Summary:

- Lucid Group, Inc. stock has outperformed since its lows in April 2024, likely stunning bearish investors.

- The Saudi PIF extended liquidity support, potentially reducing Lucid’s execution risks through Q4 FY2025.

- Despite high short-interest and bearish sentiment, Lucid’s improved momentum and potential for short-covering have improved its thesis.

- However, given its weak fundamentals and unproven high-volume production scale capabilities, I assessed a Buy rating as premature.

Justin Sullivan/Getty Images News

Lucid: Stunned Bearish Investors With Recent Outperformance

Lucid Group, Inc. (NASDAQ:LCID) investors survived the onslaught from bearish investors in the second half, as the stock of the embattled EV maker remains well above its June lows. I assessed that LCID’s buying sentiments have improved, notwithstanding a challenging environment for automobile manufacturers. The EV industry has dealt with a significant slowdown in growth. In addition, the lack of a hybrid strategy has likely worked against pure-play BEV makers like Lucid as EV adoption growth slows.

In my previous LCID article in June 2024, I maintained my Sell rating, as I enunciated its fundamentally weak thesis. However, I assessed that investor sentiments have likely been lifted by the additional financing of $1.5B by Lucid’s cornerstone backer (Saudi PIF). Hence, it has extended the runway for Lucid to potentially Q4FY2025, lowering its execution risks over the next year. Therefore, LCID has outperformed the S&P 500 (SPX, SPY), stunning short sellers since then. Despite that, LCID’s 28% short interest ratio indicates that bearish investors are still heavily bearish on the stock, betting against a sustained revival. Notwithstanding my caution, investors must assess whether LCID’s recent recovery could “compel” more short sellers to cover if its momentum recovers further. What could drive LCID short-sellers to give up on their positions moving ahead?

Lucid: Q3 Delivery Metrics Getting Back On Track

Lucid’s Q3 production report missed estimates. The EV maker announced production of 1,805 EVs, well below Wall Street’s forecasts of 2,267 EVs. Despite that, the company demonstrated a significant beat in its delivery metrics. Accordingly, Lucid delivered 2,781 vehicles, marking a nearly 30% beat against Wall Street’s estimates. Lucid still needs to produce 3,300 vehicles in Q4 to meet its production guidance of 9,000 vehicles for FY2024. Furthermore, EV industry sales have also climbed YoY, underscoring the possibility that we could have moved past the lows experienced earlier in the year.

I also assess that the company’s improved delivery metrics have likely assured the market that its worst (April 2024 lows) could be over. Saudi PIF’s commitment to extend Lucid’s liquidity cash flow runway has likely afforded more clarity for its production outlook.

Investors are likely aware that Lucid has an aggressive production ramp target in the medium- and long term. The EV maker anticipates the production of its Gravity SUV in late 2024, helping the company to broaden its TAM opportunities. Therefore, I expect investors to scrutinize Lucid’s upcoming Q3 earnings commentary on November 7 for more details. However, with an entry price point of just under $80K, it remains to be seen whether Lucid could gain sufficient scale to ramp to its full capacity (90K units) for its Arizona facility.

Lucid expects to continue scaling through 2026 in preparation for the launch of its mid-sized platform. Lucid claims its technological edge through its “superior” battery technology allows for more efficient scaling. However, its ability to enter the high-volume segment is likely filled with significant uncertainties as the EV market growth has slowed. Hence, the company might need to invest more aggressively to build its brand and marketing profile, potentially impacting its profitability trajectory. Moreover, established EV makers and legacy automakers have more solid profitability to enter a protracted price war with Lucid’s anticipated entry into the $48K to $50K segment.

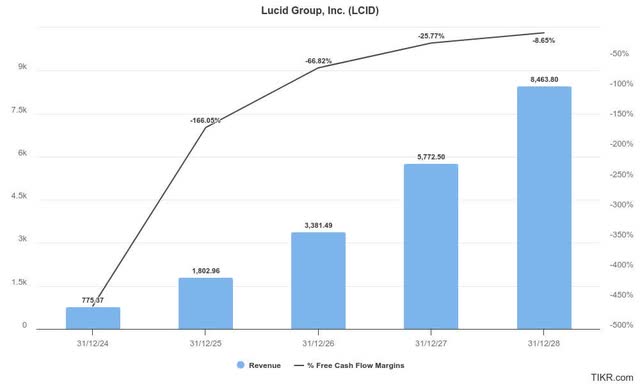

Lucid: Expect Negative Free Cash Flow Through FY2028

Wall Street still expects Lucid to continue scaling its revenue through the 2028 forecast period. Hence, there’s little doubt that the market has priced in a growth inflection thesis for LCID (“B-” growth grade). However, Lucid isn’t expected to post free cash flow profitability through FY2028.

However, LCID’s “C” valuation grade suggests investors have lowered their expectations for the EV maker (more balanced), although it isn’t priced discounted. In other words, Lucid must continue executing well as it aims to launch its Gravity SUV and mid-sized platform while competing against its more established competitors for market share.

Is LCID Stock A Buy, Sell, Or Hold?

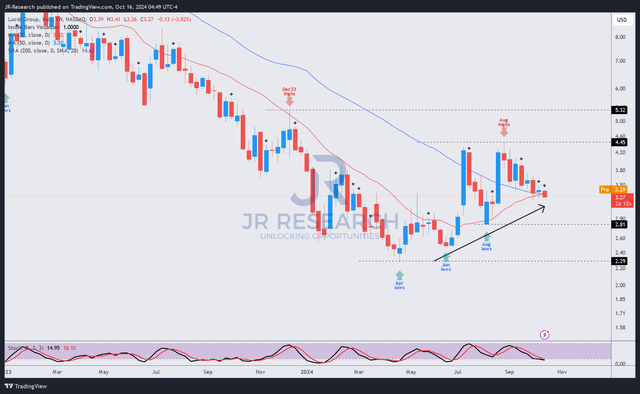

LCID price chart (weekly, medium-term) (TradingView)

Notwithstanding my caution, Lucid sellers have lost momentum over the past six months since its April 2024 lows. As a result, its momentum grade has also improved from “D-” to “C,” corroborating my assessment. There appears to be a potential stiff resistance zone under the $4.5 level, which saw steep selling pressure in July and August 2024.

I assess that my Sell rating on LCID is increasingly tenuous, as dip-buyers have been able to lift the stock above its lows in April, June, and August. Given its relatively high short-interest ratio and the potential for more intense short-covering, I find the risk/reward of a bearish thesis unattractive at the current levels.

Lucid has demonstrated its ability to outperform Wall Street’s delivery estimates despite its production metrics falling short. Despite that, a robust US economy and potentially lower interest rates through 2025 are expected to bolster Lucid’s outlook. The secular EV industry tailwinds might also get a re-rating, potentially lifting LCID’s buying sentiments. As a result, I assess that an upgrade to LCID’s rating is due, although I don’t encourage investors to go long on the stock, given its weak fundamentals.

Rating: Upgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!