Lucid Drops On Major Equity Offering

Summary:

- Lucid announced a major capital raise, aiming to raise $3 billion, which caused its shares to drop.

- LCID is struggling with ramping production and generating sales, leading to significant cash burn.

- The capital raise will help the balance sheet short-term, but the real issue is increasing production and consumer purchases.

hachiware

A couple of weeks ago, I detailed how electric vehicle startup Lucid (NASDAQ:LCID) had just reported another awful set of quarterly results. Not only did the company badly miss revenue estimates, but it also essentially lowered delivery guidance for the year. On Wednesday afternoon, the company saw its shares drop again after announcing a major capital raise to shore up the balance sheet.

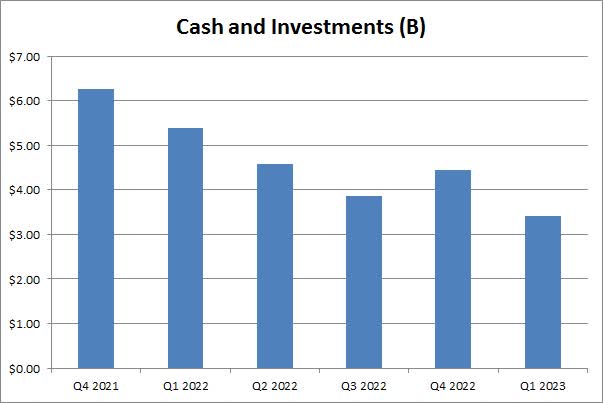

Management previously believed it had enough liquidity to get to Q2 of 2024, but it doesn’t have a great track record when it comes to guidance. Lucid burned over $1.04 billion in cash in Q1 of this year alone. As the chart below shows, the cash balance has come down quite a bit since the end of 2021, and that includes another major capital raise that came late last year.

Lucid Cash Position (Company Earnings Reports)

I previously have talked about Lucid raising more capital, especially as it gets ready to launch its next vehicle in the coming quarters. I also thought that the Saudi Investment Fund, the majority owner of Lucid, could continue to be a major backer in any capital raise. Well, that’s exactly what happened on Wednesday, with the announcement of a major capital raise as detailed below:

Lucid Group, Inc. announced today the commencement of a public offering of 173,544,948 shares of its common stock.

In addition, Lucid’s majority stockholder and affiliate of the Public Investment Fund (“PIF”), Ayar Third Investment Company (“Ayar”), has agreed to purchase from Lucid 265,693,703 shares of Lucid common stock in a private placement for an aggregate purchase price of approximately $1.8 billion. The private placement is expected to close on June 26, 2023.

Lucid anticipates that it will raise $3 billion from the offering, but of course that will depend on how and when the underwriter is able to sell those shares. The current share amounts noted above would result in more than 20% dilution to current shareholders, as the company had a market cap below $15 billion as of Wednesday’s close. Assuming that $3 billion is the rough amount of proceeds, the cash position will nearly double before taking into account any cash burn that occurs during the current quarter.

The problem for Lucid right now is ramping production and generating sales. Analysts are now expecting less than $950 million in 2023 revenue for the company. That number has come down by roughly a third in the past three months alone, and one year ago the average 2023 street revenue figure stood at just under $3.6 billion. With sales coming in well below expectations, losses have been tremendous, resulting in significant cash burn when you throw in capital expenditures. Lucid is playing in the luxury part of the electric vehicle market, which is very small and getting quite competitive. The company had originally expected to produce 20,000 vehicles last year, but guidance for this year is now to just exceed half of that amount.

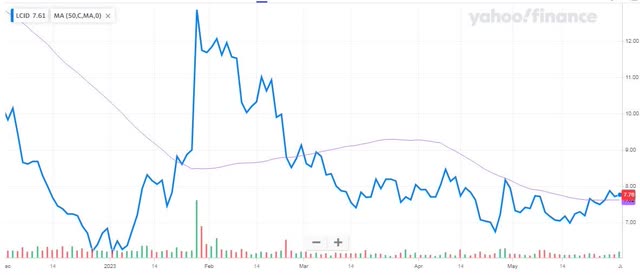

As for Lucid shares, they dipped about 5% in Wednesday’s after-hours session to $7.33. Going into the capital raise news, the average price target on the street was $8.72, implying low double digit upside from the day’s close. However, that number has come down by more than $8 alone this year, and just about 13 months ago the street saw the name as worth roughly $37. As the chart below shows, LCID stock had just regained its 50-day moving average (purple line), so if shares continue lower, it could result in this key technical trend line heading lower moving forward.

Lucid Last 6 Months (Yahoo! Finance)

In the end, Lucid shares fell after the company announced a major capital raise on Wednesday afternoon. The electric vehicle name is hoping to raise about $3 billion, providing a nice bit of cash as it looks to launch its second vehicle in the coming quarters. While this will help the balance sheet in the short term, it’s just more dilution for investors, and the real problem remains getting production to ramp significantly and having consumers actually buy these vehicles. It would not surprise me if the stock loses the $7 level again after this news, and a large rally likely won’t occur here until management really gets the growth story on track.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.