Summary:

- Lucid Group stock has collapsed from its July 2023 highs, threatening to break below its critical June bottom. However, buyers have held the level firmly so far.

- LCID short-sellers who added at its June lows were burned as it surged nearly 55% over three weeks, squeezing the less astute bears who reloaded at peak pessimism.

- I assessed that such an opportunity could form as bears loaded more by the end of August, but they haven’t gained significant traction.

- Lucid remains a highly speculative setup only for sophisticated investors. The company anticipates a more constructive second half.

- I make the case for why LCID holders looking to add exposure can capitalize before buyers return to squeeze the late short-sellers again.

Khosrork

I last updated investors about the high-end pure-play EV technology company Lucid Group, Inc. (NASDAQ:LCID) in July 2023, suggesting a speculative buy setup could be ready. However, that thesis didn’t pan out, as sellers digested LCID’s recovery further, sending it closer to its critical June 2023 short-squeeze lows (surged nearly 55% over three weeks).

Short-sellers also added more positions by the end of August, reloading their bets as they anticipated further downside. Despite that, as buyers returned, LCID has held its September lows above its critical June bottom ($5.45 level).

While I have yet to assess a more robust consolidation zone, given the nascent price action developments, I maintain my conviction that LCID has bottomed out in June 2023. Therefore, investors that stopped out in the previous setup can consider reloading their speculative positions, anticipating a more constructive second half for Lucid as it looks to improve its operating performance.

However, I wouldn’t consider LCID suitable for all investors as it’s still an unprofitable automaker struggling to scale, given its narrow focus on the high-end segment. As such, an investor looking to partake in a speculative opportunity on LCID needs to be conversant in capital allocation and risk management strategies to manage their exposure appropriately.

Notwithstanding its unprofitability, investors must consider Saudi Arabia’s PIF firm commitment to support Lucid’s liquidity needs as it continues to scale. It underscores why I observed a robust bear trap (false downside breakdown) in LCID’s long-term chart in June 2023 as buyers returned to defend against a further slide, squeezing the short sellers.

Despite that, it’s incumbent on Lucid to demonstrate its growth, forcing the short-sellers to cover and reduce their positions before LCID could regain more robust buying momentum. In its August earnings release, management updated that it anticipates more favorable market conditions in the second half. In addition, the company has likely considered significant inventory impairment charges that should normalize from H2. Therefore, Lucid must convince investors that its gross margin trajectory should move higher from the current levels, demonstrating improved fixed cost leverage.

Analysts’ estimates suggest a gross margin projection of 5.5% in FY24 before reaching 13.2% in FY25. As such, while investors contemplate Lucid’s ability to deliver its >10K production guidance for FY23, I believe the market already has an eye on its cadence over the next two years.

Management remains confident in Saudi Arabia’s support as it progresses toward production and delivery to the Kingdom. In addition, Lucid’s SUV launch in November will likely be assessed carefully, with production and delivery guidance to be considered for FY24.

While capacity expansion is necessary for Lucid to continue scaling toward profitability, I believe the market isn’t expecting that to happen in the near term. Analysts’ estimates suggest negative free cash flow or FCF through the FY26 forecast period, indicating another capital infusion is expected.

However, I believe the robustness of LCID’s June selloff indicates the market remains confident in the long-term support from the Saudis, which could compel short-sellers to cover at those levels, leading to maximum selling exhaustion. As such, I believe the current levels in LCID aren’t expected to attract short-sellers to load up aggressively, as they fear another unexpected momentum spike (as in June), leading to quick short-covering losses (once bitten, twice shy?).

Despite that, dip-buyers considering a speculative setup in LCID must anticipate that the worst in LCID has been priced in. I don’t think the market is expecting much from Lucid in the near term, given its mere >10K production guidance for FY23.

Therefore, Lucid holders seem willing to ride through the volatility at the current levels, giving the space for the company to prove its ability to scale. I also don’t think Lucid holders expect near-term profitability, given negative FCF estimates through FY27.

As such, buyers at these levels likely believe that Lucid could have an opportunity to create lucrative licensing streams with other automakers (it has a current deal with Aston Martin), leveraging on its advanced powertrain technology. However, that remains a growth optionality for now, but one that could pan out in an aggressive bull-case scenario.

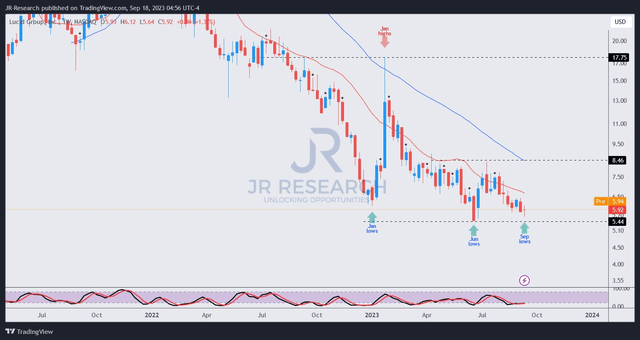

LCID price chart (weekly) (TradingView)

LCID remains supported above its June bottom ($5.45 level). The selloff from its July highs at the $8.45 level was significant. However, I gleaned that selling pressure seemed to have subsided last week, even though buying sentiments were still cautious.

Therefore, I assessed that LCID’s June 2023 lows are expected to remain a critical support level underpinning dip-buying sentiments while discouraging short-sellers from reloading aggressively.

However, buyers must be ready to cut losses if the setup doesn’t work out, indicating that the market expects even worse scaling challenges from the pure-play EV maker.

Rating: Maintain Speculative Buy. See the additional disclosure section below for important notes accompanying the Speculative Buy rating presented.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. Our cautious/speculative ratings carry a higher risk profile. They are only intended for sophisticated investors/traders. We urge new or inexperienced investors to avoid relying on such ratings. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified. Moreover, investors must exercise prudence and devise appropriate risk management strategies, such as pre-defined stop-loss/profit-taking targets, within a suitable risk exposure.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!