Summary:

- Lucid has struggled to meet production forecasts and sell its vehicles, leading to very high short interest.

- Revenue estimates for Lucid have dropped significantly, with the average for 2023 now standing at less than $794 million.

- With major losses and cash burn continuing, significant operational improvements are needed before a rating upgrade is warranted.

imaginima/iStock via Getty Images

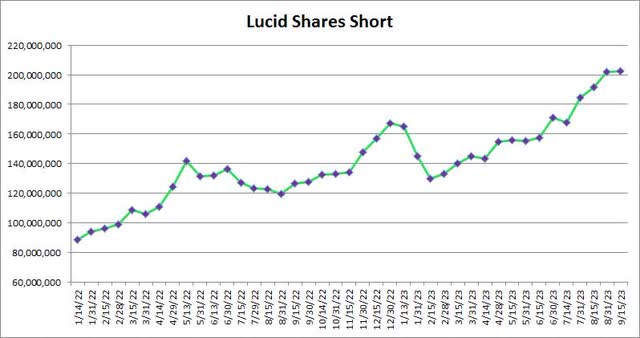

One of the most disappointing names in the electric vehicle market in recent years has been Lucid (NASDAQ:LCID). The luxury player has had a hard time meeting its production forecasts for its Air Sedan, while also struggling to sell what it actually does make. As we approach the end of the third quarter, these ongoing troubles have led short interest to continue hitting new highs.

When Lucid was going public through a SPAC a few years back, management guided to more than $5.5 billion in revenues for the company in 2023. This was based on the company selling 36,000 units of its Air Sedan, with another 12,000 or so units of its Gravity SUV being delivered late in the year. Since then, Lucid hasn’t gotten anywhere close to that for the Air, with production only expecting to be about 10,000 units this year, and the Gravity won’t hit the market until next year at the earliest.

As I mentioned in my previous article on the name, street revenue estimates for Lucid had dropped to less than $1 billion for this year going into the Q2 report. Revenues for the second quarter badly missed street estimates, while the company’s operating loss nearly tripled over the prior year period. With large cash burn continuing, more capital was raised during the period, and short interest has since risen further as seen below.

Lucid Short Interest (NASDAQ)

At the middle of September update that NASDAQ released on Tuesday afternoon, more than 202.6 million shares of Lucid were short. This number has risen by more than 10 million in the past month alone, with short interest up more than 128% over the past 20 months. With almost a quarter of the stock’s reported float short, Finviz data shows Lucid as being the 4th most shorted name out of more than 750 names that trade in the US with a market cap over $10 billion (when looking at % of float short).

Revenue estimates for Lucid have continued to drop since that ugly Q2 report. The average figure for 2023 now stands at less than $794 million, down dramatically from more than $2.8 billion just 12 months ago. Lucid has been fairly promotional during Q3 as it works to bring down inventory, so it will be interesting to see if these discounts pay off in terms of unit sales for the quarter. Over the past year, ending with Q2 2023, the company had built more than 4,100 vehicles above what it has delivered, and that’s part of the reason for major cash flow troubles.

There is the potential for a major short squeeze here if Lucid can start to get its act together. This year’s Air sedan production is expected to be 10,000 vehicles, and the company started the year with a bit of inventory to begin with. Deliveries in the first half of 2023 were only about 2,800 vehicles, which means we could see a sharp delivery ramp in the second half of the year. Even though a chunk of these shipments could be lower-priced variants of the Air, analyst revenue estimates are rather low, so if Lucid gets anywhere close to 10k deliveries the street will likely be pleasantly surprised.

I am not quite ready to upgrade Lucid shares to a hold today, just because we haven’t seen the company show any dramatic improvement yet. Even if deliveries do rise a bit in the back half of 2023, there’s no guarantee that we’ll see losses or cash burn evaporate anytime soon. I also worry about valuation here, as Lucid goes for about 5.9 times next year’s expected sales, compared to 6.1 times for EV leader Tesla (TSLA). I would feel more confident in Tesla at this valuation given its profitability and cash flow, plus its diversification into energy storage products that reduces its EV sales reliance. I should note that the average price target on the street for Lucid is $7.25 currently, representing quite a bit of upside from here, but that number stood at $24 a year ago.

For me to upgrade Lucid to hold, I need to see a few major items occur. First, I need to see deliveries ramp up to more material levels, something that’s not likely to occur until late next year at the earliest. We’ll get a better timeline on that hopefully in November when management shows off the Gravity SUV. The second thing is to see a major reduction in net losses and cash burn, to show that this business has a chance of breaking even at some point. Finally, I think another capital raise will be needed before the end of 2024 because launching a new vehicle will be rather expensive.

In the end, Lucid’s continued struggles have sent short interest to a new high at more than 202 million shares. The luxury electric vehicle player is one of the most shorted large-cap names in the market today, as we continue to see analysts cut their revenue estimates for this year and beyond. Should Air sedan deliveries really ramp in the second half of this year, a short squeeze may be possible, but Lucid’s track record needs to improve significantly before my rating gets hiked a notch or two.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.