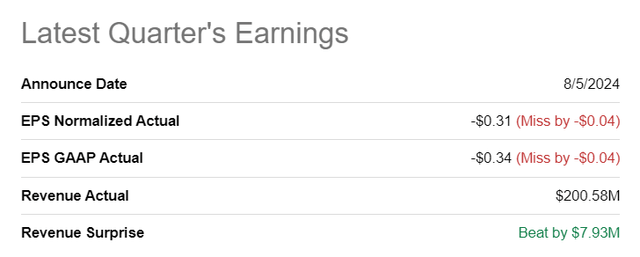

The weak profitability picture was also the reason why Lucid missed earnings expectations for the second-quarter. Lucid lost $0.31 per-share in Q2’24, missing estimates by $0.04 per-share. Based off of consensus estimates, the EV maker is not expected to be profitable until the beginning of the next decade.

Lucid’s valuation

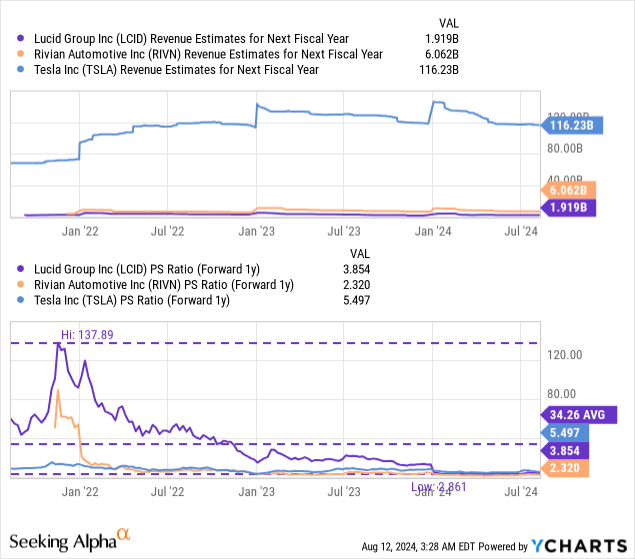

Lucid’s valuation is still stretched, in my opinion, especially considering that the electric vehicle company repeatedly cut back on its delivery targets in the past and is not yet anywhere near profitability on its current production line. Lucid is currently valued at a price-to-revenue ratio of 3.8X and is therefore considerably more expensive than Rivian Automotive (RIVN)… which I consider to be much better value for EV investors, especially because of the company’s improving unit economics and much higher production volume. Rivian also recently struck a deal with Volkswagen to develop EVs jointly, which is improving the risk profile for the U.S. company. Tesla (TSLA), the market leader, is trading at a P/S ratio of 5.5X.

I would not want to pay more than 3.0X revenue for Lucid, given its overall low production volume and persistent losses, however, and I see considerable risks on the horizon with the escalation of operating losses once the company ramps Gravity SUV production. This revenue multiplier would give the EV maker a fair value of $2.50 per-share.

Risks with Lucid

The biggest risk that I see for the electric vehicle maker is that the company will continue to burn through a lot of cash and fail to significantly increase its production output going forward. Weak demand is clearly still an issue for the EV company, otherwise Lucid would have raised its full-year production target. What would change my mind about the electric vehicle company is if it pulled off, against my expectations, a strong production ramp in FY 2025, driven by the Gravity SUV and if Lucid’s profitability and free cash flow picture drastically improved.

Final thoughts

While Lucid has seen a bit of delivery momentum in Q2’24 (which was a positive), the electric vehicle company did not raise its delivery target for the current fiscal year. Lucid continues to project to produce 9k electric vehicles this year, and I do not expect the company to see a fundamental improvement in its profitability or free cash flow picture. The $1.5B investment of Saudi Arabia once again is crucial to support the company’s Gravity SUV ramp, but ultimately, investors would want to see profits and I remain highly doubtful that investors want to continue to fund the firm’s operating losses until the end of the decade. With EV demand generally waning and Lucid reporting large losses still, I do not see a clear path for an improving profitability profile. I acknowledge, however, that PIF came to the rescue of Lucid, which I why I am up-grading shares to hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.